Benefit in Kind on Electric Cars Ireland: Tax Perks Unveiled!

Electric cars are becoming popular in Ireland. Many people want to drive them. They are good for the environment. But what about costs? In this article, we will talk about Benefit in Kind (BIK) for electric cars in Ireland. We will explain what it is and how it helps you.

What is Benefit in Kind (BIK)?

Benefit in Kind is a tax. It applies to company cars. If your employer gives you a car, you may pay tax on it. This tax is based on the car’s value and its emissions. Lower emissions mean lower tax. Electric cars have very low emissions. This is one reason they are so attractive.

Why Choose Electric Cars?

Electric cars have many benefits. Here are some key points:

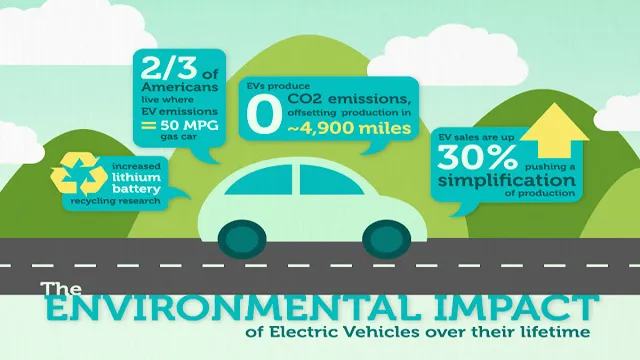

- They help reduce pollution.

- They are quiet and smooth to drive.

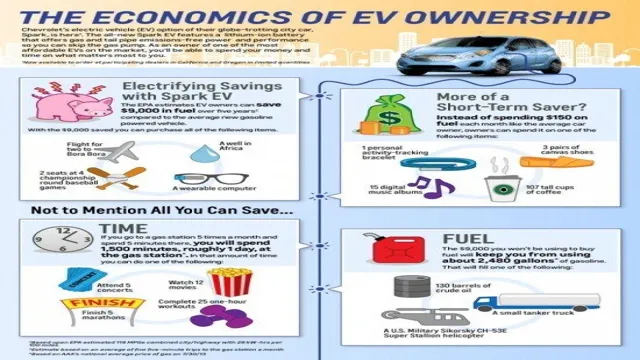

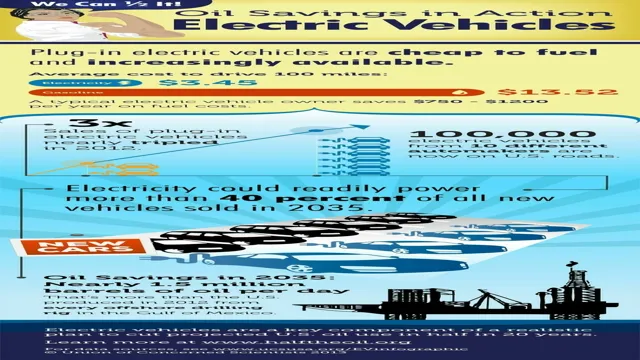

- They can save you money on fuel.

- They often have lower running costs.

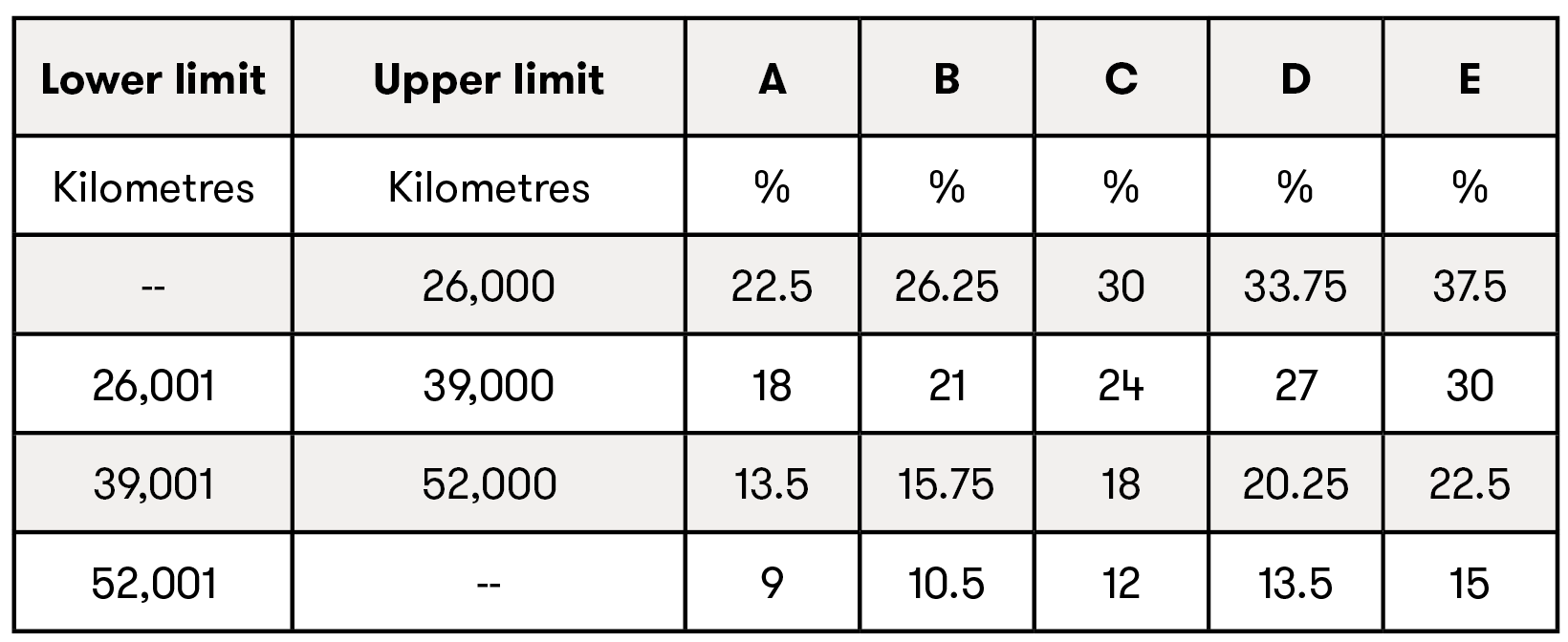

How Does BIK Work for Electric Cars?

When you drive an electric car from your job, BIK applies. The amount of tax you pay depends on the car’s CO2 emissions. Electric cars produce no emissions. This means they often have low BIK rates. The government wants to encourage electric cars. Therefore, they lower the tax for these vehicles.

Current Bik Rates For Electric Cars

The BIK rates for electric cars are very low. As of now, the rate is 0% for cars with a value below a certain limit. The limit is set by the government. If your electric car costs less than this limit, you pay no BIK. This is a big saving. It makes electric cars more attractive.

Changes In Bik Rates

BIK rates can change over time. The government reviews them regularly. They may increase the rates in the future. However, they may also continue to support electric vehicles. It is best to stay updated on any changes.

Other Benefits of Electric Cars

Besides low BIK rates, electric cars have other benefits. Here are some of them:

- Government grants are available for buying electric cars.

- There are tax incentives for charging stations.

- Many cities have low-emission zones. Electric cars can enter these areas.

- They often have free parking in some places.

Understanding the Cost

Buying an electric car can be expensive. However, lower BIK makes it easier. You can save money over time. Here are some costs to consider:

| Cost Type | Traditional Car | Electric Car |

|---|---|---|

| Purchase Price | Higher | Lower (after grants) |

| Fuel Costs | Higher | Lower |

| Tax (BIK) | Higher | Lower or 0% |

| Maintenance Costs | Higher | Lower |

How to Apply for BIK on Electric Cars?

If you want to apply for BIK on electric cars, follow these steps:

- Check with your employer about their car policy.

- Find out the price of the electric car.

- Make sure it is below the BIK limit.

- Gather necessary documents and submit them.

- Wait for confirmation from your employer.

Frequently Asked Questions

What Is Benefit In Kind For Electric Cars In Ireland?

Benefit in Kind (BIK) is a tax applied to company cars. It affects the amount of tax you pay.

How Does Bik Apply To Electric Cars In Ireland?

Electric cars have lower BIK rates than petrol or diesel cars. This makes them cheaper for employees.

What Are The Bik Rates For Electric Cars?

The BIK rate for electric cars in Ireland is currently set at 0% for 2022. It will increase to 2% in subsequent years.

Who Pays The Benefit In Kind Tax?

The employee using the car pays the BIK tax. Employers may help with these costs.

Conclusion

Driving an electric car in Ireland has many benefits. The Benefit in Kind tax is low. This makes it cheaper to own an electric car. You can save money on taxes, fuel, and maintenance. Electric cars help the environment too. They are a great choice for the future.

Consider your options. Talk to your employer. Learn more about electric cars. They can be a smart decision for you.