5 Electric Stocks to Watch: The Future of Transportation and Investing

Electric cars are quickly taking the automotive industry by storm. With the growing demand for eco-friendly transportation, car manufacturers are investing heavily in electric vehicles. What many investors are now eyeing are the stocks benefiting from the rising trend of electric cars.

The shift to electric vehicles is not only benefiting the environment but also generating immense market opportunities. As such, investing in stocks that are poised to profit from this change is a smart move for investors looking to diversify their portfolio and reap the rewards of a booming industry. In this blog, we will look at the top stocks that are gaining traction due to the growing popularity of electric cars.

Macro Trends

Electric cars have been a growing trend for years, and the market for them is only expanding. As such, investors and enthusiasts alike are wondering what stocks will benefit from this boom in electric vehicles. Companies that manufacture electric cars themselves, such as Tesla, are an obvious choice.

However, other companies that produce components for electric vehicles also stand to gain – such as battery manufacturers, like Panasonic or LG Chem, or even steel suppliers, like ArcelorMittal, as the demand for lighter, more efficient materials increases. Additionally, charging station companies like ChargePoint or EVgo could also experience significant growth as more electric cars hit the road. As with any new trend, there may be some risk involved, but investing in companies that are involved with electric cars in some way could be a wise move for those looking to capitalize on the growth of this industry.

Rising Demand for Electric Cars

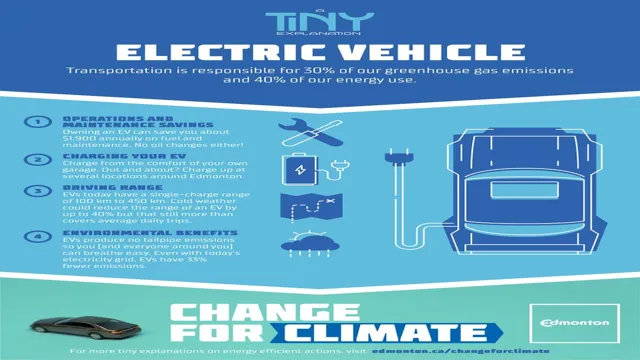

Electric Cars The increasing demand for electric cars is a macro trend that has been observed in recent years. As the world becomes more aware of the environmental impact of traditional gas-powered vehicles, many consumers are looking towards electric cars as a more sustainable and eco-friendly option. This trend has led to a surge in the production and availability of electric cars, with many major car manufacturers investing heavily in the development of their electric car offerings.

Additionally, government incentives and tax breaks have made purchasing an electric car more financially viable for many consumers. Despite the initial higher cost of some electric cars, the cost savings in the long run through reduced fuel and maintenance costs make them an attractive option. As more people seek out sustainable options, it is likely that the demand for electric cars will continue to rise in the coming years.

Government Incentives and Support

As governments become increasingly aware of the importance of sustainable practices, more and more incentives and support programs are being introduced to encourage businesses to adopt eco-friendly methods. These incentives can take many forms, from tax credits and grants to special subsidies and low-interest loans. The growth of renewable energy sources, for example, has been largely driven by government support, which has helped to lower the cost of technology while also creating new job opportunities.

In addition to financial support, governments are also providing regulatory frameworks to encourage businesses to adopt sustainable practices and meet sustainability targets. These macro trends are indicative of a shift in mindset towards more responsible and sustainable practices, and businesses that work proactively to meet sustainability goals are well-positioned to thrive in this new landscape.

Battery and Charging Infrastructure

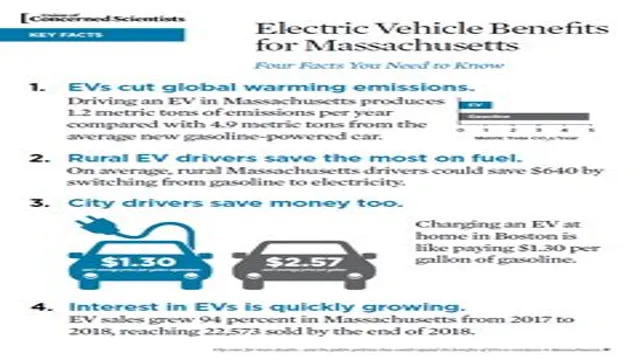

Investing in electric vehicle (EV) stocks is becoming an increasingly popular trend as the world moves towards a sustainable future. Specific stocks that will benefit from the rise of EVs include battery and charging infrastructure companies. Battery manufacturers such as Tesla and Panasonic are already seeing tremendous growth and interest from investors due to the increasing demand for EV batteries.

Charging infrastructure companies like ChargePoint and Blink are also poised to grow as more EVs hit the market, leading to a greater need for charging stations. As the world becomes more reliant on electric vehicles, the companies that provide the infrastructure to support these vehicles will become more vital, making them attractive investment opportunities for those looking to capitalize on the EV boom. Investing in these companies could help investors participate in the shift towards a sustainable future and lead to potential long-term gains for their portfolio.

Companies Providing Batteries and Charging Equipment

Battery and charging infrastructure is an essential aspect of electric vehicles. Companies such as Tesla, ChargePoint, and EVgo are leading providers of charging equipment for EV owners. Tesla is innovating with its Supercharger network, which is a fast-charging option for electric cars in North America, Europe, and Asia.

ChargePoint offers a network of Level 2 and DC fast-charging stations, while EVgo provides charging options for commercial fleets and various other industries. These companies are working to build a comprehensive network of charging stations to reduce the range anxiety traditionally associated with electric vehicles. Battery manufacturers such as Panasonic and LG Chem are also developing new battery technologies to improve the energy density and overall performance of EV batteries.

As the popularity of electric vehicles continues to grow, battery and charging infrastructure will be critical in ensuring that these cars remain a viable option for drivers worldwide.

Companies Developing Charging Stations

The development of battery and charging infrastructure is a crucial part of the electric vehicle revolution. Fortunately, companies are stepping up to the plate and developing more charging stations to make the switch to electric more accessible for drivers. Companies like ChargePoint and Electrify America are investing in charging infrastructure to give drivers peace of mind when it comes to range anxiety.

With advancements in technology, fast-charging stations have become more prevalent, allowing drivers to quickly charge their vehicles in a matter of minutes. These companies are also working on creating a seamless experience for drivers with user-friendly mobile apps that allow them to locate, reserve, and pay for charging stations easily. The expansion of battery and charging infrastructure is an exciting development in the electric vehicle space, and it’s great to see companies taking the initiative to make the switch to electric more accessible for everyone.

Transportation Services Companies Adopting Electric Vehicles

As transportation services companies start to adopt electric vehicles, a key concern is the availability of battery and charging infrastructure. While electric vehicles offer a sustainable and efficient alternative to traditional gas-powered vehicles, a lack of charging stations can lead to range anxiety among drivers. Fortunately, many companies are investing in building out charging networks to support electric vehicles.

For example, Tesla has built its own Supercharger network, which now spans across the US and many parts of Europe and Asia. Other companies, like Electrify America and ChargePoint, are also working to install charging stations in public spaces across the country. Additionally, some companies are exploring the use of battery swapping, where drivers can exchange depleted batteries for fully charged ones at regular intervals, to eliminate any range or charging concerns.

As the adoption of electric vehicles continues to grow, it is likely that many more companies will invest in building out charging infrastructure, making it easier for drivers to make the switch to electric.

Automakers and Component Suppliers

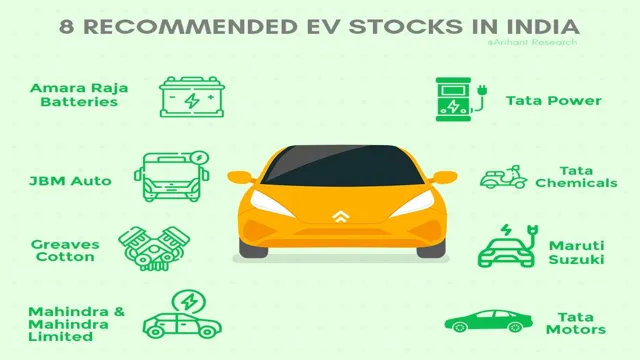

If you are a savvy investor looking to capitalize on the electric car boom, it’s worth considering automakers and component suppliers. Automakers such as Tesla, General Motors, and Ford have already taken significant steps towards transitioning to electric vehicles and continue to invest heavily in research and development. Additionally, component suppliers like LG Chem, Samsung SDI, and Panasonic are major players in the electric vehicle battery market and stand to benefit greatly from the growth of the industry.

Moreover, semiconductor manufacturers such as Nvidia, Texas Instruments, and Infineon Technologies are also well-positioned to benefit as electric vehicles require a greater amount of electronic content than traditional cars. By investing in these companies, you not only stand to benefit from the explosive growth of the electric car market but also play a critical role in the global push towards sustainability.

Automakers with Strong Electric Vehicle Lineup

Electric vehicle lineup, automakers, component suppliers Automakers and component suppliers are racing to keep up with the demand for electric vehicles. There are a few standouts in the field that are leading the charge towards a more sustainable transportation future. One of these companies is Tesla, whose full lineup is exclusively electric.

They are constantly pushing the boundaries of what is possible with electric vehicles and their technology is the envy of the industry. Another automaker with a strong electric vehicle lineup is BMW. Their i3 model is a popular choice for those who want a stylish, environmentally-friendly car.

Ford is also making strides towards electrification with the Mustang Mach-E, a sleek electric SUV. Component suppliers are also playing an important role in this transition to electric vehicles. Companies like General Electric and Siemens are producing advanced charging infrastructure and battery technology that allows for more efficient and effective electric vehicles.

With all these advancements, it’s clear that electric vehicles are the future of transportation and these companies are leading the way.

Component Suppliers Providing Key Components for Electric Vehicles

As more and more automakers shift their focus to electric vehicles (EVs), component suppliers are rising to the occasion by providing key components essential for producing these vehicles. From batteries to electric motors, suppliers are playing a crucial role in the EV industry, providing automakers with the tools they need to create sustainable and efficient vehicles. Some of the top suppliers in the market include LG Chem, Panasonic, Tesla, and CATL.

These companies are helping to drive innovation in the industry by developing and producing new and improved battery technologies, such as solid-state batteries, which promise to provide better performance and faster charging times. With the continued growth and adoption of EVs, these suppliers will remain important players in the industry, helping to pave the way for a more sustainable automotive future.

Investment Opportunities

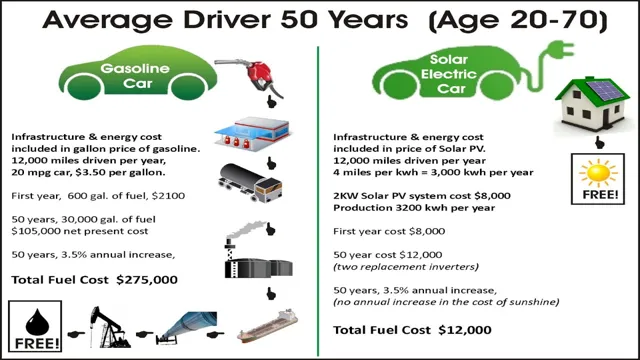

If you’re looking to invest in the rise of electric cars, there are several stocks that could potentially benefit from the industry’s growth. First and foremost, companies that produce electric vehicles themselves, such as Tesla, are a popular choice. However, it’s important to keep in mind that these stocks can be volatile, so it’s crucial to do your own research and risk assessment before investing.

Additionally, companies that manufacture electric vehicle components, such as batteries and charging systems, could also see an increase in demand. Some examples of these types of companies include LG Chem and ChargePoint. Finally, renewable energy sources like solar and wind power could also see a boost as the demand for electricity to power electric cars increases.

Overall, there are a variety of investment opportunities that could benefit from the rise of electric cars, but it’s important to do your due diligence and assess the potential risks before making any investment decisions.

Conclusion

In conclusion, if you’re looking for stocks that will benefit from the electrification of cars, it’s all about the power players in the game. Think big, think globally, and think about investing in the companies that are leading the charge (pun intended) in the electric vehicle market. From automakers to battery manufacturers to charging network providers, these are the companies that will have staying power and provide opportunity for long-term growth.

So, if you want to ride the wave of the electric vehicle revolution, get your portfolio charged up with these stocks. Happy investing!”

FAQs

Are electric cars becoming more popular in the market?

Yes, the demand for electric cars is increasing rapidly due to concerns about the impact of non-renewable energy sources on the environment and the push towards clean energy.

Which stocks are most likely to be affected by the rise of electric cars?

Stocks of companies that produce electric vehicles, electric vehicle batteries, and electric vehicle charging infrastructure are most likely to benefit from the rise of electric cars. For example, Tesla, NIO, and BYD are popular electric vehicle manufacturers, while Panasonic and CATL produce electric vehicle batteries.

Are there any other industries that might benefit from the rise of electric cars?

Yes, companies that produce renewable energy sources such as solar and wind power are likely to benefit from the rise of electric cars. This is because electric cars rely on electricity for their power needs, and the increased demand for electric cars will increase the demand for renewable energy sources.

How can investors identify the best electric vehicle stocks to invest in?

Investors can conduct research on electric vehicle manufacturers and other related industries, monitor industry trends and news, and consult with financial advisors to identify the best electric vehicle stocks to invest in based on their personal financial goals and risk tolerance.