Discover the Benefits of HMRC Electric Car Benefit in Kind: All You Need to Know

As we move towards a greener future, electric cars are becoming more and more popular. Not only are they better for the environment, but they can also save you a lot of money on fuel. But, what about the benefits of owning an electric car when it comes to taxes? In particular, what is the HMRC Electric Car Benefit in Kind and how does it work? If you’re considering purchasing an electric car for personal or business-use, then understanding this could be crucial.

In this blog post, we will explore the ins and outs of the HMRC Electric Car Benefit in Kind so you can make an informed decision.

What is Benefit in Kind?

The HMRC electric car benefit in kind is essentially a tax you have to pay on the benefit received from using an electric car provided to you by your employer. Benefit in kind is calculated based on the value of the car, so the more expensive the vehicle, the higher the tax. However, electric cars actually have a lower rate of benefit in kind than traditional fossil fuel vehicles, with rates set to drop even further in the coming years.

This is because electric cars are seen as more environmentally friendly, and the government is incentivising their uptake. It’s important to note that benefit in kind is not a personal income tax, but a tax on the benefit of using the car for personal reasons outside of work. So, if you use your company electric car for commuting, the benefit in kind will still apply.

It’s worth considering all the costs and benefits of having an electric company car, including the potential tax implications, before making a decision.

Explaining Company Car Tax

Have you ever heard of the term “Benefit in Kind”? If you’re a company car driver, then it’s vital that you know what this means. In simple terms, Benefit in Kind is the way HM Revenue and Customs (HMRC) calculate the value of any company car that you’re given for personal use. Essentially, it’s the tax you have to pay on the benefit of having a company car.

This tax includes the car’s emissions and its list price, and it’s calculated as a percentage of the car’s value. The amount you owe is then deducted from your salary via the PAYE system. This tax is often a source of confusion for many people, but it’s vital to get it right.

Failing to do so could land you in hot water with the taxman.

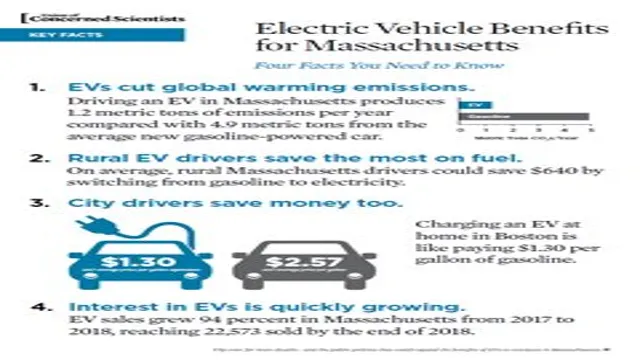

Benefits of Electric Vehicles

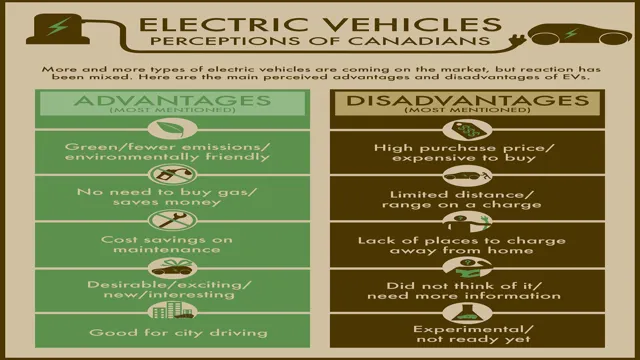

When it comes to electric vehicles (EVs), one of the benefits that businesses should consider is the “Benefit in Kind.” Essentially, this is a tax that employees will pay for using a company car for personal use. However, the tax is calculated based on the car’s CO2 emissions, which means that EVs are currently taxed at a significantly lower rate than traditional gasoline or diesel cars.

This can be a major incentive for businesses to switch to EVs, as it could mean significant savings for both the employer and employee. Plus, choosing an environmentally friendly option like an EV can also contribute to a company’s overall sustainability goals and help reduce their carbon footprint. Overall, the Benefit in Kind is an important factor for businesses to consider when deciding whether or not to make the switch to electric vehicles.

Calculating the Benefit in Kind

Calculating the benefit in kind for an electric car can be a bit confusing, but it’s essential for both employers and employees to understand. HMRC determines the benefit in kind by multiplying the car’s list price by the percentage rate assigned to its CO2 emissions and fuel type. Luckily, electric cars have a zero emission rate, which means employers won’t have to pay anything for them.

However, it’s still important to keep in mind that this can change over time. As more people transition to EVs, HMRC may adjust the benefit in kind rates. If you’re an employer looking to incentivize your employees to drive an electric car, the absence of a benefit in kind tax could be a significant factor.

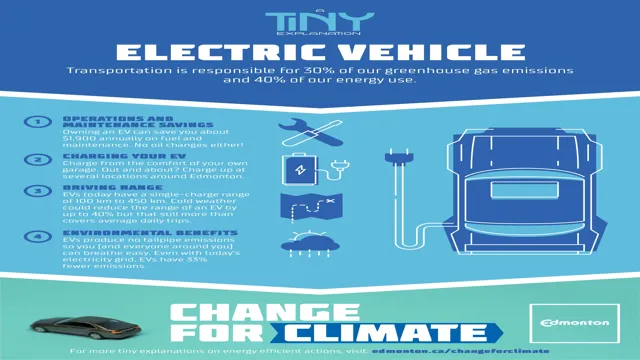

If you’re an employee, this means you can save money on your tax bill by choosing an electric car. Additionally, if you use your electric car for commuting, you could benefit from the Workplace Charging Scheme, which offers financial support to install charging points at work.

Individual Employee Calculations

When calculating the Benefit in Kind for an individual employee, there are a few key factors that need to be considered. Firstly, the value of the benefit itself needs to be established. This can vary depending on the type of benefit being provided, such as a company car or private health insurance.

Once the value has been determined, it needs to be added to the employee’s total taxable income. This will then be used to calculate the amount of tax and National Insurance contributions that need to be paid, which will then be deducted from the employee’s salary. It’s important to note that not all benefits are taxable.

For example, if an employer provides childcare vouchers or a work-related training course, these may be exempt from tax. It’s always best to seek the advice of a financial expert to ensure that the correct calculations are being made.

National Insurance Contributions

National Insurance Contributions can be a tricky subject, especially when it comes to calculating the Benefit in Kind. Basically, it refers to the value of any non-cash benefits that an employee receives from their employer during the course of their job. This can include things like company cars or private healthcare.

To calculate the Benefit in Kind, the employer must determine the cash equivalent of the benefit, and then this is added to the employee’s earnings for the year, which will then be subject to National Insurance Contributions. It’s important to get this right, as getting it wrong can lead to costly penalties or even legal action. So, if you’re an employer, it’s essential to ensure that you’re properly calculating your employees’ Benefit in Kind contributions to avoid any potential issues down the line.

Employer Costs and Savings

Calculating the Benefit in Kind is an important task for employers, especially when it comes to determining the true cost of employee compensation packages. Benefit in Kind refers to any non-cash form of remuneration provided to employees, such as company cars, health insurance, or gym memberships. These benefits often come with a tax liability which must be factored in when calculating the overall cost to the business.

However, it’s not just a matter of adding up the tax bill. Employers also need to consider the savings that can be made by providing these benefits, such as reduced absenteeism, improved morale, and increased productivity. It’s a delicate balancing act between cost and benefit, and careful consideration must be given to each component of the compensation package.

By taking the time to calculate the Benefit in Kind, employers can ensure they are providing attractive compensation packages that are both cost-effective and valued by their employees.

Incentives for Electric Cars

If you’re considering switching to an electric car, there are a number of incentives that make it an appealing choice. One key benefit is the HMRC electric car benefit in kind. Essentially, this is a tax break that allows you to avoid paying additional taxes on the battery for your electric vehicle.

This incentive is designed to encourage drivers to switch to more environmentally-friendly cars, and it’s just one of the many ways that governments and businesses are working to support the growth of the electric vehicle market. In addition to tax benefits, there are also a number of other incentives available to electric car owners, including reduced fuel costs, access to HOV lanes, and lower maintenance costs. With so many benefits associated with electric vehicles, it’s no wonder that more and more drivers are making the switch.

Whether you’re concerned about the environment, looking to save money on gas, or simply want a smoother, quieter driving experience, an electric car could be the perfect choice for you.

Plug-In Car Grant

The Plug-In Car Grant is a government incentive that provides a grant of up to £2,500 towards the purchase of an eligible electric vehicle. This is great news for those looking to make the switch from petrol or diesel to electric and want to save money in the process. Not only does this grant help to reduce the upfront cost of buying an electric car, but it also helps to lower the cost of running the vehicle, with lower fuel costs and zero road tax.

Plus, with most electric cars having low emissions, you may be eligible for additional savings on congestion charges and parking fees. The Plug-In Car Grant is a great way to incentivize the uptake of electric vehicles and help to reduce the UK’s carbon footprint. So if you’re thinking of buying an electric car, be sure to check if you’re eligible for the Plug-In Car Grant.

Electric Vehicle Homecharge Scheme

The government is eager to motivate people to switch to eco-friendly cars, and one way it’s doing so is by offering incentives for electric cars. One of these incentives is the Electric Vehicle Homecharge Scheme. This scheme provides domestic customers with up to 75% off the cost of installing a home charging point for their electric cars, up to a maximum of £350.

The idea is to encourage more people to buy electric cars by making charging more accessible and convenient. With a home charging point, electric car owners can charge their vehicles overnight, making it a hassle-free and cost-effective option. Not only does it make owning an electric car more affordable, but it also helps in the battle against air pollution by reducing the number of traditional petrol and diesel cars on the road.

Additionally, electric cars are cheaper to run and emit no harmful CO2 emissions, making them an eco-friendly choice for forward-thinking car owners. So, if you’re thinking of getting an electric car, make sure you take advantage of the Electric Vehicle Homecharge Scheme to save money on installation costs and say goodbye to petrol station visits.

Conclusion

In conclusion, the HMRC’s electric car benefit in kind is a spark of genius that not only benefits the environment but also gives a jolt to your finances. By driving an electric car, you can reduce your carbon footprint while enjoying lower taxes and increased savings. So, charge up your vehicle and experience the electrifying benefits of going green with the HMRC’s electric car benefit in kind.

“

FAQs

What is the benefit in kind for an electric car provided by an employer?

The benefit in kind for an electric car provided by an employer is currently 0% for the tax year 2021/22.

Is there a maximum value for an electric car before it is subject to a benefit in kind tax?

Yes, for the tax year 2021/22, the maximum value for an electric car before it is subject to a benefit in kind tax is £50,000.

Can an employee claim mileage reimbursement for using their own electric car for work purposes?

Yes, an employee can claim mileage reimbursement for using their own electric car for work purposes at a rate of 4p per mile for the first 10,000 miles and 2p per mile thereafter.

Are there any other tax incentives for electric cars apart from the benefit in kind?

Yes, there is currently a Plug-in Car Grant available for those purchasing new electric cars, as well as exemptions from certain taxes such as the London Congestion Charge and Vehicle Excise Duty.