Unlocking the Perks of Electric Cars: Understanding Tax Benefits for Environmentally-Friendly Commutes

Electric cars are becoming increasingly popular among environmentally conscious consumers. Not only do they help reduce carbon emissions, but they also come with a host of tax benefits that can help offset the initial cost. With so many benefits available, it can be difficult to know where to start.

What exactly are the tax benefits of electric cars, and who qualifies for them? In this blog, we’ll take a closer look at these incentives, exploring everything you need to know about electric car tax benefits. So whether you’re considering making the switch or just want to learn more, keep reading!

Federal Tax Credits

Electric car tax benefits are an important factor to consider when deciding to purchase an electric vehicle. One of the best benefits is a federal tax credit, which can help offset the initial cost of the vehicle and make it more affordable. The federal tax credit for electric cars ranges from $2,500 to $7,500, depending on the make and model of the vehicle, as well as its battery size.

This tax credit is non-refundable, meaning that it can only be used to offset your tax liability for that year. However, if you cannot use the full credit in one year, you can carry over the remaining amount to the next year. It’s important to note that not all electric cars are eligible for the federal tax credit, so it’s essential to do your research before making a purchase.

Overall, the federal tax credit is a great incentive for those who are considering purchasing an electric car, as it can help make the switch to eco-friendly transportation more accessible and cost-effective.

Up to $7,500 in tax credits for new electric cars

Are you in the market for a new electric car? If so, you could save up to $7,500 through federal tax credits. These incentives were introduced to encourage more people to invest in environmentally friendly vehicles, which have far lower emissions than traditional combustion engines. However, it’s worth noting that the maximum credit you can claim will vary depending on the vehicle’s battery capacity and the manufacturer.

This means that some electric cars will only be eligible for a smaller credit, while others will qualify for the full $7,500. Nevertheless, any reduction in the upfront cost of an electric vehicle is a welcome bonus, and it’s a great way to offset some of the extra expenses that can come with new technology. So if you’re on the fence about buying an electric car, the federal tax credit could be the push you need to make the switch!

Credit amount varies based on battery size and vehicle type

Federal Tax Credits If you’re considering purchasing an electric vehicle, it’s important to know about the federal tax credits available to you. These credits can be a significant advantage, especially since electric cars often come with a higher upfront cost. However, it’s worth noting that the amount of the credit varies based on battery size and vehicle type.

For example, plug-in hybrid electric vehicles (PHEVs) typically receive a lower tax credit compared to all-electric vehicles (EVs) with a larger battery capacity. Additionally, the credit starts at $2,500 and can go up to a maximum of $7,500, depending on the size and type of the vehicle. Ultimately, it’s essential to do your research and determine which electric vehicle makes the most sense for your driving needs and budget, while also considering the potential savings that can come from federal tax credits.

State and Local Incentives

Electric car tax benefits are not limited to just federal incentives. State and local governments also offer various incentives for electric vehicle (EV) owners. For instance, some states such as California and Colorado offer a rebate program for those who purchase or lease an EV.

This rebate can range from a few hundred dollars up to several thousand dollars depending on the state. Additionally, some states provide a tax credit or exemption, which means no sales tax or excise tax is due when purchasing an electric car. Other incentives for EV drivers can come in the form of free or reduced-price parking, HOV lane access, and discounted charging rates at public charging stations.

With all of these benefits, it’s no wonder why more and more people are making the switch to electric cars. So not only are electric cars environmentally friendly, but they can also save you money in the long run thanks to these state and local tax benefits.

Many states offer additional tax credits and rebates for EVs

If you’re considering buying an electric vehicle, it’s worth looking into the incentives offered by your state and local government. Many states offer additional tax credits and rebates for EVs, which can significantly reduce the overall cost of the vehicle. Some states even offer additional perks such as free parking, carpool lane access, and discounted registration fees.

For example, California offers a $2,000 rebate for new EVs and a $1,000 rebate for used ones, as well as access to carpool lanes and free or discounted charging at public stations. In Colorado, EV buyers can receive a tax credit of up to $4,000, while New York offers up to $2,000 in rebates. These incentives can make a big difference, so be sure to check what’s available in your area before making a decision.

By taking advantage of these state and local incentives, you can make owning an electric vehicle both environmentally and financially responsible.

Less expensive charging rates or free charging at public stations

State and Local Incentives for Less Expensive or Free Charging at Public Stations The transition to electric cars is not only good for the environment but also a smart financial decision for consumers. But, the initial costs of buying an electric vehicle and installing a home charging station can be daunting. Fortunately, many states and localities are offering incentives to encourage more people to go electric.

One such incentive is less expensive charging rates or even free charging at public stations. This can be a huge help for people who do not have a home charging station or who need to charge their car while away from home. In some places, these incentives are available to all electric vehicle drivers, while in others, they are targeted towards low-income households or certain types of electric vehicles.

Additionally, some utilities offer lower rates for electric vehicle charging during off-peak hours. These incentives not only make owning an electric vehicle more affordable, but also increase the accessibility and convenience of charging on the go. So, if you’re considering purchasing an electric vehicle, check with your state and local government to see what incentives are available to help make it a reality.

Reduced Operation Costs

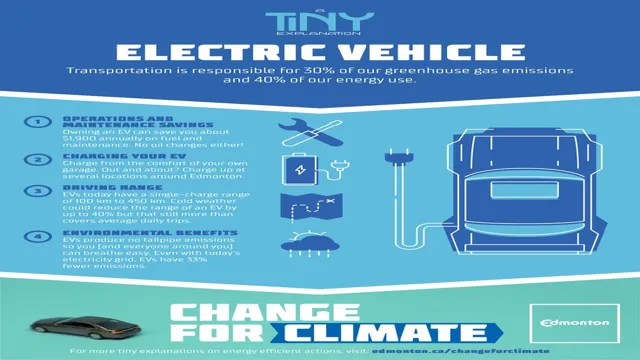

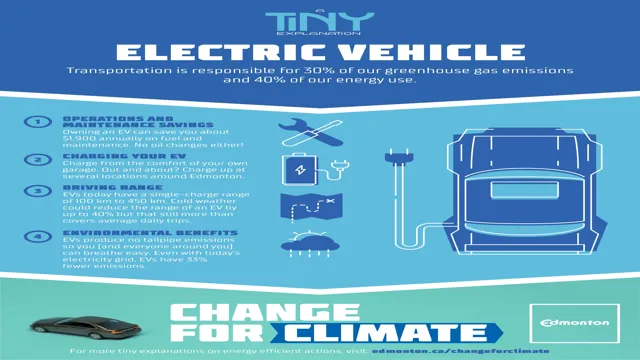

One of the biggest advantages of owning an electric car is the reduced operation costs that come with it. Not only do they require less maintenance, but they are also eligible for a range of electric car tax benefits that can save you a significant amount of money. For example, in the United States, federal tax credits of up to $7,500 are available for electric vehicle purchases, and some states offer additional incentives, such as tax exemptions, rebates, and grants.

Additionally, you can enjoy savings on fuel costs, as electric cars are much cheaper to run compared to their gasoline counterparts. Without the need for regular oil changes, spark plug replacements, and other maintenance tasks, you can save a lot of money in the long run. All in all, electric cars offer an excellent value proposition, and with the right research and planning, you can maximize your savings and enjoy the many benefits of owning an electric vehicle.

Electric cars are cheaper to operate than gas-powered vehicles

Electric cars are becoming increasingly popular, and one reason is their reduced operation costs. Unlike gas-powered vehicles that require frequent trips to the gas station, electric cars can be charged at home or at public charging stations. This can save a lot of money over time, especially with the rising price of gasoline.

In addition, electric cars have fewer moving parts than gas-powered vehicles which means they require less maintenance. This translates into less money spent on oil changes, spark plug replacements, and other regular maintenance tasks. Overall, electric cars are a cost-effective solution for those seeking to reduce their transportation expenses.

No need for frequent oil changes or expensive engine repairs

Reduced operation costs are a major benefit of using electric vehicles. You no longer have to worry about frequent oil changes or expensive repairs to your engine. This means that you can save a significant amount of money over the lifetime of your vehicle.

Not only that, but electric vehicles also have fewer moving parts than traditional gas-powered cars, which means that there is less wear and tear on the vehicle overall. This can lead to even more savings over time. Additionally, electric vehicles often have longer lifetimes than gas-powered vehicles, which means that you will not have to replace your car as frequently.

All of these factors contribute to the reduced operation costs of electric vehicles, making them a smart choice for those looking to save money while also reducing their environmental impact.

Increased Resale Value

Electric car tax benefits can significantly increase the resale value of your vehicle. These benefits include tax credits and rebates offered by both the federal government and some states, which can add up to thousands of dollars in savings when purchasing a new electric car. Additionally, many electric cars are eligible for HOV lane access and reduced parking fees in certain areas, making them even more appealing to potential buyers.

When it comes time to sell your electric car, you may be able to get a higher price than you would for a comparable gasoline-powered vehicle due to these incentives. Plus, as more and more people become environmentally conscious, electric cars are likely to become even more popular in the years to come, further increasing their resale value. So not only are electric cars better for the planet, but they can also be a wise investment for your wallet.

Electric cars retain their value better than gas-powered vehicles

Electric cars are gaining more attention in the market due to their environmental benefits, but did you know that they also have an increased resale value compared to gas-powered vehicles? This is because electric cars have lower maintenance costs and longer lifespans, making them a more reliable long-term investment. Additionally, as the demand for electric cars continues to grow, their resale value also increases. This means that not only are you doing your part for the environment, but you’re also making a smart financial decision by investing in an electric car.

So why not make the switch today and start benefiting from the increased resale value of electric cars?

Conclusion

In conclusion, electric car tax benefits may seem shocking at first, but they ultimately spark a brighter future for both drivers and the environment. By incentivizing these eco-friendly vehicles, we can charge forward towards a sustainable and electrified society. So why not join the charge and plug in to tax savings and a better tomorrow?”

FAQs

What are the tax benefits of owning an electric car?

Electric car owners can receive a federal tax credit of up to $7,500, as well as potential state and local tax incentives, making the purchase and ownership more affordable.

Do electric car tax credits apply to both new and used vehicles?

No, tax credits only apply to the purchase or lease of new electric vehicles.

How does the federal tax credit work for electric cars?

The available tax credit begins to phase out once the manufacturer has sold 200,000 qualifying electric vehicles in the United States. Electric car owners can claim the full credit if they purchased their vehicle before the manufacturer reached this threshold.

Can businesses receive tax credits for purchasing electric vehicles?

Yes, businesses can receive tax credits for purchasing electric vehicles, including a credit for charging station installation and up to 100% bonus depreciation on the vehicle cost.