Benefit in Kind Tax Electric Car: Save Big Now!

Many people want to know about electric cars. They want to learn about the benefits. One important benefit is the tax system. This tax is called Benefit in Kind (BIK). It affects many drivers in the UK. In this article, we will explore BIK tax for electric cars. Let’s break it down.

What is Benefit in Kind Tax?

Benefit in Kind tax is a tax on company cars. If you get a car from your job, you might pay this tax. It is based on the car’s value and its emissions. The more pollution a car makes, the higher the tax. But electric cars are different.

Why Choose an Electric Car?

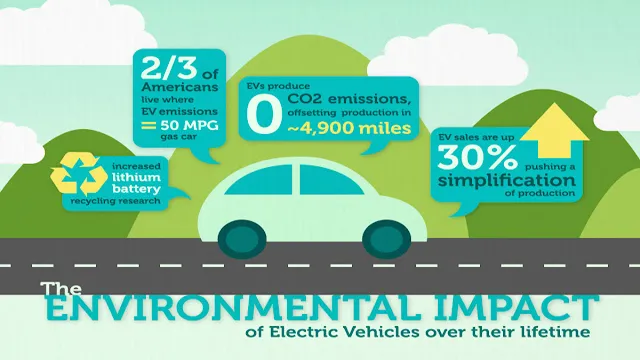

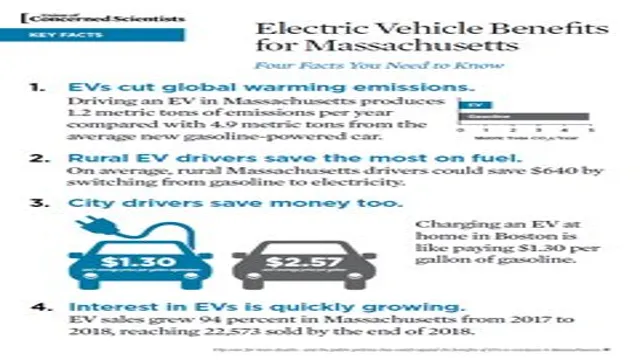

Electric cars are popular today. They are good for the environment. They do not emit harmful gases. This helps reduce air pollution. Also, electric cars are cheaper to run. You can save money on fuel. Many people want to drive electric cars for these reasons.

How is BIK Tax Calculated for Electric Cars?

The BIK tax for electric cars is lower than for regular cars. This makes them attractive for drivers. BIK tax uses a percentage of the car’s value. This percentage depends on the car’s emissions. Electric cars have zero emissions. Therefore, they have a lower BIK rate.

For example, if the car’s value is £30,000 and the BIK rate is 1%, the tax is:

| Car Value | BIK Rate | Tax Amount |

|---|---|---|

| £30,000 | 1% | £300 |

This means you only pay £300 in tax. This is much less than a petrol or diesel car.

Current BIK Rates for Electric Cars

The UK government sets BIK rates. They change every year. As of 2023, the BIK rate for electric cars is low. It is 2% for electric vehicles. This rate is very good compared to other cars. For example, petrol cars can have rates above 20%.

Saving Money with Electric Cars

Choosing an electric car can save you money. Here are some ways:

- Lower BIK tax means less money taken from your salary.

- Electric cars are cheaper to charge than petrol cars.

- You can get grants for buying electric cars.

- Insurance costs may be lower for electric cars.

Grants and Incentives for Electric Cars

The UK government offers grants. These help you buy electric cars. This can reduce the car’s price. The amount of the grant can be up to £2,500. This makes electric cars more affordable.

Many local councils also give incentives. These can include free charging points. Some places even offer free parking for electric cars.

Charging Electric Cars

Charging an electric car is easy. You can charge it at home. Many people install charging points at home. This makes it convenient. You can also find charging stations in many places.

Charging stations are growing in number. They are found in shopping centers, car parks, and along roads. This makes traveling easier. You can plan trips without worrying about charging.

Environmental Benefits

Driving an electric car helps the environment. Electric cars produce zero emissions. This helps improve air quality. Less pollution means healthier communities.

Many cities are trying to reduce pollution. They encourage electric cars. Some cities even have low-emission zones. This means only electric cars or low-emission cars can enter.

Future of Electric Cars

The future looks bright for electric cars. More people are buying them every day. Car manufacturers are making more electric models. They are working on better batteries. This means longer ranges and faster charging.

The UK government has plans too. They want to ban new petrol and diesel cars by 2030. This will push more people to electric cars. The BIK tax will likely remain low to encourage this change.

Frequently Asked Questions

What Is Benefit In Kind Tax For Electric Cars?

Benefit in Kind (BiK) tax is a tax on the value of perks, like electric cars, provided by your employer.

How Is Benefit In Kind Tax Calculated?

BiK tax is calculated based on the car’s list price and its CO2 emissions. Lower emissions mean lower tax rates.

What Are The Tax Rates For Electric Cars?

For electric cars, the BiK tax rates are very low, often starting at 1% and increasing slightly each year.

Do Electric Cars Have Lower Bik Tax?

Yes, electric cars typically have lower BiK tax rates compared to petrol or diesel vehicles.

Conclusion

In summary, Benefit in Kind tax for electric cars is low. This is a great advantage for drivers. Electric cars are good for the environment. They are also cheaper to run. With government grants and incentives, they are more affordable.

Charging is easy and convenient. More charging stations are appearing everywhere. The future of electric cars looks promising. As more people switch to electric cars, our planet will benefit.

Driving an electric car is a smart choice. It saves money and helps the environment. If you are thinking about getting a new car, consider an electric one.

Take advantage of the BIK tax benefits. Make a positive impact on your wallet and the planet.