Electric Car Tax Benefits Limited Company: Smart Savings!

Electric cars are becoming popular. Many people want to know about their benefits. Limited companies can gain from using electric cars. This article explains the tax benefits for limited companies. Let’s explore how these benefits work.

What is a Limited Company?

A limited company is a type of business. It has its own legal identity. This means it can own assets and take on debts. The owners are called shareholders. They are not personally responsible for company debts. This is a key feature of limited companies.

What Are Electric Cars?

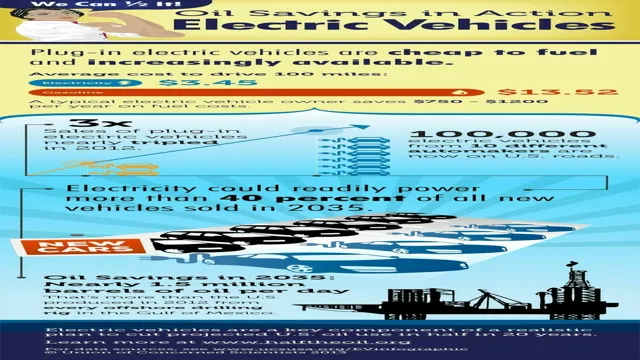

Electric cars use electricity to run. They do not use petrol or diesel. This makes them better for the environment. Electric cars produce less pollution. They are quiet and can save money on fuel.

Why Choose Electric Cars for Your Limited Company?

Choosing electric cars has many advantages. Here are some key reasons:

- Lower running costs

- Less maintenance needed

- Environmentally friendly

- Tax benefits

Now, let’s look at the tax benefits in more detail.

Tax Benefits of Electric Cars for Limited Companies

Electric cars can give your limited company many tax benefits. Here are the main ones:

1. Capital Allowances

When a limited company buys an electric car, it can claim capital allowances. This means the company can reduce its tax bill. The amount depends on the car’s emissions. Electric cars often have 100% first-year allowances. This is a big help for businesses.

2. Lower Benefit In Kind (bik) Tax

Benefit in Kind (BIK) tax applies to company cars. Electric cars have a much lower BIK rate. This means employees pay less tax on their car benefit. For example, in 2023, the BIK rate for electric cars is just 2%. This is much lower than petrol or diesel cars.

3. Vat Reclaim

Your company can reclaim VAT on electric cars. This is only possible if the car is used for business. If the car is also for personal use, you may reclaim some VAT. This can lower the overall cost of the car.

4. Fuel Benefits

Companies can also benefit from electric fuel costs. If the company pays for charging, it can deduct these costs. This can save money over time. It is important to keep records of all expenses.

How to Claim Electric Car Tax Benefits

Claiming tax benefits is simple. Here are the steps:

- Purchase the electric car through the limited company.

- Keep all invoices and receipts.

- Fill out your company’s tax return.

- Claim capital allowances on the car.

- Calculate the BIK tax for employees.

- Reclaim VAT if eligible.

Always consult a tax advisor for guidance. They can help you understand the rules better. This ensures you get all benefits due to your company.

Important Considerations

While electric cars have many benefits, there are some things to consider:

1. Initial Costs

Electric cars can be more expensive initially. However, the long-term savings can be worthwhile. It’s essential to evaluate the overall costs.

2. Charging Infrastructure

Check if your area has enough charging stations. This is crucial for daily use. Having a home charging point can be a good option.

3. Employee Preferences

Consider employee preferences. Some may prefer petrol or diesel cars. Discussing options can help in decision-making.

Frequently Asked Questions

What Are Electric Car Tax Benefits For Limited Companies?

Electric car tax benefits for limited companies include reduced tax rates and grants for purchasing electric vehicles.

How Can My Company Claim Electric Car Tax Relief?

Companies can claim tax relief by providing details on the electric vehicle in their tax returns.

Do Electric Cars Have Lower Benefit-in-kind Rates?

Yes, electric cars typically have lower benefit-in-kind rates compared to traditional petrol or diesel cars.

Can I Receive Grants For Electric Cars In My Business?

Yes, businesses can apply for government grants to support the purchase of electric vehicles.

Conclusion

Electric cars offer great tax benefits for limited companies. They can reduce tax bills and save money on running costs. Lower emissions also help the environment. As electric cars become more popular, understanding these benefits is important.

Always keep up to date with tax rules. This ensures you maximize your benefits. If you run a limited company, consider going electric. It can be a smart move for your business and the planet.

Frequently Asked Questions

1. Can I Use Electric Cars For Personal Use?

Yes, but it may affect your tax benefits. Keep a record of business and personal use.

2. Do I Need To Pay Tax On Electric Cars?

Yes, but the tax is usually much lower than petrol cars.

3. How Do I Find The Best Electric Car For My Business?

Research different models. Consider costs, range, and features. Talk to car dealers for advice.

4. Is It Expensive To Charge Electric Cars?

Charging costs are usually lower than petrol or diesel. Home charging can save even more money.

5. Should I Consult A Tax Advisor?

Yes, a tax advisor can help you understand the rules and benefits.

Electric cars present a good opportunity for limited companies. They offer financial and environmental benefits. Understanding and utilizing these tax benefits can lead to significant savings. Start exploring electric options for your business today.