Maximize Your Savings: How Fringe Benefits Tax Can Make Owning an Electric Car Even More Affordable!

Have you considered purchasing an electric vehicle but are hesitant because of added costs? Well, the good news is that there are fringe benefits that can make investing in an electric car worthwhile. One such benefit is the Fringe Benefits Tax (FBT) that may apply to electric cars. The FBT is a tax that employers pay on the benefits they provide to employees, which can include company cars.

However, electric cars are eligible for a reduced FBT rate, making them a cost-effective option for both employers and employees. How does this work, you may ask? Essentially, the FBT rate is based on the car’s cost, kilometres driven, and the duration of personal use. The rate is then multiplied by the employee’s grossed-up taxable value, which results in the FBT amount.

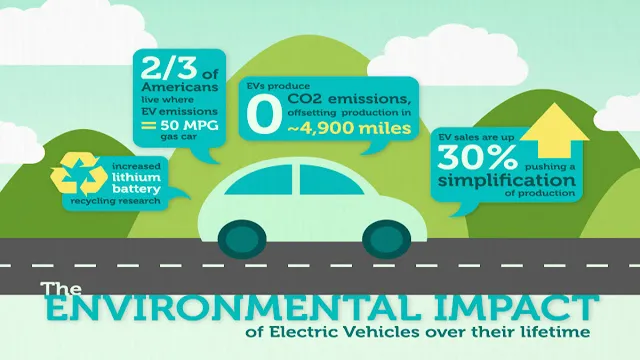

For electric cars, there is a lower FBT rate because they produce lower emissions, making them an environmentally friendly choice. Not only does this benefit the environment, but it also benefits your wallet. With the reduced FBT rate, the cost of owning an electric car can be significantly lower than owning a non-electric car.

This benefit is in addition to the savings you already receive from reduced fuel and maintenance costs. In conclusion, the Fringe Benefits Tax for electric cars is a great incentive for both employers and employees. It promotes the use of environmentally friendly transportation while also providing cost savings.

So, if you’re considering investing in an electric car, don’t let the potential added costs deter you. Take advantage of the fringe benefits offered and make a move towards a more sustainable future while saving money in the process.

What is Fringe Benefits Tax (FBT)?

Fringe Benefits Tax (FBT) is a tax paid by employers on certain benefits they provide to their employees. These benefits can include company cars, health insurance, and even employee discounts. But what about electric cars? Are they subject to FBT? The answer is yes – if an employer provides an electric car to an employee for private use, it is considered a taxable fringe benefit.

However, there are also FBT exemptions and concessions for electric cars, which can make them a more attractive option for employers looking to provide sustainable transport options to their employees. It’s important for employers to understand their FBT obligations when it comes to electric cars, as it can impact the overall cost-effectiveness of implementing an electric car program.

Explanation of FBT and its impact on businesses

Fringe Benefits Tax (FBT) Fringe Benefits Tax (FBT) is a tax paid by employers on any non-cash benefits provided to their employees, aside from their normal salary or wages. These benefits may include things like company cars, health insurance, or even free meals. FBT is calculated based on the taxable value of these benefits, which is then added to the employee’s gross income and taxed at their individual tax rate.

The purpose of FBT is to ensure that all employee benefits are treated fairly and taxed appropriately, regardless of the form they take. For businesses, the impact of FBT can vary depending on the type and amount of fringe benefits they provide to their employees. While the tax can be an additional expense, it can also be a useful tool for attracting and retaining top talent by offering competitive and attractive benefits packages that are not subject to FBT.

Ultimately, businesses need to carefully consider their employee benefit offerings and weigh the cost and benefits of FBT in their overall tax planning strategy.

Benefits of Electric Cars for Businesses

Did you know that electric cars can offer significant benefits to businesses when it comes to the fringe benefits tax (FBT)? As the Australian government moves towards a greener future, electric cars are one of the major players in that transition. For businesses, using electric cars can help reduce the amount of FBT paid on company vehicles, as they are considered to have lower emissions and therefore attract a lower rate. In addition, businesses that provide electric cars as a benefit to their employees can also benefit from reduced FBT payments.

Not only do electric cars help businesses reduce their environmental footprint, but they can also help save costs on FBT payments – a win-win situation for both the environment and the business bottom line!

Overview of the advantages of using electric cars

Electric cars have become increasingly popular in recent years, and for good reason. They offer many benefits, not only to individuals but also to businesses. The use of electric cars in businesses can be advantageous because they are much more cost-effective in the long run.

They require less maintenance and fuel costs are significantly reduced. Additionally, electric cars offer a much more environmentally friendly option for businesses who are looking to reduce their carbon footprint. They emit zero emissions, which helps to reduce air pollution, leading to healthier, happier employees.

Furthermore, electric cars are also less noisy, which makes for a much more pleasant work environment. All of these benefits demonstrate why electric cars are a worthy investment for businesses who are looking to prioritize sustainability and cost-efficiency. Overall, electric cars are a great option for businesses who want to take advantage of the many benefits they offer.

Cost savings in terms of fuel and maintenance

One of the benefits of electric cars for businesses is the cost savings in terms of fuel and maintenance. Switching to electric cars can significantly reduce the cost of fuel for businesses as they can be charged at a fraction of the cost of gasoline or diesel. Besides, electric cars require less maintenance than traditional vehicles, which translates into lower maintenance costs for the business.

Electric cars have fewer moving parts, no oil changes, and require less frequent brake changes because of regenerative braking technology. Overall, electric cars are more efficient, which saves businesses money in the long run. The main keyword “cost savings” is crucial when it comes to running a business, and electric cars provide a significant advantage in this area.

By reducing fuel and maintenance costs, businesses can allocate those funds towards other areas that promote growth and development.

Environmental benefits and company image

The environmental benefits of electric cars are paramount in today’s world, and businesses are starting to take notice. Electric cars help to reduce emissions and lower carbon footprints, which is essential in reducing our impact on the environment. Not only can businesses contribute to a greener world by using electric cars, but they also improve their company image by doing so.

Consumers are becoming increasingly conscious of the impact that businesses have on the environment, and they are more likely to support companies that use green technologies. By using electric cars, companies can show their commitment to sustainability and attract environmentally conscious customers. Additionally, electric cars are much quieter and produce less noise pollution, making them an ideal choice for businesses located in residential areas.

With all these benefits, it’s no wonder that more and more businesses are making the switch to electric cars.

FBT Exemptions for Electric Cars

If you’re an employer who offers electric cars as a company vehicle, you may be eligible for a fringe benefits tax (FBT) exemption. The Australian Taxation Office (ATO) provides certain conditions for electric vehicles to qualify for an exemption from the FBT on car expenses. One of the requirements is that your employee uses the electric car solely for business purposes.

That means they shouldn’t use it for personal use, like running errands or going on a weekend trip unless it’s for work-related purposes. The exemption is also dependent on the car’s value, so it’s essential to ensure that the electric car’s value meets the criteria to qualify for the exemption. It’s important to note that FBT exemptions for electric vehicles are only available until 31 March 202

So, if you’re an employer looking to reduce your company’s FBT liability, you may want to consider providing electric cars to your employees. Not only can it save you money, but it also supports the environment by promoting sustainable transportation.

Details on FBT exemptions for low-emission vehicles

If you’re looking to buy an electric car for business purposes, you may want to take advantage of the Fringe Benefits Tax (FBT) exemptions that come with low-emission vehicles. FBT exemptions mean that you won’t have to pay a tax on the value of the car provided to you by your employer. This is great news for anyone who wants to use an electric vehicle for work as these exemptions are only available to zero-emission cars.

The catch, however, is that the car must be solely used for business purposes, so it’s not something that you can use for personal trips. Furthermore, if your employer provides you with a car park, you’ll need to make sure that charging facilities are available. In any case, taking advantage of FBT exemptions for electric cars can be highly beneficial to your business, as you’ll be able to save on taxes and reduce your carbon footprint at the same time.

How to qualify for FBT exemptions

Electric cars are becoming increasingly popular, and if you own one as a business asset, you may be eligible for FBT exemptions. To qualify for FBT exemptions for electric cars, the car must be wholly electric and emit less than 125 grams of CO2 per kilometre travelled. Additionally, the car must be used primarily, at least 50% of the time, for business-related purposes.

It’s also important to note that luxury car tax may still apply to electric vehicles despite FBT exemptions. Keeping accurate records and documentation of the car’s usage is crucial to ensure compliance with FBT regulations. By taking advantage of FBT exemptions for electric cars, businesses can reduce costs and become more environmentally friendly.

Conclusion

In conclusion, while owning an electric car may come with some fringe benefits in terms of reduced emissions and fuel costs, it’s important to remember that it also comes with its own unique tax considerations. Fringe Benefits Tax (FBT) is a complex beast, and navigating its rules and regulations can be a real shock to the system. But fear not, intrepid electric car owners! With a bit of research and planning, you can drive confidently knowing you’re making a positive impact on both the environment and your bottom line.

So buckle up, charge up, and get ready to enjoy the many perks of owning an electric vehicle – just make sure you’re not caught off guard by the FBT curveball!”

Summary of FBT and electric car benefits for businesses

FBT exemptions for electric cars are a great benefit for businesses looking to reduce their car-related expenses. The Australian government provides FBT exemptions for electric vehicles that produce zero emissions while being driven. This means that businesses can save a significant amount in terms of FBT payments when using electric cars for business-related purposes.

Additionally, businesses can also avail a 50% reduction in their car-related income tax through the instant asset write-off scheme, specifically for electric cars. By investing in electric vehicles, businesses not only save on expenses but also help reduce carbon emissions and promote sustainable practices.

FAQs

What is fringe benefits tax (FBT)?

Fringe benefits tax (FBT) is a tax applied to non-cash employee benefits given by an employer to an employee or their associate.

Are electric cars subject to fringe benefits tax (FBT)?

Yes, electric cars are subject to fringe benefits tax (FBT) based on their market value.

How is the fringe benefits tax (FBT) calculated for electric cars?

The fringe benefits tax (FBT) for electric cars is calculated based on the applicable statutory rate multiplied by the car’s taxable value.

Can an employer claim an exemption from fringe benefits tax (FBT) for electric cars?

Yes, an exemption may apply if the electric car is used primarily for business purposes and meets certain criteria set by the Australian Taxation Office.