Power up Your Wallet with Benefit in Kind Charge for Electric Cars: Benefits You Can’t Resist

If you’re considering switching to an electric car, it’s important to understand the Benefit in Kind (BIK) charge that comes with it. Essentially, a BIK charge is a tax that you pay on any benefits you receive from your employer – like a company car. This means that if you get a company electric car, you will likely have to pay a BIK charge.

But what exactly is the BIK charge for electric cars? How is it calculated? And is it worth it to switch to an electric car despite the charge? In this blog post, we’ll break down everything you need to know about the BIK charge for electric cars. We’ll explain the ins and outs of the tax, include some real-life examples, and help you decide if an electric car is the right choice for you. So whether you’re an employer considering offering electric company cars to your employees, or an employee curious about the financial implications of making the switch, keep reading to learn more about the Benefit in Kind charge for electric cars.

What is Benefit in Kind Charge?

Electric cars are revolutionizing the automotive industry, and with their eco-friendliness, comes a variety of benefits. However, when it comes to company cars, electric vehicles come with a benefit in kind charge. This charge is applied to employees who use company cars, which they can also use for personal use.

The Benefit in Kind charge is calculated using the vehicle’s list price, CO2 emissions, and the type of fuel it uses. The amount that employees must pay is directly correlated with how much the car’s value is, and its emissions rating. While these charges can be significant, the UK government is working to incentivize electric vehicle usage by lowering the BIK rate on electric vehicles to zero percent by the year 202

This is excellent news for companies who are looking to become more sustainable and reduce their carbon footprint, as making the switch to electric car usage can mean big savings for both the environment and for employee expenses.

Definition and Calculation

Benefit in Kind Charge, or BIK in short, is a term used to refer to the tax on the non-cash benefits or perks that employees receive from their employers. These perks usually include company cars, housing allowances, healthcare benefits, and other non-monetary benefits. The value of these perks is added to the employee’s taxable income, and the resulting figure is subject to income tax.

The calculation of BIK charge is based on the market value of the perk received, the length of time for which it was used, and the employee’s income tax bracket. The rate of BIK charge may vary depending on the type of perk received. For instance, the BIK charge on company cars is determined by factors such as the car’s CO2 emissions and its list price.

It’s essential for both employers and employees to be aware of the BIK charge as it can have a significant impact on the employee’s take-home pay and the employer’s tax liabilities.

How does it apply to electric cars?

As electric cars gain in popularity, more and more drivers are curious about the Benefit in Kind (BIK) Charge. Essentially, this is a tax applied to the “perk” of driving a company car. The amount of the tax is based on a percentage of the car’s list price, multiplied by the driver’s income tax band.

For electric cars, however, the BIK Charge is much lower due to their favourable environmental impact. In fact, in the UK, electric cars are currently exempt from BIK tax for the current tax year (2021-2022), making them an even more attractive option for company car drivers. This exemption will continue to decrease in the coming years, before returning to normal levels in 202

So, if you’re considering driving an electric company car, now is the perfect time to take advantage of this great benefit.

Why Electric Cars have Lower Benefit in Kind Charge?

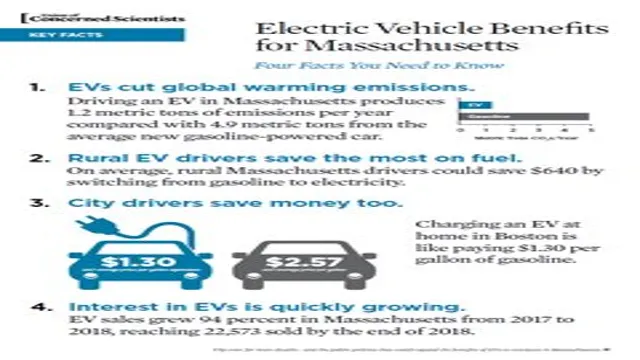

Benefit in kind charge for electric cars is lower than traditional vehicles due to their lower CO2 emissions and cleaner energy use. With the world becoming more environmentally conscious, governments are promoting greener technologies, and electric cars are leading the way in this revolution. The lower benefit in kind charge makes electric cars more attractive to drivers looking to save money on their company car tax.

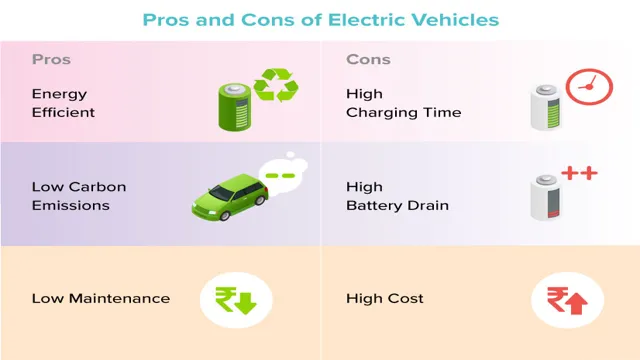

This tax is based on the car’s list price and its CO2 emissions, with electric vehicles producing no emissions and therefore having a lower tax rate. It’s also worth noting that electric cars have lower operating costs, as they require less maintenance and have fewer parts that require replacement. This makes them a viable option for drivers looking to save money in the long run.

As cities aim to reduce air pollution, electric cars are becoming increasingly popular, and with lower benefit in kind charges, they are a practical and cost-effective option for many drivers.

Government Incentives for Electric Cars

The UK government provides incentives for electric cars to encourage people to switch from fossil-fuel-powered vehicles to more environmentally friendly options. One such incentive is the lower Benefit in Kind (BIK) charge for company cars that are fully electric. The BIK charge is a tax that employees pay on the use of their company car for personal travel.

Generally, the BIK charge is higher for cars that have higher CO2 emissions. However, because electric cars produce zero emissions, they are exempt from the charge, making them a more attractive option for company car fleets. This not only benefits the environment but also saves individuals and companies money on taxes and fuel costs.

With the expansion of charging infrastructure and improvements in battery technology, electric cars are becoming an increasingly viable option for the average driver. So if you’re looking to make a greener choice and save some money, it might be worth considering an electric car for your next vehicle purchase or lease.

Electric Cars and CO2 Emissions

When it comes to electric cars and CO2 emissions, it’s no secret that electric cars have a lower carbon footprint than their petrol or diesel-powered counterparts. This is due to the fact that they run on electricity, which generates much less carbon emissions than fossil fuels. But why do electric cars have a lower Benefit in Kind charge? The answer lies in the way that the Benefit in Kind charge is calculated.

The tax charge is based on the car’s CO2 emissions, which means that by choosing an electric car with zero emissions, you could potentially save a great deal of money on your Benefit in Kind tax. This is because electric cars have no tailpipe emissions, so they are not subject to the same level of taxation as traditional petrol or diesel cars. So, not only are electric cars better for the environment, but they could also save you money in the long term.

It’s a win-win situation!

Electric Cars and Fuel Costs

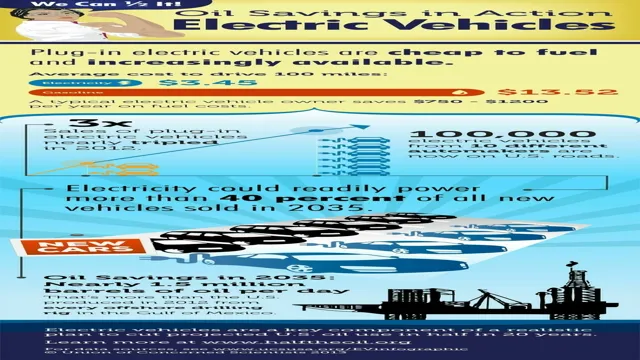

When it comes to electric cars and fuel costs, there’s a lot of talk about their lower benefit in kind charges. But why is this the case? Well, for starters, electric cars simply don’t use as much fuel as traditional cars. This means that the amount of fuel used to power an electric car is far lower than what’s required to power a gas-powered vehicle.

As a result, the benefit in kind charge for electric cars is far lower. Additionally, electric cars are far more efficient than traditional vehicles, meaning that they can travel further on a single charge. This further reduces the need for fuel and lowers the benefit in kind charge even more.

So if you’re looking to save money on fuel costs and benefit in kind charges, an electric car is definitely worth considering. Not only will you be doing your part for the environment, but you’ll also be saving money in the process.

How to Reduce Benefit in Kind Charge for Electric Cars?

If you’re considering purchasing an electric car, it’s important to understand the implications of the benefit in kind charge. This charge refers to the tax that employees must pay on the value of any non-cash benefits they receive from their employer. For electric cars, this value can be quite high due to their expensive price tag.

However, there are a few ways to reduce this charge. For example, ensuring that the car emits less than 50g of CO2 per kilometre can bring the benefit in kind charge down to 2%. Additionally, choosing a car with a lower list price or leasing the car rather than purchasing it outright can also reduce the charge.

Ultimately, it’s important to carefully consider your options and speak with a tax specialist to ensure that you understand the full implications of the benefit in kind charge for electric cars.

Salary Sacrifice Scheme

If you’re considering purchasing an electric car, you may be wondering how to reduce the Benefit in Kind charge. One way to do this is through a salary sacrifice scheme. This scheme allows you to give up a portion of your salary in exchange for a non-cash benefit, such as a company car.

By doing this, you can lower the taxable value of the car and reduce your Benefit in Kind charge. Additionally, your employer may also benefit from reduced National Insurance contributions. However, it’s important to note that this scheme may not be suitable for everyone, as it can affect things such as pension contributions and mortgage eligibility.

It’s important to speak with a financial advisor and weigh your options before making a decision. Overall, a salary sacrifice scheme can be a great way to reduce your Benefit in Kind charge and save money while driving an electric car.

Installing Workplace Charging

If you’re considering purchasing an electric car, reducing the benefit in kind (BIK) charge should be on your mind. One way to do this is by installing workplace charging, which can lower the BIK charge and save you money. A workplace charging scheme shows that you’re committed to promoting sustainable transport, and it can also incentivize your employees to switch to electric vehicles.

Additionally, if you have employees who regularly commute by car, installing charging stations can increase productivity by allowing them to charge while at work. The process of installing workplace charging is relatively straightforward, and there are many companies who specialize in it. By taking this step, you’ll be making a significant investment in both your business and the environment, while also reducing the cost of owning an electric car.

Conclusion

In conclusion, the benefits of driving an electric car are not just limited to saving the planet and reducing carbon emissions. They also come with an unexpected perk – a lower Benefit in Kind charge for company car drivers. By making the switch to electric, not only can individuals do their bit for the environment, but they can also save money on their tax bill.

It’s a win-win situation, a charge that will electrify your bank account and your conscience!”

FAQs

What is a benefit in kind charge for electric cars?

A benefit in kind charge is a tax on an employee’s personal use of a company car, including electric cars. It is calculated based on the value of the car and its CO2 emissions.

How is the benefit in kind charge calculated for electric cars?

The benefit in kind charge for electric cars is calculated based on the car’s list price, including any optional extras, and its CO2 emissions. The charge is then multiplied by the employee’s income tax rate.

Are there any exemptions to the benefit in kind charge for electric cars?

Yes, electric cars with zero emissions are exempt from the benefit in kind charge until April 2025. After that, the exemption will only apply to cars with a range of at least 130 miles.

Can employers reduce their company’s benefit in kind charge by offering charging facilities for electric cars?

Yes, employers can reduce their company’s benefit in kind charge by providing charging facilities for electric cars. This is because the charge is calculated based on the car’s CO2 emissions, and if the car is charged using renewable energy, its emissions will be lower.