Unlocking the Tax-Saving Power of Electric Cars: Exploring Benefit in Kind Tax Benefits and Other Cost Benefits

Electric cars have become a popular choice for environmentally conscious drivers who want to reduce their carbon footprint. Not only are they better for the environment, but they also offer various benefits, including lower fuel costs, reduced maintenance fees and tax benefits. However, one aspect that can be confusing for electric car owners is the Benefit in Kind (BIK) tax.

Simply put, BIK is a tax on any benefits you receive from your employer that are not part of your salary, including the provision of an electric company car. In this blog post, we’ll explore what you need to know about BIK tax for electric cars and why it matters to you. So buckle up and let’s get started!

Overview of Benefit in Kind Tax

Benefit in Kind (BIK) tax is a tax paid on non-cash benefits provided to employees by their employers. This tax applies to a range of benefits, including company cars, medical insurance, and gym memberships. In recent years, electric cars have become an increasingly popular employee benefit.

Under current UK tax law, electric company cars have lower BIK tax rates than traditional petrol or diesel cars, making them a great option for employers looking to offer a greener benefit to their employees. In fact, in some cases, electric company cars attract no BIK tax at all. This means that not only are electric cars a more environmentally friendly option, but they can also provide a significant tax advantage for both employers and employees.

With the government’s commitment to reducing carbon emissions, it’s likely that BIK tax rates for electric cars will remain favourable for some time to come.

Explanation of Benefit in Kind Tax

Benefit in Kind Tax is an additional tax levied on non-salary benefits that employees receive from their employer. It is important to understand that this type of tax is applicable to all benefits received in cash or in kind, with the exception of reimbursement for expenses actually incurred for work purposes. Examples of non-cash benefits include company cars, employee accommodation, private medical insurance, and other fringe benefits, all of which are taxable.

The value of the benefit is usually calculated as a percentage of the benefit’s cash equivalent, which is the cost the employer would have incurred if the benefit had been offered in cash. The BIK tax rate is determined by the value of the benefit and the employee’s tax bracket. This tax is an important factor to consider when taking up employment that offers non-cash benefits or fringe benefits as part of the remuneration package.

How Benefit in Kind Tax is Calculated

Benefit in Kind Tax is a tax that you may have to pay if you receive certain benefits from your employer in addition to your salary. These benefits could include a company car, private health insurance, or reduced rent on company-provided accommodation, among others. The amount of tax you pay will depend on a number of factors, such as the value of the benefit, how often you use it, and your income tax bracket.

Benefit in Kind tax is calculated based on a percentage of the benefit value, ranging from 0% to 37%, depending on the employee’s income tax bracket. For example, if an employee earns over €70,000 per year and receives private health insurance worth €2,000, they can expect to pay Benefit in Kind tax of around 37%, which would amount to €740. It is important to note that Benefit in Kind tax is not payable on all benefits, and some may be tax-free or subject to a reduced rate of tax.

Electric Cars and Benefit in Kind Tax

Benefit in kind tax makes a significant difference when it comes to owning an electric car. Currently, the UK government has introduced a zero benefit in kind tax rate for electric cars which will remain in place until 2025, after which it will gradually increase. This means that if an electric car is chosen as a company vehicle, the tax that the owner has to pay on the car will be significantly lower than what would be paid on a petrol or diesel car.

This is because electric cars have a much lower carbon footprint, which contributes towards the government’s goal to reduce carbon emissions and tackle climate change. So, it is worth considering an electric car as a company car not only for its environmental benefits but also for the financial savings that can be made.

Lower Tax Rates for Electric Cars

Electric cars have been gaining popularity in recent years as an eco-friendly alternative to traditional gas-powered vehicles. With the rise of these cars, there has been a push for incentives to encourage more people to adopt them. One such benefit is lower tax rates for electric cars in the form of benefit in kind tax.

This tax applies to company cars and is based on the car’s value, emissions, and fuel type. As electric cars have zero emissions, they are given the lowest tax rate possible, which can save drivers a significant amount of money each year. This reduction in tax rates not only benefits the driver’s wallet but also helps to reduce carbon emissions, making electric cars a win-win for both the individual and the environment.

So, if you’re in the market for a new company car, it may be worth considering an electric option to not only save money but also do your part in reducing your carbon footprint.

Zero Benefit in Kind Tax for Electric Cars

If you’re thinking about getting an electric car, there’s good news on the tax front! You won’t have to pay a Benefit in Kind (BIK) tax, which is usually associated with company cars. This means you could save thousands of dollars per year if you opt for an electric vehicle instead of a traditional petrol or diesel car. The zero BIK tax for electric cars is part of the UK government’s push to incentivise people to switch to low-emission vehicles.

So not only will you be doing your bit for the environment by reducing your carbon footprint, but you’ll also be saving money on taxes at the same time. It’s a win-win situation that more and more people are taking advantage of. So go ahead, make the switch to electric and enjoy the benefits!

Case Study: Example of Tax Savings with an Electric Car

Electric cars are becoming increasingly popular due to their environment-friendly nature and their potential cost savings. One significant advantage of driving an electric car is the potential tax savings. This is because electric cars are subject to lower Benefit in Kind (BIK) tax rates compared to petrol or diesel vehicles.

For instance, an electric car with a list price of £30,000 and zero emissions has a BIK rate of zero in 2021-22, while its petrol counterpart would attract a BIK tax of £3,000. This means that driving an electric vehicle can result in significant savings in terms of tax. Additionally, when it comes to running an electric car, there are no fuel costs to incur, and the maintenance expenses are also typically lower since these vehicles have fewer moving parts.

Therefore, choosing to drive an electric car can not only help protect the environment but also result in considerable tax savings.

Additional Benefits of Driving an Electric Car

One additional benefit of driving an electric car is the lower Benefit In Kind tax rates. Benefit In Kind (BIK) tax is a tax on perks and benefits employees receive from their employers, such as company cars. Traditionally, company car drivers had to pay a BIK tax based on the value of the car and the level of CO2 emissions.

However, as electric cars produce no CO2 emissions, they are exempt from BIK tax in the financial year 2021-202 This means that electric car drivers are taxed at a much lower rate, making them a more affordable option for company car drivers. It’s a win-win situation for both the environment and your wallet.

So, if you’re considering getting a company car, or if you’re an employer providing one, an electric car can be a more attractive option with its lower tax rate.

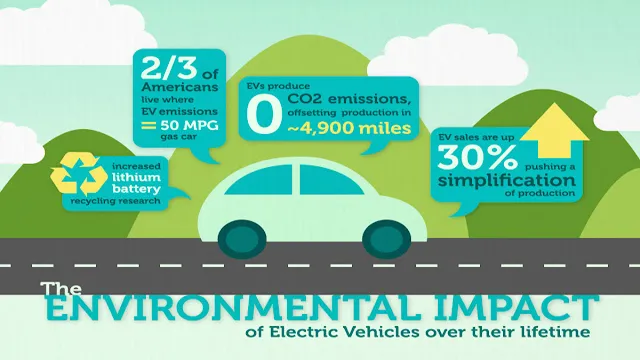

Environmental Benefits of Electric Cars

One of the biggest benefits of driving an electric car is the positive impact it can have on the environment. Electric cars produce significantly less harmful emissions than gasoline-powered cars, reducing air pollution and improving air quality in cities. Additionally, electric cars don’t produce tailpipe emissions, which can cause harm to the environment and contribute to climate change.

Aside from reducing emissions, electric cars also have other environmental benefits. For example, they are much quieter than gasoline-powered cars, reducing noise pollution in urban areas. Finally, electric cars can be powered by renewable energy sources like solar or wind power, making them a more sustainable transportation option.

Ultimately, by choosing an electric car, you are making a positive contribution towards a cleaner and greener planet.

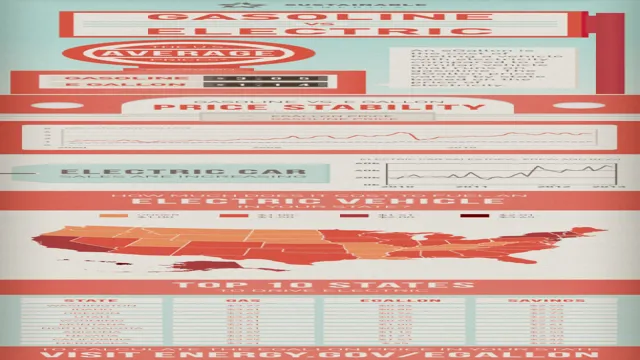

Lower Fuel and Maintenance Costs with Electric Cars

One of the biggest benefits of driving an electric car is the potential to save money on fuel and maintenance costs. When compared to traditional gas-powered vehicles, electric cars are much more efficient and typically use less energy to travel the same distance. This means that drivers can save significant amounts of money on fuel costs over time.

In addition, electric cars often require less maintenance than gas cars since they have fewer moving parts and don’t require regular oil changes or other expensive maintenance tasks. Overall, choosing an electric car can be a smart financial decision for drivers who want to save money on their transportation costs and reduce their environmental impact. By making the switch, you can enjoy the benefits of a more sustainable, cost-effective, and hassle-free vehicle that will serve you well for years to come.

Conclusion: Electric Cars Offer Tax and Non-Tax Advantages

In conclusion, the benefit in kind tax for electric cars is more than just a government policy to promote environmentally friendly transportation. It’s an excellent opportunity for drivers to save on taxes while cruising in style and comfort. With lower emissions and lower costs, electric cars are the smart choice for those who want to go green without breaking the bank.

So, let’s drive towards a cleaner future, one kilometer at a time!”

FAQs

What is the benefit in kind tax for electric cars?

The benefit in kind tax for electric cars is currently set at 0% until April 2025 in the UK, making them a more affordable option for company car drivers.

Are there any other tax incentives for using electric cars?

Yes, there are other tax incentives for using electric cars, such as exemption from vehicle excise duty and reduced rates of capital allowances for businesses.

Is the benefit in kind tax rate for electric cars likely to change in the future?

It is possible that the benefit in kind tax rate for electric cars may change in the future, as the government seeks to encourage the uptake of low-emission vehicles and reduce air pollution.

How do I calculate the benefit in kind tax for my electric car?

The benefit in kind tax for an electric car is calculated as a percentage of its list price, based on its CO2 emissions and electric range. There are online calculators available to help you work out your benefit in kind tax liability.