Shock and Electrify Your Portfolio: Top Stocks Set to Benefit from the Electric Car Revolution

Electric cars have revolutionized the automotive industry, and as more people turn to eco-friendly transportation, the benefits are starting to spill over into the stock market. The demand for electric vehicles has triggered a massive growth of electric car companies, and investors are taking notice. But who really benefits from the rise of stocks in the electric car market? Is it just the investors, or does it trickle down to the broader economy? In this blog post, we’ll explore the relationship between the electric car industry and the stock market and dig deeper into who stands to gain from this emerging market.

EV Market Growth Trends

As the world shifts towards more sustainable and environmentally-friendly modes of transportation, electric cars are becoming increasingly popular. This growth in the EV market has led to various stocks that stand to benefit from the trend. One such company is Tesla, which is currently dominating the EV industry.

With a wide range of innovative electric vehicles and a focus on renewable energy, Tesla has been a popular choice among environmentally conscious consumers. Another company to watch is NIO, a Chinese EV maker that has been on the rise due to its unique battery swapping system and luxurious designs. Other companies that could benefit from the EV market growth include battery manufacturers like LG Chem and Panasonic, and semiconductor companies such as Nvidia and Intel, which provide components for EVs.

As the demand for electric cars continues to grow, investors should keep an eye on these emerging stocks and their potential for long-term growth.

Data on the Increase of Electric Vehicle Sales

Electric Vehicle Sales, EV Market Growth Trends Electric vehicles have become increasingly popular in recent years, and the sales figures show no signs of slowing down. The global market for EVs is expected to grow at an unprecedented rate in the coming years, as both consumers and governments increasingly prioritize environmentally friendly transportation options. In 2020 alone, worldwide sales of electric vehicles increased by 43%, with China accounting for the largest share of EV sales.

This trend is expected to continue, with estimates suggesting that by 2030, EVs could account for up to 70% of all new car sales. The growth of the EV market is being driven by both increased consumer demand and the availability of new and innovative EV models from a variety of manufacturers. With a combination of improved technology, increased affordability, and government incentives, the future looks bright for electric vehicles and their role in the transportation industry.

Electric Car Adoption Rates in Different Markets

Electric car adoption rates are rising steadily in different markets around the world. Governments and automakers alike are investing heavily in electric vehicles (EVs) as a means of reducing carbon emissions and combatting climate change. In Europe, for instance, the adoption rate of EVs has grown significantly over the past few years.

Norway, for example, has the highest EV market share in the world, with over 50% of new car sales being electric. Similarly, Germany is aiming to have 7-10 million EVs on the road by 2030. In the US, California alone accounts for nearly half of all EV sales in the country, followed by states such as Washington and New York.

China, on the other hand, is the largest EV market in the world, with over a million EVs sold in 2020 alone. The growth of the EV market in these different regions is fueled by factors such as government policies, tax incentives, and increasing consumer awareness of the benefits of EVs. As the world continues to shift towards sustainability, the trend towards electric vehicles is set to continue and accelerate in the years to come.

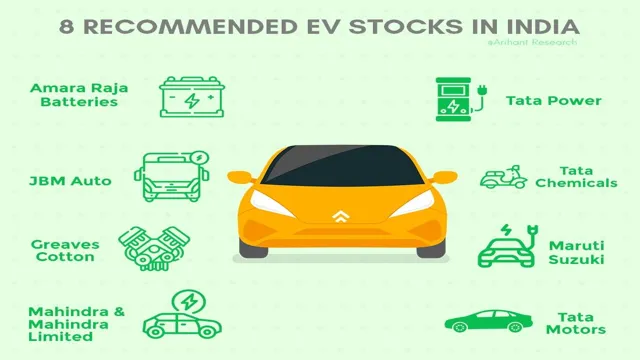

Stocks to Watch

If you’re looking to invest in stocks that will benefit from the electric car revolution, then you’ve come to the right place. Consumers are increasingly becoming conscious about the environmental impact of their daily activities, and the transportation sector is no exception. It’s no secret that electric cars are here to stay, and as they become more mainstream, the demand for companies that produce essential components such as batteries, semiconductors, and charging infrastructure will soar.

Companies like Tesla, NIO, and BYD are some of the most prominent electric vehicle manufacturers, but there are other firms that might not immediately come to mind, such as LG Chem, which is a supplier of battery cells for various carmakers. Additionally, charging infrastructure providers like ChargePoint and Blink Charging could see significant growth as more electric cars hit the road. Keep an eye out for these stocks, and you might just reap the benefits of the electric car boom!

Companies Leveraging EV Sales for Growth

As electric vehicles (EVs) continue to gain popularity worldwide, companies are finding ways to leverage their sales to drive growth. One such company to watch is Tesla, whose EV sales have been steadily increasing over the past few years. With a market cap of over $600 billion, Tesla is a heavyweight player in the EV space.

Another company worth keeping an eye on is General Motors. The American automaker has set a goal to produce all-electric vehicles by 2035 and plans to invest $27 billion in EV and autonomous vehicle technology by 202 Additionally, companies such as Nio and Li Auto, both headquartered in China, have experienced significant growth in their EV sales.

Nio, which specializes in smart EVs, reported a 352% increase in deliveries in 2020 compared to the previous year. Similarly, Li Auto, which focuses on plug-in hybrid electric vehicles, saw a 478% year-over-year increase in vehicle sales in January 202

As the shift towards EVs continues, keeping an eye on these companies can provide valuable insight into the future of the automotive industry.

Auto Makers Investing in Electric Vehicle Technology

Electric Vehicle Technology As we move towards a more eco-friendly future, more and more auto manufacturers are investing heavily in electric vehicle technology. With the looming threat of climate change and the need for zero-emission vehicles, the demand for electric cars is on the rise. Some major automakers such as Tesla, General Motors, and Ford have already made electric cars a significant part of their portfolio.

Furthermore, we have seen a surge in the number of all-electric and hybrid electric vehicles on the market. This shift towards electric cars is expected to gain momentum in the coming years, and investors are all eyes on the auto industry. If you are looking for potential stocks to watch out for, keep an eye on electric vehicle manufacturers and suppliers.

These are exciting times for the auto industry, and the electric vehicle revolution is just getting started.

Battery and Charging Infrastructure Companies to Watch

When it comes to battery and charging infrastructure companies, there are a few stocks that investors should be keeping an eye on. One of these companies is Tesla, which has been at the forefront of the electric vehicle industry for years. With their state-of-the-art batteries and charging technology, Tesla is a major player in this space.

Another company to watch is ChargePoint, which operates the largest network of electric vehicle charging stations in the US. Recently, they went public through a merger with a special purpose acquisition company and have been receiving a lot of attention from investors. Lastly, there is QuantumScape, which is a leader in solid-state battery technology.

Their batteries have the potential to revolutionize the industry, offering increased energy density, faster charging times, and improved safety. With all of these companies showing exciting developments in the battery and charging infrastructure space, it’s an exciting time to be an investor in this area.

Investment Strategies

Looking to invest in stocks that are likely to benefit from the growing popularity of electric cars? There are plenty of options worth exploring, including companies involved in electric car production, charging infrastructure, and battery technology. One stock that comes to mind is Tesla, which dominates the electric car market and has a strong reputation for innovation. Other options include major automakers like Ford and General Motors, who have been investing heavily in electric vehicle technology and are poised to strike big in the coming years.

For those interested in the battery space, companies like Panasonic, LG Chem, and Samsung SDI are worth exploring. Investing in electric car stocks can offer significant potential for growth, but it’s important to do your research and carefully consider the risks before making any decisions. With the continued growth of the electric car market, now may be the time to jump in and ride the wave of change.

Diversifying with EV-Related Stocks

Investing in electric vehicle-related stocks can be a great way to diversify your portfolio and profit from the growing popularity of EVs. One strategy is to invest in established companies that have a significant portion of their revenue coming from EV-related businesses, such as Tesla, NIO, and General Motors. Another approach is to invest in up-and-coming companies that are disrupting the auto industry and changing the way we think about transportation, such as Lucid Motors or Rivian.

Of course, as with any investment, there are risks to consider when investing in EV-related stocks. Market volatility, competition, and regulatory changes can all impact the value of your investment. It’s important to do your research and carefully consider your options before making any investment decisions.

Ultimately, investing in EV-related stocks can be a smart move if you believe in the future of the technology and are willing to stay the course through any short-term fluctuations. The EV industry is rapidly evolving, and there are sure to be both winners and losers along the way. However, by diversifying your portfolio with a mix of established and up-and-coming companies, you can position yourself for long-term success in this exciting and growing market.

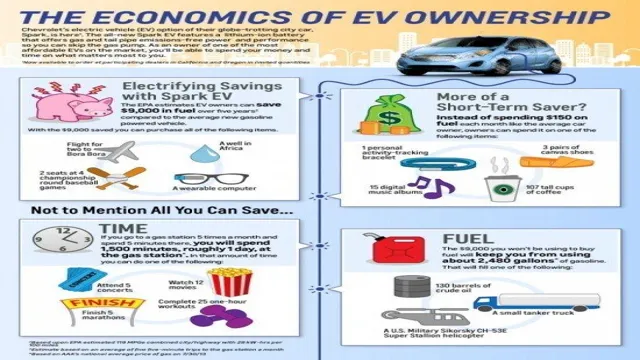

Long-Term vs. Short-Term Investment Options

Investment Strategies When it comes to investing, there are different options you can choose from- long-term or short-term. Long-term investment strategies refer to investing your money in assets that appreciate in value slowly over a long period of time, usually more than five years, such as bonds, mutual funds, and real estate. On the other hand, short-term investment strategies refer to investing your money in assets that increase in value quickly, usually less than a year, often referred to as day trading or swing trading.

Long-term investment strategies are generally considered safer because they provide a consistent return on investment and are less susceptible to market volatility. A long-term investment portfolio is well-suited for those who are willing to take a more passive approach to investing as it can be relatively low maintenance. There are also tax benefits associated with long-term investment strategies, such as the long-term capital gains tax rate.

Short-term investment strategies, on the other hand, offer higher returns but also come with higher risks. While short-term investing can provide quick gains, it can also result in quick losses, making it a more volatile investment strategy. It’s best suited for individuals who are willing to take on higher risks and are willing to closely monitor the market daily.

Ultimately, the right investment strategy depends on your financial goals, risk tolerance, and investment timeframe. Consider consulting with a financial advisor to help determine the best investment strategy for you.

Final Thoughts

Which stocks will benefit from electric cars? This question has been nagging investors’ minds as the world shifts towards greener living. The truth is that several industries stand to benefit from the proliferation of electric cars. One of the most prominent sectors is the battery industry.

Electric cars use lithium-ion batteries, the same type used in smartphones, laptops, and other electronic devices. With the rising demand for electric cars, the demand for these batteries is also expected to surge. This increase in demand presents an opportunity for companies that manufacture batteries, such as Panasonic, LG Chem, and Samsung.

Another industry that will benefit from electric cars is the renewable energy sector. Companies that produce wind turbines, solar panels, and hydroelectric power systems are expected to experience a surge in demand as more people move towards electric cars. Therefore, investing in companies like Vestas Wind Systems, Siemens Gamesa, and First Solar could pay dividends in the long run.

Finally, traditional automakers that have already made significant investments in electric cars are expected to benefit tremendously from this shift towards greener living. Companies like Tesla and General Motors offer investors a great opportunity to profit from the growing demand for electric cars. In conclusion, as the world moves towards a greener future, so do investment opportunities.

Investing in companies with exposure to the battery industry, renewable energy sector, and electric car manufacturing could be a wise investment decision for those interested in profiting from the transition to electric vehicles.

Conclusion

As electric cars continue to gain popularity and become more mainstream, the stocks that stand to benefit will be those that are involved in the production of electric components for cars, such as lithium-ion batteries and electric motors. Companies such as Tesla, Panasonic, and General Electric are poised for growth as the demand for electric cars becomes more widespread. However, don’t overlook the behind-the-scenes players, such as mining companies that provide the raw materials for these components.

In short, investing in the future of electric cars may just be the smartest move you make.”

FAQs

Why are electric cars becoming more popular?

Electric cars are becoming more popular due to their eco-friendliness and cost efficiency compared to gasoline-powered cars.

Which companies produce electric cars?

Some of the top companies producing electric cars include Tesla, Nissan, BMW, and Chevrolet.

How do electric cars work?

Electric cars run on electricity stored in batteries, which power an electric motor to drive the wheels. The batteries can be recharged by plugging the car into an electrical outlet or charging station.

Which stocks are expected to benefit from the rising popularity of electric cars?

Some of the companies expected to benefit from the electric car revolution include Tesla, Panasonic (which produces batteries for electric cars), and Toyota (which has invested heavily in developing electric cars). Other companies involved in producing components for electric cars, such as Semiconductors or suppliers of Lithium-ion batteries could also see increased demand.