Electric Cars: Drive Towards Tax Savings with Exciting Benefits

If you are considering buying an electric car, then you are in for some great benefits when it comes to taxes. Did you know that you can save a lot of money on tax credits, rebates, and even exemptions when you decide to go green with your vehicle? Electric cars not only help the environment but also help you save money. In this blog, we will discuss the various tax benefits that come with buying an electric car.

We will explore the advantages that electric car owners have over those with gas vehicles and help you understand why an electric car is the future of the automobile industry. So, buckle up and let’s dive into the benefits of owning an electric car.

Federal Tax Credits

If you’re thinking about buying an electric car, you may be eligible for a tax benefit on your purchase. The federal government offers tax credits that can significantly reduce the cost of buying an electric vehicle. These credits vary depending on the make and model of the car, but they can be as high as $7,500.

To qualify for the tax credit, your car must be new and purchased for personal use. If you buy a used electric car, you won’t be eligible for the tax credit. It’s important to note that the tax credit begins to phase out once the manufacturer sells 200,000 eligible vehicles, so if you’re considering a popular model, you’ll want to check whether the credit is still available.

The tax credit can be a great incentive to invest in an electric car, especially since electric vehicles can be more expensive than gas-powered cars. Plus, not only will you be saving money on gas in the long run, but you’ll also be doing your part to reduce your carbon footprint. Overall, the tax benefit on electric cars is a great way to make the transition to electric vehicles more affordable for consumers.

Available for new, qualified electric vehicles

“electric cars” If you’re thinking about purchasing a brand-new electric car, you could be eligible for a federal tax credit. This tax credit is an incentive provided by the government to encourage more people to invest in electric vehicles. However, not all electric cars qualify for this credit, and the amount you can claim varies depending on the vehicle’s battery capacity.

For instance, if your electric car has a battery capacity of less than 5 kWh, you won’t qualify for the credit. On the other hand, if your car has a battery capacity of 16 kWh or more, you could be eligible to claim a maximum tax credit of $7,500! It’s also worth noting that the credit only applies to new, qualified electric vehicles. If you’re considering purchasing a used electric car, you won’t be eligible for the credit.

Nonetheless, purchasing an electric car even without the tax credit can still be financially beneficial in the long run, as electric cars are known to save you money on fuel costs and maintenance compared to traditional gasoline-powered vehicles.

Up to $7,500 in tax credits

If you’re considering purchasing an electric vehicle, you might be eligible for a federal tax credit of up to $7,500. This tax credit serves as an incentive for individuals to switch to more environmentally friendly vehicles, and it can significantly lower the cost of purchasing an EV. The amount of the tax credit varies depending on the make and model of the vehicle, as well as the battery capacity.

For example, a Tesla Model 3 has a tax credit of $7,500, while a Nissan Leaf has a tax credit of $7,500. Keep in mind that this tax credit is not a rebate – it can only be applied to your tax liability for the year in which you purchased the vehicle. It’s important to consult with a tax professional to determine whether you’re eligible for this credit and how it can be applied to your taxes.

Overall, the federal tax credit for electric vehicles is an excellent opportunity to save money and reduce your carbon footprint.

Based on battery capacity and manufacturer

When it comes to buying an electric vehicle, there are certain factors you may consider before making your purchase. One of these factors is the battery capacity and the manufacturer. The larger the battery capacity, the longer the vehicle can drive on a single charge.

Different manufacturers also have different battery technologies and capacities, affecting the driving range and performance of electric vehicles. Moreover, purchasing an electric vehicle can get you eligible for federal tax credits. These credits offer incentives that can help offset the cost of buying an electric vehicle, depending on the battery capacity and manufacturer.

However, it’s essential to note that these credits are not unlimited and do have a cap limit for each manufacturer. Thus, it’s crucial to check these rules and regulations before purchasing your electric vehicle. As a savvy consumer, checking the battery capacity and manufacturer and taking advantage of federal tax credits can help you save and get the best value for your money.

State and Local Incentives

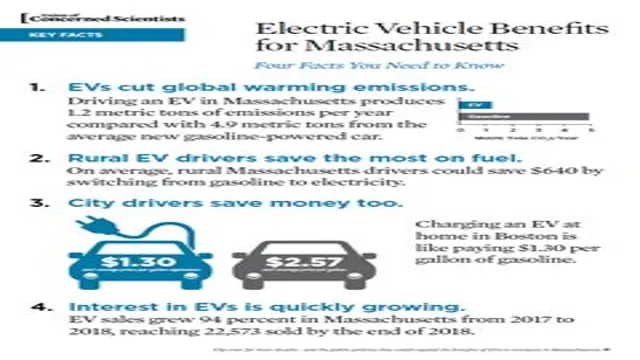

Electric cars have been gaining popularity in recent years due to a variety of reasons, including their eco-friendliness and cost-effectiveness. One of the biggest reasons people are opting to switch to electric cars is the tax benefits that come with them. Many state and local governments offer incentives to electric car owners, such as tax credits, reductions in registration fees, and even free parking.

These incentives can help offset the initial costs of purchasing an electric car and make them more attainable for the average consumer. It’s important to check with your local government to see what incentives are available in your area. With so many benefits to owning an electric car, it’s no wonder why they continue to grow in popularity.

Varies by state and region

When it comes to state and local incentives for businesses, it’s important to remember that they can vary greatly depending on where you are located. While some states may offer tax breaks or grants for small businesses, others might provide assistance with workforce development or access to capital. In addition, certain regions within a state may have their own unique incentives to help foster economic growth.

It’s worth doing your research and exploring all of the available options to see which ones would be the best fit for your business. Keep in mind that you may need to meet certain criteria or abide by certain regulations in order to qualify for some incentives. By taking advantage of these programs, you can help increase your chances of success and ensure that your business thrives in the long run.

Includes rebates, tax credits, and HOV lane access

State and local governments offer a variety of incentives to encourage consumers to use electric cars. These incentives can come in the form of rebates, tax credits, or access to HOV lanes. Rebates are usually given when someone buys a new electric car, and they typically range from a few hundred to a few thousand dollars.

Tax credits are often available at both the state and federal level, and they can be worth several thousand dollars. Finally, some states allow electric car drivers to use HOV lanes, even if they are driving alone. This can be a significant time-saver, as HOV lanes are often less crowded than other lanes during busy times.

The exact incentives available will vary depending on where you live, so it is worth doing some research to see what is available in your area. By taking advantage of these incentives, you can make owning an electric car more affordable and convenient.

Check with local government for specifics

If you’re thinking about starting a business, or expanding an existing one, it’s worth checking with your local government to see if there are any state and local incentives available to you. Different regions may offer different incentives depending on their economic priorities and goals. Some common incentives include tax breaks, grants, and loans.

To qualify for these incentives, there may be specific criteria that you’ll need to meet. For example, you may need to hire a minimum number of employees, be located in a specific area, or operate in a certain industry. It’s worth doing your research to see what incentives are available to you, as they can help offset some of the costs associated with starting or growing your business.

Total Cost of Ownership

If you’re in the market for a new vehicle, you might want to consider an electric car not just for its environmental benefits but also for its tax benefits. Owning an electric car can save you money due to the tax benefits that come with it. The government offers a federal tax credit of up to $7,500 for the purchase of a new electric car.

Additionally, some states offer their own incentives like tax credits or rebates, further reducing the cost of ownership. More than that, electric cars are less expensive to operate and maintain so that you’ll save more on fuel and maintenance costs over time. With all the advantages of electric cars, it’s no wonder that they are becoming increasingly popular.

So, make sure to talk to your local dealer and accountant to learn more about the tax benefits of owning an electric car.

Factor in tax benefits when considering purchase

When considering purchasing a new car or property, it’s important to factor in the tax benefits that may be available to you. This can play a significant role in the total cost of ownership, as tax incentives can greatly reduce your overall expenses. For example, if you purchase an electric vehicle, you may be eligible for federal or state tax credits that can offset a portion of the purchase price.

Similarly, if you purchase a rental property, you may be eligible for tax deductions on your mortgage interest, property taxes, and other expenses related to the property. It’s important to do your research and understand the tax benefits available to you before making any major purchase, as this can ultimately impact your bottom line. By taking advantage of tax benefits, you can reduce your total cost of ownership and make a smart financial decision for your future.

So, don’t forget to consider tax incentives when making any major purchase – it could save you a lot of money in the long run.

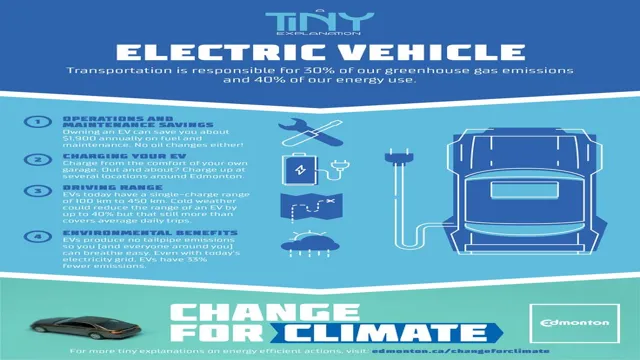

Lower maintenance and fuel costs

Lower maintenance and fuel costs are essential factors to consider when purchasing a vehicle. The Total Cost of Ownership (TCO) includes all expenses associated with owning and operating a vehicle, such as fuel, maintenance, repairs, insurance, depreciation, and taxes. Opting for a vehicle with lower maintenance and fuel costs will result in a lower TCO and ultimately save you money in the long run.

One way to lower maintenance costs is by choosing a reliable and durable vehicle that requires less frequent repairs. Regular maintenance, such as oil changes and tire rotations, can also help prevent costly repairs down the line. Additionally, purchasing from a brand with a good reputation for reliability and low maintenance costs, such as Honda or Toyota, can also provide peace of mind and save you money over time.

Fuel costs are another significant expense to consider, especially as gas prices continue to fluctuate. Choosing a fuel-efficient vehicle, such as a hybrid or electric model, can significantly reduce your fuel expenses. Along with saving you money, reducing fuel consumption also has environmental benefits by reducing emissions and dependence on fossil fuels.

In summary, vehicles with lower maintenance and fuel costs can provide significant financial savings through lower Total Cost of Ownership. Choosing a reliable vehicle, performing regular maintenance, and selecting a fuel-efficient model are all ways to lower these costs and save money in the long run.

Conclusion

In conclusion, the tax benefit on electric cars is not just a way for the government to incentivize eco-friendly behavior, it’s also a clever way to spark innovation and propel our society towards a brighter and more sustainable future. By encouraging consumers to adopt electric cars, we’re not just reducing our carbon footprint, but also supporting the growth of a booming industry that’s creating jobs and driving technological advancement. So the next time you’re cruising down the road in your electric vehicle, remember that you’re not just saving money on gas, you’re also contributing to a greener world and a smarter economy.

Drive on, eco-warrior!”

FAQs

What is the tax benefit on electric cars?

The tax benefit on electric cars allows buyers to receive a federal tax credit of up to $7,500 depending on the battery size of the vehicle.

Are there any state-level tax benefits for electric cars?

Yes, some states offer additional tax incentives for electric car buyers such as rebates, exemptions from sales tax, or lower registration fees.

Do leased electric cars qualify for the tax credit?

Yes, electric cars that are leased can still qualify for the federal tax credit, but the credit is typically applied to the leasing company, which can then pass on the savings to the lessee.

Is there a limit to the number of electric cars that can receive the tax credit?

Yes, there is a limit to the number of electric cars that can receive the tax credit per manufacturer. Once a manufacturer sells 200,000 electric cars in the US, the tax credit begins to phase out for that manufacturer’s vehicles.