Revolutionizing Company Cars: Uncovering the Benefits of Electric Car Benefit-In-Kind Rates

Are you considering buying an electric car? It’s not just an environmentally-friendly choice, it has several economic benefits too! One of the notable perks of owning an electric car is the reduced Benefit in Kind (BIK) rates compared to traditional cars. What does BIK mean? It refers to the value of any benefits an employee receives from their employer, such as a company car or fuel allowance, that are not included in their salary. As it turns out, the BIK rates are much lower for electric cars.

This means, as an employee, you’ll pay less income tax and National Insurance contributions. The UK government has been encouraging the use of electric cars by offering several incentives. Not only are BIK rates lower for electric cars, but there is also no tax on electricity as fuel.

There are also exemptions on Vehicle Excise Duty (VED) and reduced parking fees in some cities. Perhaps most notably, electric cars are exempt from the Ultra Low Emission Zone (ULEZ) and, in some cases, the London Congestion Charge too. These savings can certainly add up, so it’s worth considering an electric car for your next vehicle purchase.

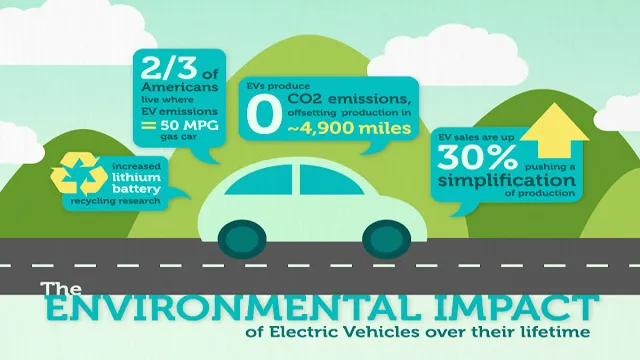

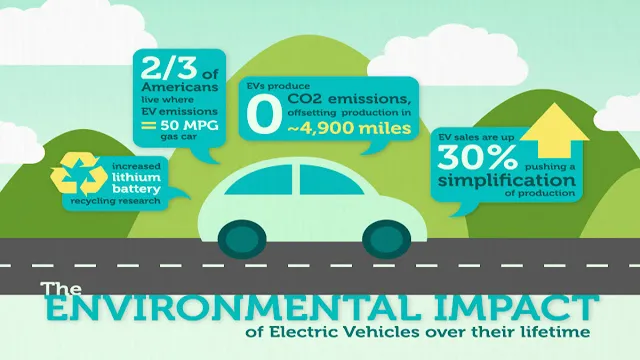

In addition to the financial benefits, electric cars provide a smooth and quiet driving experience, and you’ll be helping to reduce air pollution. It’s a win-win! So, why not explore the benefits of an electric car for yourself and make a positive impact on both your bank account and the environment?

What is Benefit in Kind?

If you’re considering purchasing an electric car, it’s important to understand the concept of benefit in kind. Benefit in kind, or BIK, refers to the taxable benefits provided to employees for the use of a company car. In the case of electric cars, the benefit in kind rates are calculated based on the car’s list price and CO2 emissions.

However, for electric cars with zero emissions, the benefit in kind rates are much lower, making them an attractive option for both employers and employees. This is because electric cars produce no harmful emissions and are better for the environment, making them a viable option for companies looking to reduce their carbon footprint. So not only is it environmentally conscious to choose an electric car, but it also comes with tax benefits for both employers and employees.

Explanation of Benefit in Kind and why it’s relevant to electric cars

Benefit in Kind or BIK is a term used to refer to the non-cash benefits that employees receive in addition to their salaries or wages. It can come in different forms such as company cars, housing allowances, medical insurance, and others. BIK is relevant to electric cars because it affects the tax that employees and employers have to pay.

The benefit of having an electric car as a company car is that it attracts a lower BIK tax rate compared to petrol or diesel cars. The BIK rate for electric cars is currently at 1% for the tax year 2021/22, while it’s at 20% for petrol or diesel cars with similar CO2 emissions. This lower BIK tax rate makes electric cars more attractive to employees or company car drivers, especially if they’re looking to save money on fuel costs or reduce their carbon footprint.

So, if you’re an employer or an employee considering an electric car as a company car, it’s worth looking into the BIK tax rate to see how it can benefit you financially.

Current Benefit in Kind Rates

Electric car benefit in kind rates have been a fast moving target for the past few years, with constantly evolving government policies and incentives. As of 2021, the benefit in kind rate for electric cars is 1% for vehicles with zero emissions, which means that employees who receive an electric company car pay just 1% of its value in tax instead of the usual rate based on the car’s carbon dioxide emissions. This obviously makes electric cars an incredibly attractive prospect for many employees, and helps incentivize their uptake.

However, it’s worth noting that this benefit in kind rate is set to increase to 2% in 2022 and 2023, before returning to 1% in 2024, so companies and employees alike will need to factor these changes into their decision making. Nonetheless, in the current climate, electric cars offer significant savings and it’s well worth considering them for your company or personal vehicle.

Overview of current rates for electric cars vs. petrol/diesel cars

Electric cars have emerged as an increasingly viable alternative to petrol and diesel vehicles as we shift towards more sustainable modes of transportation. One of the major incentives for drivers to switch to electric cars is the current Benefit in Kind (BIK) rates in the UK. BIK rates determine the amount of tax that drivers need to pay based on the value of their vehicle and the amount of CO2 emissions it produces.

For electric cars, the BIK rate is 0% until April 2021, meaning drivers will not have to pay any tax on their electric vehicle company car. This is compared to the petrol and diesel BIK rates which have been increasing yearly. As of 2020/21, the minimum BIK rate for petrol and diesel cars is 21%, meaning a driver would have to pay thousands of pounds in tax for a company car worth £30,000.

This stark contrast in BIK rates provides a clear financial incentive for drivers to make the switch to electric cars, benefiting not only their own wallet but also the environment.

Comparison of Benefit in Kind rates for popular electric car models

If you’re considering purchasing an electric car, it’s important to know what the Benefit in Kind (BIK) rates are for popular models. BIK rates determine the amount of tax you must pay on the benefits you receive from your employer, such as a company car. Currently, the BIK rates for electric cars are significantly lower than those for petrol and diesel cars.

For example, the BIK rate for a Tesla Model 3 is 1% for the tax year 2021-2022, compared to the 31% BIK rate for a petrol car with the same list price. Other popular electric car models with low BIK rates include the Volkswagen ID.3, Nissan Leaf, and BMW i

By choosing an electric car with a low BIK rate, you could save thousands of pounds in taxes over the course of your car’s life. Plus, you’ll be doing your part to reduce harmful emissions and help the environment.

Savings with Electric Cars

One of the most significant benefits of owning an electric car is the savings you receive on the benefit in kind (BIK) tax rates. These rates represent the tax you pay based on the value of a perk from your employer, such as a company car. With electric cars, the BIK rates are significantly lower than traditional gasoline cars, making EVs a desirable option for company car drivers.

In fact, BIK rates for electric cars are currently set at 1% of the vehicle’s list price for the tax year 2021-2022, compared to 20-37% for petrol and diesel engines. Furthermore, electric cars boast much lower fuel and maintenance costs, meaning they are a wise investment for both the wallet and the environment. By switching to an electric car, not only can you save money, but you can also contribute to the reduction of harmful emissions and support a sustainable future.

Potential savings on Benefit in Kind and other taxes with electric cars

Electric cars bring about several potential savings on Benefit in Kind (BIK) and other taxes. This is because they produce zero CO2 emissions, unlike the conventional fossil-fuelled cars. As the UK government strives to combat climate change, it has incentivised electric car adoption to encourage a greener and cleaner planet.

Employees who drive electric cars, for instance, benefit from a lower BIK tax rate. For instance, in the 2021-2022 tax year, employees with electric cars stand to pay 1% BIK tax rate only compared to their counterparts with gasoline or diesel cars, which can range between 25%-37%. Additionally, electric cars are exempted from the Vehicle Excise Duty (VED) and the congestion charge of some UK cities, thus saving motorists a significant sum of money.

In summary, electric cars not only come with environmental benefits but also offer potential tax savings to vehicle users.

Examples of how much you could save with an electric car

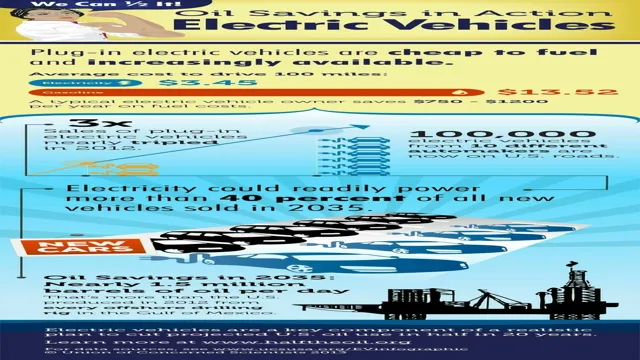

Electric car Imagine saving thousands of dollars every year by simply switching to an electric car. By going electric, you can save up to $1,000 or more annually on fuel costs alone, not to mention the savings on maintenance, insurance, and operating expenses. In fact, electric cars are considerably cheaper to maintain and operate than their gasoline-powered counterparts, thanks in part to the simplicity of the electric powertrain.

Moreover, electric car owners are eligible for a range of tax incentives, rebates, and credits that can further reduce the purchase price and ownership costs. For instance, the US government offers a tax credit of up to $7,500 for qualifying EV purchases, while some states provide additional incentives such as HOV lane access or free parking. By owning an electric car, you can not only save money but also help reduce carbon emissions and improve air quality for yourself and the community.

It’s time to make the switch to electric and enjoy the cost savings and environmental benefits.

Future Benefit in Kind Changes

Electric car benefit in kind rates are set to change in the near future, with the UK government seeking to incentivize the use of more eco-friendly vehicles. This could mean a significant reduction in the tax costs associated with company cars, particularly for those driving electric vehicles. The changes could also benefit employers who may be able to reduce their tax liabilities by providing their workers with electric cars.

However, there may also be some uncertainty for drivers around how these changes will affect them and whether there will be any additional costs associated with ensuring that their company vehicle is electric. That said, overall it appears that the future benefit in kind changes should be a welcome development for both individuals and businesses looking to reduce their carbon footprint and tax bills.

Possible changes to Benefit in Kind rates for electric cars in the coming years

Possible changes to Benefit in Kind rates for electric cars in the coming years could have a significant impact on the adoption of EVs in the UK. Currently, Benefit in Kind rates are based on a percentage of a car’s list price, with rates ranging from 0% to 37% depending on the vehicle’s CO2 emissions. However, the government has announced plans to change the system in 2022, introducing new rates that are based on the vehicle’s CO2 emissions only.

This means that electric cars with zero emissions will have a lower Benefit in Kind rate than petrol or diesel cars with higher emissions. Furthermore, there have been discussions about reducing the rate to zero for electric cars by 202 These changes could make EVs much more attractive to company car drivers, who currently pay a higher rate for the benefit of driving a green vehicle.

With the government committed to phasing out petrol and diesel cars by 2030, these changes to Benefit in Kind rates could help to accelerate the shift towards electric vehicles.

Predictions for future savings on electric cars

As we look to the future of electric cars, one of the key areas for potential savings is in changes to Benefit in Kind (BiK) rates. These are the rates that employers and employees pay on company cars, based on factors like the car’s CO2 emissions and fuel type. Currently, electric cars enjoy a much lower BiK rate than their petrol and diesel counterparts, making them an attractive option for both employers and employees looking to save money.

In fact, from April 2021 to March 2022, the BiK rate for electric cars will be just 1%, compared to 10-37% for petrol and diesel cars. However, as electric cars become more mainstream and emissions regulations become tighter, it’s possible that these BiK rates could change. While we can’t predict the future with certainty, it’s likely that electric cars will continue to enjoy lower BiK rates than traditional cars for the foreseeable future.

That means if you’re considering an electric car as your next company car, you could stand to save a significant amount of money in BiK payments.

Conclusion

In conclusion, the benefits of electric cars are truly electrifying! With lower emissions, reduced running costs, and now even lower benefit in kind rates, electric vehicles offer a sustainable and cost-effective alternative to traditional combustion-engined cars. So why not give your wallet and the planet a charge by switching to an electric car today?”

Summary of the benefits of electric cars for Benefit in Kind rates

Electric cars are the way of the future. Not only do they help protect the environment, but they also come with numerous benefits for drivers, including lower running costs and tax incentives. One such tax incentive is the Benefit in Kind (BIK) rate for electric cars, which has been significantly reduced by the UK government.

From April 2020, companies that supply electric vehicles as company cars to their employees have benefitted from a BIK rate of 0%, compared to the previous rate of 16%. This means that there are significant tax savings for drivers of electric cars, as they are not charged tax on the benefit they receive from their company car. With further reductions in the BIK rate planned for the coming years, it is clear that the future of company cars is electric.

It is a welcome change for those looking for an environmentally friendly and cost-effective vehicle.

FAQs

What are benefit in kind rates for electric cars?

Benefit in kind rates for electric cars are currently at 0% for the 2020/21 tax year, 1% for the 2021/22 tax year and 2% for the 2022/23 tax year.

How do electric car benefit in kind rates compare to those of petrol or diesel cars?

Electric car benefit in kind rates are significantly lower than those of petrol or diesel cars, as these rates are based on the level of CO2 emissions produced by the vehicle. As electric cars emit no CO2 emissions, the benefit in kind rate is at 0% for electric cars.

Do electric car benefit in kind rates vary based on the car’s purchase price?

No, electric car benefit in kind rates do not vary based on the car’s purchase price. These rates are solely based on the level of CO2 emissions produced by the vehicle.

Can the benefit in kind rates for electric cars change over time?

Yes, the benefit in kind rates for electric cars can change over time, as they are subject to review by the government. However, it is expected that the rates for electric cars will remain significantly lower than those of petrol or diesel cars, as part of the government’s efforts to encourage the use of low-emission vehicles.