Unlocking the Tax Benefits: Understanding Benefit in Kind for Electric Cars as per HMRC Guidelines

Electric cars are rapidly becoming a popular alternative to traditional gas-powered vehicles, and for good reason. With their eco-friendliness and long-term cost savings, electric cars are a smart choice for both individuals and businesses. One important aspect of owning an electric car is understanding the Benefit-in-Kind system, or BIK, which can have significant implications for tax and financial planning.

In this blog post, we’ll dive deep into the BIK system and explain everything you need to know about how it applies to electric cars. Whether you’re already a proud owner of an electric vehicle or considering making the switch, this guide will provide valuable insights into the world of electric cars and taxes. So sit back, relax, and let’s get started!

What is Benefit-In-Kind (BIK)?

If you are considering purchasing an electric car for business purposes, it is important to understand what Benefit-In-Kind (BIK) is and how it can affect you. BIK is a tax paid on any benefits you receive from your employer, such as a company car or fuel allowance. When it comes to electric cars, the BIK rates are currently much lower than for petrol or diesel vehicles, making them a more attractive option for business use.

This is because electric cars produce significantly less CO2 emissions and are therefore more environmentally friendly. The HMRC has set specific guidelines on how BIK is calculated, taking into account the vehicle’s list price, CO2 emissions, and fuel type. By opting for an electric car, you could potentially save money on your tax bill while also helping to reduce your carbon footprint.

Definition and Importance of BIK

If you are an employee, you may have heard of Benefit-In-Kind (BIK). It is a term that refers to any non-cash benefit that you receive from your employer in addition to your salary. This can include things like a company car, medical insurance, or a mobile phone.

The value of these benefits is calculated and added to your taxable income. As a result, you may end up paying more in tax. BIK is important because it ensures that employees are paying the correct amount of tax on their income.

This helps to prevent tax evasion and ensures that everyone is contributing their fair share. It also allows employees to understand the true value of the benefits they receive from their employer.

How Does BIK Work for Electric Cars?

When it comes to electric cars, many people wonder how the benefit in kind (BIK) tax works. Essentially, BIK is a tax on employee perks, such as company cars, and it is based on the vehicle’s value and CO2 emissions. With electric cars, however, the BIK tax is significantly lower than with traditional petrol or diesel vehicles, making them a more financially attractive option for both employers and employees.

The reason for this is that electric cars produce zero emissions, which means they fall into the lowest BIK tax band of 1%, whereas petrol or diesel cars can have BIK rates as high as 37%. This means that electric cars are not only better for the environment, but also for your wallet. Thanks to measures put in place by the UK government and HMRC, owning an electric vehicle is becoming increasingly affordable and accessible, making it a smart choice for those looking to reduce their carbon footprint while enjoying significant financial benefits.

BIK Rates for Electric Cars

If you are thinking of buying an electric car and using it as a company car, you might be wondering how the Benefit in Kind (BIK) rates work for them. Well, the good news is that BIK rates for electric cars are much lower compared to their petrol or diesel-powered counterparts. In fact, from April 2021, electric cars with zero emissions will incur 1% BIK rates, while cars emitting between 1g/km to 50g/km CO2 emissions will incur 2% BIK rates.

This means that you will pay less tax on your electric company car each month. It’s a great incentive to consider owning an electric car as a company car. Furthermore, not only will you save some money on the taxes you pay, but electric cars are less expensive to run and maintain, so the benefits keep piling up.

So, why not be a part of the electric revolution and jump on-board with an electric company car?

Reducing BIK Through Salary Sacrifice

If you decide to choose an electric car as your next vehicle, it’s essential to familiarize yourself with the concept of Benefit-in-Kind (BIK) tax. This tax is calculated based on the car’s list price, CO2 emissions, and fuel type, and is included in the taxable benefits an employee receives from their employer. For electric cars, BIK rates are at an all-time low, meaning the tax burden is significantly reduced.

This could lead to savings of several thousands of pounds per year, especially when you opt for salary sacrifice schemes. Salary sacrifice allows employees to waive a portion of their salary in exchange for additional non-cash benefits such as a company vehicle. This method helps reduce both employer and employee tax liability.

With salary sacrifice schemes, electric cars have become more feasible for many employees by lowering the BIK tax rate, making them even more cost-effective over their petrol or diesel counterparts.

Why Choose Electric Cars for BIK?

If you’re looking for a company car or fleet vehicle, choosing an electric car can offer significant benefits when it comes to benefit in kind (BIK) tax rates. The HMRC has recognised the push towards electric vehicles and has reduced the BIK rate on electric cars to 0% for the 2020/21 tax year. This means that drivers of a fully electric company car will not have to pay any BIK tax whatsoever, which is a considerable saving compared to the rates on petrol or diesel vehicles.

In addition, electric cars also offer lower running costs than their traditional counterparts, making them even more cost-effective in the long run. With a growing number of electric vehicle options on the market, you’ll be able to find an electric vehicle to meet the needs of your business or fleet. By choosing an electric car, you can reduce your costs and contribute positively to the environment by lowering your carbon footprint.

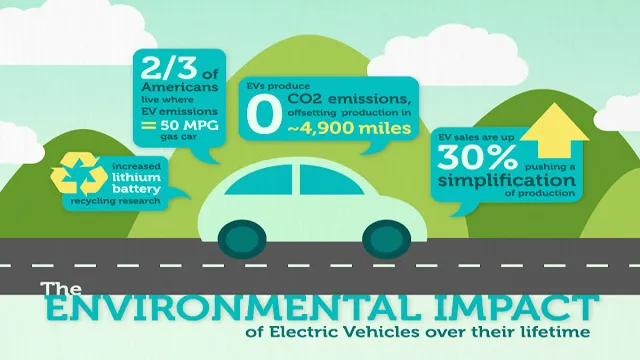

Environmental Benefits of Electric Cars

When it comes to choosing a company car, opting for an electric car can have numerous benefits, particularly in terms of the environment. Electric cars produce zero emissions whilst driving, making them a more environmentally friendly option than traditional petrol or diesel cars. This is because they do not require any fossil fuels to run and instead rely solely on their rechargeable batteries.

By choosing an electric car for your BIK scheme, you can reduce your carbon footprint and contribute to a cleaner, greener future. Not only do electric cars produce less pollution, but they are also much quieter than diesel or petrol cars, reducing noise pollution in busy urban areas. So, if you’re looking for an eco-friendly option for your company car, why not consider an electric vehicle?

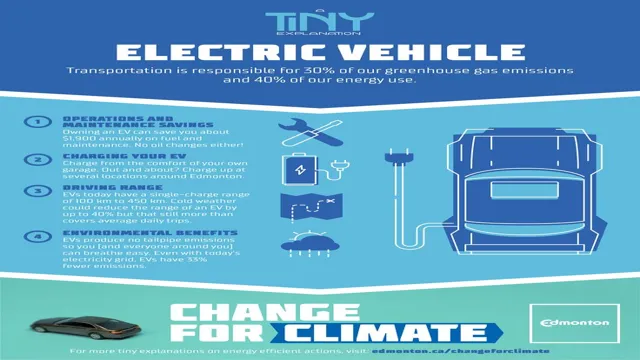

Cost Savings for Drivers and Employers

Electric cars are becoming increasingly popular among drivers and employers due to the significant cost savings they offer. The reduced Taxable Benefit in Kind (BIK) rates for electric vehicles make them an excellent choice for drivers looking to save money on company cars. With tax rates linked to CO2 emissions, electric vehicles offer considerably lower tax rates than their petrol or diesel counterparts.

Additionally, electric cars have lower running costs, require less maintenance, and may be eligible for government grants, including the OLEV grant. These cost savings benefit not only drivers but also employers looking to reduce company car costs. By switching to electric vehicles, businesses can achieve long-term savings while reducing their carbon footprint and contributing to a greener future.

It’s a win-win situation for both drivers and employers!

How to Calculate BIK for Electric Cars?

If you’re considering investing in an electric car, you’ll need to understand how the benefit in kind (BIK) tax system works. BIK is a tax on the value of the benefits you receive from your employer, such as a company car. HMRC calculates the BIK based on the car’s CO2 emissions and list price, meaning that electric cars are currently subject to the lowest BIK rate of all vehicles.

To calculate your BIK tax liability, you’ll need to multiply the list price of your electric car by its BIK rate, which is currently 0% for the 2021/22 tax year. However, if your electric car has a range that exceeds 130 miles, its BIK rate will increase to 1% in the 2021/22 tax year and 2% in the following year. It’s worth noting that BIK rates can change, so it’s important to stay up to date with the latest HMRC guidelines.

By understanding how BIK works, you can make an informed decision about the most cost-effective way to purchase an electric car.

Factors Affecting BIK Calculation

When it comes to calculating the Benefit in Kind (BIK) for electric cars, there are several factors that come into play. Essentially, BIK is the tax paid on any benefit an employee receives from their employer, such as a company car. However, with electric cars, the BIK is calculated differently due to their unique features.

One of the main factors affecting BIK calculation is the battery electric range of the car. The more range the car has, the lower the BIK rate will be. This is because electric cars with a larger battery can produce lower CO2 emissions and are therefore more environmentally friendly.

Other factors that affect the BIK calculation for electric cars include the list price, CO2 emissions, and the level of electric vehicle support put in place by the government. By taking all of these factors into account, you can accurately calculate the BIK for electric cars and ensure that your tax bill is as low as possible. So, if you’re considering an electric company car, make sure to factor in these details to get the most bang for your buck.

Calculating BIK for Different Electric Car Models

Calculating BIK for different electric car models can be a confusing task for those who are not familiar with the process. However, it is important to understand BIK when purchasing or leasing an electric car, as it can have a significant impact on the overall cost. BIK, or Benefit in Kind, is a tax that is calculated based on the value of the car, its CO2 emissions, and the income tax rate of the driver.

The BIK rate for electric cars is generally lower than for petrol or diesel cars, making them a more attractive option for company car drivers. To calculate BIK for electric cars, you will need to know the list price of the car, its CO2 emissions, and the driver’s income tax rate. There are also online BIK calculators that can be used to simplify the process.

By understanding how BIK is calculated and the specific rate for electric cars, drivers can make more informed decisions when choosing their next vehicle.

Electric Cars and HMRC Guidelines

When it comes to owning an electric car, it is important to understand the guidelines set out by HMRC regarding benefit in kind. HMRC guidelines state that electric cars are exempt from paying any benefit in kind, meaning that drivers of electric cars do not have to pay any tax on the use of their vehicle for personal journeys. This is a great incentive for people to switch to an electric car as not only are they better for the environment, but they also offer a significant financial saving compared to their petrol or diesel counterparts.

It is important to note, however, that this exemption only applies to pure electric cars and not hybrid vehicles. With the UK government aiming for all new cars to be electric by 2030, it is important to stay up to date with any changes in the guidelines set out by HMRC.

HMRC Rules and Regulations for BIK on Electric Cars

If you are considering an electric car as your company car, it is important to understand the HMRC rules and regulations regarding BIK (benefit in kind) tax. The good news is that electric cars have significantly lower BIK rates than conventional cars. In fact, electric cars have a zero percent BIK rate in the current tax year and a low rate of 1% in the following tax year.

This means that you will not need to pay tax on the full value of the car, but only a fraction of it based on its list price and CO2 emissions. It’s important to note that any optional extras will increase the car’s list price and BIK tax liability. Overall, electric cars provide a great opportunity to save money on BIK tax while also benefiting the environment.

Conclusion

In conclusion, the benefit in kind on electric cars from HMRC is a sweet deal for both employees and employers. Employees get to drive a sleek and eco-friendly vehicle without having to pay the hefty taxes associated with traditional company cars. Employers, on the other hand, get to show their commitment to sustainability while also enjoying financial incentives, such as reduced National Insurance contributions.

So, if you’re looking to save money and the environment, electrify your ride and enjoy the benefits in kind!”

FAQs

What is a benefit in kind on electric cars according to HMRC?

A benefit in kind on electric cars is a tax that an employee must pay on the private use of a company-provided electric car. HMRC defines it as the value of the benefit an employee receives through the provision of the electric car.

How is the benefit in kind value of an electric car calculated by HMRC?

HMRC calculates the benefit in kind value of an electric car by taking a percentage of the car’s list price, based on its CO2 emissions. For electric cars, this percentage is currently 1%.

Is the benefit in kind on electric cars different from that on petrol or diesel cars?

Yes, the benefit in kind on electric cars is different from that on petrol or diesel cars. The rate is generally lower for electric cars and can also vary depending on the car’s CO2 emissions and list price.

Can I avoid paying the benefit in kind tax on my company-provided electric car?

It may be possible to avoid paying the benefit in kind tax on your company-provided electric car if you can prove that you use the car exclusively for business purposes. However, it’s important to keep detailed records of your mileage and journeys to avoid any issues with HMRC.