Rev up Your Savings: How HMRC’s Electric Car Benefit Can Cut Your Commuting Costs

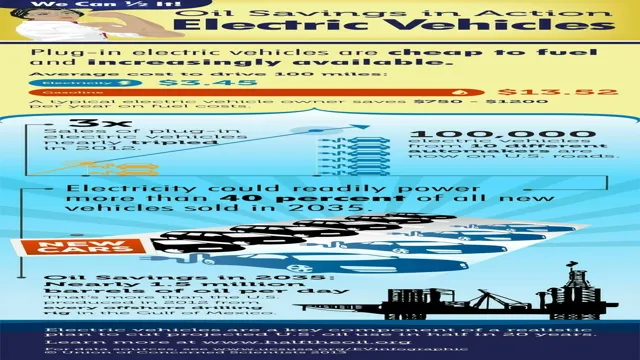

Electric vehicles are becoming increasingly popular due to their numerous benefits, not just for the environment, but also for drivers. More and more people are turning to electric vehicles, not just for the reduced pollution, but also for the boosted savings. Fortunately, the government in the United Kingdom is also doing its part in promoting the use of electric vehicles with tax incentives and benefits.

In this blog, we will delve into these benefits and how they are viewed in the eyes of HMRC. By doing so, we hope to provide you with a better understanding of how electric vehicles can benefit you as a driver, as well as the environment.

What is Car Benefit?

HMRC car benefit is a tax charge that applies when an employee is provided with a company car for personal use. The amount of the tax payable depends on several factors, including the car’s value, CO2 emissions, and fuel type. However, if the car is electric, the tax charge is significantly lower due to the government’s effort to promote the use of low-emission vehicles.

The tax is calculated based on the car’s list price, and the percentage charge is determined by the car’s CO2 emissions. As electric vehicles have low or zero emissions, their percentage charge is significantly lower than petrol or diesel cars. Additionally, there is no fuel benefit charge for fully electric cars, meaning the tax burden is even lower for employees who use an electric company car.

So, if you’re considering a company car, an electric vehicle could mean not just environmental benefits but also some tax savings.

A brief introduction of the concept

Car Benefit is a term that refers to a benefit a company provides to its employees in the form of a company car. This benefit is usually given to high-ranking employees as an incentive to keep them motivated and productive. The company is responsible for the cost of the car, its maintenance, and its insurance.

On the other hand, the employee may be required to pay for fuel and taxes based on their country’s laws. Car benefits are common in many countries, especially those where the use of personal cars is widespread. This benefit gives employees access to a car they may not have been able to afford, and it also saves them the hassle of buying and maintaining one themselves.

Overall, car benefits are a win-win for both the employer and the employee, but the costs and tax implications must be carefully considered before offering them.

Why is Car Benefit important?

Car benefit is an important component of employee compensation in many organizations. This perk is typically offered to high-ranking executives, but it can also be extended to other employees in certain cases. Car benefit refers to the provision of a car or car allowance to an employee as part of their salary package.

The type of car provided can vary between organizations, but it’s usually a top-of-the-range model that is meant to reflect the employee’s status within the company. Some organizations may choose to provide a set car allowance instead, which allows employees to choose their own car. Car benefit is an attractive perk that helps organizations to attract and retain top talent.

It’s also a way for companies to show their appreciation to their employees and to motivate them to perform better. Having a car benefit can be a major selling point for employees, especially those who are required to travel extensively for work. As such, it can enhance an organization’s overall employee morale and productivity.

Benefits of electric cars for Car Benefit tax purposes

If you’re considering purchasing an electric car, there are several benefits you should know about for car benefit tax purposes. HMRC have implemented measures to encourage people to switch from traditional fuel cars to electric vehicles, which can bring some significant savings to the owner. For one, electric cars are exempt from certain taxes and levies, like the vehicle excise duty, fuel duty, and, most importantly, company car tax.

The government believes that electric cars are eco-friendly and want to incentivize citizens to purchase them, so you won’t have to pay as much in tax for owning an electric car compared to a traditional car. With the nation’s emphasis on reducing air pollution, the government has been working to reduce the tax for electric cars. Owning an electric car can, therefore, be a great way to save money on taxes and make a positive impact on the environment.

It’s all part of the national effort to reduce the UK’s carbon footprint, and employing environmentally-friendly transportation is a notable way to contribute.

Lower CO2 emissions and the benefits

When it comes to lowering CO2 emissions, electric cars are a viable option that offers various benefits, including tax incentives for company car users. With electric cars, drivers can save on car benefit tax as they have lower emissions compared to their petrol or diesel counterparts. This means that drivers are not only able to contribute to the environment by reducing their carbon footprint but also save money in the process.

This is because the UK government offers tax incentives for low-emission vehicles, which means that you could be taxed at a lower rate for driving an electric car. Beyond this, electric cars are also generally cheaper to run and maintain, offering further benefits to drivers. So, if you’re looking for a sustainable and cost-effective way of driving, electric cars could be the right choice for you.

Electric cars and other incentives

If you’re looking to reduce your Car Benefit Tax expenses, investing in an electric car might be a wise choice. One of the key benefits of driving an electric car is its tax efficiency. Electric cars are exempt from paying the traditional fuel benefit charge, which in previous years has saved drivers hundreds of pounds per year.

Additionally, electric cars have a very low carbon emission rate, further reducing their tax liabilities and helping you support your company’s environmental commitments. With an increasing number of incentives available for electric car purchases, you could benefit from a government grant and reduced road tax payments, making an electric vehicle a more affordable option in the long run. Not only are electric cars environmentally-friendly, they’re also a smart business choice for cost-conscious drivers as well.

Reduced fuel costs and tax benefits for electric cars

When it comes to electric cars, the benefits go beyond just reducing our carbon footprint. One major advantage is the reduced fuel costs. With electric vehicles, you don’t need to constantly fill up at the gas pump, which can save you a significant amount of money in the long term.

Moreover, electric cars can qualify for Car Benefit tax purposes, providing an added incentive for eco-conscious individuals. Unlike traditional gas-powered vehicles, electric cars usually have lower CO2 emissions, which make them eligible for tax credits and incentives. These tax benefits can be significant depending on where you live, making an electric car not only a more environmentally friendly choice, but also a more financially attractive one.

By driving an electric car, you can enjoy reduced fuel costs, tax benefits, and do your part in creating a more sustainable future.

How to find the right car for Car Benefit tax purposes?

When it comes to car benefit tax purposes, electric cars are a great option. The HMRC provides tax incentives for electric cars, making them an affordable and eco-friendly option. However, there are a few things to consider when choosing the right electric car for your needs.

Firstly, you should take into account your daily commute and ensure that the car’s range is sufficient for your needs. You should also consider the size and functionality of the car, as well as its safety features and overall cost. Don’t forget to check the manufacturer’s warranty and take a test drive before making your final decision.

With so many electric cars on the market, it can be overwhelming, but with a little research, you can find the perfect car that is not only good for the environment but also good for your wallet.

Factors to consider when choosing an electric car

When choosing an electric car for car benefit tax purposes, there are a few factors to consider. First, it’s important to check the car’s CO2 emissions to ensure it falls within your company’s tax bracket. Additionally, you’ll want to look at the car’s range and charging options, as well as its size and practicality for your needs.

It’s also worth considering any incentives or grants available for electric vehicles, as these can help offset the cost. When it comes to finding the right car, it’s important to do your research and test drive different models to see which one feels the most comfortable and suits your particular needs. By considering these factors, you can find an electric car that not only meets your car benefit tax requirements but is also a great fit for your lifestyle.

Tools and resources to help you choose

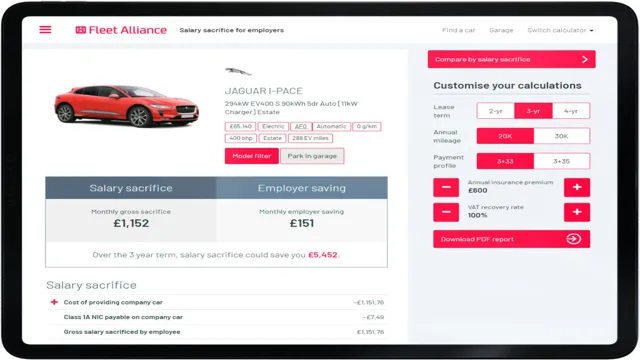

When it comes to choosing the right car for Car Benefit Tax (CBT) purposes, it can be overwhelming to know where to start. Luckily, there are some helpful tools and resources available to make the process easier. First, it’s important to understand what CBT is and how it can affect your tax liabilities.

Then, you can use online calculators and comparison tools to determine which cars are the most tax-efficient. These tools take into account factors such as CO2 emissions, fuel type, and list price to help you make an informed decision. Additionally, you can consult with a financial advisor or accountant who can provide personalized guidance based on your specific situation.

With these resources at your disposal, you can feel confident in your car selection and ensure you’re not overpaying on your taxes.

Conclusion and final thoughts

In summary, it’s clear that electric cars offer many benefits for both the environment and those who drive them. And with the recent changes to HMRC car benefit tax rates, there’s never been a better time to make the switch to an electric vehicle. So don’t be shocked – join the electric revolution and enjoy all the perks that come with it!”

FAQs

What is the car benefit charge for electric cars according to HMRC?

The car benefit charge for electric cars according to HMRC is 0% until 2025.

Are there any conditions for an electric car to qualify for 0% car benefit charge according to HMRC?

Yes, the electric car must be capable of being driven at least 130 miles between charges to qualify for 0% car benefit charge according to HMRC.

Is there any difference in car benefit charge for electric and non-electric cars according to HMRC?

Yes, there is a difference in car benefit charge for electric and non-electric cars according to HMRC. Electric cars are currently taxed at a lower rate than non-electric cars.

Do electric cars have any other tax benefits according to HMRC apart from car benefit charge?

Yes, electric cars have other tax benefits according to HMRC. For instance, they are exempt from vehicle excise duty (VED) and have lower rates of company car tax.