Electrify Your Commute and Wallet: Understanding Electric Car Benefit in Kind with HMRC

Electric cars have taken the world by storm in recent years, with more and more people realizing the benefits of driving an electric vehicle. However, as with anything new, there are still some questions and uncertainties surrounding the regulations and financial implications of owning an electric car. One such question is how the Benefit in Kind (BIK) tax applies to electric cars in the UK.

The HMRC has laid out specific rules regarding electric car BIK, and in this blog post, we will explore these rules and explain what they mean for you as an electric vehicle owner. So, buckle up and let’s dive into the world of electric cars and the BIK tax!

What is Benefit in Kind?

If you’re considering making the switch to an electric car, it’s important to understand Benefit in Kind (BIK) and how it relates to electric vehicles. BIK is a tax paid by employers on any benefits they provide to their employees, such as company cars. Under the current tax rules, electric cars have a lower BIK rate compared to traditional petrol and diesel cars, making them a more attractive option for both employees and employers.

For the tax year 2021-2022, the BIK rate for electric cars is 1% compared to 2-37% for traditional cars, depending on their CO2 emissions. However, it’s important to note that the BIK rates will increase gradually over the next few years. So, if you’re thinking about getting an electric car as a company car, it’s important to consider the long-term costs and tax implications.

But, overall, electric cars are still a great option for those looking to save money on company car tax while also helping the environment.

Definition and Explanation

If you’re an employee, you may have come across the term “benefit in kind.” This term refers to any benefit you receive from your employer that isn’t in the form of cash. Essentially, it’s any non-monetary perk or advantage that you get as part of your employment package.

Some common examples of benefits in kind include company cars, private healthcare, and professional development opportunities. These benefits can be a great way for your employer to incentivize you to work hard and stay loyal to the company. However, it’s important to remember that benefit in kind payments can also have tax implications, so it’s worth speaking to a tax professional if you’re unsure about anything.

Ultimately, benefit in kind refers to any non-cash advantage you receive as part of your job, and these benefits can vary widely depending on the employer.

Tax Liability for Employees and Employers

As an employee, you may have heard of Benefit in Kind (BIK) and wondered what it is and how it will affect your tax liability. Essentially, a BIK refers to any non-cash benefit that an employer provides to their staff in addition to their regular salary. These benefits may include facilities like company cars, health insurance, gym memberships, or even free meals and accommodation.

These perks can be a great incentive to work for a particular company and can enhance an employee’s overall job satisfaction. However, it’s important to know that these benefits may come with an additional tax responsibility. As an employee, you will be required to declare the value of your BIK on your tax return, and your employer will also have to report this to the tax authority.

It’s essential to understand the tax implications of these benefits to avoid any under-reporting or overpayment of tax.

Electric Car Benefit in Kind

Electric car benefit in kind refers to a tax on employee perks, such as the use of an electric car for personal use. HMRC calculates this tax based on the value of the car as well as its CO2 emissions, which for electric vehicles is zero. This makes EVs much more attractive to businesses wanting to offer company cars or employee perks.

The benefit in kind tax for electric cars is 1% for the 2021/22 tax year, which increases to 2% in 2022/23 and 2023/24 before rising to 3% from 2024/2 This low tax rate is a significant incentive for employees to switch to electric vehicles, which are not only better for the environment but also offer significant cost savings in terms of fuel and maintenance.

Overview of Electric Car Benefit in Kind

Electric Car Benefit in Kind is a program that provides a huge incentive to switch to electric vehicles. Under this scheme, you could save thousands of pounds on income tax and national insurance contributions by driving an environmentally-friendly car. Currently, most electric cars have a 0% Benefit in Kind (BiK) rate, which makes owning an electric car much cheaper than a petrol or diesel vehicle.

The BiK rate is determined based on the car’s CO2 emissions, and with electric cars producing zero emissions, they score best on this front. As a result, electric vehicles reduce the employer’s Class 1A National Insurance contributions while saving the employee hundreds or even thousands of pounds in BiK tax each year. The benefits are not just financial, however; electric cars will also help reduce the UK’s carbon emissions in the long run, benefiting the country’s environment.

If you are an employee or employer in the UK, it is well worth checking out the latest BiK rates and incentives for electric cars.

Criteria for Qualifying Electric Cars

If you’re considering getting an electric car, you may have heard about the Electric Car Benefit in Kind (BIK), which is a tax that some employers offer to their employees for using electric vehicles as company cars. To qualify for the BIK tax, there are certain criteria that your car needs to meet. One of the most important factors is the car’s CO2 emissions, which should be zero or very low.

This is because the UK government is committed to reducing carbon dioxide emissions, and it wants to encourage people to use electric cars instead of petrol or diesel vehicles. Other criteria that your electric car needs to meet include its range, battery capacity, and whether it can be charged from home. Check with your employer to find out if your electric car is eligible for the Electric Car Benefit in Kind.

How to Calculate Electric Car Benefit in Kind

Calculating your Electric Car Benefit in Kind (BIK) can seem difficult at first, but it’s actually quite simple. It’s the tax that you pay on using a company car for personal use. Electric cars are often known for their green credentials, and as such, there are considerable tax benefits of using one as a company car.

To calculate the Electric Car Benefit in Kind, you need to know your car’s list price and its electric range. Once you have this information, you can use a BIK calculator to determine your tax liability. The lower the emissions and longer the electric range, the less you’ll pay.

All in all, owning an electric company car has never looked so promising, both for its economic and environmental benefits.

Benefits of Choosing an Electric Car

One of the most significant benefits of choosing an electric car is the potential reduction in benefit-in-kind tax liability. This is a tax that employees pay on the personal use of a company car. Electric cars typically have lower emissions and higher efficiency rates compared to traditional petrol or diesel vehicles.

As such, they qualify for lower benefit-in-kind rates, which can result in significant savings. Additionally, electric cars tend to be cheaper to run overall, due to lower fuel costs and reduced maintenance needs. They also have the added benefit of being much quieter and smoother to drive, providing a more relaxing experience for drivers and passengers alike.

So, if you’re looking for a cost-effective and eco-friendly alternative to traditional cars, an electric car could be the perfect choice for you.

Cost Savings for Employees and Employers

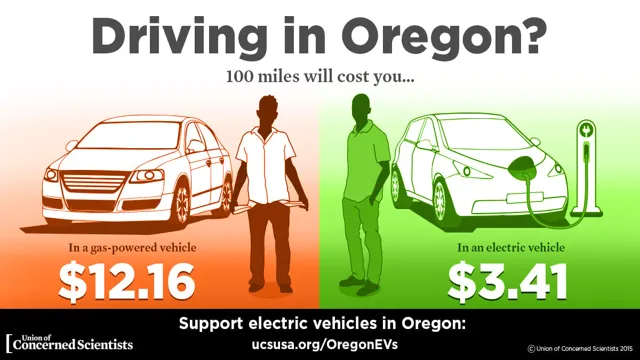

Electric cars offer significant cost savings to both employees and employers. They are more energy-efficient, which translates to lower running costs. These cars also require less maintenance than their gas-powered counterparts, reducing the total cost of ownership.

Employees who choose electric cars also benefit from tax incentives, rebates, and lower fuel costs. In addition, electric cars emit fewer greenhouse gases, making them an environmentally friendly choice. For employers who provide electric cars as company vehicles, they can save on fuel and maintenance costs, creating a positive impact on the bottom line.

Switching to electric cars is a smart choice for anyone looking to save money while reducing their carbon footprint.

Environmental Benefits

Electric cars are becoming increasingly popular due to their many benefits. One of the biggest advantages of choosing an electric car is the positive impact on the environment. Electric cars produce significantly less greenhouse gas emissions than traditional gasoline-powered vehicles.

In fact, a study showed that over their lifetime, electric cars can produce 50-70% less emissions compared to gasoline-powered cars. This is ideal for those who strive to make environmentally-conscious choices. Furthermore, electric cars do not require oil changes, cutting down on environmental waste and pollution caused by disposing of used oil.

This is just one of many reasons why electric cars are a great choice for those who want to make an eco-friendly choice while still enjoying the freedom of driving.

How to Claim Electric Car Benefit in Kind

If you’re an employee using an electric company car, you may be eligible for an electric car benefit in kind (BIK) tax. This means that you are required to pay tax on the car’s value, including any accessories or modifications. To claim the electric car benefit in kind with HMRC, you need to provide your employer with proof of your annual earnings and the car’s CO2 emissions and electric range.

Your employer will then calculate the taxable amount, which will be included in your annual earnings. While the electric car BIK tax can be quite substantial, it’s important to remember that electric cars are more environmentally friendly, cheaper to run and maintain, and often have reduced road tax fees. So, if you’re looking to save money and reduce your carbon footprint, an electric company car could be a smart choice.

Application Process and Documentation Requirements

If you are an employer providing electric company cars to your employees, you may be eligible for an electric car benefit in kind. To claim this benefit, you will need to fill out a P11D form and submit it to HM Revenue and Customs (HMRC). Documentation requirements include proof of the vehicle purchase or lease agreement, as well as information on the car’s CO2 emissions and electric range.

The benefit in kind will then be calculated based on the car’s list price, CO2 emissions, and electric range. It’s important to note that if the car is used for both personal and business use, the benefit in kind will only apply to the portion used for personal use. By claiming the electric car benefit in kind, not only will you be reducing your company’s carbon footprint, but you will also be providing a great perk for your employees.

Conclusion

As we reach the end of our journey exploring the benefits of electric cars in terms of benefit in kind from HMRC, it’s clear to see that the future is electric. With zero emissions, low running costs, silent operation, and government incentives, electric cars not only benefit the environment but also our wallets. So let’s leave behind the fossil fuels of the past and embrace the electric revolution.

After all, with an electric car, you’ll not only be driving towards a sustainable future but also towards a healthier bank account. It’s a win-win situation, don’t you think?”

FAQs

What is the benefit in kind for electric cars according to HMRC?

HMRC defines the benefit in kind for electric cars as 0% for the 2021-2022 tax year, meaning that there is no tax to pay on electric company cars for employees.

Can electric cars be used for business purposes?

Yes, electric cars can be used for business purposes, and the benefit in kind tax also applies for company vehicles used for business and personal purposes.

Is there a cap on the value of electric cars eligible for the 0% benefit in kind tax?

No, there is no cap on the value of electric cars as long as they meet the requirements for the 0% benefit in kind tax according to HMRC.

How does the benefit in kind tax for electric cars compare to petrol or diesel cars?

The benefit in kind tax for electric cars is significantly lower than for petrol or diesel cars, as the tax rate is 0% for the 2021-2022 tax year, whereas petrol and diesel cars are taxed at a rate based on their carbon emissions.