Electric Cars: The Financial and Environmental Win-Win with Income Tax Benefits!

Electric cars have become increasingly popular over the years, not just for their environmental benefits but also for the cost savings they offer. One of the many advantages of owning an electric car is the various income tax benefits available to consumers. With electric vehicles becoming more mainstream, it’s essential to understand how you can take advantage of tax incentives to maximize your savings.

As governments worldwide aim to promote a clean environment, they have implemented various tax benefits for electric car owners. These benefits range from credits for purchasing a new electric vehicle to charging station installation credits and even tax credits for businesses. These tax credits and deductions can significantly reduce the total cost of electric cars, making them more accessible and affordable for many consumers.

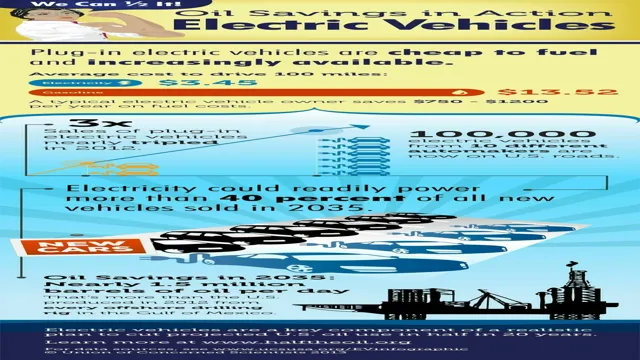

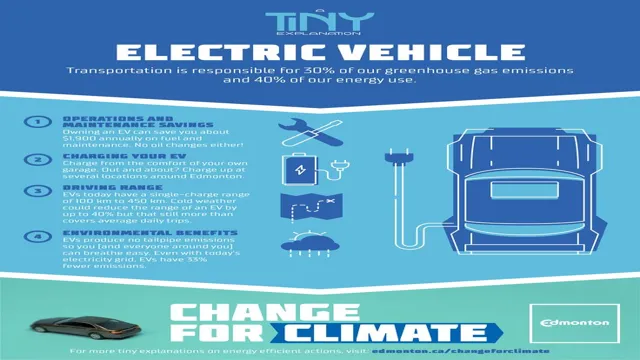

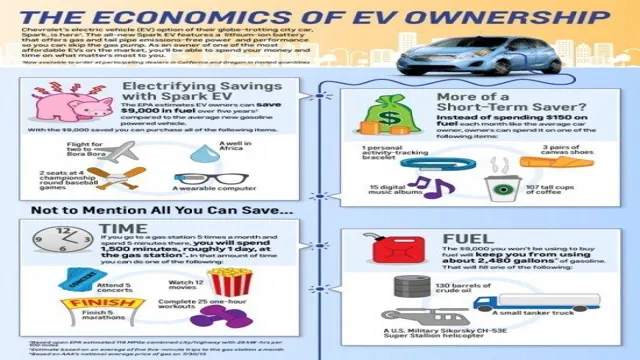

Furthermore, electric vehicles’ low operating costs can make them an attractive option for anyone looking to save more money on transportation expenses. While gasoline-powered vehicles can have high fuel costs, electric vehicles’ simple mechanics and low energy consumption reduce their overall expenses. Tax incentives on top of these low operating costs can make electric vehicles among the most affordable and financially sensible transportation options today.

In conclusion, owning an electric car offers many income tax benefits that can help save you money. From federal incentives to localized credits, you can take advantage of a range of tax reductions that can significantly reduce the total cost of purchasing and owning an electric vehicle. As electric vehicles’ popularity increases, it’s more important than ever to understand the benefits available to you and how they work so that you can make an informed decision about purchasing an electric car.

Overview

Are you considering purchasing an electric car? Not only is it better for the environment, but it could also provide you with an income tax benefit. Currently, the federal government offers a tax credit of up to $7,500 for the purchase of an electric vehicle. This credit can be applied to your income tax return and can greatly reduce your tax liability.

However, it’s important to note that this credit is not a refund, meaning it can only be used to offset taxes owed. Additionally, state and local governments may also offer their own incentives for purchasing electric cars, so it’s worth researching what options are available in your area. Overall, investing in an electric car not only benefits the environment, but it also offers potential financial benefits through income tax credits and other incentives.

Explanation of Income Tax Benefit

Income Tax Benefit The income tax benefit is an advantage that taxpayers can enjoy on their yearly income tax bill. This is typically a credit or deduction that reduces the amount of taxes paid or owed by taxpayers. The amount of the benefit can vary depending on various factors, such as the taxpayer’s income level, filing status, and the specific credits or deductions applied.

Some common income tax benefits include the earned income tax credit, child tax credit, and education credits. These benefits are designed to provide financial relief to taxpayers who may be struggling to make ends meet or who have significant expenses throughout the year. By taking advantage of available income tax benefits, taxpayers can potentially save significant amounts of money on their annual tax bill.

Current State of the Law

The current state of the law surrounding the topic has been a contested issue in recent years. Many potential changes to existing regulations have been proposed, generating a lot of debate and discussion. The main focus of the discussion has been finding the right balance between protecting the rights of those involved and ensuring the safety and security of society as a whole.

While some argue for stricter regulations to prevent abuse and misuse of the system, others feel that excessive regulations could be counterproductive and even harmful. As the conversation continues, it is crucial to keep in mind the potential impact of any changes on the individuals and communities that they affect. Only by approaching the issue with sensitivity and an open mind can we find a solution that works for everyone.

Qualifying for the Benefit

To qualify for the income tax benefit on electric cars, there are a few criteria to be met. First and foremost, the vehicle must be a plug-in electric car, either fully or partially. This means hybrid vehicles that only use gas will not qualify for the benefit.

The vehicle must also have been purchased or leased within the current tax year. The benefit is only applicable to the original purchaser or lessee, and not transferable. Additionally, the vehicle must be used for personal, not commercial use, and the owner must have a federal tax liability for the year in question.

It’s important to note that the benefit is a non-refundable tax credit – if the credit exceeds the amount owed in taxes, the excess will not be refunded. Overall, qualifying for the income tax benefit on electric cars is fairly straightforward, as long as you meet the above requirements and have a federal tax liability.

Criteria for Eligibility

To qualify for a benefit, certain eligibility criteria must be met. The eligibility criteria vary from benefit to benefit, but generally include age, income, and residency requirements. Additionally, factors such as disability status, veteran status, and family composition may also be taken into account.

It’s essential to review the eligibility requirements thoroughly before applying for any benefit to ensure you meet the necessary criteria. Missing just one eligibility requirement could cause your application to be denied. However, don’t let that discourage you from applying.

There may be other options available to you, and the only way to find out is by taking the first step and submitting your application.

Types of Electric Cars that Qualify

To qualify for the benefit of electric vehicle tax credits, drivers need to make sure they have a qualifying vehicle. There are a few different types of electric cars that meet the criteria, including plug-in hybrids, battery electric vehicles, and fuel cell vehicles. Plug-in hybrids are cars that have both an electric motor and an internal combustion engine, while battery electric vehicles are solely powered by electricity.

Fuel cell vehicles use a hydrogen fuel cell to generate electricity, which then powers the motor. It’s important to note that not all models of these types of cars will qualify for the tax credits, as the government sets certain requirements for things like battery size and range. Checking the IRS’ list of qualified vehicles is the best way to determine if your electric car qualifies for the benefit.

How to Claim the Benefit

If you have recently purchased an electric car, congratulations! Not only are you significantly reducing your carbon footprint, but you could also be eligible for an income tax benefit on your purchase. To claim the benefit, you will need to file your taxes using IRS Form 893 This form will calculate the total amount of the credit you are eligible for, based on the make and model of your electric car.

The maximum credit amount is $7,500, but this varies depending on the make and model of your vehicle. It’s important to note that this credit is non-refundable, meaning that if your credit exceeds your tax liability, you will not receive the difference as a refund. However, you can carry over any unused credit to future tax years.

Overall, taking advantage of the income tax benefit on your electric car is a smart financial decision, and one that could pay off for years to come.

Documentation and Forms

If you are eligible for a benefit, it is important to know how to claim it. First and foremost, gather all necessary documentation and forms to support your claim. This may include medical records, employment records, and identification.

Once you have all the necessary documents, fill out the appropriate form(s) completely and accurately. Be sure to provide all required information and double-check for any errors. Submit the form(s) along with the supporting documentation to the relevant authority.

Keep a copy of everything for your own records. It is important to understand the timeline for processing your claim, as it may take some time. If you have any questions or concerns along the way, don’t hesitate to reach out to the authority handling your claim.

Remember, claiming your rightful benefit can be a bit of a process, but it’s worth it in the end.

Estimated Financial Savings

Many individuals and families are eligible for financial savings through various programs and benefits offered by the government. However, knowing how to claim these benefits can be a challenge. To start, it is important to research the specific benefits available in your area and determine whether you meet the eligibility requirements.

From there, you will need to gather the necessary documentation to support your claim, such as tax returns, proof of income, and personal identification information. Once you have collected all of the necessary information, you can submit your claim either online or through a local office. It’s important to note that the process can be lengthy and there may be strict deadlines, so it’s crucial to start early and stay on top of the process.

Taking advantage of financial savings through government benefits can help individuals and families save a significant amount of money each year, making it worth the time and effort to pursue.

Conclusion

In conclusion, the income tax benefit on electric cars is truly shocking! Not only do you get to save the environment by driving a green vehicle, but you also get rewarded with generous tax breaks. So why settle for a gas-guzzler when you can charge up your electric car and watch your tax savings soar? It’s electrifying!”

FAQs

What is the income tax benefit for buying an electric car?

In India, buyers of electric cars are eligible for a tax benefit of up to Rs. 1.5 lakhs under Section 80EEB of the Income Tax Act.

Can businesses claim income tax benefits for buying electric cars?

Yes, businesses that purchase electric cars can claim a 100% depreciation in the year of purchase to reduce their taxable income.

Are there any conditions for availing income tax benefits on electric cars?

Yes, the electric car must be bought on or after April 1, 2019, and the tax benefits are only available to individuals and businesses that are not engaged in the business of renting or leasing cars.

Can the income tax benefit on electric cars be claimed on a second-hand purchase?

No, the tax benefit is only available for the purchase of a new electric car. Second-hand purchases are not eligible for this benefit.