Powering up your Benefits: The Incredible Advantages of Electric Cars for Businesses

Electric cars have been gaining popularity in recent years due to their environmentally friendly nature and cost savings in the long run. However, did you know that there are also Benefits in Kind (BIK) for electric cars? BIK refers to any non-cash items or services that an employer provides to their employees in addition to their salary. In this case, owning an electric car as an employee comes with its own set of advantages, such as reduced tax rates and exemption from certain vehicle-related taxes.

In this blog, we will explore the various benefits in kind for electric cars, how they work, and how employers and employees can take advantage of them. So, if you’re considering purchasing an electric car, or if you’re an employer looking to offer this as a benefit to your employees, keep reading!

Reduced Company Car Tax

One of the biggest benefits of driving an electric car is the reduced company car tax. This is because electric cars are considered to be low-emission vehicles and therefore qualify for lower rates of company car tax compared to petrol or diesel cars. The reduced company car tax not only benefits companies, but also individuals who drive an electric car as a company car.

They can save a considerable amount of money on tax, making electric cars an even more attractive option. So, if you’re in the market for a new company car, consider an electric car to take advantage of the reduced company car tax. Plus, it’s great for the environment!

Electric vehicles are eligible for lower tax rates compared to diesel/petrol cars.

Electric vehicles offer a multitude of benefits over traditional petrol or diesel-powered cars. A significant one is the reduced company car tax that electric vehicles are eligible for. Under the UK’s current system, company car tax is based on a car’s carbon dioxide emissions and its list price.

Electric vehicles are lower on emissions and also cheaper in price, making them a more attractive proposition for companies seeking to save on tax costs. As a result, electric vehicles typically have a lower company car tax rate than traditional cars. This is not only a great incentive for companies to switch to greener vehicles but also helps to reduce air pollution and promote sustainability.

In the long run, electric vehicles can contribute to a cleaner and more cost-effective transport system.

This can result in significant savings for businesses.

Reduced Company Car Tax has been a significant relief for businesses, particularly those that rely heavily on company vehicles. The reduced company car tax encourages businesses to invest in low-emission vehicles and helps to reduce their carbon footprint. Not only does this benefit the environment, but it also means cost savings for businesses as low-emission vehicles attract reduced tax rates.

Businesses can save a considerable amount of money on their tax bills, which can be reinvested in other areas of the business. With the introduction of low-emission vehicles and reduced company car tax, businesses can now thrive without worrying about excessive costs associated with high-emission vehicles. By investing in low-emission vehicles and embracing the reduced company car tax, businesses are not only reducing their carbon footprint but also making significant savings while doing so.

Grants and Incentives

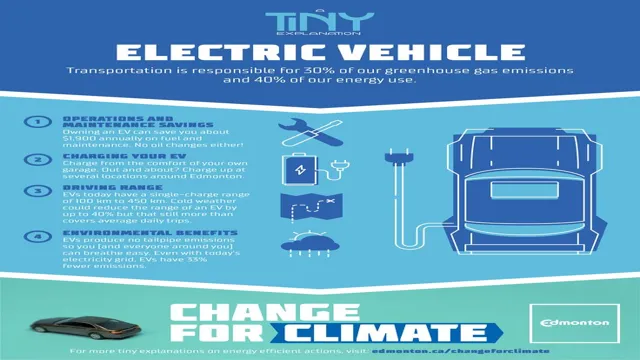

When it comes to electric cars, there are many benefits in kind that can save you money in the long run. One key advantage is the availability of grants and incentives provided by the government and electric car manufacturers. These incentives can vary by location but may include tax credits, rebates, and even free or discounted charging at public charging stations.

You can also benefit from lower fuel costs and reduced maintenance expenses, as electric cars have fewer moving parts and don’t require oil changes. Switching to an electric car can also increase your environmental footprint, reducing greenhouse gas emissions and helping to protect the planet. Overall, there are many reasons to consider an electric car, including the many benefits in kind that can save you money and help to create a more sustainable future.

The government offers grants of up to £3,000 to businesses purchasing electric vehicles.

Grants and Incentives If you’re a business owner looking to make the switch to an electric vehicle, good news! The UK government is offering grants of up to £3,000 to help you do so. Not only will you be doing your part for the environment, but you’ll also be saving money on fuel costs and maintenance in the long run. It’s a win-win situation! To be eligible for the grant, the vehicle must meet certain criteria, such as emitting no more than 50g of CO2 per km and having a range of at least 70 miles on a single charge.

The process of applying for the grant is fairly simple and can be done online. So why not take advantage of this offer and make the switch to an electric vehicle today? You’ll be doing your business and the planet a favour.

Additionally, there are various incentives such as reduced parking fees and exemption from congestion charges.

If you’re considering buying an electric vehicle, there are various grants and incentives that you could take advantage of. One of the most popular incentives is the federal tax credit, which can be up to $7,500. However, the amount you can get depends on the battery size of your EV and the manufacturer.

Furthermore, several states offer their own incentives to encourage the purchase of electric vehicles. For instance, California provides a rebate of up to $2,000, while Colorado offers a tax credit up to $5,000. Additionally, some cities provide their own incentives to promote the use of EVs, such as reduced parking fees and exemption from congestion charges.

These incentives can help reduce the overall cost of owning an electric vehicle and make them more accessible to the general public. So, if you’ve been considering purchasing an EV, it may be a good idea to investigate what grants and incentives are available in your area. Not only could you save money, but you’ll also be contributing to a more sustainable future.

These incentives can help reduce the overall cost of owning electric cars.

Electric cars can be a cost-effective investment, but the upfront price can still be a deterrent for some. Fortunately, there are plenty of grants and incentives available that can help reduce the overall cost of owning an electric car. These incentives vary depending on your location, but many countries and states offer tax credits, rebates, and grants to incentivize the purchase and use of electric vehicles.

For example, in the United States, federal tax credits of up to $7,500 are available for electric cars, and many states offer additional incentives such as rebates, exemptions from sales tax, and free or reduced-price charging stations. These incentives not only make electric cars more affordable, but they also help to promote sustainable transportation and reduce greenhouse gas emissions. Investing in an electric car with these incentives can not only save you money in the long run but can also help pave the way for a cleaner and more sustainable future.

Environmental Benefits

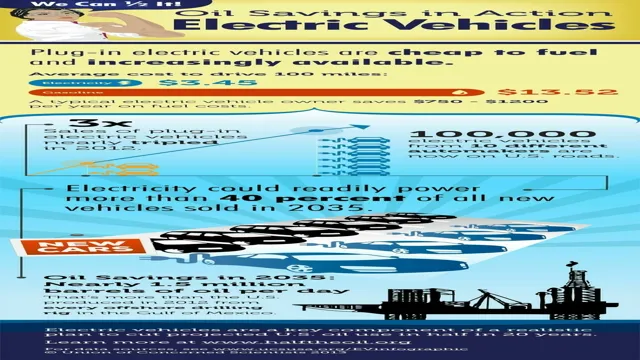

One of the most significant benefits in kind of electric cars is their positive impact on the environment. Electric cars produce zero emissions, which contributes to reducing air and noise pollution. This means that when driving an electric car, there is no release of harmful pollutants into the atmosphere, which helps to protect the planet.

Furthermore, electric cars are more efficient than traditional gasoline cars because they convert more of the energy stored in their batteries into driving the wheels. This translates into less fuel consumption and less damage to the environment. Switching to electric cars can also help reduce our dependence on fossil fuels, which are a finite resource and are responsible for significant greenhouse gas emissions.

All of these benefits make switching to an electric car an excellent way of reducing our impact on the environment.

Electric cars have lower carbon emissions, reducing a company’s carbon footprint.

When it comes to reducing a company’s carbon footprint, electric cars have a major advantage over traditional gas-powered vehicles. Electric cars produce far lower carbon emissions, which makes them a more environmentally-friendly choice for fleet operations. By switching to electric vehicles, companies from all industries can make a significant impact on reducing their carbon footprint.

This is especially important for companies that rely heavily on transportation, such as delivery and logistics companies. By investing in electric cars, these companies can not only do their part to reduce their environmental impact, but they can also save money in the long run by reducing fuel costs and reducing the need for maintenance on their fleets. So not only do electric cars benefit the environment, but they also make good business sense.

By leading the way in sustainability and adopting electric cars, companies can set an example for others to follow and help us all move towards a cleaner and greener future.

This can help a company meet their sustainability goals and improve their reputation.

One major benefit of incorporating environmentally sustainable practices into a company’s operations is the positive impact it can have on the environment. By reducing carbon emissions, minimizing waste, and conserving natural resources, companies can help mitigate the impact of industrialization on the planet. This not only has long-term benefits for the environment, but it also has a positive impact on the company’s reputation.

Customers are increasingly becoming more environmentally conscious and are more likely to support companies that prioritize sustainability. By taking steps to reduce environmental impact, companies can demonstrate their commitment to social responsibility and improve their reputation in the eyes of consumers. Implementing sustainable practices can also lead to cost savings in the long run, making it a win-win for both the planet and the bottom line.

Improved Employee Wellbeing

One of the benefits in kind that companies can offer to their employees is the use of electric cars. This not only benefits the environment, but also the wellbeing of employees. Electric cars emit zero emissions which greatly improves the air quality, resulting in cleaner and healthier surroundings for people.

With better air quality, employees can breathe easier, reducing the risk of respiratory issues such as asthma and bronchitis. Electric cars are also quieter than traditional cars which lessen the noise pollution and provide a more peaceful and less stressful commute for employees. Additionally, by providing electric cars, companies can show their commitment to sustainability and encourage employees to adopt eco-friendly lifestyles.

This can create a sense of pride and satisfaction among employees, leading to improved morale and job satisfaction. Benefits in kind such as electric cars can help companies attract and retain top talent, while also promoting a healthier and happier workplace.

Electric cars emit less air pollution than diesel/petrol vehicles, resulting in better air quality for employees.

When it comes to employee wellbeing, air quality is a crucial factor that can have a significant impact on their health and productivity. Electric cars are a great option to reduce air pollution and improve air quality in the workplace. They emit fewer pollutants, including particulate matter, nitrogen oxides and carbon monoxide, which are harmful to health and can cause respiratory problems.

Improved air quality can lead to lower absenteeism, fewer respiratory problems and overall more productive employees. Investing in an electric fleet can also improve a company’s reputation as a responsible and eco-friendly business. By making the switch to electric vehicles, companies can demonstrate their commitment to a sustainable future, attracting customers who value environmental and social responsibility.

Electric cars are more cost-efficient in the long run, as they require less maintenance and have lower running costs than diesel/petrol vehicles. In conclusion, providing a cleaner environment for employees through the adoption of electric vehicles can improve employee wellbeing and engagement, while also being a responsible and cost-efficient decision for the business.

This can improve employees’ health and wellbeing, resulting in higher productivity.

Employee Wellbeing Employee wellbeing is a crucial aspect of any organization, as it has a direct impact on productivity levels. When employees feel mentally and physically healthy, they tend to work more efficiently, resulting in better performance and fewer sick days. Employers must invest in measures that promote employee wellbeing, such as providing healthy snack options in the office, organizing stress-reducing activities, and offering flexible work schedules.

Furthermore, creating a positive work environment that encourages collaboration, communication, and recognition also contributes significantly to employee wellbeing. As an employer, it is vital to prioritize the wellbeing of your team to ensure high levels of productivity, job satisfaction, and overall success. By providing a supportive and healthy work environment, businesses can create a positive feedback loop that benefits both employees and the organization as a whole.

Conclusion

In conclusion, the benefits of electric cars as a benefit in kind are truly electrifying! Not only do they provide a sustainable and environmentally-friendly mode of transportation, but they also offer financial savings in the form of reduced fuel costs and tax incentives. In addition, electric cars provide a smoother and quieter driving experience, as well as a range of advanced technologies and features. So, if you’re looking for a modern, forward-thinking benefit to offer your employees, an electric car may be the spark your business needs to charge ahead!”

FAQs

What is a benefit in kind for an electric car?

A benefit in kind is a non-cash form of remuneration that an employer provides to an employee, which for electric cars is determined by the vehicle’s emissions and the electric range.

Are electric cars subject to benefit in kind tax?

Yes, electric cars are subject to benefit in kind tax. However, the amount of tax you pay will depend on the CO2 emissions and the electric range of your vehicle.

How much benefit in kind tax will I pay for my electric car?

The amount of benefit in kind tax you pay for your electric car is determined by its CO2 emissions and electric range, with the tax rate currently set at 0% for zero-emission cars.

Can I claim tax relief on the purchase of an electric car?

Yes, you may be able to claim capital allowances on the purchase of an electric car as a business expense. Additionally, if your employer provides charging facilities for your electric car, you will not be taxed on the value of electricity used to charge it.