Maximizing Your Savings: How Tax Benefits Make Buying an Electric Car a Smart Financial Move!

Looking to take advantage of tax benefits while reducing your carbon footprint? Purchasing an electric car might be just what you need. Not only does owning an electric car put you at the forefront of eco-friendly transportation, but it may also provide you with a range of tax benefits to maximize your savings. With more and more governments incentivizing electric vehicle ownership, now is the perfect time to learn how to maximize your tax benefits with an electric car.

In this blog, we’ll discuss how driving an electric car can save you money in taxes, and provide you with all the information you need to make an informed decision about your next vehicle purchase.

Understanding Tax Credits

Are you considering purchasing an electric car? Aside from the benefits of reducing your carbon footprint and saving money on gas, did you know that you could also receive tax benefits? The federal government offers a tax credit of up to $7,500 for buyers of new electric cars. However, it’s important to note that this tax credit only applies to purchases of new electric vehicles, and not used ones. Additionally, the amount of the credit diminishes as more electric cars are sold by the manufacturer, so it’s important to act quickly if you want to take advantage of this tax credit.

To claim the credit, you’ll need to file IRS Form 8936 with your tax return. Don’t forget to also check with your state to see if there are any additional tax incentives for electric cars. Overall, purchasing an electric car not only benefits the environment, but it can also have a positive impact on your wallet come tax season.

Federal Tax Credit

Federal tax credits can be a significant benefit for taxpayers. Understanding how tax credits work is key to taking advantage of them. Tax credits lower your overall tax bill by reducing the amount of tax you owe dollar-for-dollar.

This is different from a tax deduction, which reduces taxable income. Tax credits come in different forms, such as personal, business, and energy-related credits, and can be refundable or non-refundable. Refundable credits are more beneficial because they can reduce your tax bill to zero and still offer a refund for any remaining amount.

On the other hand, non-refundable credits can only reduce your tax bill to zero, but don’t provide any refund. Tax credits can help offset expenses from child care, education, homeownership, and energy efficiency, among other things. Understanding tax credits can ultimately save taxpayers money, so it’s important to research which credits you may qualify for and how to claim them.

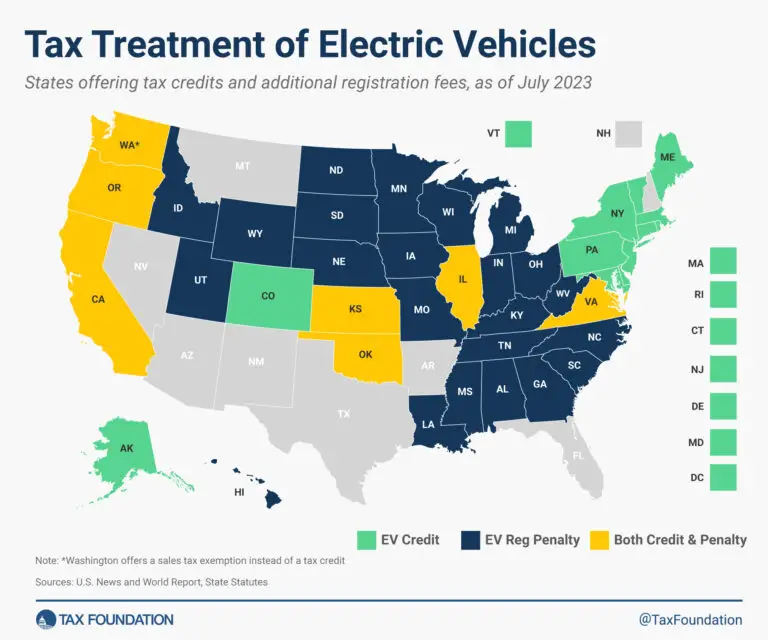

State and Local Incentives

If you’re a business owner looking to save some money, you might want to consider taking advantage of state and local incentives in the form of tax credits. Tax credits reduce the amount of tax you owe, dollar-for-dollar. They differ from tax deductions, which reduce the amount of your income that is subject to tax.

For example, if you qualify for a $5,000 tax credit and owe $7,000 in taxes, your tax bill would be reduced to $2,000. State and local tax credits vary depending on where you live, what your business does, and other factors. Some common types of tax credits include those for hiring employees from certain groups, such as veterans or people with disabilities, investing in energy-efficient equipment, and contributing to certain types of charitable organizations.

By taking advantage of these incentives, you can save money on your taxes and reinvest those savings back into your business.

Choosing the Right Electric Car

When it comes to choosing an electric car, one of the biggest advantages is the tax benefits you can receive. In many states, the purchase of an electric car can qualify you for a tax credit, which can save you thousands of dollars. The federal government also offers a tax credit for buying an electric car, which can be up to $7,500.

However, it’s important to note that these credits are subject to change and may not always be available, so it’s best to do your research before making a purchase. Additionally, make sure to factor in the cost of charging your electric car and any potential state incentives when determining if an electric car is the right choice for you.

Researching Tax Benefits by Model

One of the biggest incentives for purchasing an electric car is the tax benefits you’ll receive from the government. But not all electric car models have the same benefits. That’s why researching the tax benefits by model is crucial when choosing the right electric car for you.

Some models may qualify for larger tax credits while others may have lower credits or none at all. It’s important to do your research beforehand and understand what tax credits apply to each specific model. This way, you can make an informed decision and get the most out of your investment.

Plus, you’ll be helping the environment and saving money on gas in the long-run. Don’t forget to check with your state’s incentives and rebates as well, as they may differ from federal benefits.

Comparing Costs and Savings

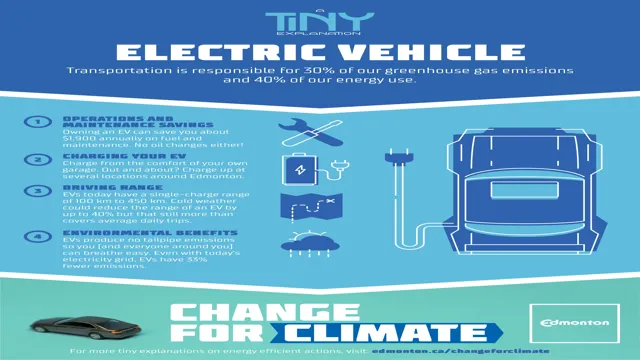

When it comes to choosing the right electric car, one of the most important factors to consider is the costs and savings involved. While electric cars tend to have higher upfront costs compared to traditional gasoline cars, there are many potential savings to be had in the long run. For example, since electric cars run on electricity, they can save you a lot of money on fuel costs over time.

Additionally, many electric cars qualify for federal and state tax incentives, as well as other perks like HOV lane access and free charging at certain locations. Ultimately, the decision to invest in an electric car will depend on your individual budget and driving needs, but it’s worth considering the long-term savings potential.

Evaluating Key Features

Choosing the right electric car can be a daunting task. With so many features and options available, it’s essential to evaluate each one carefully. One key feature to consider is the range of the vehicle.

How far can it travel on a single charge? This is important because it determines how often you’ll need to stop to recharge the battery. Another important feature is charging time. How long does it take for the battery to recharge fully? This is important to know because it can affect your travel plans and schedule.

Additionally, you should evaluate the safety features of the vehicle, such as airbags, backup cameras, and collision avoidance systems. Ultimately, the right electric car for you will depend on your specific needs and preferences. Consider features like size, style, and comfort, as well as performance and environmental impact.

With careful consideration, you can find the perfect electric car to meet your needs and complement your lifestyle.

Getting the Most Out of Your Investment

Looking to purchase an electric vehicle? Besides being environmentally friendly, electric cars come with a tax benefit that can save you money. The federal government offers a tax credit of up to $7,500 for the purchase of an electric car. Additionally, many states offer their own tax credits or rebates, so be sure to research what incentives are available in your area.

The tax benefit not only reduces your overall cost of purchasing an electric vehicle but also provides a welcome break on your tax bill come tax time. It’s a win-win situation for both the environment and your wallet. So why not take advantage of this tax benefit and invest in an electric car today?

Maximizing Tax Deductions

When it comes to maximizing your tax deductions, it’s important to understand that the investments you make throughout the year can greatly impact your overall tax burden. By strategically investing your money in tax-deductible accounts or assets, you can potentially reduce your taxable income and increase your deductions. For example, contributing to a traditional IRA can lower your taxable income by the amount you contribute, up to certain limits.

Additionally, investing in real estate or business equipment can provide for deductions on your taxes as well. However, it’s important to consult with a tax professional to ensure that you are making the right investment decisions and accurately reporting your deductions. With proper planning and careful consideration, you can get the most out of your investments and minimize your tax liability.

Optimizing Charging and Maintenance

Optimizing Charging and Maintenance is crucial in getting the most out of your investment in technology. One of the most important aspects of optimizing charging is to use the correct charging method. Most devices come equipped with a charging cable and adapter, but not all are created equal.

Ensuring that you use the manufacturer-approved charging accessories is essential to preserving the health of your device’s battery. It is also important to avoid overcharging your device, as this can damage and significantly reduce the lifespan of the battery. On the maintenance side, keeping your device clean, up-to-date with software updates, and protected from physical damage can help extend its lifespan.

Taking care of your device in these ways will ensure that you get the most out of your investment and help to avoid costly repairs or replacements down the road.

Final Thoughts

In conclusion, purchasing an electric car not only provides numerous benefits to the environment, but it can also provide significant tax benefits to the owner. With the federal tax credit of up to $7,500 and potential state and local incentives, the cost of an electric car becomes more manageable. However, it is important to do proper research and understand the eligibility criteria as well as the expiration of these incentives.

While the tax benefits may not be the sole reason for buying an electric car, they certainly make it a more appealing option for those who are environmentally conscious and financially savvy. So, if you are in the market for a new car, consider the tax benefits an electric vehicle can offer while also embracing a greener future.

Conclusion

In conclusion, choosing to drive an electric car not only benefits the environment, but it can also be a smart financial decision. With tax benefits and incentives, electric car owners can save money on their initial purchase, as well as ongoing operational costs. Plus, the peace of mind that comes with supporting a cleaner, more sustainable future is priceless.

So why not join the electric car revolution and enjoy the ride to a better, brighter tomorrow!”

FAQs

What is a tax benefit of owning an electric car?

One tax benefit of owning an electric car is that you may be eligible for a federal tax credit of up to $7,500. Some states may also offer additional tax incentives.

Are all electric cars eligible for the tax credit?

No, not all electric cars are eligible for the federal tax credit. The amount of the credit and eligibility requirements vary based on the make, model, and battery capacity of the vehicle.

How do I claim the tax credit for my electric car?

To claim the federal tax credit for your electric car, you must complete IRS Form 8936 and attach it to your tax return. Make sure to check with your tax professional for any other specific requirements.

Can the tax credit be carried forward or back?

Yes, you may be able to carry forward any unused portion of the tax credit for up to one year or carry back any unused portion for up to three years. Again, it’s best to consult with a tax professional to determine your specific eligibility and circumstances.