Florida Electric Car Tax Credit Reddit Insights and Updates

Featured image for florida electric car tax credit reddit

Image source: lihpao.com

Florida currently offers no state-level electric car tax credit, but Reddit discussions reveal growing demand for incentives like those in other states. Savvy buyers are leveraging federal tax credits up to $7,500 while sharing tips on Reddit about local rebates, charging programs, and pending legislation that could expand savings in 2024.

Key Takeaways

- No state tax credit: Florida currently offers no electric car tax credit at the state level.

- Federal incentives apply: Buyers can claim the federal $7,500 EV tax credit in Florida.

- Reddit discussions: Real-time updates on EV incentives often shared by Floridians on Reddit forums.

- HOA restrictions: Some Florida HOAs limit EV charger installations—check local rules first.

- Utility rebates: Local power companies may offer EV charging equipment rebates—research providers.

- Future legislation: Monitor Florida bills for potential state-level EV incentives in 2024.

📑 Table of Contents

- Florida Electric Car Tax Credit Reddit Insights and Updates

- What Is the Florida Electric Car Tax Credit? (And Why It’s Confusing)

- Federal vs. Local: How to Maximize Your Savings in Florida

- Reddit’s Role: Real People, Real Experiences

- Data Table: Florida EV Incentives at a Glance (2024)

- Future Outlook: What’s Next for EV Incentives in Florida?

- Final Thoughts: Your Roadmap to EV Savings in Florida

Florida Electric Car Tax Credit Reddit Insights and Updates

Picture this: you’re sipping your morning coffee, scrolling through Reddit, and you come across a thread titled “Just saved $7,500 on my Tesla in Florida!” Your interest is piqued. You’ve been thinking about switching to an electric vehicle (EV), but the upfront cost has always held you back. Now, you’re wondering—could you really get a tax credit for going green in the Sunshine State?

If you’ve been hunting for reliable, up-to-date information about the Florida electric car tax credit Reddit community has been buzzing about, you’re not alone. Thousands of Floridians are turning to platforms like Reddit to share real-world experiences, uncover hidden incentives, and figure out how to make the switch to electric without breaking the bank. Whether you’re eyeing a Tesla, Ford Mustang Mach-E, or a Hyundai Ioniq 5, understanding what tax credits and rebates are available—and how to claim them—can make a huge difference. In this post, we’ll dive deep into what Reddit users are saying, what’s actually available in Florida, and how to avoid the common pitfalls. No fluff, no hype—just honest, practical insights from real people and official sources.

What Is the Florida Electric Car Tax Credit? (And Why It’s Confusing)

Let’s start with the basics: there is no state-level electric car tax credit in Florida—at least not in the traditional sense. That might sound like bad news, but don’t close the tab just yet. The confusion around the “Florida electric car tax credit Reddit” discussions often stems from mixing up federal incentives, local rebates, and misunderstandings about state policy. Let’s clear that up.

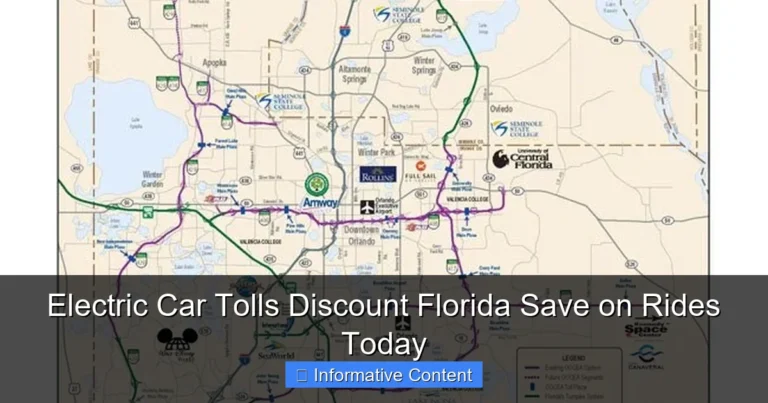

Visual guide about florida electric car tax credit reddit

Image source: wp-cpr.s3.amazonaws.com

Federal EV Tax Credit: The Real Game-Changer

The big player here is the federal EV tax credit, officially known as the Clean Vehicle Credit (Section 25E of the Internal Revenue Code). This is a non-refundable credit of up to $7,500 for new qualifying EVs and $4,000 for used EVs. But here’s the catch: it’s not a “rebate at the dealership”—it’s a credit you claim when you file your federal taxes. That means you need to have a tax liability (i.e., you owe federal income tax) to benefit.

Reddit threads like r/electricvehicles and r/teslamotors are full of users sharing their experiences. One user, u/SunshineEV2023, wrote: “I bought a 2023 Ford F-150 Lightning in Miami. The dealer didn’t apply the credit at the point of sale, but I claimed it on my 2023 return. Got the full $7,500 back—just had to wait until April.”

Another user, u/NoMoreGas99, added: “I didn’t owe taxes this year, so I couldn’t use the full credit. That was a bummer. I wish I’d planned better.” This highlights a key point: the federal credit only reduces what you owe—it doesn’t give you cash back if you’re in a low-income tax bracket.

Florida’s Role: No State Credit, But No Tax on EVs Either

Unlike states like California or Colorado, Florida doesn’t offer a direct state tax credit for EV purchases. But here’s a silver lining: Florida does not impose a special registration fee or annual tax on electric vehicles—at least not yet. Some states (like Texas and Georgia) charge extra fees to compensate for lost gas tax revenue, but Florida has held off on that so far.

That said, there’s been political debate. In 2023, a bill was introduced (HB 1027) to impose a $200 annual registration fee for EVs, but it didn’t pass. Reddit users in r/FloridaPolitics and r/teslamotors closely followed the debate. One user joked, “They want to tax my silence,” referencing the quiet nature of EVs. While the fee is currently off the table, it’s something to watch for in future legislative sessions.

Why the Confusion on Reddit?

So why do so many Reddit threads claim there’s a “Florida electric car tax credit”? It’s usually one of three things:

- Misunderstanding the federal credit: People assume it’s a state program because it’s often discussed in local EV groups.

- Confusing rebates with tax credits: Some local utilities and cities offer rebates (more on that below), and people lump them all together.

- Outdated info: Florida briefly had a small EV incentive in the 2010s, but it expired. Some old threads still reference it.

Bottom line: there’s no standalone Florida EV tax credit, but that doesn’t mean you’re out of luck. The real savings come from a mix of federal, local, and utility incentives.

Federal vs. Local: How to Maximize Your Savings in Florida

Now that we’ve cleared up the confusion, let’s talk strategy. To get the most out of your EV purchase in Florida, you need to layer multiple incentives. Think of it like stacking coupons—you don’t just use one. The Florida electric car tax credit Reddit discussions often miss this nuance, so let’s break it down.

Step 1: Qualify for the Federal Tax Credit

As of 2024, the federal EV tax credit has new rules under the Inflation Reduction Act (IRA). Here’s what you need to know:

- Vehicle must be assembled in North America. Most Tesla, Ford, GM, and Rivian models qualify. Check the DOE’s list.

- MSRP limits apply: $80,000 for vans, SUVs, and trucks; $55,000 for cars.

- Income limits: $150,000 (single), $225,000 (head of household), $300,000 (married filing jointly).

- Battery component and critical mineral requirements: At least 50% of battery components must be made or assembled in North America (rising to 100% by 2029). 40% of critical minerals must come from the U.S. or a free-trade partner (rising to 80% by 2027).

Reddit user u/BatteryRules2024 posted a helpful spreadsheet tracking which 2024 models qualify. “I cross-referenced the DOE list with the IRA rules. Only 12 models fully qualify for the full $7,500. My Hyundai Ioniq 5 didn’t because of the critical minerals rule. I ended up with $3,750.”

Step 2: Look for Local Utility Rebates

Here’s where Florida starts to shine. While there’s no state tax credit, many local utilities offer rebates and discounts. These are usually instant—applied at the dealership or via mail-in forms. Examples:

- Florida Power & Light (FPL): Offers up to $1,000 rebate for new EV purchases or leases. Must be FPL customer and install a Level 2 charger. Details here.

- Tampa Electric (TECO): $1,000 rebate for new EVs. Also offers a $250 rebate for used EVs.

- Orlando Utilities Commission (OUC): $1,500 rebate for new EVs, $500 for used.

- Gainesville Regional Utilities (GRU): $1,000 rebate + free public charging for 1 year.

Tip: Check your utility’s website or call their customer service. Some rebates have limited funds, so apply early. Reddit user u/OUC_EV_Life said, “I got the $1,500 rebate, but only because I applied the same day I bought my car. They ran out two weeks later.”

Step 3: Explore Municipal Incentives

Some cities and counties in Florida offer additional perks:

- Miami-Dade County: Free or discounted parking for EVs in municipal garages.

- Broward County: Priority parking at county facilities.

- City of St. Petersburg: $500 rebate for EV purchases (limited to 100 per year).

These aren’t tax credits, but they add up. One Reddit user, u/SunCoastEV, calculated: “Between the federal credit, FPL rebate, and St. Pete’s $500, I saved $9,000 total. That covered my down payment.”

Step 4: Consider Used EVs

Don’t overlook the used EV market. The federal credit now includes used EVs (model year 2023 or newer) with a $4,000 cap. Plus, many utilities offer rebates for used EVs too. A 2023 Nissan Leaf in Orlando might cost $25,000, but with the federal credit and OUC rebate, your effective cost drops to $20,000—cheaper than many gas cars.

Reddit’s Role: Real People, Real Experiences

When it comes to navigating EV incentives, Reddit is a goldmine—but it’s also a minefield of misinformation. The Florida electric car tax credit Reddit community is active, passionate, and sometimes chaotic. Let’s look at how real users are using the platform to make informed decisions.

Best Subreddits for Florida EV Info

- r/electricvehicles: The largest EV community. Great for general advice, but Florida-specific threads are mixed in.

- r/teslamotors: Heavy on Tesla, but many Florida owners share local tips. Search for “Florida” or “FPL” in the sub.

- r/Florida: General state news, but EV threads pop up during legislative debates.

- r/Orlando, r/Miami, r/Tampa: Local subs where users discuss city-specific incentives.

One user, u/OrlandoEVNewbie, posted: “I was overwhelmed by all the rules. I made a list of all the rebates in Central Florida and tracked which ones I qualified for. Saved me $8,500 total.”

Common Pitfalls and How to Avoid Them

Reddit is full of stories about people who missed out:

- Missing deadlines: Utility rebates often have application deadlines (e.g., 90 days from purchase). u/FPL_LateApplicant said, “I forgot to submit the form. Lost $1,000.”

- Not checking eligibility: Some rebates require you to install a home charger. u/NoChargerNoRebate learned the hard way.

- Assuming all dealers apply credits: The federal credit can now be transferred to the dealer (new in 2024), so you can get the $7,500 at the point of sale. But not all dealers do this. u/TeslaDealerHelp wrote: “I asked three dealers. Only one offered the credit transfer. I saved $7,500 instantly.”

Pro tip: Always ask, “Do you offer the federal EV credit transfer?” If not, you’ll have to claim it on your taxes.

Success Stories and Lessons Learned

One of the most upvoted posts in r/electricvehicles was from u/FloridaEVJourney: “I bought a 2024 Kia EV6 in Tampa. Here’s my savings breakdown:

- Federal tax credit: $7,500 (transferred at sale)

- TECO rebate: $1,000 (applied via mail)

- Free public charging: $300 value (from GRU, even though I don’t live there—used it for 6 months)

- Total savings: $8,800

“The key was planning ahead and knowing what I qualified for. I made a checklist and stuck to it.”

Data Table: Florida EV Incentives at a Glance (2024)

| Incentive | Provider | Amount | Eligibility | How to Apply |

|---|---|---|---|---|

| Federal Clean Vehicle Credit | IRS | Up to $7,500 (new), $4,000 (used) | Vehicle assembly, MSRP, income, battery rules | File Form 8936 with tax return or transfer to dealer |

| FPL EV Rebate | Florida Power & Light | $1,000 | FPL customer, install Level 2 charger | Online application within 90 days of purchase |

| TECO EV Rebate | Tampa Electric | $1,000 (new), $250 (used) | TECO customer | Online form or dealer submission |

| OUC EV Rebate | Orlando Utilities Commission | $1,500 (new), $500 (used) | OUC customer | Online application |

| GRU EV Rebate | Gainesville Regional Utilities | $1,000 + 1 year free public charging | GRU customer | Online form |

| St. Pete EV Rebate | City of St. Petersburg | $500 | Resident or business in city | Online application, first-come |

Note: Incentives subject to change. Always verify with the provider before purchasing.

Future Outlook: What’s Next for EV Incentives in Florida?

So, what’s on the horizon? The Florida electric car tax credit Reddit community is already debating what 2025 and beyond might bring. Here’s what we know.

Potential State-Level Changes

With EV adoption rising (Florida had over 150,000 registered EVs in 2023), the state is under pressure to act. Two big possibilities:

- Annual EV registration fee: As mentioned earlier, HB 1027 didn’t pass, but similar bills could return. If implemented, it would likely be $150–$200 per year.

- State tax credit or rebate: Some lawmakers have floated the idea of a $2,000–$3,000 state rebate to boost adoption. No bill has been introduced yet, but it’s a talking point.

Reddit user u/FL_PoliticsWatcher said, “I’ve been following this for years. The fee is more likely than a credit. They’ll tax us eventually, but it’s a trade-off—no gas taxes, so they need revenue.”

Federal Updates to Watch

The federal EV tax credit is also evolving:

- 2025 changes: Battery component requirement jumps to 60%, critical minerals to 50%. Fewer models may qualify.

- Commercial vehicles: New credits for EV trucks and vans (up to $40,000).

- Home charger credit: 30% credit (up to $1,000) for installing a Level 2 charger. Can be claimed separately from the vehicle credit.

One Reddit thread, “Is the 2025 credit worth waiting for?”, sparked debate. Most users agreed: if you qualify now, buy now. “The rules are only getting stricter,” said u/BatteryFuture2025.

Utility and Local Incentives: The Bright Spot

Local rebates are likely to grow. As more utilities face grid demands, they’re investing in EV programs to manage load and promote clean energy. FPL, for example, is rolling out “smart charging” incentives—get paid to charge during off-peak hours. Reddit user u/FPL_SmartCharge said, “I charge at night and get $10/month. Not much, but it’s free money.”

Final Thoughts: Your Roadmap to EV Savings in Florida

Switching to an electric car in Florida isn’t just about saving on gas—it’s about smartly navigating a patchwork of incentives. The Florida electric car tax credit Reddit discussions show that while there’s no single “state credit,” the combination of federal, utility, and local incentives can save you thousands.

Here’s your action plan:

- Step 1: Check if your desired EV qualifies for the federal credit (use the DOE’s list).

- Step 2: Contact your local utility—ask about rebates and deadlines.

- Step 3: Research city/county perks (parking, charging).

- Step 4: At the dealership, ask: “Do you offer the federal credit transfer?”

- Step 5: Apply for all rebates within the deadline—set a calendar reminder.

- Step 6: Join Reddit communities to stay updated. But verify everything with official sources.

Remember, the EV landscape is changing fast. What’s true today might not be true next year. But one thing’s for sure: Floridians are leading the charge (pun intended) in making EVs affordable. With a little research and the right strategy, you can too. And who knows? Maybe your next Reddit post will be: “Just saved $9,000 on my EV in Florida—here’s how.”

Frequently Asked Questions

Is there a Florida electric car tax credit in 2024?

As of 2024, Florida does not offer a state-level electric car tax credit, but buyers may qualify for the federal EV tax credit of up to $7,500. Some local utility companies in Florida also provide rebates, so check with your provider.

Can I claim the federal EV tax credit if I buy an electric car in Florida?

Yes, Florida residents are eligible for the federal electric car tax credit if they meet IRS requirements, such as income limits and purchasing a qualifying EV. The credit is nonrefundable, so it can only reduce your tax liability to $0.

What are Reddit users saying about the Florida electric car tax credit?

Reddit threads highlight confusion about state incentives but confirm eligibility for the federal credit. Users also share tips on maximizing savings through local utility rebates and timing purchases before potential policy changes.

Are there any local incentives for electric cars in Florida besides the federal tax credit?

Some Florida cities and utility companies, like FPL and TECO, offer limited-time EV rebates or charging station incentives. These aren’t state-mandated but can provide additional savings—check your provider’s website for details.

Does Florida offer tax breaks for used electric car purchases?

Florida doesn’t have a state-level used EV tax credit, but the federal tax credit (up to $4,000) may apply if you buy a qualifying used EV from a dealership. Private sales aren’t eligible for the credit.

How do I apply for the Florida electric car tax credit or federal EV incentive?

For the federal tax credit, file IRS Form 8936 with your tax return. Florida doesn’t require a separate application for the state (as there’s no credit), but document all purchases and eligibility details for federal claims.