Electric Cars: The Future of Transportation and Tax Benefits You Need to Know About

Electric cars are slowly becoming the go-to choice for environmentally conscious individuals who want to reduce their carbon footprint. Not only are they eco-friendly, they also come with a range of tax benefits that make them an attractive option for anyone looking to save money. So, why should you consider an electric car? For starters, the federal government offers a tax credit of up to $7,500 for anyone who purchases an electric car.

This can significantly reduce the overall cost of the vehicle, making it more affordable for many people. In addition, there are a plethora of state and local incentives aimed at encouraging people to make the switch. These incentives can include everything from cash rebates and reduced registration fees to free charging station access and carpool lane privileges.

If you’re looking to cut your expenses, owning an electric car could be a smart move. Not only will you save money on gas, but you’ll also be able to take advantage of the many tax benefits available. So why wait? Make the switch to electric and start reaping the rewards today!

Federal Tax Credits up to $7,500

If you’re considering buying an electric car, there are a lot of benefits that come with it – and one of the most significant ones is the federal tax credit of up to $7,500. This credit is available to anyone who buys a new electric car, and it can be a huge help in offsetting the cost of the vehicle. While the exact amount of the credit will depend on the make and model of the car you buy, the good news is that most electric cars on the market today qualify for it.

So if you’re looking for a way to go green and save some money at the same time, buying an electric car could be the perfect solution. Not only will you be doing your part to help the environment, but you’ll also be taking advantage of some major tax benefits that can help make the transition to electric much more affordable.

How the credit works

If you’re considering purchasing an electric vehicle, you may be eligible for federal tax credits of up to $7,500. How does this credit work? When you buy an eligible vehicle, you may qualify for a credit against your federal income tax owed. The credit amount varies depending on the make and model of the vehicle, and it begins to phase out once a manufacturer sells 200,000 qualifying vehicles.

This means that some popular models, such as the Tesla Model S and Model X, are no longer eligible for the credit, while others may receive a reduced credit amount. To claim the credit, you’ll need to complete IRS Form 8936 and include it with your tax return. Keep in mind that this credit is non-refundable, meaning that if the credit exceeds your tax owed, you won’t receive a refund for the difference.

Nonetheless, the federal tax credit can be a significant incentive to consider when deciding whether an electric vehicle is right for you.

Limitations and phaseout

Federal Tax Credits up to $7,500 While the federal tax credit for electric vehicles (EVs) has been a significant incentive for many buyers, it is important to note that there are limitations and a phaseout period. The tax credit only applies to the first 200,000 qualified EVs sold by each automaker, so once a company reaches that threshold, the credit starts to phase out. This means that some EV manufacturers may no longer offer the full $7,500 credit for eligible vehicles.

Additionally, the credit is non-refundable, meaning that it can only be used to offset a taxpayer’s tax liability, making it less beneficial for lower-income taxpayers. However, for those who are eligible, the federal tax credit can significantly reduce the upfront cost of purchasing an EV. It is important to stay up-to-date on the availability and changes to any tax credits when considering purchasing an EV.

State Incentives and Rebates

When it comes to buying an electric car, one of the most significant benefits you can reap is through state incentives and rebates. Several states offer tax credits and rebates to buyers of electric cars, which can save you a significant amount of money. In some states, these benefits can be as much as $7,500 or more.

Tax credits can also be used to offset the cost of installation for a charging station at your home. Some states also have HOV lane access for electric car owners, which can save you time and hassle during your daily commute. However, it’s essential to note that each state has its rules and regulations, so it’s essential to research and understand your state’s specific tax benefits before making your purchase.

Overall, opting for an electric car can provide an array of benefits, including reduced emissions and significant savings in the long run, thanks to incentives and rebates.

Examples of state incentives

State incentives and rebates are initiatives taken by state governments to encourage people to adopt alternative sources of energy by providing financial incentives and rebates. These incentives and rebates vary from state to state and can include tax credits, grants, low-interest loans, and discounts on equipment installation. For instance, California offers rebates for homeowners who install solar panels on their homes.

New York State has a Green Jobs-Green New York program that provides a low-cost loan to homeowners who want to make energy-efficient upgrades to their homes. In addition to this, there are also federal government incentives such as tax credits for installing solar panels or geothermal heat pumps, which can further reduce the cost of making your home more energy-efficient. All these incentives and rebates can help homeowners and businesses reduce their energy consumption, lower their utility bills, and contribute to a greener environment.

How to check your state’s incentives

State Incentives and Rebates One of the crucial steps in buying an electric vehicle (EV) is to check your state’s incentives and rebates. These incentives can help you save money on the purchase or lease of an EV, which can be significant for your budget. Each state has a different set of incentives, so it’s essential to do your research.

Some states offer tax credits, rebates, or exemptions from sales tax, while others offer discounts on charging stations or free parking. To find out which incentives are available in your state, you can check with your state’s department of transportation or energy. It might also be helpful to search your state’s website for EV incentives or check out the Department of Energy’s website.

Be sure to take advantage of these rebates and incentives, as they can help make your transition to an EV easier and more affordable.

Combined federal and state benefits

State Incentives and Rebates If you’re looking for ways to reduce the cost of energy-efficient upgrades to your home, state incentives and rebates are a great place to start. Many states offer a variety of incentives and rebates for things like solar panels, energy-efficient appliances, and insulation. These incentives can help you save money on the upfront costs of these upgrades, and reduce your energy bills over time.

For example, in California, homeowners can take advantage of the Residential Energy Efficiency Rebate Program, which provides rebates of up to $5,000 for eligible upgrades. In New York, the NYSERDA Home Performance with ENERGY STAR program offers incentives for specific energy-efficient upgrades, like $2,000 for air sealing and insulation. By taking advantage of these programs, you can make your home more energy-efficient and save money at the same time.

Lower Operating Costs

If you’re considering purchasing an electric car, you should be aware of the various tax benefits that come with it. In addition to helping the environment and reducing your carbon footprint, electric cars offer lower operating costs due to the many tax breaks they receive. For example, the government offers incentives such as federal tax credits and state rebates that can significantly lower the purchase price of electric cars.

Moreover, electric cars are exempt from certain expenses that traditional car owners must pay, including fuel taxes and vehicle registration fees. Overall, these tax benefits can greatly reduce the overall cost of ownership for electric car owners and make them an appealing option for those looking to save money on transportation in the long run. So, if you’re looking to go green and save money, an electric car might just be the perfect choice for you.

Electricity vs. gasoline costs

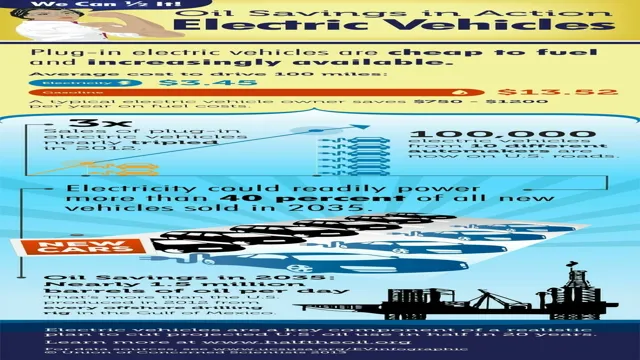

Operating costs are a primary concern for car owners. When it comes to electric cars, the good news is that the operating costs are much lower compared to traditional gasoline vehicles. The cost of electricity per mile is almost half the cost of gasoline per mile.

Therefore, switching to an electric car can save you a significant amount of money in the long run. Apart from that, electric cars require much less maintenance compared to gasoline cars, which also means fewer expenses on repairs and replacements. So, even though the initial cost of buying an electric car may be higher than a gasoline car, the lower operating costs of an electric car are worth considering.

Maintenance savings

One of the benefits of regular maintenance is lower operating costs. By ensuring that all equipment and machinery are in good condition and running efficiently, businesses can save money on energy bills and repairs. When equipment is not properly maintained, it can lead to breakdowns, downtime, and costly repairs.

In addition, poorly maintained equipment often requires more energy to operate, driving up electricity bills. By investing in regular maintenance, businesses can avoid these costs and improve their bottom line. Think of it like getting an oil change for your car – regular maintenance may seem like an unnecessary expense at first, but it ultimately saves you money in the long run by avoiding bigger problems.

Overall, businesses that prioritize maintenance can enjoy significant savings on their operating costs while also extending the lifespan of their equipment.

Environmental and Social Benefits

Electric cars offer several environmental and social benefits, and tax incentives are one such benefit. When you consider the carbon footprint of conventional vehicles, electric cars emit significantly less pollution. They produce no greenhouse gasses, which are known to contribute to climate change.

In addition, electric vehicles require less maintenance, which translates to less waste going to landfills. By driving an electric car, you are also contributing to reduced noise pollution because electric cars are quieter than conventional gasoline or diesel engines. Moreover, electric cars offer tax incentives, including federal tax credits, state and local tax exemptions, and other perks such as free or discounted parking in certain areas.

Overall, electric cars are the ideal solution for anyone who is environmentally conscious, and tax incentives make them a more attractive option for budget-conscious individuals.

Conclusion

In conclusion, the tax benefits of electric cars are shocking in all the right ways. Not only do they save you money on fuel, they also qualify for federal tax credits and state incentives. Plus, with zero emissions, electric cars are a current that won’t electrify the planet with harmful pollutants.

So charge up and drive onward towards a cleaner, greener future.”

FAQs

What kind of tax benefits are available for electric car owners?

Electric car owners may be eligible for federal and state tax credits, rebates, and other incentives that can lower their total cost of ownership. These benefits vary based on location and the specific make and model of the vehicle, so it’s important to check with your local government or dealership for details.

Are there any limitations to the electric car tax benefits?

Yes, there are often restrictions on who can qualify for electric car tax benefits. For example, some incentives may only be available to individuals or businesses that purchase or lease a new electric vehicle, while others may require the installation of charging equipment at a home or business. Additionally, many incentives have a limited funding pool, so it’s important to apply as soon as possible.

How do electric car tax benefits compare to traditional gasoline tax benefits?

While traditional gasoline cars may be eligible for certain tax deductions related to fuel and maintenance costs, electric vehicles typically offer more extensive and valuable tax benefits. This is partly because electric cars are seen as a way to reduce greenhouse gas emissions and promote clean energy, which has led to additional government support and incentives for their adoption.

What is the future outlook for electric car tax benefits?

As the popularity of electric cars continues to grow, it’s likely that tax benefits and incentives will become even more prevalent in the coming years. Many governments and organizations around the world have set ambitious targets for reducing carbon emissions and promoting sustainable transportation, and electric cars are expected to play a key role in achieving these goals.