Tax Benefits Electric Car Owners Must Know in 2024

Electric cars are becoming more popular. Many people choose them for many reasons. One important reason is tax benefits. In this article, we will look closely at these benefits. We will also explain how you can save money.

What are Electric Cars?

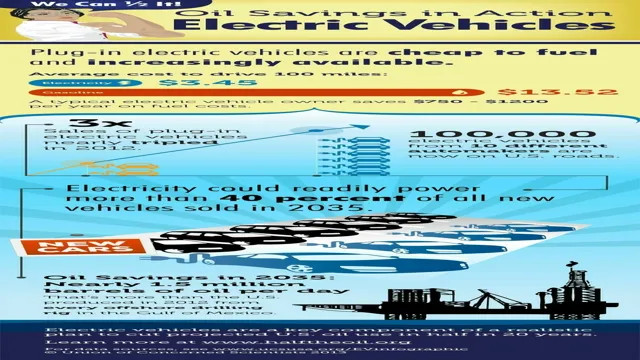

Electric cars run on electricity. They do not use gasoline. This makes them different from regular cars. They are good for the environment. They produce less pollution. This is why many governments support electric cars.

Why Tax Benefits Matter

Tax benefits help people buy electric cars. They make the cars cheaper. When the cars are cheaper, more people can afford them. This helps the environment too. The more electric cars, the less pollution.

Types of Tax Benefits

There are different types of tax benefits for electric cars. Here are the main types:

- Federal Tax Credit

- State Tax Credits

- Sales Tax Exemption

- Tax Deductions

- Other Incentives

Federal Tax Credit

The federal government offers a tax credit for electric cars. This means you can reduce your taxes. The amount can be up to $7,500. The exact amount depends on the car model. Not all electric cars qualify. Check if your car is eligible.

State Tax Credits

Many states offer their own tax credits. These can help you save more money. Some states give credits up to $5,000. Others may offer less. Always check your state’s rules. This can change from year to year.

Sales Tax Exemption

Some states do not charge sales tax on electric cars. This means you pay less when you buy the car. This can save you hundreds or even thousands of dollars. Check if your state has this benefit.

Tax Deductions

Some people can use tax deductions. This is different from a tax credit. A deduction lowers your taxable income. This means you pay taxes on a smaller amount. You may need to meet certain conditions to qualify.

Other Incentives

There are other incentives too. Some cities offer rebates. These are cash payments to help you buy an electric car. Some areas provide free charging stations. This can save you money on electricity.

How to Get These Benefits

Getting tax benefits for electric cars is not hard. Here are steps to follow:

- Choose an electric car that qualifies.

- Check the federal tax credit amount.

- Look for state tax credits in your area.

- Ask about sales tax exemptions.

- Keep all purchase documents and receipts.

Considerations Before Buying

Before you buy an electric car, think about a few things:

- Is the car eligible for tax benefits?

- What is the total cost of the car?

- How much will you save on gas?

- How much do you drive each day?

Environmental Impact

Electric cars are better for the environment. They produce less carbon dioxide. This helps fight climate change. Choosing an electric car is a good choice for the planet.

Frequently Asked Questions

What Are Tax Benefits For Electric Cars?

Tax benefits for electric cars include credits, deductions, and exemptions that reduce your tax bill.

How Much Is The Federal Tax Credit For Electric Vehicles?

The federal tax credit for electric vehicles can be up to $7,500, depending on the car model.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Eligibility depends on the vehicle’s make and model.

Can You Claim Tax Benefits For Used Electric Cars?

Yes, some states offer tax benefits for used electric cars, but it varies by location.

Conclusion

Tax benefits make electric cars more affordable. They help you save money and help the environment. Before buying, check all the benefits available. Do your research. Make sure you choose the right car. You can save money on taxes and help the planet.

Frequently Asked Questions

1. How Much Can I Save With Tax Benefits?

The savings depend on the type of car and where you live. You can save up to $12,500 or more.

2. Are All Electric Cars Eligible For Tax Benefits?

No, not all electric cars qualify. Check the eligibility before you buy.

3. Can I Combine State And Federal Tax Credits?

Yes, you can often combine both credits for more savings.

4. What If I Don’t Owe Taxes? Can I Still Get Benefits?

Some credits may be refundable. This means you can get cash back even if you owe no taxes.

5. How Often Do These Benefits Change?

Tax benefits can change every year. Always check the latest information.

In summary, electric cars have many tax benefits. They help reduce costs for buyers. They also support a cleaner environment. Consider all your options before making a choice.