Electric Driving Force: Uncovering the Top Stocks Poised for Growth in the Electric Car Industry

The world we live in is rapidly changing, and nowhere is that more apparent than in the automotive industry. Electric cars are no longer a futuristic concept but are instead a growing reality that is giving traditional gasoline-powered cars a run for their money. With this new shift, the stock market is also changing, and investors are reaping the benefits.

But where should you invest if you want to take advantage of the electric car movement? What stocks are leading the charge, and which ones will be left in the dust? In this blog, we will explore the relationship between electric cars and the stock market, and we will provide valuable insights that will help guide your investment decisions. So sit back, buckle up, and get ready to take your portfolio on a thrilling electric ride.

Electric Car Growth in Market

As the world shifts towards cleaner and more sustainable energy options, electric vehicles are gaining increasing popularity. This growth presents an excellent opportunity for investors to capitalize on the automotive industry’s evolution. However, not all companies are poised to benefit from this trend equally.

Investing in electric car stocks could provide high returns, but investors must research to identify companies with a competitive edge. Some of the companies that might benefit the most from the proliferation of electric cars include battery manufacturers such as Tesla Inc. and LG Chem, automakers such as Ford, General Motors, and Volkswagen, and technology companies like Aptiv and NVIDIA, which provide the components such as driver-assistance systems and high-performance computing chips that are integral to the electric cars’ functioning.

Investing in these companies can provide investors with an opportunity to grow their portfolios and play an active role in shaping the clean energy future.

Key Players and Electric Cars Model

Electric cars are slowly but surely becoming a significant player in the car manufacturing industry. With the increased focus on sustainable and environmentally friendly modes of transportation, electric cars are gaining traction among consumers. There are several key players who are leading the way when it comes to electric car production, such as Tesla, Nissan, and Chevrolet.

Tesla, in particular, has been at the forefront of the electric car movement, with their Model S and Model 3 leading the charge. Nissan’s Leaf is also a popular option, with its affordable price point and reliable performance. Chevrolet’s Bolt EV has also gained popularity due to its impressive range and fast charging capabilities.

As more car manufacturers begin to invest in electric car production, we can expect to see even more models enter the market in the coming years. With their quiet and efficient engines, electric cars are not only better for the environment, but they also provide a smoother and more enjoyable driving experience. It’s no wonder that they are quickly gaining popularity among consumers worldwide.

Estimated Growth of Electric Cars on the Market

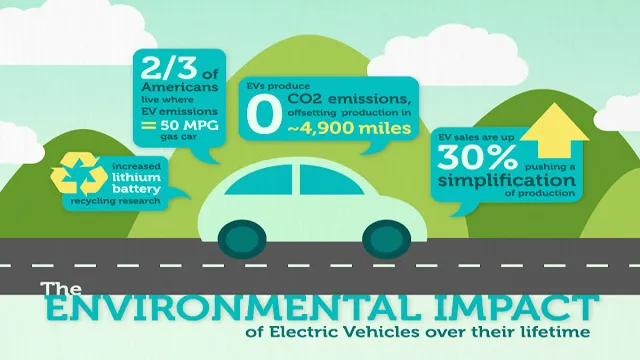

The growth of electric cars in the market has been impressive over the past few years. According to a report by BloombergNEF, at least 10 million electric vehicles will be on the road globally by 202 This represents a significant increase from the current estimate of about 3 million electric vehicles in 2020.

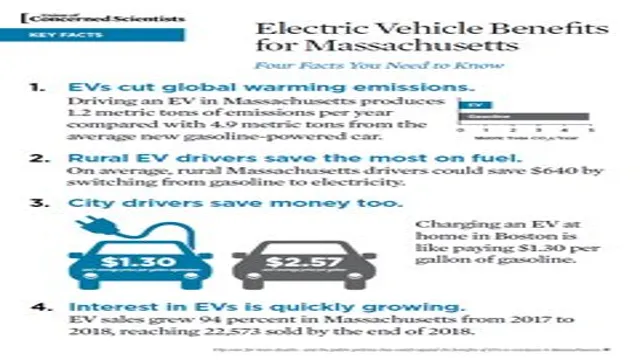

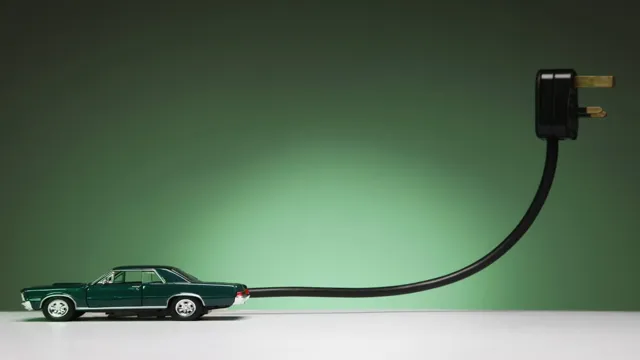

The growth of electric cars has been fueled by several factors, including government incentives, better technology, and increased awareness of their benefits. Electric cars are more cost-effective in the long run, with lower fuel costs and maintenance expenses. Additionally, electric vehicles are environmentally friendly, producing fewer emissions than traditional petrol or diesel cars.

As more people become aware of these benefits, the demand for electric cars is set to skyrocket in the coming years. Therefore, it is safe to say that the future looks bright for electric cars, and they will continue to gain popularity in the market.

Electric Car Sector and the Stock Market

Electric cars are rapidly gaining traction in the automotive industry, and as a result, the stock market is taking notice. Investors are flocking to companies that are involved in the electrification of vehicles, from major automakers like Tesla and General Motors to battery producers like Panasonic and LG Chem. Some companies, like NIO and Fisker Inc, focus exclusively on electric vehicles, and may be worth watching in terms of stock market performance.

Additionally, electric utilities such as NextEra Energy and Enel are expected to benefit from increased demand for charging infrastructure. While the electric car sector is still developing, early indicators suggest that companies involved in this industry will continue to see growth in the coming years, making them a potentially valuable addition to investors’ portfolios.

Current Stock Market Trends

The electric car industry is becoming a major player in the stock market as more investors put their money into this growing sector. With companies like Tesla leading the charge, many investors are optimistic about the future of electric cars and the potential for profits. One factor driving this trend is the increasing demand for electric vehicles as people become more concerned about climate change and reducing their carbon footprint.

Additionally, advances in technology are making electric cars more affordable and practical for everyday use. However, like any emerging industry, there are risks involved, and investors need to be mindful of potential downsides such as regulatory changes or competition from established automakers. Nonetheless, electric cars remain a hot topic in the stock market, and it will be interesting to see how this trend evolves in the years to come.

Stocks Most Likely to Benefit from Electric Car Industry

With the rise of electric vehicles, the stock market is witnessing a shift in focus towards green energy and sustainability. Many companies are repositioning themselves to benefit from the electric car industry, such as battery manufacturers like Tesla Inc. and Panasonic Corporation.

Moreover, auto manufacturers like General Motors and Ford Motors are investing heavily in electric cars to cater to this growing demand. Companies such as Albemarle Corporation, which produces lithium, a key component in electric car batteries, are also seeing significant returns. It is important to keep an eye on the stock market trends and the companies that stand to gain from the electric car sector.

Although the industry is still in its nascent stages, it has the potential to revolutionize the automobile industry and the stock market simultaneously. So, investing in the companies that are likely to benefit from this shift towards electric cars might be a wise decision for investors looking to reap the benefits of this paradigm shift.

Stocks to Avoid in Electric Car Industry

The electric car industry has been growing rapidly in recent years and has caught the eye of investors looking to make a quick profit. However, not all companies in the sector are worth investing in. Some companies may lack the necessary infrastructure or technology to drastically increase production or meet the demands of consumers.

Investing in the wrong company can lead to losses that can be difficult to recover from. As a result, it is important to do extensive research and analysis before investing in any company within the electric car industry. Avoid investing in companies without a proven track record or those with a high debt-to-equity ratio.

Always make sure to analyze the company’s financial strength, market share, and management team. By doing so, you can be sure that the investment you make in the electric car industry is a wise one. Remember, not all electric car stocks are created equal, so it’s important to do your homework beforehand!

Tips for Investing in Electric Car Stocks

If you’re interested in investing in the electric car industry, there are several stocks you may want to consider. Companies like Tesla (TSLA), NIO (NIO), and General Motors (GM) are among the most prominent players in the electric vehicle market and have seen significant growth in recent years. However, it’s important to do your research and make informed decisions before investing your money.

Factors to consider include a company’s financial health, their level of innovation within the industry, and their ability to compete with established players. Remember, investing in stocks can be risky, so it’s essential to diversify your portfolio and not put all your eggs in one basket. By doing your research and staying informed about industry trends, you can invest in electric car stocks with confidence knowing that you’re making informed decisions.

Diversification is Key

When it comes to investing, diversification is key. This means spreading out your investments across different industries and companies, rather than putting all your eggs in one basket. One industry that has been gaining traction in recent years is the electric car industry.

There are a few tips to keep in mind if you’re interested in investing in electric car stocks. First, do your research and make sure you understand the market and the specific companies you’re considering investing in. Look at their financials, their competitors, and any potential regulatory or technological changes that could impact their success.

Second, consider diversifying within the electric car industry itself, by investing in both established companies like Tesla and newer players like NIO and Lucid Motors. Finally, keep a long-term perspective and don’t get caught up in short-term fluctuations – remember that the electric car industry is still in its early stages and there will likely be ups and downs along the way. By following these tips, you can potentially benefit from the growth of the electric car industry while still maintaining a balanced and diversified investment portfolio.

Pay Attention to Data, Not Hype

Investing in electric car stocks can be a game-changer for your portfolio, but before diving in, it’s crucial to pay attention to data rather than hype. While electric vehicles (EVs) have received immense attention in recent years, it’s important to consider factors beyond their buzz. Look at the data and projections related to EV sales, production costs, and government policies that affect the industry’s growth.

It’s also essential to scrutinize the financials of the companies you plan to invest in and compare them with their competitors. Keep in mind that investing in EV stocks is not a get-rich-quick scheme and needs a long-term approach. Choose carefully, don’t get swayed by hype, and base your decisions on solid data to reap the benefits.

Conclusion: Electric Cars and Stock Market: A Smart Investment?

It’s time to shift your investment mindset and power up your portfolio with electric car stocks. As the world moves towards a sustainable future, the demand for electric cars is skyrocketing. Companies that lead the race in producing electric cars, batteries, and EV charging infrastructure are prime targets for savvy investors.

Investing in these stocks not only supports the clean energy transition but also offers potential for high returns. So, forget gas-guzzling dinosaurs and embrace the future with electric car stocks – your portfolio and the planet will thank you.”

FAQs

How will the rise of electric cars impact the stock market?

The rise of electric cars could potentially benefit stocks in the electric car industry, such as Tesla or NIO.

Will traditional car manufacturers see a decline in their stock values with the emergence of electric cars?

It is possible that traditional car manufacturers may see a decline in their stock values as consumer demand shifts towards electric cars. However, some traditional car manufacturers are investing heavily in electric car technology to stay competitive.

Are there any lesser-known stocks that could benefit from the growth of the electric car industry?

There are several smaller companies that specialize in electric car parts or charging stations that may see growth in their stock values as demand for electric cars increases.

How do government regulations and incentives impact the stock values of electric car companies?

Government regulations and incentives, such as tax credits for electric car purchases, can have a significant impact on the stock values of electric car companies. Positive government support can lead to increased demand and investment in the industry, potentially leading to higher stock values.