Unlocking the Tax Benefits of Electric Cars: A Complete Guide to Benefit in Kind Rules

So, you’re driving an electric car for a while and wonder how it could impact your wallet. Well, here’s something that might pique your interest – the Electric Car Benefit in Kind Rules. These are a set of regulations that offer a tax break to drivers who own electric vehicles (EVs).

As the government increases their commitment to the UK’s transition to zero-emission vehicles, the tax incentives for EVs and Plug-in Hybrids (PHEVs) are getting more exciting. If you’re an employee or an employer planning to go the EV route, you might want to pay close attention to the Benefit in Kind (BIK) rules. In short, the benefit in kind is an amount of value given to an employee or director in the form of low or free-cost benefits like company cars, fuel, and accommodation.

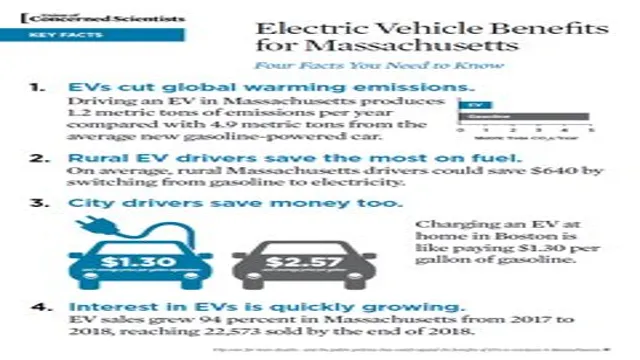

For EV drivers, they’re particularly attractive, as the tax incentives could reduce the BIK rate to 0%. The introduction of BIK rules for EVs has undoubtedly fueled EV sales in the UK, as it makes the ownership cost more reasonable compared to traditional fossil-fueled vehicles. Not only that, but switching to EVs also reduces carbon emissions, which is a step towards achieving the UK’s net-zero emissions target by 2050.

If you’re still unsure how the Electric Car Benefit in Kind Rules can benefit you, don’t worry – in this blog post, we’ll dive deep into the specifics of the policy and the exemptions available. So, buckle up and continue reading to find out more!

What is Benefit in Kind?

Electric cars are becoming increasingly popular due to the benefits they offer, including lower emissions and more affordable running costs. However, when it comes to company cars, there is something called Benefit in Kind (BIK). BIK refers to the value of any non-cash benefit that an employee receives from their employer.

When it comes to electric cars, there are specific Benefit in Kind rules that apply. In the UK, the Benefit in Kind for electric company cars is currently set at 1% for the tax year 2021/2 This means that employees who are given an electric company car will only pay 1% of its total value as tax, making it a cost-effective option for both employers and employees.

With the UK government’s push towards decarbonization, it is likely that the Benefit in Kind for electric cars will continue to be favorable, making them an attractive option for businesses looking to reduce their carbon footprint while also saving money.

Explaining Benefit in Kind for Company Cars

Benefit in Kind (BIK) is a tax system that is applied to company cars and other benefits that employees receive from their employer. Specifically, BIK is the tax an employee has to pay on the value of the benefit their employer provides. For companies, providing a company car or other benefit is a way to attract and retain talent, but it can also represent a significant expense.

That’s why it’s important to understand how Benefit in Kind works. The taxable value of a benefit is calculated by taking the car or asset’s list price and multiplying it by the appropriate percentage, based on its CO2 emissions. The employee then pays tax on that value at their applicable income tax rate.

So, the more expensive the car, and the higher its CO2 emissions, the more tax the employee will have to pay, making it even more important for businesses to choose company cars that have lower emissions.

Why are Electric Cars Different?

One major difference between electric cars and their traditional gasoline counterparts is the benefit in kind rules for company cars. In many countries, including the UK, the benefit in kind tax (BIK) rate is significantly lower for electric cars. This means that if an employer provides an electric car to an employee, the employee will be taxed at a lower rate for the use of that car compared to a gasoline car.

This is because electric cars have zero emissions, which is seen as a more environmentally friendly choice. The lower BIK rate makes electric cars a more appealing option for companies looking to provide their employees with company cars, and for employees who want to enjoy a tax break while driving an environmentally friendly car. Overall, the benefit in kind rules serve as a significant incentive for choosing an electric car over a traditional gasoline car.

Benefits of Electric Cars for Employers

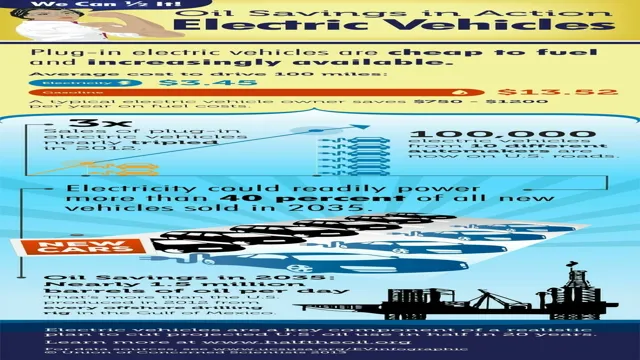

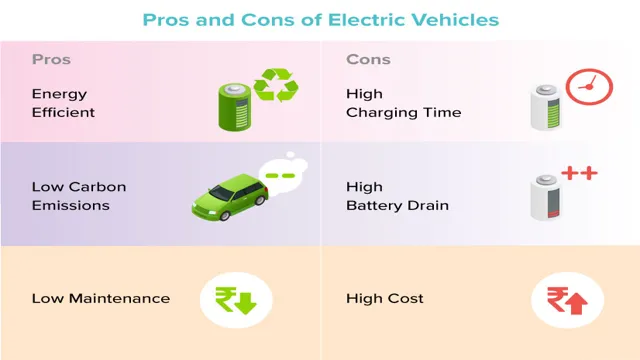

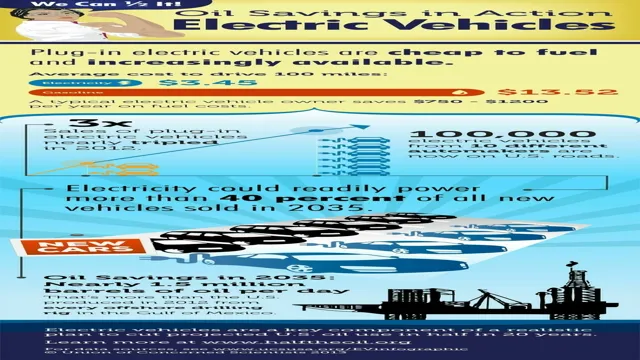

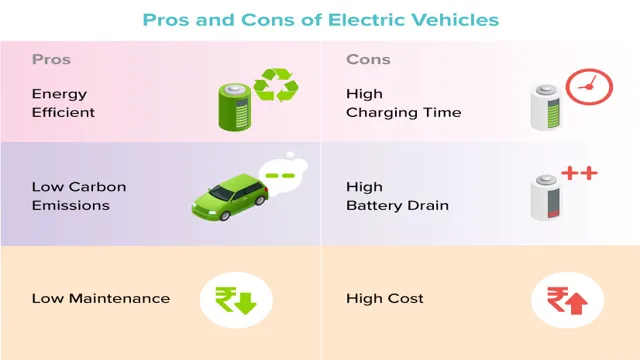

Electric cars have been increasing in popularity, and for good reason. For employers, electric cars provide many benefits that traditional gas-powered vehicles do not. One major difference is the electric car’s ability to recharge, which means less time and money spent on refueling.

Additionally, electric cars are sustainable and eco-friendly, which improves the employer’s corporate responsibility. These cars also have fewer moving parts, leading to lower maintenance costs and fewer breakdowns, reducing employee downtime. In terms of employee satisfaction, electric cars can be quieter, smoother, and more comfortable to drive, improving morale and productivity.

By adopting electric cars, employers can save money and improve their company’s image, making electric cars a smart investment.

Benefits of Electric Cars for Employees

Electric Cars for Employees Electric cars are different from traditional gasoline-powered cars in many ways. Firstly, they don’t emit harmful pollutants into the environment, making them a much cleaner and greener alternative. As a result, companies that invest in electric cars for their employees demonstrate their commitment to environmental sustainability.

Additionally, electric cars require less maintenance than traditional cars and can help reduce the company’s fuel expenses. Furthermore, electric cars are quieter than traditional cars, which makes for a more pleasant driving experience. Adopting electric cars as company vehicles can also improve the corporate image and attract eco-conscious employees.

By providing electric cars to employees, companies can experience many benefits, including cost savings, improved corporate image, and a healthier environment. As the market continues to shift towards cleaner energy sources, adopting electric cars is a smart and sustainable choice for companies looking to stay ahead of the curve.

Calculating Benefit in Kind for Electric Cars

Electric car benefit in kind rules can be confusing, but they are crucial to understand if you’re considering getting an electric vehicle (EV) for personal or company use. Benefit in kind (BIK) is a tax that employees must pay when they get certain perks from their employer apart from salary. This can include the use of a company car or fuel.

However, EVs tend to have lower BIK rates compared to conventional cars, making them a more tax-efficient option. This is because electric cars have zero emissions, and the government seeks to incentivize their use to achieve its environmental goals. The BIK rates for electric cars are determined by their value, CO2 emissions, and electric range.

It’s worth noting that these rules can change, so it’s best to stay updated on the latest developments.

Calculating CO2 Emissions for Electric Cars

Calculating Benefit in Kind for Electric Cars can be quite different from the traditional method. For electric cars, the Benefit in Kind (BIK) is calculated based on a percentage of the vehicle’s list price, including VAT and any options. However, this percentage is much lower for electric cars than for traditional petrol or diesel vehicles.

The BIK rate for electric cars is currently set at just 1% for the tax year 2021/22, which is significantly lower than the usual 20% for petrol and diesel cars. This means that employees who are given an electric car as a company car will pay much lower tax than those who are given a petrol or diesel car. It also makes electric cars a more attractive option for businesses looking to provide company cars to their employees.

In addition to the financial benefits of lower BIK rates, electric cars also have lower CO2 emissions, helping to reduce pollution and combat climate change.

Calculating the List Price for Electric Cars

Calculating Benefit in Kind for Electric Cars When it comes to purchasing an electric car, there are many benefits to consider. Not only are they better for the environment, but they come with tax incentives as well. One major benefit is the ability to reduce your Benefit in Kind (BIK), which is essentially a tax on company cars.

The BIK tax is determined by the car’s list price, CO2 emissions, and fuel type. However, for electric cars, the list price can be reduced by £3,000 due to the government’s plug-in car grant. This means that the list price used to calculate the BIK tax is lower, resulting in a lower tax rate.

For example, if the list price of an electric car is £30,000, its taxable value would be £27,000 due to the grant. This can save you a significant amount of money, especially if you are a company car driver or employer. So, if you’re considering switching to an electric car, it’s important to calculate your BIK and see the potential savings you could make.

Examples of Benefit in Kind for Electric Cars

The benefit in kind rules for electric cars is a hot topic among drivers and businesses alike. When an electric car is provided by an employer for personal use, it is considered a benefit in kind and the employee is required to pay a tax on the perceived value of this benefit. However, the rules for electric cars are more favorable than those for traditional cars, as they offer significant tax savings.

For example, the taxable value of an electric car is significantly lower than a traditional one. Additionally, there is no fuel benefit charge for electric vehicles, which means employees who use electric cars for personal journeys don’t have to pay a tax on the electricity used. These benefits make electric cars a more attractive option for businesses looking to provide their employees with company cars, as well as for employees seeking to reduce their tax bill.

So, not only do electric cars reduce emissions and contribute to a greener environment, they provide tangible financial benefits to both businesses and employees alike.

Low CO2 Emissions Benefit in Kind Example

One of the significant benefits of driving an electric car is the lower CO2 emissions and tax benefits that come with it. The UK government has incentivized electric car drivers by providing them with a Benefit in Kind (BIK). The BIK tax is lower for electric car drivers compared to petrol or diesel car drivers, making electric cars more affordable.

For instance, if an employee is provided with an electric car by their employer, they pay less tax on it compared to a petrol or diesel car, resulting in more savings. The amount of tax paid on the BIK is determined by the car’s value, CO2 emissions, and the employee’s income. Since electric cars emit lower or zero CO2 emissions, the BIK tax rate is less compared to a petrol or diesel car.

Moreover, electric cars do not produce any Nitrogen Oxide and particulate matter, making them more eco-friendly and reducing air pollution. Overall, the BIK tax relief provides a significant incentive for employers to provide electric cars to their employees, promoting the use of eco-friendly vehicles and promoting a cleaner environment.

Electric Car List Price Benefit in Kind Example

One major benefit of purchasing an electric car is that it can significantly reduce your Benefit in Kind (BIK) tax liability. BIK is a tax that employees have to pay on any perks or benefits they receive from their employer, including company cars. The amount of tax an employee has to pay depends on the car’s list price and CO2 emissions.

For electric cars, the list price is significantly lower than their petrol or diesel counterparts. For example, a Tesla Model S Long Range has a list price of £87,980, but its electric powertrain means that its CO2 emissions are zero, making its BIK tax rate just 1% for the 2021/22 tax year. This means that the BIK tax liability for an employee who receives the car as a perk would only be £87

80. In contrast, a similar petrol-powered car with a list price of £70,000 would have a BIK rate of 37%, leading to a tax liability of £25,900. As we can see, the savings on BIK tax with an electric car can be substantial, making them an attractive option for both employers and employees.

Conclusion

In conclusion, the benefits of electric cars are shocking. Not only do they offer significant savings to our environment through reduced emissions, but they also provide financial savings through lower running costs and tax incentives. The change in benefit in kind rules towards electric cars is a positive step towards a sustainable future.

So, why not join the plug-in revolution and shock your colleagues with the benefits of going electric?”

FAQs

What are the electric car benefit in kind rules?

Electric car benefit in kind rules are the taxation rules applied by the UK government on the cars provided by employers to their employees. These rules determine the amount of tax payable by the employees on the vehicle provided.

How do the electric car benefit in kind rules work?

The electric car benefit in kind rules work by taking into account the vehicle’s list price and its CO2 emissions. The lower the CO2 emissions, the lower the rate of taxation for the employee. For electric cars, the rate is currently set at 1% of the list price.

What are the benefits of electric cars under the benefit in kind rules?

Electric cars have significant benefits under the benefit in kind rules. They are taxed at a much lower rate than petrol and diesel cars, which can result in substantial savings for employees. Furthermore, electric vehicles have lower running costs and are better for the environment.

Are there any exemptions to the electric car benefit in kind rules?

Certain exemptions apply to the electric car benefit in kind rules, such as if an electric vehicle is provided for workplace commuting only. In this case, there is no tax liability for the employee. Additionally, ultra-low emission vehicles are also exempt from the congestion charge in London.