Electric Cars and Tax Benefits: Understanding the Advantages of In-Kind Benefits

Are you considering purchasing an electric car? If so, you’re not alone. Electric vehicles (EVs) are becoming increasingly popular due to their environmental benefits and the savings gained from reduced fuel costs. But did you know that choosing an EV as your company car can also have financial benefits? This is due to something called the “Electric Cars Benefit in Kind.

” Essentially, this means that the tax you pay on your company car is based on the car’s list price and CO2 emissions. As most EVs have very low CO2 emissions, they can be taxed at a lower rate compared to traditional petrol or diesel vehicles. But how exactly does this work, and what are the financial benefits of choosing an EV as your company car? Let’s take a closer look.

What is a Benefit in Kind

If you’re considering purchasing an electric car, you may have heard of the term “benefit in kind”. So, what exactly is the benefit in kind on electric cars? Put simply, it refers to the non-cash benefits an employee receives in connection with their employment, and is calculated based on the car’s list price and CO2 emissions. For electric cars, the benefit in kind is currently set at 1% for the 2021-2022 tax year, making it a highly attractive option for those looking to reduce their environmental impact and save on tax.

This means that if you’re an employee and your company provides you with an electric car, you’ll only be taxed on 1% of the list price of the vehicle. It’s worth noting that the benefit in kind rates are subject to change, so always check with your employer or HMRC for the most up-to-date information. Overall, the benefit in kind on electric cars presents a great opportunity for both employers and employees to make greener choices and save on tax.

Explanation on Benefit in Kind for Electric Cars

A Benefit in Kind (BIK) is a tax paid on perks or benefits an employee receives on top of their salary or wages. For example, if an employee gets a company car and the car is occasionally used for private journeys, BIK tax is levied. Electric cars are becoming more popular due to their environmental benefits, and the government recognizes this by providing incentives to employees who drive these vehicles.

Consequently, electric cars have been associated with lower BIK rates and tax liability for employees. In addition, companies themselves can claim tax exemptions for electric company cars, meaning that it is a great advantage to them. With the emergence of more electric cars, we can expect further improvements in incentives to encourage more companies to purchase and employees to adopt them.

The government is keen on improving our environment, and one way they aim to achieve this is by using benefits in kind to progress our economy towards greener alternatives.

Tax Benefit

If you’re considering buying an electric car, then you’ll be pleased to know that there is a tax benefit in kind on electric cars. Benefit in kind, or BiK, refers to the value of the car that an employee gets as part of their employment package. With electric cars, the UK government incentivizes their adoption by offering attractive tax rates on BiK.

In some cases, you could save thousands of pounds on taxes by choosing an electric car rather than a traditional petrol or diesel vehicle. The BiK rate varies depending on the car’s value, CO2 emissions, and how far it can travel on a single charge. Generally, electric cars incur lower BiK taxes than their fossil-fuel equivalents, making them a cost-effective and eco-friendly option for company car drivers.

So, if you’re looking to save some money on taxes and reduce your carbon footprint, consider switching to an electric car today.

Exemption from Vehicle Excise Duty

If you own a vehicle, you may be familiar with Vehicle Excise Duty. It’s an annual tax that all drivers in the UK have to pay, and the amount you pay depends on the type of vehicle you own. However, did you know that some vehicles are exempt from Vehicle Excise Duty? This tax benefit can save you hundreds of pounds per year, so it’s important to understand if you’re eligible.

Electric or hybrid cars are exempt from Vehicle Excise Duty, and this tax exemption can even apply to cars that cost over £40,000. This exemption can make a significant difference in how much you pay for your car each year and is definitely worth considering if you’re in the market for a new vehicle. Not only that, but you’ll also be doing your part to help the environment.

So, if you’re considering purchasing a new car, think about going electric or hybrid to take advantage of this fantastic tax benefit.

Lower Company Car Tax Rates

Lower company car tax rates are a tax benefit that many employees and businesses can take advantage of. With the rising cost of living and shrinking budgets, these tax rates can be a lifeline for many people. Essentially, lower company car tax rates allow those who are using their company cars for personal use to pay less tax on them.

This means that employees can enjoy the benefits of a company car without being penalized for it. Businesses can also benefit from lower company car tax rates by reducing their overall tax liability and helping to attract and retain employees. So, whether you’re an employee or a business owner, lower company car tax rates are definitely worth exploring as a way to save money and get more value out of your company car.

Environmental Benefit

What is the benefit in kind on electric cars? Well, besides the obvious cost savings on fuel, electric cars have a significant environmental benefit compared to traditional combustion engine vehicles. Electric cars produce zero emissions while driving, which means they don’t contribute to air pollution. This is especially important in urban areas where air pollution can have serious health consequences.

Additionally, electric cars help reduce our dependence on fossil fuels, which are a finite resource. By transitioning to electric cars, we’re able to create a more sustainable future for ourselves and for the planet. The benefit in kind on electric cars is the positive impact they have on the environment, which is something we should all strive to support.

Lower Emissions

Lower Emissions Lowering emissions can have a significant environmental benefit. By reducing the amount of greenhouse gases that are released into the atmosphere, we can help slow down global warming and mitigate the damaging effects of climate change. Carbon dioxide (CO2) is the main greenhouse gas that is released by human activities, such as burning fossil fuels to generate electricity, transportation, and industrial processes.

By adopting cleaner energy sources, such as wind and solar power, we can reduce our dependence on fossil fuels and cut down on CO2 emissions. Additionally, energy-efficient technologies and practices, such as LED bulbs and smart thermostats, can reduce energy consumption and lower electricity bills. By making these small changes in our daily lives, we can make a big impact on the environment.

Reduced Carbon Footprint

Reduced Carbon Footprint It’s no secret that businesses, both large and small, have a significant impact on the environment. One of the most pressing issues we face is the increase in greenhouse gas emissions, primarily carbon dioxide, which is responsible for climate change. Fortunately, businesses that strive to reduce their carbon footprint can help combat the problem.

By implementing energy-efficient practices, reducing waste, and using cleaner energy sources, businesses can significantly reduce their carbon emissions, thus helping to mitigate the impact of climate change. Not only does this benefit the environment, but it also benefits the business itself. Companies that implement these practices can save money on energy costs, reduce waste disposal expenses, and enhance their overall brand reputation.

Therefore, reducing carbon footprint is a win-win for everyone involved.

Financial Benefit

“What is the benefit in kind on electric cars”? One of the main benefits of electric cars is its financial advantages. The Benefit in Kind (BIK) tax is a tax on perks or benefits provided by employers in addition to employees’ salaries. BIK tax on electric cars is currently at a lower rate than the tax on internal combustion engines (ICE) cars, making them a more cost-effective option for employers.

With electric cars being exempt from road tax and with lower maintenance costs, it is not only good for the environment but can save employers money in the long run. Furthermore, the government has also incentivized electric car ownership by offering grants and subsidies for both individuals and businesses. Overall, the financial benefits of electric cars, such as BIK reductions, grants and subsidies, and lower running costs, make them a smart investment for both individuals and companies alike.

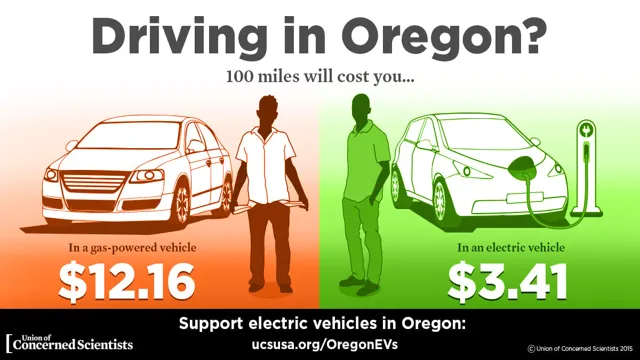

Lower Fuel Costs

Lower Fuel Costs If you’re looking to reduce your expenses and save a bit of money, then one of the best areas to look into is your fuel costs. Lowering your fuel expenses can have a significant financial benefit, especially if you drive frequently or have a long commute. There are several ways to achieve this, including driving at a more consistent speed, avoiding rapid acceleration or braking, and keeping your car in good condition with regular maintenance.

Another option is to consider purchasing a fuel-efficient vehicle, such as a hybrid or electric car, which can help save you money in the long run. Not only will you save on gas, but you’ll also help reduce your carbon footprint. So, the next time you’re at the pump, think about how you can lower your fuel costs and put more money back in your pocket.

Government Grants and Incentives

Government grants and incentives can provide a significant financial benefit for businesses of all sizes. These programs are designed to encourage investment, innovation, and growth, and can help offset some of the costs associated with expanding or upgrading operations. For example, a business may be eligible for a grant to help fund research and development of new products or technologies, or to purchase equipment that will improve efficiency and productivity.

Additionally, certain incentives are available to businesses that engage in environmentally-friendly practices, such as energy-efficient lighting, water conservation, and waste reduction. By taking advantage of these programs, businesses can not only save money on operational costs but also gain a competitive advantage in their industry. So if you’re a business owner, it’s worth taking the time to research your options for government grants and incentives and see how they can benefit your bottom line.

Conclusion

In conclusion, the benefit in kind on electric cars is like finding a hidden treasure in a modern world of taxation and environmentalism. Owning an electric car not only reduces carbon emissions, but it also presents a financial advantage that is hard to resist. The government’s decision to offer a tax break to electric car owners is a smart move that incentivizes green driving habits while also saving money.

It’s a win-win situation that helps both the environment and our wallets. So, if you’re looking for a guilt-free and cost-effective way to zip around town, switching to an electric car might be the treasure hunt you want to embark on.”

FAQs

What is a benefit in kind for electric cars?

A benefit in kind for electric cars is a tax on any non-cash compensation given to employees, such as the use of an electric car as a company vehicle.

How is the benefit in kind calculated for electric cars?

The benefit in kind for electric cars is calculated based on the car’s list price, CO2 emissions, and electric range.

Are there any exemptions for electric cars when it comes to benefit in kind taxes?

Yes, electric cars are exempt from paying any benefit in kind taxes for the years 2020-2022. However, from 2023 onwards, electric cars will be subject to a reduced benefit in kind rate.

Can a self-employed individual claim a benefit in kind for an electric car?

No, self-employed individuals cannot claim benefit in kind for an electric car as it is only applicable for company vehicles provided to employees. However, they can claim capital allowances on the purchase of an electric car for business use.