Benefit in Kind Tax Electric Cars: Smart Savings!

Many people want to know about electric cars. They are becoming more popular. With this popularity, new rules appear. One rule is the Benefit in Kind Tax (BIK). This tax affects many car owners. Let’s dive into what BIK tax is and how it works for electric cars.

What is Benefit in Kind Tax?

Benefit in Kind Tax is a tax for company cars. When a company provides a car, the employee gets a benefit. This benefit has value. The government wants to tax this value. This is where BIK comes in. It helps the government collect money from company cars.

Why is BIK Tax Important?

BIK tax is important for a few reasons:

- It helps raise money for public services.

- It encourages people to choose greener cars.

- It makes car benefits fair for everyone.

How Does BIK Tax Work for Electric Cars?

Electric cars have special rules for BIK tax. These rules are different from petrol or diesel cars. The government wants to promote electric cars. They do this by lowering the BIK tax rate for them.

Understanding Bik Rates

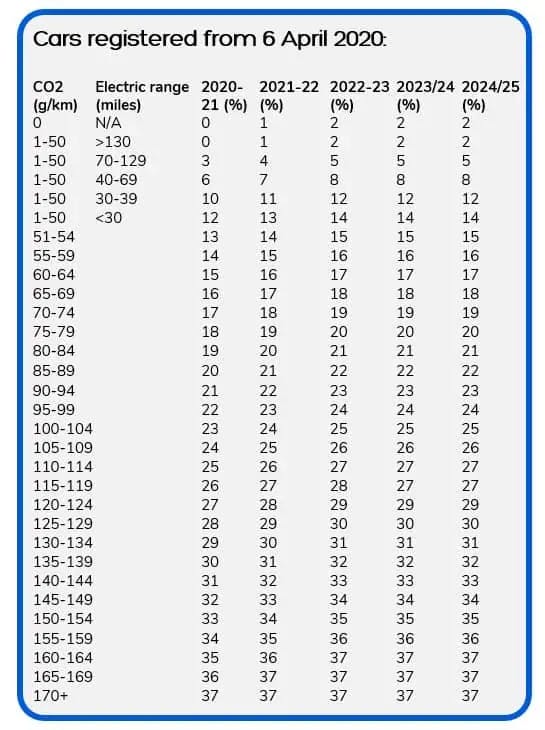

BIK rates depend on the car’s CO2 emissions. Electric cars produce no emissions. Because of this, they have low BIK rates. For example, in 2023, the BIK rate for electric cars is just 2%.

How Is Bik Tax Calculated?

To calculate BIK tax, follow these steps:

- Find the car’s list price.

- Multiply the list price by the BIK rate.

- Multiply the result by your income tax rate.

Let’s look at an example. Imagine an electric car costs £30,000. The BIK rate is 2%. Your income tax rate is 20%.

First, calculate the BIK value:

Now, calculate the tax:

So, you would pay £120 in BIK tax for that year.

Benefits of Electric Cars and BIK Tax

There are many benefits to driving electric cars. Here are a few:

- Lower running costs.

- Less maintenance needed.

- Good for the environment.

- Lower BIK tax rates.

Lower Running Costs

Electric cars cost less to run than petrol cars. Electricity is cheaper than petrol. This means you save money each month.

Less Maintenance

Electric cars have fewer moving parts. This means they need less repair. You save money and time on maintenance.

Good For The Environment

Electric cars are better for the planet. They produce no CO2. This helps fight climate change.

Lower Bik Tax Rates

As we saw, electric cars have low BIK tax rates. This means you pay less tax. This makes electric cars more attractive.

Other Incentives for Electric Cars

Besides BIK tax, there are other benefits. Here are some:

- Government grants.

- Free charging points.

- Lower road tax.

Government Grants

The government gives money to help buy electric cars. These grants can reduce the price. This makes buying an electric car easier.

Free Charging Points

Many places have free charging points. You can charge your car at work or shopping centers. This saves you money on fuel.

Lower Road Tax

Electric cars often have lower road tax. This is another way to save money. You pay less each year.

Challenges of Owning an Electric Car

While electric cars have benefits, there are challenges too. Some people worry about:

- Charging infrastructure.

- Range anxiety.

- Initial cost.

Charging Infrastructure

Some areas have few charging stations. This makes it hard to charge. However, the number of stations is growing.

Range Anxiety

Range anxiety is the fear of running out of battery. Many electric cars can go far. Still, planning trips is necessary. Always check your battery level before long trips.

Initial Cost

Electric cars can be expensive to buy. However, the savings over time help. You save money on fuel and maintenance.

Frequently Asked Questions

What Is Benefit In Kind (bik) Tax For Electric Cars?

Benefit in Kind tax is a tax on company cars, including electric cars. Employees pay tax based on the car’s value and CO2 emissions.

How Is Bik Tax Calculated For Electric Vehicles?

BIK tax is calculated using the car’s list price, the CO2 emissions, and the employee’s income tax rate.

What Are The Bik Tax Rates For Electric Cars?

Electric cars have low BIK tax rates. In 2023, the rate is typically around 2% for fully electric vehicles.

Do Electric Cars Have Lower Bik Tax Rates?

Yes, electric cars have significantly lower BIK tax rates compared to petrol or diesel cars.

Conclusion

In summary, Benefit in Kind Tax for electric cars is low. This makes electric cars a good choice. They are good for your wallet and the planet.

Many benefits come with owning an electric car. Lower running costs, less maintenance, and good tax rates help. So, think about going electric. It may be the right choice for you.

Final Thoughts

As the world moves toward greener options, electric cars are key. Understanding BIK tax helps you make informed choices. Remember the benefits, and consider the challenges. With the right information, you can choose what suits you best.