Is Toyota Planning an Electric Car Discover the Future of Mobility

Featured image for is toyota planning an electric car

Toyota is aggressively entering the electric vehicle market with a $70 billion investment to launch 30 new EV models by 2030, marking a major shift from its hybrid-focused legacy. The automaker plans to phase out combustion engines entirely by 2035, aligning with global sustainability goals while leveraging its reputation for reliability and innovation in electrified mobility.

Key Takeaways

- Toyota confirms aggressive EV plans with 10 new models by 2026.

- Solid-state batteries set to revolutionize range and charging speed by 2027.

- Hybrid focus shifts as Toyota commits $70B to electrify entire lineup.

- New EV platform targets 600-mile range and 10-minute fast charging.

- North America prioritized for bZ4X and future EV manufacturing investments.

- Autonomous tech integrated across upcoming EVs for safer mobility.

📑 Table of Contents

- The Electric Revolution: Is Toyota Finally Ready?

- Toyota’s Electric Evolution: From Hybrid Pioneer to EV Contender

- The Toyota bZ Series: The First Wave of Electric Cars

- Next-Gen Technology: Solid-State Batteries and Beyond

- Global Strategy: How Toyota Will Compete in Key Markets

- Challenges and Opportunities: Can Toyota Succeed?

- Conclusion: The Future is Electric, and Toyota is Charging Ahead

The Electric Revolution: Is Toyota Finally Ready?

The automotive world is undergoing a seismic shift. Electric vehicles (EVs) are no longer a niche market reserved for tech enthusiasts and environmental activists – they’ve become a mainstream movement, with nearly every major automaker investing heavily in battery-powered mobility. From Tesla’s dominance to the aggressive EV roadmaps of Ford, GM, and Volkswagen, the race toward electrification is accelerating at an unprecedented pace. Amid this transformation, one name stands out – Toyota, the world’s largest automaker by volume, renowned for its reliability, innovation, and hybrid technology leadership. For years, Toyota’s cautious approach to full electrification raised eyebrows, leading to speculation: Is Toyota planning an electric car?

For over two decades, Toyota has championed hybrid technology, with the Prius becoming a global symbol of eco-conscious driving. While competitors rushed to develop pure electric vehicles, Toyota prioritized hydrogen fuel cells and plug-in hybrids, arguing that battery-electric vehicles (BEVs) faced challenges in charging infrastructure, battery sustainability, and range. However, as global regulations tighten, consumer demand shifts, and battery technology improves, Toyota has finally acknowledged that the future is electric. The answer to the burning question is no longer speculative – Toyota is not just planning electric cars; it’s launching a comprehensive EV strategy that aims to redefine its role in the future of mobility. In this deep dive, we’ll explore Toyota’s evolving EV roadmap, technological breakthroughs, market strategy, and what it means for drivers, investors, and the planet.

Toyota’s Electric Evolution: From Hybrid Pioneer to EV Contender

The Legacy of Hybrid Leadership

Toyota’s journey into electrification began not with batteries, but with hybrids. The Prius, launched in Japan in 1997 and globally in 2000, was the world’s first mass-produced hybrid electric vehicle. Over 25 years, Toyota has sold more than 20 million hybrid vehicles worldwide, establishing itself as the undisputed leader in hybrid technology. Models like the Camry Hybrid, RAV4 Hybrid, and Highlander Hybrid have proven that fuel efficiency and performance can coexist. This legacy gave Toyota a unique advantage: deep expertise in electric motors, battery management systems, and power electronics – the core components of any EV.

However, Toyota’s hybrid focus also created a strategic blind spot. While competitors like Tesla, Hyundai, and Volkswagen invested early in dedicated EV platforms, Toyota remained skeptical of pure battery-electric vehicles. In 2018, CEO Akio Toyoda famously stated that BEVs were “overhyped” and that hydrogen fuel cells represented the “ultimate” zero-emission solution. This stance drew criticism from environmental groups and investors, who saw Toyota as falling behind in the EV race. But as battery costs dropped, charging networks expanded, and governments set aggressive ICE (internal combustion engine) phase-out dates, Toyota realized that hybrids alone wouldn’t suffice.

The Turning Point: Toyota’s 2021 EV Strategy Announcement

In December 2021, Toyota made a landmark announcement that signaled a dramatic shift in its electrification strategy. The company revealed plans to invest $70 billion in electrification through 2030, with $35 billion dedicated specifically to battery electric vehicles. This included:

- Launching 30 new BEVs by 2030

- Targeting 3.5 million BEV sales annually by 2030

- Introducing a new dedicated EV platform called e-TNGA (Toyota New Global Architecture)

- Establishing a new battery division to develop next-gen solid-state batteries

This wasn’t just a minor pivot – it was a full-scale commitment to electrification. The message was clear: Toyota was no longer just a hybrid company; it was becoming a serious EV player. The announcement came just months after Toyota’s first mass-market BEV, the Toyota bZ4X, began production, marking the beginning of the “Beyond Zero” (bZ) sub-brand dedicated to electric vehicles.

Why the Change of Heart?

Several factors forced Toyota’s strategic shift:

- Regulatory pressure: The EU’s 2035 ICE ban, California’s Advanced Clean Cars II rule, and China’s NEV mandates left Toyota with no choice but to accelerate BEV development.

- Investor demands: Shareholders pushed for greater EV transparency and faster progress to maintain Toyota’s valuation against Tesla and other EV-focused automakers.

- Technological maturity: Improvements in battery energy density, charging speed, and manufacturing efficiency made BEVs more viable for Toyota’s global markets.

- Consumer expectations: Buyers increasingly prioritize zero-emission vehicles, even in markets where hybrids were previously dominant.

The Toyota bZ Series: The First Wave of Electric Cars

Introducing the bZ4X: Toyota’s Flagship BEV

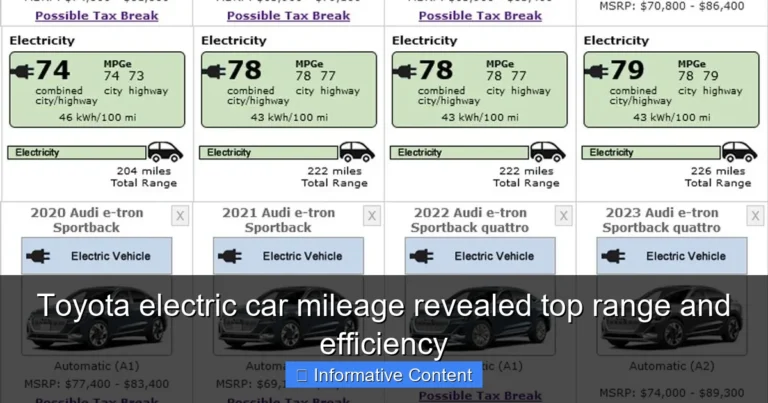

The Toyota bZ4X is the first model in the “Beyond Zero” lineup and Toyota’s first globally available battery-electric SUV. Launched in 2022, the bZ4X is built on the e-TNGA platform, a flexible architecture designed specifically for EVs. Key features include:

- Range: Up to 252 miles (EPA) in front-wheel drive (FWD) configuration; 228 miles (AWD)

- Power: 201 hp (FWD), 214 hp (AWD)

- Charging: DC fast charging up to 150 kW (80% charge in ~30 minutes)

- Features: Solar charging roof option (adds up to 1,000 miles annually), steer-by-wire system (in some markets), and Toyota Safety Sense 3.0

Early reviews praised the bZ4X for its spacious interior, comfortable ride, and intuitive tech interface. However, it faced criticism for its relatively modest range compared to rivals like the Hyundai Ioniq 5 (303 miles) and Kia EV6 (310 miles). Toyota addressed this with a 2024 refresh that includes improved battery chemistry and more efficient motors.

Beyond the bZ4X: The bZ Product Roadmap

Toyota’s bZ sub-brand will expand rapidly in the coming years. The company has confirmed at least five additional bZ models by 2025:

- bZ3: A compact sedan developed in partnership with BYD, targeting the Chinese market. Features Blade batteries and a starting price under $30,000.

- bZ Compact SUV: A smaller, more affordable electric SUV for urban markets, expected to launch in 2025.

- bZ Large SUV: A three-row electric SUV to compete with the Tesla Model X and Rivian R1S.

- bZ Pickup: An electric light-duty truck, likely based on the Toyota Hilux or Tacoma platform.

- bZ Sports Car: A high-performance coupe, potentially resurrecting the Supra nameplate in electric form.

Notably, the bZ3 collaboration with BYD highlights Toyota’s pragmatic approach. By leveraging BYD’s expertise in low-cost battery technology (especially LFP chemistry), Toyota can offer competitive pricing while maintaining its quality standards. This “open innovation” strategy allows Toyota to scale quickly without overextending its own R&D budget.

Practical Tips for bZ4X Buyers

If you’re considering the bZ4X or future bZ models, here are key factors to evaluate:

- Range needs: The bZ4X is ideal for city driving and short commutes but may require planning for long trips. Use apps like PlugShare to map charging stations.

- Charging setup: Invest in a Level 2 home charger (240V) for overnight charging. Toyota partners with ChargePoint for installation support.

- Climate considerations: Cold weather can reduce range by 20-30%. Precondition the battery while plugged in to mitigate losses.

- Warranty: Toyota offers an 8-year/100,000-mile battery warranty (10 years in some states), providing peace of mind.

- Resale value: Early EV models depreciate faster than hybrids. Check KBB and Edmunds for projected values.

Next-Gen Technology: Solid-State Batteries and Beyond

The Solid-State Breakthrough

While most automakers focus on improving lithium-ion batteries, Toyota is betting big on solid-state batteries (SSBs) – a technology that could revolutionize EVs. Traditional lithium-ion batteries use liquid electrolytes, which pose safety risks (e.g., thermal runaway) and limit energy density. Solid-state batteries replace the liquid with a solid electrolyte, offering:

- Higher energy density: 2-3x more range per charge

- Faster charging: 80% charge in 10-15 minutes

- Longer lifespan: 1,000+ charge cycles with minimal degradation

- Enhanced safety: No risk of leaks or fires

Toyota holds over 1,000 solid-state battery patents – more than any other automaker. The company plans to launch a BEV with SSBs by 2027-2028, initially in limited production. Toyota’s SSBs use sulfide-based electrolytes, which are more stable and easier to manufacture than oxide-based alternatives. The goal is to achieve a 745-mile range with 10-minute charging.

Challenges and Realistic Timelines

Despite the promise, solid-state batteries face significant hurdles:

- Manufacturing scalability: Current SSB production is slow and expensive. Toyota is building a dedicated SSB pilot line in Japan.

- Cost: SSBs are projected to cost 2-3x more than lithium-ion batteries initially, though prices should drop with scale.

- Durability: Solid electrolytes can crack over time due to electrode expansion, reducing battery life.

- Supply chain: New materials (e.g., lithium metal anodes) require new mining and refining processes.

To mitigate risks, Toyota is pursuing a “hybrid” approach: continuing to improve lithium-ion technology for near-term EVs while developing SSBs for the long term. The company is also investing in lithium iron phosphate (LFP) batteries for entry-level models, which are cheaper and safer than nickel-based chemistries.

Beyond Batteries: Toyota’s Broader Tech Ecosystem

Toyota’s EV ambitions extend beyond batteries. The company is integrating EVs into a broader mobility ecosystem:

- Vehicle-to-Grid (V2G): Future bZ models will support bidirectional charging, allowing EVs to power homes during outages or feed energy back to the grid.

- AI and autonomy: Toyota Research Institute (TRI) is developing AI-driven driving systems for EVs, aiming for Level 3 autonomy by 2025.

- Hydrogen synergy: Toyota still believes in hydrogen fuel cells for heavy trucks and industrial use. The Mirai sedan will coexist with BEVs in its lineup.

- Circular economy: Toyota plans to recycle 90% of EV batteries by 2035, reducing reliance on raw material mining.

Global Strategy: How Toyota Will Compete in Key Markets

North America: Chasing Tesla and Ford

The U.S. and Canada are critical for Toyota’s EV success. Here’s how the company is positioning itself:

- Product focus: Prioritizing SUVs and trucks, which dominate U.S. sales. The bZ Large SUV and bZ Pickup will target the Tesla Model Y and Ford F-150 Lightning.

- Manufacturing: Toyota is investing $2.5 billion in its Kentucky plant to build EVs and batteries, creating 2,000 jobs.

- Incentives: Leveraging the Inflation Reduction Act (IRA) to qualify for U.S. tax credits. The bZ4X is already eligible for $7,500 in some configurations.

- Dealer network: Training 1,500 dealerships in EV sales and service by 2025 to ensure a seamless customer experience.

Europe: Meeting Strict Emissions Rules

With the EU’s 2035 ICE ban, Europe is a make-or-break market for Toyota:

- BEV targets: 100% of Toyota’s European sales will be zero-emission vehicles by 2030.

- Compact models: The bZ Compact SUV will compete with the Volkswagen ID.3 and Renault Zoe.

- Local production: Toyota is upgrading its UK plant to build EVs, reducing tariffs and supply chain risks.

- Charging partnerships: Collaborating with IONITY and Allego to expand fast-charging access.

China: The BYD Partnership and Market Adaptation

China is the world’s largest EV market, and Toyota is adapting its strategy:

- Local collaboration: The bZ3 uses BYD’s Blade batteries and is manufactured in China to reduce costs.

- Affordable models: Developing sub-$25,000 EVs to compete with Wuling Hongguang Mini EV.

- Software focus: Integrating Baidu’s AI and navigation systems for Chinese consumers.

Emerging Markets: Hybrids First, EVs Later

In regions like Southeast Asia, Latin America, and Africa, Toyota will maintain its hybrid focus while gradually introducing BEVs:

- Hybrid dominance: The RAV4 Hybrid and Corolla Hybrid will remain top sellers.

- EV introduction: bZ models will launch in major cities first, where charging infrastructure exists.

- Affordability: LFP batteries and simplified models will keep prices competitive.

Challenges and Opportunities: Can Toyota Succeed?

Key Challenges

Toyota faces several obstacles in its EV transition:

- Brand perception: Overcoming the “latecomer” image and proving it can innovate in the EV space.

- Software expertise: Unlike Tesla, Toyota has limited experience in EV-specific software (e.g., OTA updates, battery management).

- Supply chain risks: Battery materials (lithium, cobalt) and semiconductor shortages could delay production.

- Competition: Tesla, Ford, and Chinese EV startups are already ahead in market share and technology.

Unique Advantages

However, Toyota has strengths that could give it an edge:

- Manufacturing excellence: Toyota’s lean production system can scale EVs efficiently.

- Global reach: 10 million vehicles sold annually provide a massive customer base for cross-selling EVs.

- Hybrid synergy: Existing hybrid owners are more likely to consider Toyota EVs.

- Reliability reputation: Toyota’s “bulletproof” image can attract cautious EV buyers.

Data Table: Toyota’s EV Sales vs. Competitors (2023)

| Automaker | Global BEV Sales (2023) | BEV % of Total Sales | Key EV Models |

|---|---|---|---|

| Toyota | 14,000 | 0.1% | bZ4X, bZ3 |

| Tesla | 1.8 million | 100% | Model 3, Model Y |

| BYD | 1.5 million | 52% | Han, Atto 3 |

| Volkswagen | 572,000 | 6% | ID.4, ID.3 |

| Ford | 109,000 | 3% | Mustang Mach-E, F-150 Lightning |

Note: Toyota’s BEV sales are growing rapidly, but still represent a small fraction of its total volume. The company aims to reach 15% BEV sales by 2025 and 50% by 2030.

The Road Ahead

For Toyota, the EV journey is just beginning. The company’s success will depend on:

- Execution: Delivering promised models on time and within budget.

- Innovation: Bringing solid-state batteries to market before competitors.

- Customer trust: Ensuring EVs meet Toyota’s legendary reliability standards.

- Global coordination: Balancing regional strategies with a unified brand identity.

Conclusion: The Future is Electric, and Toyota is Charging Ahead

So, is Toyota planning an electric car? The answer is an unequivocal yes – but it’s not just about adding EVs to its lineup. Toyota is undergoing a fundamental transformation, redefining its identity for the electric age. From the bZ4X to solid-state batteries, from Kentucky factories to BYD partnerships, Toyota is leveraging its strengths in manufacturing, reliability, and global reach to compete in the EV race.

This isn’t a sudden pivot; it’s a strategic evolution. Toyota’s hybrid expertise gives it a unique advantage in powertrain integration, while its cautious approach ensures that EVs meet the company’s high standards for safety and durability. The road ahead won’t be easy – competition is fierce, technology is complex, and markets are unpredictable. But Toyota has a track record of long-term thinking and resilience, as demonstrated by its recovery from the 2011 tsunami and the 2008 financial crisis.

For consumers, Toyota’s EV push means more choices: reliable, well-built electric vehicles that don’t sacrifice comfort or performance. For the planet, it means another major automaker committing to zero-emission mobility. And for the automotive industry, it signals that even the most established giants can adapt to the electric revolution. The future of mobility is electric, and Toyota – after years of deliberation – is finally charging ahead with the confidence, scale, and innovation to shape it.

Frequently Asked Questions

Is Toyota planning an electric car for the mass market?

Toyota has confirmed plans to launch multiple electric car models by 2025, targeting the mass market with affordable and efficient options. The company aims to achieve 3.5 million annual EV sales by 2030, signaling a major shift toward electrification.

What is Toyota’s strategy for electric car development?

Toyota’s electric car strategy includes a mix of battery EVs (BEVs), hybrids, and hydrogen fuel cell vehicles, with a $70 billion investment in electrification by 2030. The focus is on sustainability, performance, and leveraging its global manufacturing scale.

When will Toyota’s first fully electric car be available?

Toyota’s first dedicated electric car, the bZ4X SUV, is already available in select markets, with broader rollouts planned through 2024. Future models, including sedans and compact EVs, are expected to follow soon after.

How does Toyota’s electric car lineup compare to competitors?

Toyota’s electric car lineup, including the bZ4X and upcoming models, emphasizes reliability, long-range capabilities, and advanced safety features. While slower to market than some rivals, Toyota is betting on its reputation for durability to gain an edge.

Will Toyota discontinue hybrid vehicles to focus on electric cars?

No, Toyota will continue producing hybrid vehicles alongside electric cars, viewing them as complementary technologies. The company believes hybrids will remain relevant for markets where EV infrastructure is still developing.

Are Toyota’s electric cars eligible for government incentives?

Yes, many of Toyota’s electric car models, including the bZ4X, qualify for federal and state EV incentives in regions like the U.S. and Europe. Buyers should check local eligibility rules for tax credits or rebates when purchasing.