Rev Up Your Savings: The Ultimate Guide to DMV Electric Car Tax Benefits!

Driving an electric car has become increasingly popular in recent years, and it’s not hard to see why. Not only are electric cars better for the environment, but they can also save you money in the long run. In fact, if you live in the DMV area, you may be eligible for a tax benefit just for owning an electric car.

This benefit can help offset the initial cost of purchasing an electric car and make it easier for you to make the switch to a more eco-friendly mode of transportation. Curious to learn more about the DMV electric car tax benefit? Here’s everything you need to know.

What is the DMV Electric Car Tax Benefit?

Did you know that owning an electric car could not only help you save on gas, but also give you a tax benefit? The DMV electric car tax benefit is aimed at promoting the use of electric cars, which is a greener and more sustainable form of transportation. This benefit varies from state to state, but it typically involves either a tax credit or exemption from certain state taxes. For example, in California, electric car owners may be eligible for a rebate of up to $7,000, depending on their income and the type of vehicle they own.

Other states offer similar incentives, such as exemptions from sales tax, registration fees, and more. So, if you’re considering buying an electric car, it’s worth researching the DMV electric car tax benefit in your state to see if you can take advantage of these savings.

Detailed explanation of the tax benefit

The DMV Electric Car Tax Benefit refers to the tax incentive provided by the Department of Motor Vehicles to individuals who purchase an electric car. This tax benefit is aimed at promoting the use of electric cars as an eco-friendly alternative to traditional gas-powered vehicles. The tax benefit program provides a significant reduction in the annual registration fee for electric cars and allows owners to save a considerable amount of money over the lifetime of their vehicle.

In addition, it also offers a significant tax credit during the year of purchase, which can be used to offset the cost of the vehicle. This electric car tax benefit is one of the best incentives currently available, yet most people are unaware of this program and miss out on the opportunity to save money on their vehicle expenses. So, if you’re planning to buy an electric car, be sure to take advantage of this tax benefit to reduce your overall costs while contributing to a greener planet.

Is your E-car eligible?

Are you an electric car owner wondering if your vehicle is eligible for a tax benefit from the DMV? The good news is that many states offer incentives for driving an electric or hybrid car. However, the specifics vary from state to state and are subject to change. To determine your eligibility for the DMV electric car tax benefit, you should visit the official website of your state’s Department of Motor Vehicles.

You’ll find information on qualifying vehicles, available credits, and any other requirements you must meet. Don’t miss out on the opportunity to save money while enjoying the many benefits of driving an eco-friendly vehicle. Check today to see if you qualify for a DMV electric car tax benefit.

Eligibility criteria for the tax benefit

If you’re considering getting an electric car and taking advantage of the tax benefits that come with it, you’ll need to make sure your vehicle meets the eligibility criteria. The good news is that many electric vehicles on the market today are eligible for tax credits, but there are a few requirements to keep in mind. First, the car must be new, meaning you can’t claim the tax credit for a used electric car.

Additionally, the car must be primarily powered by an electric motor, not a gasoline or diesel engine. Finally, the vehicle must meet certain battery capacity requirements to be eligible for the full tax credit amount. It’s important to note that these eligibility criteria can change, so it’s always a good idea to consult with a tax professional or do your own research to make sure you’re getting the most accurate and up-to-date information.

So, if you’re planning on purchasing an electric car, be sure to check the eligibility criteria to see if you can take advantage of the tax benefit!

Examples of eligible E-cars

If you’re considering purchasing an E-car, it’s important to know whether it’s eligible for certain benefits or incentives. Some examples of E-cars that may be eligible include the Nissan Leaf, Chevy Bolt, Tesla Model S, and the BMW i However, it’s important to research the specific incentives and requirements for your state and local area, as they may vary.

In addition, make sure to check with the dealership or manufacturer if they offer any additional incentives or discounts. Remember, going electric doesn’t just benefit the environment, but it can also benefit your wallet. So, take the time to do your research and see if your E-car is eligible for any incentives or benefits.

How to claim the tax benefit?

If you have recently bought an electric car in DMV, congratulations, you are eligible for a tax credit! Claiming this tax benefit is a straightforward process. Firstly, make sure that you qualify for the credit by checking the specific requirements for the electric vehicle tax credit in your state. Next, get the necessary documentation ready, such as the bill of sale and the Manufacturer Certification Statement.

Then, when filing your annual tax return with the IRS, complete IRS Form 8936, which is specifically for claiming the qualified electric vehicle credit. The amount of the credit will depend on the battery size and the make and model of your vehicle, among other things. It’s important to note that you cannot claim both the tax credit and the rebate offered by your state, so choose the option that gives you the most benefit.

With this tax credit, not only will you save money but you also contribute to a cleaner environment by driving an electric vehicle.

Step by step guide to claiming the tax benefit

To claim the tax benefit, you need to follow a step-by-step process. The first step is to ascertain the expenses incurred on the eligible activities. Then, you need to ensure that you have a valid Tax Deduction Account Number (TAN) and that the company is registered with the Income Tax Department.

Once you have confirmed these details, you can file your tax returns and claim the benefit by filling out the relevant section in the forms available for filing. Make sure to include the total amount of your expenses, along with receipts, invoices, and any other supporting documentation. It’s essential to keep in mind that the tax benefit applies only to eligible activities, so review your expenses carefully to ensure they are eligible.

Additionally, the benefit may vary based on the type of activity or investment, so it’s wise to consult a tax professional to ensure you are claiming the maximum benefit. In conclusion, claiming the tax benefit may require some effort, but it can result in significant savings. As long as you follow the appropriate steps and provide all the necessary documentation, you should have no trouble claiming your eligible expenses.

So, take advantage of the tax benefit and keep more money in your pocket!

Benefits of owning an electric car

Electric cars have become increasingly popular over the years due to their numerous benefits. If you live in the United States, there is good news for those considering purchasing an electric car: the DMV electric car tax benefit. This tax incentive is aimed at incentivizing drivers to purchase electric vehicles by allowing them to take advantage of tax credits.

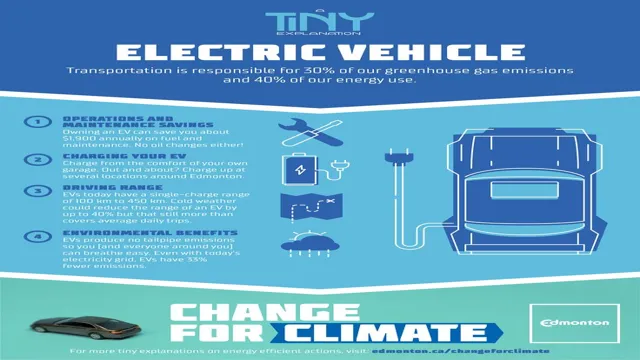

These credits can range from a few hundred to several thousand dollars depending on the state in which you reside. Not only will you save money on gas, but you will also be doing your part in reducing your carbon footprint. Owning an electric car will also allow for a smoother and quieter ride, as well as lower maintenance costs.

Plus, with advancements in technology, electric cars are now able to travel longer distances without the need for frequent charging. By investing in an electric car, you can reap the benefits of saving money, helping the environment, and enjoying a reliable and efficient mode of transportation.

Environmental and financial benefits of owning an electric car

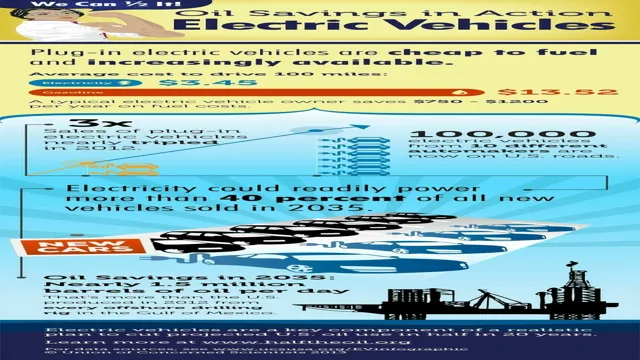

Owning an electric car can provide various benefits, both financially and environmentally. Firstly, purchasing an electric vehicle can help save money on fuel costs as they are more energy-efficient and require less maintenance than traditional gas-powered cars. Furthermore, there are often incentives and tax credits available for those who purchase an electric car, which can offset the initial cost.

In terms of the environment, electric cars emit less greenhouse gases and pollutants, making them a cleaner alternative to traditional cars. Plus, they also don’t produce any emissions during operation, unlike gas-powered vehicles. By switching to an electric car, you can contribute to a cleaner environment and reduce your carbon footprint.

Overall, owning an electric car is a smart choice that can provide you with numerous benefits, including cost savings and environmental sustainability.

Data-backed benefits of driving an electric car

If you’re considering purchasing an electric car, you’ll be pleased to know that the decision to switch to electric has many data-backed benefits. Firstly, electric vehicles are much cheaper to maintain than their gas-guzzling counterparts. With fewer moving parts and no need for oil changes, EV owners can save between $500-$1,000 per year in maintenance costs.

Secondly, electric cars emit significantly less carbon dioxide than traditional gasoline-powered vehicles. This means you’ll be doing your part to reduce greenhouse gas emissions and air pollution. Thirdly, driving an electric car can also save you money on fuel costs.

While the upfront cost of an EV can be higher than a conventional car, the cost of charging an electric vehicle is much less expensive than filling up a gas tank. In fact, data shows that EV owners can save up to $1,000 per year on fuel costs alone. Overall, switching to an electric car has many benefits for both your wallet and the environment.

Conclusion

In conclusion, the DMV electric car tax benefit is not just a government incentive for eco-friendliness, it’s the gift that keeps on giving. Not only do electric car owners get to enjoy the smooth and silent ride, but they also get to reap the financial rewards of owning a vehicle that saves them money at the pump and on their taxes. So next time you’re stuck in traffic, remember that with an electric car, you’re not just reducing emissions, you’re also giving your wallet a well-deserved break.

“

FAQs

What is the DMV electric car tax benefit?

The DMV electric car tax benefit allows owners of electric vehicles to claim a tax credit or rebate on their vehicle purchase or lease, depending on the state they live in.

How much is the DMV electric car tax benefit?

The amount of the DMV electric car tax benefit varies depending on the state and the specific electric vehicle. In some states, it can be up to $7,500.

Can I claim the DMV electric car tax benefit if I lease an electric vehicle?

Yes, in most states, lessees can claim the DMV electric car tax benefit. However, the amount of the benefit may be different for leases compared to purchases.

Is there an income limit for claiming the DMV electric car tax benefit?

In some states, there are income limits for claiming the DMV electric car tax benefit. It’s important to check the specific requirements for your state before claiming the credit or rebate.