7 Surprising Benefits of Benefit in Kind on Electric Cars.

Electric cars have been steadily gaining popularity in recent years, and for good reason. Not only are they more environmentally friendly than traditional gas-powered cars, but they also offer financial benefits for both individuals and businesses. One of the most significant advantages is the Benefit-in-Kind (BIK) tax savings that can be gained by using electric cars for business purposes.

This tax incentive can make a substantial difference to company car drivers and fleet operators, who can stand to save thousands of pounds. In this blog, we explore the BIK tax benefits of making the switch to an electric car and how it can help both employers and employees. Let’s take the first step towards a greener, more cost-effective future for businesses.

Definition of Benefit in Kind

When it comes to electric cars, many people wonder what the definition of a “benefit in kind” (BIK) is since it can affect their taxes and finances. A BIK can be any non-cash benefit that an employer provides to an employee, and it’s considered as part of their taxable income. In the case of electric cars, a BIK would be the value of the car that an employee uses for private purposes, such as commuting or running personal errands, rather than just for work purposes.

The BIK value is calculated based on the car’s list price and its CO2 emissions. However, electric cars are usually exempt from BIKs since they emit no CO2 emissions. Employers can provide electric company cars and charge points to their employees without having to pay extra tax on their behalf.

This makes driving an electric car not only sustainable but also financially rewarding for both employers and employees.

Explaining what benefit in kind is and how it relates to electric cars

Benefit in Kind (BIK) is the tax that employers pay on perks provided to their employees. It’s important to understand the definition of Benefit in Kind as it plays a significant role in the financial aspects of owning an electric vehicle. Electric vehicles are often seen as a more environmentally friendly option for commuting or driving, but they come at a higher purchase price than their petrol or diesel counterparts.

However, the Benefit in Kind taxes provide incentives for electric car buyers as they are lower than traditional gasoline-powered cars. With the growing awareness of climate change, more employers may be willing to incorporate electric vehicles into their fleets in the future, and the Benefit in Kind tax could be beneficial in making the transition easier for both employers and employees.

Tax Benefits for Electric Cars

If you’re considering an electric car, you’re in for some great tax benefits in kind! Benefit in kind on electric cars is the rate at which you pay tax on your car usage, but with an electric vehicle, you’ll enjoy lower rates. Plus, you’ll save on fuel costs since electric cars run off of electricity, which is significantly cheaper than gasoline. And, don’t forget about the government subsidies for purchasing an electric vehicle.

These subsidies can offset much of the upfront cost and make owning an electric car much more affordable. Additionally, electric cars are better for the environment since they don’t emit harmful pollutants like traditional gasoline vehicles do. With tax benefits, government subsidies, and a lower carbon footprint, owning an electric vehicle is a smart choice for both your wallet and the planet.

Describing the tax incentives available for electric cars under the benefit in kind system

Tax Benefits for Electric Cars If you own an electric car, then you are entitled to certain tax benefits under the benefit in kind system. The system allows employees to pay less tax on cars that are considered to have lower CO2 emissions, such as electric cars. This means that if you have an electric car, you could pay less tax than you would with a petrol or diesel car.

Furthermore, electric company cars are completely exempt from paying car tax altogether, which can save businesses a fortune. These incentives are designed to encourage people to switch to electric cars, which are better for the environment and can save you money in the long run. So if you’re thinking about buying an electric car, it’s definitely worth considering the tax benefits that come with it.

Providing statistics and examples of tax savings for individuals and businesses

Electric cars come with a plethora of tax benefits for both individuals and businesses alike. For individuals, the Federal government offers a tax credit of up to $7,500 for the purchase of qualified electric vehicles, which can help offset the cost of the vehicle. Additionally, several states offer their own incentives for electric car ownership, such as tax credits, rebates, and reduced registration fees.

In terms of tax benefits for businesses, purchasing or leasing an electric vehicle can provide significant tax savings through the Section 179 deduction and the Modified Accelerated Cost Recovery System (MACRS). Not only do these incentives lower upfront costs, but they also reduce the overall cost of ownership for electric vehicles. It’s important to note that these tax savings may vary depending on specific circumstances, such as the make and model of the electric vehicle and the tax codes in the area.

However, it’s clear that electric cars can provide substantial tax benefits for both individuals and businesses.

Environmental Impact of Electric Cars

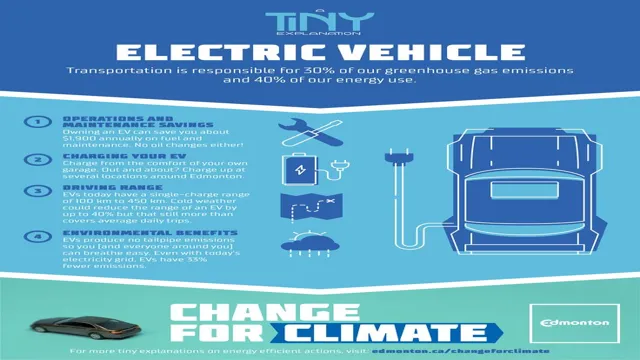

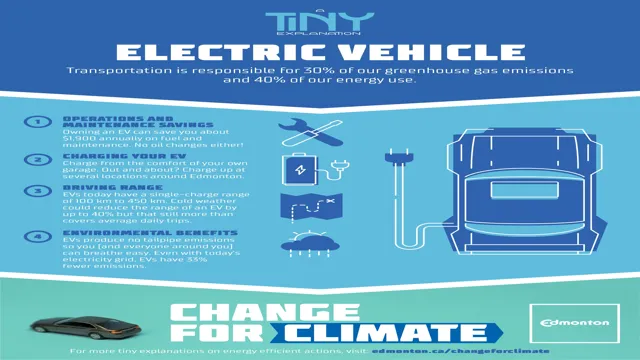

One of the biggest reasons why electric cars are gaining popularity is their positive impact on the environment. Electric cars do not emit harmful pollutants and greenhouse gases that contribute to climate change. Additionally, they are far more efficient than traditional combustion engines as they use energy from batteries rather than gasoline.

This has led to governments around the world providing incentives for people to switch to electric cars, including reductions in tax and benefit in kind on electric cars. By encouraging people to make the switch, we can all make a contribution towards a cleaner and more sustainable future for our planet.

Highlighting the benefits electric cars have on the environment

Electric cars have a significantly lower impact on the environment compared to traditional gas-powered cars. The main reason for this is that electric cars don’t produce any emissions directly from the car itself. Gas cars, on the other hand, release harmful emissions like carbon dioxide, nitrogen oxides, and particulate matter that contribute to air pollution and climate change.

In addition, electric cars use energy more efficiently, which means they produce less pollution indirectly as well. Generating electricity produces some pollution, but it’s still less than what would be produced by burning gasoline. So by driving an electric car, you can significantly decrease your carbon footprint and contribute to a cleaner, more sustainable future.

It’s a win-win situation.

Presenting data on the reduction of CO2 emissions with electric cars

Electric cars have been gaining popularity worldwide due to their potential to reduce greenhouse gas emissions and curb air pollution. The environmental impact of electric cars cannot be overstated, especially in terms of reducing CO2 emissions. Traditional cars that use internal combustion engines are responsible for a significant proportion of global CO2 emissions, making them the largest contributor to greenhouse gas emissions.

However, electric cars are powered by electric motors and do not emit harmful pollutants or greenhouse gases into the atmosphere. A recent study shows that the use of electric cars could reduce CO2 emissions from the transportation sector drastically. Electric cars produce fewer emissions than gasoline-powered cars and have lower long-term costs.

Overall, electric cars have the potential to reduce CO2 emissions significantly and play a vital role in mitigating the effects of climate change.

Future of Benefit in Kind

As the world shifts towards a greener future, the future of Benefit in Kind (BIK) for electric cars is creating a lot of buzz. Benefit in Kind refers to the additional perks or benefits that employees receive alongside their salary, for example, a company car that they can also use for personal purposes. Previously, BIK rates for electric cars were low, meaning that they were a much cheaper option over their petrol or diesel-fueled counterparts.

However, the government has now decided to change the BIK rates, increasing them for electric cars and reducing them for petrol and diesel cars. This change is expected to reduce the current demand for electric cars and stunt the growth of the industry. While the government claims that the change is to ensure a fairer system and reduce carbon dioxide emissions, it remains to be seen how these changes will affect the current trend of electric vehicle adoption.

Exploring potential future changes and updates to the benefit in kind system in relation to electric cars

The future of Benefit in Kind (BIK) is an interesting subject, especially in relation to electric cars. Electric vehicles have been touted as a greener alternative to traditional gasoline-powered cars. However, the current BIK system does not always incentivize their use.

In the UK, the current BIK system for electric cars is based on the vehicle’s list price, with a 0% tax rate for fully electric cars in the 2020-21 tax year and a rate increase to 1% in 2021-2 This system can make electric cars more expensive to run than their petrol or diesel equivalents, despite their lower emissions. But there could be changes to the BIK system on the horizon.

The UK Government has proposed a change that would mean company car drivers could be taxed on the cash value of the electricity they use to charge their cars, rather than the full vehicle list price. Another possible future change could be the introduction of BIK rates that are based on a vehicle’s carbon dioxide emissions, as opposed to just its list price. These changes could help incentivize the use of electric cars and encourage companies to switch to greener transport options.

Discussing the potential implications these changes could have on individuals and businesses

As we look towards the future of benefits in kind, there is a lot to consider for both individuals and businesses. The proposed changes to the tax system around company cars and living accommodations could have a significant impact on how both employees and employers approach these perks. For individuals, it could mean a change in the way they view these benefits, potentially opting for different options that may be more tax-efficient.

For businesses, it could mean a shift in how they structure their employee benefits, potentially offering different perks or adjusting the way they calculate and allocate costs. Ultimately, the changes could have both positive and negative implications for both parties. It will be interesting to see how they play out and what the long-term effects will be on the business landscape.

Conclusion

In conclusion, the benefits of electric cars are more than just environmentally friendly. The benefit in kind (BIK) tax reduction on electric cars is a great incentive for individuals and businesses to invest in cleaner and more efficient transportation. Not to mention, the lower fuel and maintenance costs of electric cars can save drivers a significant amount of money in the long run.

So step on the accelerator, because electric cars are not only good for Mother Nature but also your wallet – it’s a win-win situation!”

FAQs

What is a benefit in kind on electric cars?

A benefit in kind on electric cars is a taxable benefit provided to an employee or director of a company who is given the use of an electric car for personal as well as business purposes.

How is the benefit in kind on electric cars calculated?

The benefit in kind on electric cars is calculated by multiplying the list price of the car by the percentage set by the government, which is currently 1% for the tax year 2021/2022.

Are there any exemptions or reductions in the benefit in kind on electric cars?

Yes, there are some exemptions and reductions in the benefit in kind on electric cars, such as zero-emission cars, which have a reduced rate of 0%, and if the employee makes a contribution towards the car’s cost, this can reduce the taxable amount.

How can an employee claim their benefit in kind on electric cars tax rebate?

An employee can claim their benefit in kind on electric cars tax rebate by completing a self-assessment tax return or by contacting HM Revenue and Customs (HMRC) directly. They will need to provide information such as the make and model of the car, its list price, and the amount of contribution they have made towards it.