Electric Cars: Drive Your Savings Up with Tax Benefits!

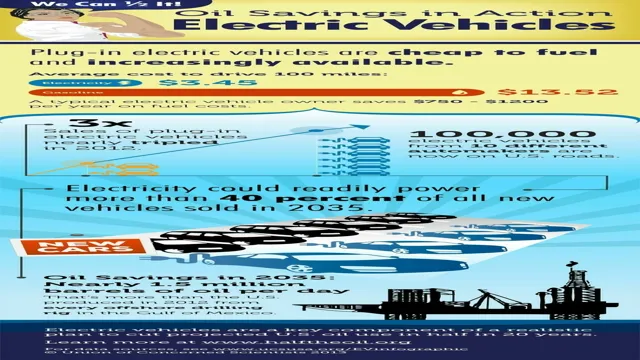

You’re ready to hit the road in your new electric car, but did you know that it could also provide you with some significant tax benefits? That’s right, the government is promoting the use of eco-friendly vehicles with a range of incentives, including tax credits, rebates, and deductions. These incentives can help you save money on your next tax bill and offset some of the upfront costs of purchasing an electric car. Plus, they’re good for the environment too! So, if you’re considering going green with your vehicle, keep reading to learn more about the tax benefits for electric cars and how you can take advantage of them.

Federal Tax Credits

If you are thinking about purchasing an electric car, there are many tax benefits you can take advantage of. Federal tax credits are available for eligible vehicles, with the amount depending on the battery capacity of the car. For example, the maximum tax credit for a fully electric vehicle with a battery capacity of 16 kWh or higher is currently $7,500.

Additionally, some states and local governments provide their own incentives for electric vehicle purchases. These incentives can include tax credits, rebates, or reduced registration fees. By taking advantage of these tax benefits, you can save money on your electric car purchase and reap the rewards of driving a more environmentally friendly vehicle.

So, if you’re in the market for a new car, consider going electric and taking advantage of the tax benefits available to you.

Qualifying Vehicles and Amounts

Federal Tax Credits If you’re considering purchasing an electric vehicle (EV), you may be eligible for a federal tax credit. This credit is intended to encourage people to switch to EVs and reduce their carbon footprint. The amount of the credit varies depending on the make and model of the EV.

For example, Tesla vehicles are no longer eligible for federal tax credits, but there are still many other eligible vehicles to choose from. The credit ranges from $2,500 to $7,500 and is based on the vehicle’s battery size. The larger the battery, the higher the credit.

It’s important to note that the credit is non-refundable, which means that if you owe less than the credit amount, you won’t receive any money back. However, if you owe more than the credit amount, you’ll receive a credit on your taxes for the following year. Overall, if you’re considering purchasing an EV, the federal tax credit can help make it more affordable and environmentally friendly.

Income Limitations and Lease Structure

Federal Tax Credits Federal tax credits are essential in helping low-income individuals and families access affordable housing. The tax credits aim to incentivize private investment in affordable housing, which in turn increases the supply of affordable housing in a given area. The eligibility for the credits is determined by income limitations, which vary depending on the location and project of the housing.

This helps ensure that the tax credits go to those who need them the most. The housing’s lease structure is also important in determining eligibility for federal tax credits. For example, some housing projects may require tenants to pay a percentage of their income in rent, while others may have a flat rental rate.

Overall, federal tax credits provide a valuable tool for increasing affordable housing options for low-income individuals and families.

State and Local Incentives

If you’re considering purchasing an electric car, you may be curious about the potential tax benefits and incentives that come with it. Fortunately, many state and local governments offer various incentives to encourage the purchase and use of electric vehicles. These incentives can take the form of tax credits, exemptions, or rebates.

For example, some states offer a tax credit for EV purchases up to a certain amount, while others provide exemptions from vehicle emissions testing or reduced registration fees. Additionally, certain cities and municipalities offer free charging stations or parking to electric car owners. To find out what incentives are available in your area, check with your state or local government’s Department of Transportation or Department of Motor Vehicles.

By taking advantage of these incentives, you can enjoy the benefits of electric car ownership while saving money in the process. So, whether you’re looking to reduce your carbon footprint or simply lower your transportation costs, consider the tax benefits and incentives available for electric cars in your state.

State Tax Credits and Rebates

State tax credits and rebates are a great way to incentivize individuals and businesses to invest in renewable energy and reduce their carbon footprint. Many states and localities offer tax credits and rebates for installing solar panels, wind turbines, and other renewable energy systems. In some cases, these incentives can cover up to 30% of the total installation cost, making it more affordable for individuals and businesses to make the switch to clean energy.

Additionally, some states offer property tax exemptions for renewable energy systems, which can save homeowners and businesses thousands of dollars over time. Investing in renewable energy not only benefits the environment but can also provide significant long-term financial savings. It’s important to check with your state or local government to see if you qualify for any tax credits or rebates before installing a renewable energy system.

HOV Lane Access and Parking Benefits

One of the benefits of owning an electric vehicle is that it may qualify you for state and local incentives. These incentives can include access to HOV lanes and parking benefits. Many states offer special perks to electric vehicle owners to encourage them to make the switch to clean energy.

For example, California offers a Green Clean Air Vehicle sticker which allows EV owners to use the carpool lane even with no passengers in the vehicle. In addition, many cities and municipalities offer free or discounted parking for electric vehicles. These small perks can add up and make owning an electric car more affordable and convenient.

So if you’re considering making the switch to an EV, be sure to check for any state or local incentives that may be available to you!

Utility Company Rebates and Discounts

When looking to save money on your utility bills, it’s always a good idea to check with your local utility company to see if they offer any rebates or discounts. Many states and local governments offer incentives for homeowners and businesses to use energy-efficient appliances and make home upgrades that help conserve energy. These incentives can include rebates on appliances, discounts on solar panel installations, and tax credits for energy-efficient upgrades.

For example, in California, homeowners who install solar panels can receive a rebate from their utility company, while in New York, residents can receive tax credits for installing energy-efficient windows and doors. Checking with your local utility company is a simple way to see what incentives are available in your area and how you can take advantage of them to save money on your utility bills.

Long-Term Savings

When it comes to long-term savings, electric cars can provide numerous tax benefits to their owners. For instance, the federal government offers a tax credit of up to $7,500 for the purchase of an electric vehicle, which can significantly reduce the initial cost of the car. Moreover, some states also offer additional incentives such as tax credits or rebates for buying an electric car.

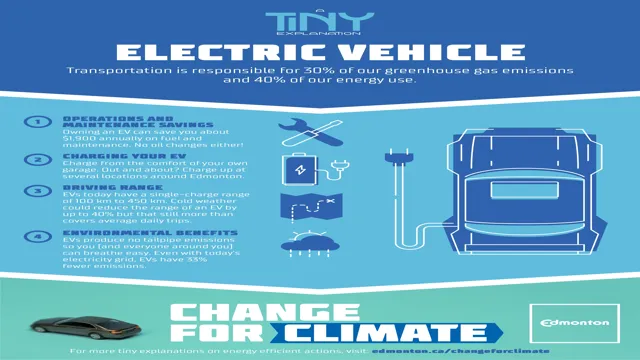

Additionally, electric cars are exempt from certain taxes, such as the gas tax, which can save drivers a substantial amount over time. Furthermore, electric cars have relatively low maintenance costs compared to traditional cars, as they have fewer moving parts and require less frequent oil changes. All of these tax benefits and cost savings can add up to substantial long-term savings for electric car owners.

Lower Operating Costs and Maintenance Expenses

One of the most significant advantages of investing in energy-efficient systems is the long-term savings that come with lower operating costs and maintenance expenses. By opting for energy-efficient technology in your home or business, you can reduce your monthly utility bills while also minimizing the level of maintenance required to keep your systems functioning optimally. Energy-efficient systems are designed to operate using minimal energy, which results in lower utility bills over time.

Additionally, these systems often require less maintenance, as they have fewer moving parts and are less prone to breakdowns and malfunctions than traditional systems. By making the switch to energy-efficient technology, you can enjoy significant long-term savings and reduce the impact of your energy consumption on the environment. So, why stick with old, outdated systems when you can save money and reduce your carbon footprint with energy-efficient alternatives?

Increased Resale Value

As a car owner, you may be constantly searching for ways to save money in the long run. Investing in regular maintenance and repairs can be costly, but did you know that purchasing a high-quality car can actually increase your savings in the long run? By opting for a car with a good reputation for reliability and longevity, you can maximize your resale value down the line. This is because buyers are often willing to pay more for cars with a proven track record of durability.

Furthermore, a car that retains its value well means that you’ll be able to get a larger return on your initial investment. So, while purchasing a high-quality car may seem like a larger expense upfront, it can lead to significant long-term savings. So, if you want to save money in the long run, consider investing in a reliable and durable vehicle that will pay off in the long term.

Environmental Benefits

One of the major benefits of owning an electric car is the various tax incentives available to owners. These benefits vary depending on where you live, but they can include federal tax credits, state tax credits, and even local incentives. Some state governments offer purchase rebates, while others exempt electric vehicles from certain fees, such as emissions testing.

Additionally, some cities offer free parking or access to carpool lanes for electric vehicles. In terms of environmental benefits, electric cars produce zero emissions and greatly reduce the amount of greenhouse gas produced by transportation. This is not only good for the environment but also leads to improved air quality, particularly in urban areas.

Moreover, electric cars require less maintenance than gasoline-powered cars, further reducing their carbon footprint. Purchasing an electric car not only makes financial sense in the long run, it also contributes to the greater good of the planet.

Conclusion

In conclusion, the tax benefits for electric cars are not just a clever way to save money, but also an investment in the future of our planet. By transitioning to electric vehicles, we can reduce our carbon footprint and improve air quality, while also taking advantage of the financial incentives available. So let’s plug in and charge up, because driving an electric car is truly electrifying!”

FAQs

What tax benefits are available for owning an electric car?

Electric car owners are eligible for a federal tax credit of up to $7,500. Additionally, depending on the state, electric vehicle owners may also be eligible for state-specific tax credits, rebates, or exemptions.

Are there any restrictions on the type of electric vehicles that qualify for tax credits?

Yes, to be eligible for federal tax credits, the electric car must meet certain criteria, such as having a battery capacity of at least 4 kWh and being powered by a battery that holds at least 4 kWh of energy. Some state-specific incentives may also have additional eligibility requirements.

How do I claim the tax credits for owning an electric car?

To claim the federal tax credit, complete IRS Form 8936, “Qualified Plug-In Electric Drive Motor Vehicle Credit,” and submit it with your federal tax return. For state-specific incentives, check your state’s website for the application process and requirements.

Can I receive tax credits for leasing an electric car?

Yes, in most cases, the tax credits for owning an electric car can also apply to leased vehicles. However, it is important to note that some leasing companies may factor in the tax credit in lease payments, rather than applying them as a tax credit to the lessee. Check with your lease provider for more information.