Will Ford Be Forced to Continue Electric Cars Amid Rising Demand

Featured image for will ford be forced to continue electric cars

Image source: techfieber.de

Ford is under mounting pressure to accelerate its electric vehicle (EV) production as global demand surges and regulations tighten. With competitors advancing and governments setting aggressive emissions targets, the automaker may have no choice but to double down on EVs—or risk falling behind in the rapidly evolving auto market.

Key Takeaways

- Ford must adapt to rising EV demand or lose market share.

- Regulatory pressure will likely force Ford to expand EV production.

- Consumer shift toward EVs makes discontinuation a risky move.

- Invest in charging infrastructure to maintain competitive edge in EV market.

- Supply chain readiness is critical for Ford’s long-term EV success.

- Delaying EV plans could damage Ford’s brand and investor confidence.

📑 Table of Contents

- The Electric Crossroads: Is Ford’s EV Future Set in Stone?

- Why Electric Cars Are No Longer Optional

- Consumer Demand: Are Buyers Actually Choosing EVs?

- Ford’s Electric Investments: Are They All In?

- The Competition: Can Ford Keep Up?

- Will Ford Be Forced to Continue Electric Cars? The Verdict

- Data Snapshot: Ford’s EV Performance (2020–2023)

- The Road Ahead: What It Means for You

The Electric Crossroads: Is Ford’s EV Future Set in Stone?

Imagine walking into a car dealership in 2030 and being told, “Sorry, no gas-powered Fords left.” That future isn’t as far-fetched as it sounds. Ford, the iconic automaker behind the Mustang, F-150, and generations of American drivers’ favorite rides, is now at a pivotal moment. The question isn’t just whether Ford *wants* to go electric—it’s whether they’ll be *forced* to. With governments tightening emissions rules, consumers demanding cleaner options, and competitors like Tesla and Hyundai pulling ahead in the EV race, Ford’s path forward is anything but simple. It’s like watching a beloved diner chain suddenly told to switch to vegan-only menus—possible, but not without growing pains.

But let’s be real: Ford didn’t just wake up one day and decide to build electric cars. The shift started years ago, driven by a mix of external pressure and internal ambition. The real question now is whether Ford can keep up—or whether the market, regulations, and technology will leave them no choice. Whether you’re a Ford loyalist, an EV enthusiast, or just curious about what’s next in transportation, this story is about more than just cars. It’s about how legacy companies adapt (or fail to) in a world demanding change. And if you’re wondering whether Ford will be forced to continue electric cars amid rising demand, the answer isn’t a simple yes or no. It’s a mix of policy, profit, and public opinion—and we’re diving into all of it.

Why Electric Cars Are No Longer Optional

Let’s start with the big picture: the world is moving toward electric vehicles, and fast. It’s not just a trend—it’s a transformation. In 2023, global EV sales topped 14 million, up from just 4% of new car sales in 2020 to over 18% today. In the U.S., that number is around 9%, but in Europe and China, it’s over 20%. The writing is on the wall: internal combustion engines (ICE) are on their way out.

Visual guide about will ford be forced to continue electric cars

Image source: cdn-fastly.thetruthaboutcars.com

The Regulatory Pressure Cooker

One of the biggest reasons Ford may be forced to continue electric cars is government regulation. The U.S. Environmental Protection Agency (EPA) recently tightened emissions standards, requiring automakers to reduce fleet-wide greenhouse gas emissions by 56% by 2032. That means even if Ford sells a bunch of gas trucks today, they’ll need a growing share of zero-emission vehicles (ZEVs) to meet the math.

California’s Advanced Clean Cars II (ACC II) rule is even more aggressive. Starting in 2035, all new cars sold in the state must be electric or hydrogen-powered. Since California is the largest auto market in the U.S., and 17 other states follow its lead, this isn’t just a regional issue. It’s a national mandate in all but name.

Practical tip: If you live in a state with clean car standards, check your local DMV website. You might be eligible for EV tax credits or rebates just for buying an electric Ford. For example, New York offers up to $2,000 in point-of-sale rebates for EVs under $55,000—including the Ford Escape PHEV.

Global Climate Commitments

Beyond the U.S., the pressure is global. The European Union’s “Fit for 55” package bans new gas and diesel car sales by 2035. China, the world’s largest car market, has a national target of 40% new energy vehicles (NEVs) by 2030. Ford has operations in all three regions, meaning they can’t afford to ignore any of them. If Ford wants to sell cars in Europe or China, they *have* to offer EVs.

And it’s not just governments. Investors are demanding sustainability too. BlackRock, Ford’s largest shareholder, has made climate risk a top priority in its investment decisions. If Ford lags in electrification, it could face shareholder lawsuits, lower stock ratings, or even divestment.

Consumer Demand: Are Buyers Actually Choosing EVs?

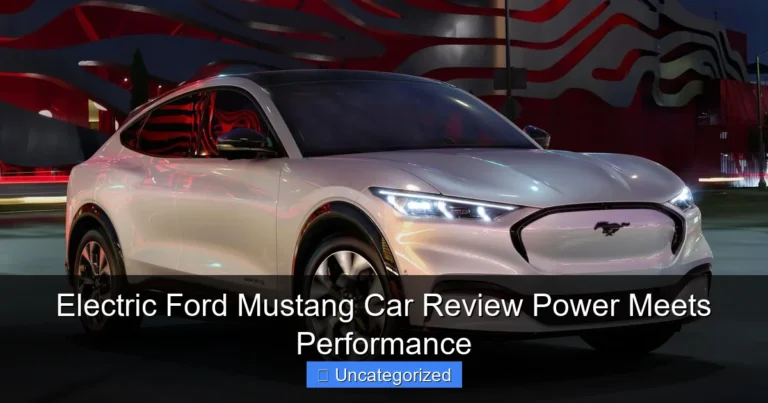

Regulation is one thing, but what about real people? Do consumers actually want electric cars? The answer is yes—but with caveats. In 2023, Ford sold over 72,000 EVs in the U.S., a 55% increase from 2022. The Ford Mustang Mach-E and F-150 Lightning are consistently among the top-selling EVs in their categories. That’s not a fluke. It’s proof that when Ford builds compelling electric vehicles, people buy them.

The Rise of the “EV Curious”

But not everyone is ready to go all-electric. Many buyers are what we call “EV curious.” They like the idea of lower emissions and cheaper fuel, but they’re worried about range, charging, and cost. Ford knows this. That’s why they’ve invested heavily in plug-in hybrids (PHEVs) like the Escape PHEV and Explorer PHEV—vehicles that offer electric range (30–40 miles) with a gas engine for backup. These models act as a bridge, easing buyers into the EV world without the anxiety.

Take my neighbor, Sarah, for example. She drives about 25 miles a day and charges her Escape PHEV overnight. She uses gas maybe once a month. “I didn’t think I’d like it,” she told me, “but now I can’t imagine going back.” Stories like hers are becoming more common. Ford’s strategy isn’t to force everyone into full EVs overnight—it’s to offer options that make the transition feel natural.

Charging Infrastructure: The Elephant in the Room

One of the biggest barriers to EV adoption is charging. Ford knows this. That’s why they’ve partnered with companies like EVgo and ChargePoint to expand fast-charging networks. They’ve also joined the Ionna initiative—a joint venture with BMW, GM, Honda, Hyundai, Kia, and Mercedes-Benz—to build 30,000 ultra-fast chargers across North America by 2030.

And here’s a smart move: Ford offers free charging for two years with every new EV purchase. That’s not just a perk—it’s a way to reduce range anxiety and build trust. Think of it like a free trial. Once people experience the convenience of charging at home and fast top-ups on the road, they’re more likely to stick with EVs.

Practical tip: If you’re considering an EV, use Ford’s “EV Trip Planner” tool on their website. It shows you charging stations along your route and estimates charging time. It’s not perfect, but it’s a great way to test-drive the EV lifestyle before buying.

Ford’s Electric Investments: Are They All In?

So, is Ford just reacting to pressure, or are they genuinely committed to electric cars? The answer is both. Ford has spent over $50 billion on electrification through 2026—more than any other automaker except Tesla and Volkswagen. That’s not pocket change. It’s a full-scale transformation.

BlueOval: The EV Manufacturing Powerhouse

Ford’s biggest move is the creation of BlueOval, a new division focused entirely on EVs and batteries. They’ve built three battery plants in the U.S.—two in Kentucky and one in Tennessee—through a joint venture with SK On. These plants will produce enough batteries for over 1 million EVs annually by 2026. That’s not just about supply; it’s about control. By making their own batteries, Ford reduces reliance on foreign suppliers and stabilizes costs.

The Tennessee plant, called BlueOval City, is a $5.6 billion mega-campus that will build the next-generation F-Series electric pickup. It’s expected to create 6,000 jobs and produce 400,000 vehicles a year. That’s not just an investment in EVs—it’s a bet on the future of American manufacturing.

The Software Edge: Ford’s Hidden Weapon

But Ford isn’t just building cars. They’re building digital ecosystems. Their Ford Pro software platform helps fleets manage EVs, track energy use, and optimize charging. For commercial customers—like delivery companies or construction firms—this is a game-changer. It’s not just about selling a vehicle; it’s about selling a service.

And then there’s Ford Power-Up, the company’s over-the-air (OTA) software update system. Like your smartphone, Ford EVs can get new features, improved performance, and bug fixes without visiting a dealership. The F-150 Lightning, for example, recently got a “Power My Trip” feature that helps plan charging stops based on weather, terrain, and battery health. That’s not just cool—it’s essential for long-distance travel.

Practical tip: If you own a Ford EV, make sure your software is up to date. Many performance improvements and safety features are rolled out via OTA updates. Check your vehicle’s touchscreen or the FordPass app monthly.

The Competition: Can Ford Keep Up?

Ford isn’t alone in the EV race. Tesla still dominates the market, with over 50% of U.S. EV sales. Hyundai and Kia are gaining fast, thanks to affordable, well-equipped models like the Ioniq 5 and EV6. Even traditional rivals like GM and Toyota are rolling out aggressive EV plans.

The Price War

One of Ford’s biggest challenges is pricing. In 2023, Ford cut prices on the Mach-E by up to $8,100 to stay competitive. The base model now starts at $39,895—down from $50,000 just a year earlier. The F-150 Lightning also saw price drops, with the Pro model now starting at $49,995. These cuts hurt margins, but they’re necessary to keep up with Tesla, which has slashed prices repeatedly to boost demand.

But here’s the catch: Ford’s EVs aren’t just competing on price. They’re competing on brand, utility, and trust. The F-150 Lightning, for example, appeals to truck buyers who want power, towing, and durability—not just zero emissions. Ford’s challenge is to maintain that identity while evolving into an EV brand.

Supply Chain and Battery Challenges

Another hurdle is supply chain. EV batteries require rare earth metals like lithium, cobalt, and nickel. These materials are in high demand, and supply is volatile. Ford has responded by securing long-term contracts with mining companies and investing in battery recycling. They’ve also developed a new battery chemistry called LFP (Lithium Iron Phosphate), which uses less nickel and cobalt—reducing cost and environmental impact.

The F-150 Lightning already offers an LFP battery option for fleet customers. It’s not as energy-dense as nickel-based batteries, but it’s cheaper, safer, and longer-lasting. That’s a smart move for commercial buyers who prioritize durability over range.

Will Ford Be Forced to Continue Electric Cars? The Verdict

So, will Ford be forced to continue electric cars? The short answer is: **yes, but not in the way you might think**. It’s not that Ford has no choice. It’s that the alternatives are worse. If Ford *doesn’t* go electric, they risk:

- Fines and penalties from missing emissions targets

- Loss of market share to competitors with better EV lineups

- Damage to brand reputation as consumers and investors demand sustainability

- Reduced access to key markets like California and Europe

The Hybrid Strategy: A Smart Middle Ground

But Ford doesn’t have to go 100% electric tomorrow. Their current strategy—focusing on a mix of full EVs, PHEVs, and efficient ICE vehicles—is actually smart. It gives them time to scale production, improve technology, and win over skeptical buyers. The key is balance. Ford can’t ignore EVs, but they don’t have to abandon their core customers either.

For example, the 2024 Ford Ranger comes with a hybrid option in some markets. The 2025 Ford Explorer will offer a plug-in hybrid with 50 miles of electric range. These models let Ford meet emissions rules while giving buyers the flexibility they want.

The Wild Card: Technology Breakthroughs

And then there’s the wildcard: innovation. What if solid-state batteries become viable in the next 5 years? Or if hydrogen fuel cells take off? Ford is hedging its bets. They’ve invested in hydrogen research and are exploring alternative fuels for heavy-duty trucks. But for now, EVs are the clear priority. Why? Because the infrastructure, consumer demand, and regulatory pressure are strongest in the electric space.

Practical tip: If you’re waiting for the “perfect” EV, you might be waiting forever. The technology improves every year. Focus on what matters to you—range, price, charging speed, or towing capacity—and buy when it meets your needs. Ford’s lineup is diverse enough that there’s likely a model that fits.

Data Snapshot: Ford’s EV Performance (2020–2023)

| Year | EV Sales (U.S.) | EV Models Available | Battery Production (GWh) | EV % of Total Sales |

|---|---|---|---|---|

| 2020 | 2,500 | 1 (Focus Electric) | 0.5 | 0.1% |

| 2021 | 18,000 | 3 (Mach-E, E-Transit) | 1.2 | 1.2% |

| 2022 | 46,000 | 4 (add F-150 Lightning) | 3.8 | 3.5% |

| 2023 | 72,000 | 6 (add Escape PHEV, Explorer PHEV) | 7.1 | 5.8% |

Source: Ford Annual Reports, U.S. Department of Energy, BloombergNEF

The data shows a clear upward trend. Ford’s EV sales are growing fast, and their battery production is scaling up. But they’re still far behind Tesla, which sold over 500,000 EVs in the U.S. in 2023. The race isn’t over—but Ford is in it to win.

The Road Ahead: What It Means for You

So what does all this mean for you? If you’re a Ford fan, it means your favorite brand is changing—but not disappearing. The Mustang, F-150, and Explorer aren’t going away. They’re evolving. If you’re an EV skeptic, Ford is giving you more options than ever to ease into the transition. And if you’re just watching from the sidelines, this story is a reminder: the future of cars isn’t about one company. It’s about how industries adapt when the world demands change.

Ford may be forced to continue electric cars, but they’re doing it with a plan. They’re investing in technology, listening to customers, and navigating the complex web of regulations and competition. It’s not perfect. There will be missteps. Some models will flop. But the direction is clear: electric is the future. And Ford, for all its legacy, is trying to build it—not just survive it.

So the next time you see a Mustang Mach-E on the road or hear about the F-150 Lightning’s power export feature, remember: this isn’t just about cars. It’s about a century-old company learning to dance in a new rhythm. And if they get it right, we all win—drivers, the planet, and the future of mobility.

Frequently Asked Questions

Is Ford legally required to continue producing electric cars?

While no federal law *forces* Ford to make electric vehicles (EVs), tightening emissions regulations and state-level ICE bans (like California’s 2035 rule) create strong incentives. Ford’s own sustainability goals and investor pressure also push them toward an electric future.

Will rising EV demand force Ford to expand its electric car lineup?

Absolutely. Consumer demand for EVs is growing rapidly, and Ford risks losing market share if it doesn’t meet it. The automaker has already committed $50 billion to electrification through 2026 to keep pace.

How do government incentives impact Ford’s electric car strategy?

Tax credits (like the U.S. Inflation Reduction Act) and infrastructure funding reduce costs for Ford to develop EVs. These programs make it financially smarter to continue electric cars rather than revert to gas models.

Could Ford stop making electric cars if they wanted to?

Technically yes, but it would be costly. Ford has invested billions in EV platforms, factories, and partnerships. Backing out would waste capital and damage their reputation as a forward-thinking automaker.

Are Ford’s competitors forcing them to continue electric cars?

Yes. Tesla, GM, and Volkswagen are aggressively expanding EV offerings, raising consumer expectations. If Ford lags, it risks becoming irrelevant in key markets, especially younger demographics.

What happens if Ford ignores the shift to electric cars?

Ignoring the EV transition could lead to lost sales, regulatory fines, and investor backlash. Ford’s “Model e” division is already a standalone unit, signaling their long-term commitment to electric cars.