Tax Benefit of Electric Car: Unlock Savings Now!

Many people want to know about electric cars. They are good for the planet. They also have some tax benefits. This article will explain these benefits. It will help you understand how electric cars can save you money.

What is an Electric Car?

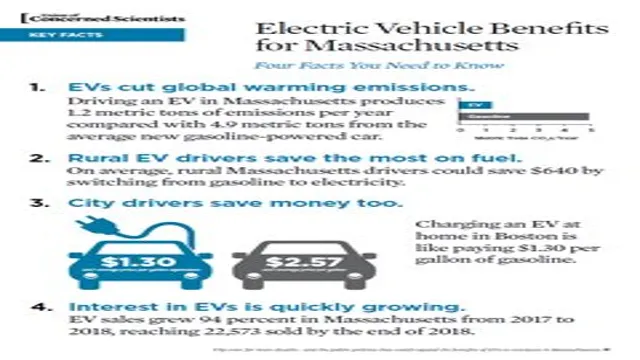

An electric car uses electricity to run. They do not use gas. This means they are cleaner for the air. Electric cars are quiet, too. They are becoming more popular every year.

Why Choose an Electric Car?

There are many reasons to choose an electric car:

- They are better for the environment.

- They can save you money on gas.

- They often have lower maintenance costs.

- They can be fun to drive.

Tax Benefits Explained

Now, let’s talk about tax benefits. These are the ways you can save money on your taxes when you buy an electric car.

Federal Tax Credit

The federal government gives a tax credit for electric cars. This credit can be up to $7,500. Not everyone will get the full amount. It depends on the size of the car’s battery. The bigger the battery, the bigger the credit.

How to Qualify for the Credit

To qualify for the federal tax credit, you must:

- Buy a new electric car.

- Use the car for personal use.

- Complete IRS Form 8834.

This form helps you claim your credit. You need to file it with your tax return.

State Tax Credits

Many states offer their own tax credits. These can add more savings. Each state has different rules. Some states give cash back. Others offer tax credits.

Examples of State Benefits

Here are a few examples:

- California offers up to $2,500.

- New York can give you $2,000.

- Texas has local incentives based on the city.

Sales Tax Exemptions

Some states do not charge sales tax on electric cars. This means you pay less when you buy your car. For example, if a car costs $30,000 and the sales tax is 6%, you save $1,800. That is a great deal!

Reduced Registration Fees

Some areas have lower registration fees for electric cars. This helps you save more money. It is important to check local laws. This benefit is not the same everywhere.

Hov Lane Access

In some places, electric cars can use the HOV lane. This lane is for cars with more than one person. Using the HOV lane can save time. It makes driving less stressful.

Charging Station Incentives

Some states help pay for charging stations. You may get money back if you install a charging station at home. This can make owning an electric car easier.

How to Claim Your Tax Benefits

Claiming tax benefits is simple. Follow these steps:

- Buy an electric car.

- Keep all your receipts and documents.

- Fill out the necessary forms.

- File your tax return.

Things to Consider

Before buying an electric car, think about these points:

- How far can the car go on one charge?

- Is there a charging station near your home?

- How much will you save on gas?

Frequently Asked Questions

What Are The Tax Benefits Of Owning An Electric Car?

Owning an electric car can offer significant tax benefits. These may include federal tax credits, state incentives, and deductions.

How Much Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500. The amount depends on the car’s battery size and the manufacturer.

Do All Electric Cars Qualify For Tax Benefits?

Not all electric cars qualify. Only those that meet specific criteria set by the IRS can get tax credits.

Can I Claim Tax Benefits For Used Electric Cars?

Yes, some used electric cars may qualify for tax benefits. Check local laws for details on eligibility.

Conclusion

Electric cars have many benefits. Tax benefits can save you money. The federal tax credit is a great start. State credits, sales tax exemptions, and other incentives help too. If you want to save money and help the planet, an electric car is a good choice.

Remember to check local rules. Every place has different benefits. Research can help you find the best deal. Enjoy your ride and the savings!