Are There Tax Benefits for Electric Cars in 2019: Unveiled!

Electric cars are becoming popular. More people want to drive them. They are good for the environment. But, are there tax benefits for electric cars in 2019? Let’s find out.

What is a Tax Benefit?

A tax benefit helps you pay less in taxes. It can lower your tax bill. This is good for you. Many people like to save money. Tax benefits can help you do that.

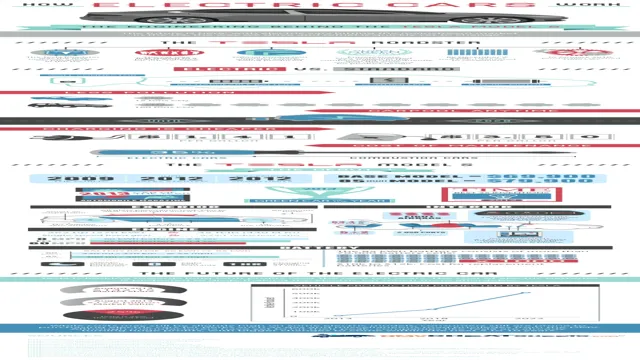

What is an Electric Car?

An electric car runs on electricity. It has a battery instead of gas. You charge it, just like a phone. Electric cars do not pollute the air. This is why many people choose them.

Types of Electric Cars

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

Both types can have tax benefits. But the benefits may be different.

Federal Tax Credit for Electric Cars

In 2019, there was a federal tax credit. This credit could be up to $7,500. It depends on the car you buy. Not all electric cars qualify. Check if the car is eligible.

To qualify for this credit, you must:

- Buy a new electric car

- Use it for personal use

- Meet the battery capacity requirement

How to Claim the Federal Tax Credit

To claim the tax credit, you need to fill out a form. The form is called IRS Form 8834. You submit this form with your tax return. This will help reduce your taxes.

State Tax Benefits for Electric Cars

Some states have their own tax benefits. These can be different from the federal benefits. Check your state rules. Many states offer rebates or credits.

Examples of State Benefits

| State | Benefit |

|---|---|

| California | Up to $2,500 rebate |

| New York | Up to $2,000 rebate |

| Texas | Up to $2,500 rebate |

These benefits can help you save money. But, not every state has them. Make sure to research.

Other Benefits of Electric Cars

Electric cars have other benefits. They can save money on fuel. Electricity is cheaper than gas. This can help you save money every month.

They may also have lower maintenance costs. Electric cars do not need oil changes. This means fewer trips to the mechanic.

Environmental Benefits

Electric cars are good for the planet. They do not emit harmful gases. This helps keep the air clean. A cleaner environment is better for everyone.

Frequently Asked Questions

What Are The Tax Benefits For Electric Cars In 2019?

Electric cars had a federal tax credit of up to $7,500 in 2019. This benefit helped reduce your tax bill.

How Do I Qualify For Electric Car Tax Credits?

To qualify, you must buy a new electric car. The vehicle must meet specific criteria set by the IRS.

Can I Get State Tax Credits For Electric Cars?

Yes, many states offered additional tax credits or rebates for electric car buyers in 2019. Check your state’s rules.

Are Tax Benefits The Same For All Electric Cars?

No, tax benefits vary by manufacturer and vehicle model. Some cars qualify for full credits, while others may not.

Conclusion

In 2019, there are tax benefits for electric cars. These benefits can help you save money. The federal tax credit can be up to $7,500. Many states offer their own benefits too.

Consider all the benefits of electric cars. They save money on fuel and maintenance. They are also better for the environment.

Before buying, check all your options. Know the tax credits and rebates available. Make the best choice for you and your wallet.

FAQs

1. What Is The Maximum Federal Tax Credit For Electric Cars?

The maximum is $7,500. It depends on the car.

2. Can I Get State Tax Benefits?

Yes, some states offer their own benefits. Check your state.

3. How Do I Claim The Federal Tax Credit?

Fill out IRS Form 8834 with your tax return.

4. Are Electric Cars Cheaper To Maintain?

Yes, they have lower maintenance costs.

5. Do Electric Cars Help The Environment?

Yes, they reduce air pollution.