Unlock the Benefits of HMRC’s Electric Cars Benefit in Kind Scheme: Saving Money and the Environment Together

Electric cars are the future of modern transport, and their popularity is continuing to grow. Not only do they offer a sustainable alternative to traditional petrol and diesel cars, but they also come with a range of benefits, including those from HMRC. If you’re considering purchasing an electric car, it’s important to understand the financial incentives available to you.

In this blog post, we’ll explore the various benefits that HMRC offers electric car owners, breaking down the specifics of each one and what they could mean for you. Get ready to plug in and discover the many ways electric cars could save you money.

What is Benefit in Kind

If you drive an electric car for work, you might be curious about Benefit in Kind (BIK). Essentially, BIK is a tax levied on employees who receive non-cash benefits from their employer, including company cars. The amount of BIK you owe depends on the value of the vehicle, its CO2 emissions, and your personal income tax rate.

However, good news for electric car drivers: as of April 2021, electric cars receive a much lower BIK rate than their diesel or petrol counterparts. For example, from 6 April 2021, the BIK rate for fully electric cars was 1% of the list price, rising to 2% in the 2022/23 tax year. This makes electric cars hugely attractive to company car drivers keen to reduce their tax liability.

It’s worth noting, though, that not all electric cars qualify for the reduced BIK rate – check with HMRC to find out what your personal tax rate would be.

Explanation of Benefit in Kind for Electric Cars

Benefit in Kind Benefit in Kind (BIK) is a tax that an employee has to pay on any non-cash benefits that they receive from their employer. This tax can include anything from company cars to health insurance and even gym memberships. When it comes to electric cars, the government has introduced a BIK incentive that offers a reduced rate for employees who use these vehicles.

The aim of this incentive is to encourage more people to switch to electric cars, which are more environmentally friendly and produce fewer emissions. Employers can also benefit from offering electric cars as a perk, as they can reduce their carbon footprint and build a reputation for being an environmentally responsible company. So not only is using an electric car a smart financial move for employees, it’s also an excellent way to do your bit for the planet.

Tax Breaks for Electric Cars

As the world shifts towards more sustainable modes of transportation, electric cars have become increasingly popular. Not only are they better for the environment, but they also come with a range of benefits for drivers. One of these benefits is the tax breaks that come with owning an electric car.

Specifically, there is a concept called Benefit in Kind (BIK) that can significantly reduce the taxes you pay on your company car. BIK is a tax that employers pay on the value of benefits that they provide to their employees, including company cars. In the case of electric cars, the BIK rate is much lower than for traditional petrol or diesel cars, making them a much more tax-efficient option.

This means that if you’re considering purchasing an electric car for your business or personal use, you could stand to save a significant amount of money in taxes. So not only are you doing your part for the environment, but you’re also saving on your bottom line. It’s a win-win situation.

How to Claim Benefits

If you are an employee who uses electric company cars, you might be curious about how to claim benefits. The HMRC electric cars benefit in kind allows drivers of electric cars to benefit from certain tax reductions. This includes paying a lower amount of National Insurance and Income Tax contributions.

However, to access these benefits, employees must first declare the electric car as their main mode of transportation to and from work. The benefit in kind is calculated by determining the car’s original list price and CO2 emissions before any modifications such as the installation of a battery or other charging device. To claim this benefit, you can contact the HMRC or your employer to learn more about the application process.

By doing so, you can take advantage of the many perks associated with owning an electric car and contribute to a cleaner, more sustainable planet.

Registering Your Electric Car with HMRC

When it comes to owning an electric car, there are several benefits that can be claimed on your taxes. In order to claim these benefits, you must first register your car with HMRC. This can be done online, and requires you to provide proof of ownership, as well as information about the car itself.

Once you have registered your electric car, you may be eligible for benefits such as reduced road tax and access to special charging stations. It’s important to keep in mind that the specific benefits you are eligible for will depend on a number of factors, such as where you live and how often you use your car. To ensure you are getting the most out of your electric car, it’s a good idea to speak with a tax professional who can help you navigate the ins and outs of HMRC registration and tax benefits.

Calculating Your Benefit in Kind for Tax Purposes

If you receive benefits from your employer, such as a company car or private healthcare, you may be required to pay tax on these benefits in kind. Calculating your benefit in kind can be a complicated process, as it is based on the value of the benefit rather than its actual cost. To determine the value of your benefit in kind, you first need to know the car or healthcare provider’s list price and its CO2 emissions rating, respectively.

Once you have this information, you can use HMRC’s online benefit in kind calculator to work out how much tax you need to pay. When claiming benefits in kind, it’s important to keep accurate records of all expenses and payments to ensure you don’t pay more tax than necessary. If you’re unsure about how to claim benefits in kind, seek advice from a qualified tax professional to avoid any potential issues with HMRC.

Submitting Your Claim to HMRC

When it comes to claiming benefits, the process can seem daunting. However, submitting your claim to HMRC doesn’t have to be complicated. First, you’ll need to determine which benefits you’re eligible for and gather all the necessary documentation.

This may include proof of income, medical records, and employment history. Once you have everything you need, you can begin the application process. You can apply online, by phone, or by mail.

The application will typically ask for personal information, such as your name, address, and national insurance number. It’s important to be as accurate as possible when filling out the application to avoid any delays or issues with your claim. If you need assistance with filling out the application or have any questions about the process, you can contact HMRC’s customer service team for support.

With a little bit of preparation and guidance, submitting your claim for benefits can be a smooth and stress-free experience.

Why Choose Electric Cars for Business Use?

If you’re a business owner, you may be wondering whether switching to electric cars will be worth it. One major factor to consider is the HMRC electric cars benefit in kind. Essentially, choosing electric cars can have significant tax benefits for both your business and your employees.

In fact, electric cars are currently exempt from company car tax and have lower rates of National Insurance contributions. Additionally, electric cars have lower running costs and require less maintenance, which can save your business money in the long run. But it’s not just about finances.

By choosing electric cars, you can also reduce your carbon footprint and show your clients and customers that you’re committed to sustainability. So if you’re looking to make a positive impact on both your bottom line and the environment, electric cars may be the way to go.

Environmental Benefits of Electric Cars

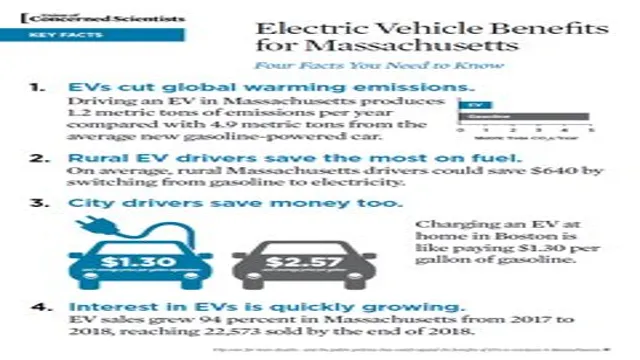

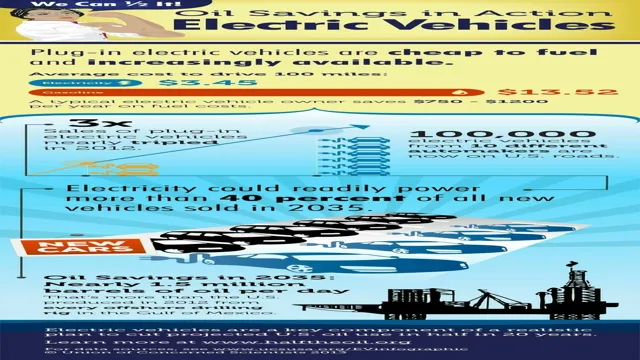

Electric cars have numerous environmental benefits that make them an ideal choice for businesses. First and foremost, electric cars generate zero emissions, which means they do not pollute the air we breathe. This is especially important in highly populated urban areas where air pollution can have a significant impact on public health.

Secondly, electric cars are much more energy-efficient than traditional vehicles, meaning they require less fuel to operate and ultimately emit less greenhouse gases. Finally, electric cars produce very little noise pollution which can make a meaningful impact on community noise levels in busy urban areas. Choosing electric cars for business use is not only good for the environment, but it also sends a powerful message to customers and stakeholders about your company’s commitment to sustainability.

Cost Savings for Businesses

If you’re looking for a way to save costs for your business, switching to electric cars should be on your radar. Not only will you be reducing your carbon footprint, but you’ll also be able to save on maintenance and fuel costs. Electric cars require little to no maintenance, and with the rising cost of fuel, going electric can save you a lot in the long run.

It’s also worth noting that many governments offer incentives or tax credits to businesses that switch to electric vehicles. These savings can add up and make a significant impact on your bottom line. So why not choose electric cars for your business use and join the growing movement towards sustainable and cost-effective business practices?

Conclusion

In conclusion, if you’re looking for a tax-efficient way to reduce your environmental footprint, look no further than the HMRC’s electric car benefit in kind policy. This scheme allows for a reduced taxable benefit on your company car if it’s an electric vehicle, meaning you’ll not only be doing your bit for the planet, but you’ll also be saving money. So don’t let your tax return shock you – make the switch to an electric ride and reap the benefits in more ways than one!”

FAQs

What is benefit in kind and how does it apply to electric cars?

Benefit in kind refers to the non-cash benefits that employees receive in addition to their salary, such as the use of a company car. For electric cars, the benefit in kind is calculated differently than for traditional petrol or diesel cars, as electric cars have lower CO2 emissions and are thus subject to lower tax rates.

Which electric cars are eligible for the benefit in kind tax break?

All fully electric cars are eligible for the benefit in kind tax break, as they have zero CO2 emissions and thus qualify for the lowest tax rate. Hybrid cars with low CO2 emissions may also be eligible for a reduced benefit in kind tax rate.

How is the benefit in kind tax calculated for electric cars?

The benefit in kind tax for electric cars is calculated by multiplying the car’s list price by the appropriate percentage of the car’s CO2 emissions. As electric cars have zero CO2 emissions, the percentage used is the lowest possible, resulting in a lower tax liability for employees.

What happens if I charge my electric company car at home, will I be taxed for the electricity used?

If your electric company car is charged at home, the electricity used will be considered a taxable benefit in kind. However, there are certain exemptions for electricity used to power a company car that are not available to the general public, so it’s important to check with HMRC to determine your tax liability.