Tax Benefits of Electric Car for Business: Unlock Savings!

Electric cars are becoming more popular. More people are choosing them. They are good for the environment and can save money. Businesses can also benefit from electric cars. This article will explain the tax benefits of electric cars for businesses.

What is an Electric Car?

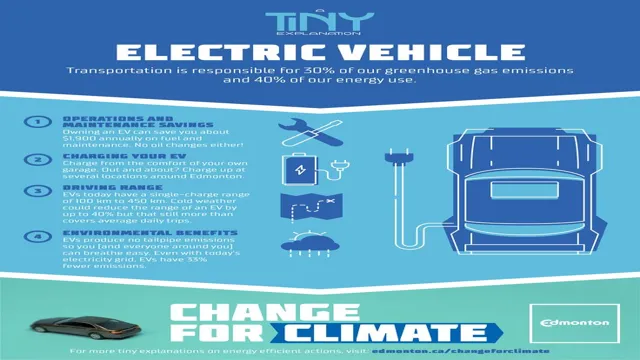

An electric car uses electricity for power. It does not use gas. This means less pollution. Electric cars are quiet and can be fun to drive. They have fewer moving parts, so they can be cheaper to maintain.

Tax Benefits Overview

Many countries offer tax benefits for electric cars. These benefits help businesses save money. Here are some common benefits:

- Tax credits for buying electric cars

- Deductions for business expenses

- Lower registration fees

- Incentives for charging stations

Tax Credits for Buying Electric Cars

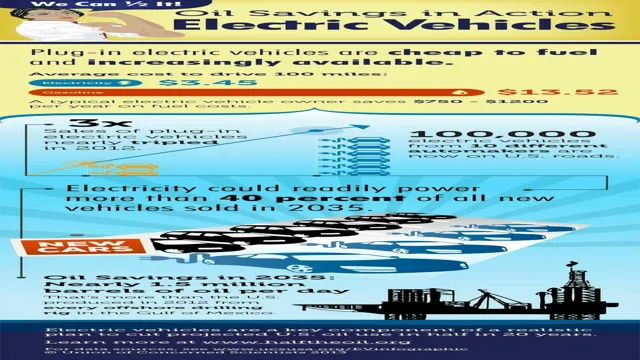

When a business buys an electric car, it may qualify for a tax credit. A tax credit reduces the amount of tax the business owes. This means the business can save money. The amount of the credit depends on the car’s battery size. Bigger batteries usually mean bigger credits.

Business Expense Deductions

Businesses can deduct expenses related to electric cars. This includes costs for charging. It also includes maintenance and repairs. Deductions lower the taxable income. This means the business pays less tax overall.

Lower Registration Fees

In many places, electric cars have lower registration fees. This means it costs less to register the car. Lower fees help businesses save money each year. This is another way electric cars can be good for business.

Incentives for Charging Stations

Some governments offer incentives for installing charging stations. These incentives can help businesses save money. They may get money back for building the station. This makes it easier for employees and customers to charge their cars.

Environmental Benefits

Electric cars help the environment. They produce less pollution. This is good for the planet. Many customers prefer businesses that care about the environment. Using electric cars can improve a business’s image.

How to Get Started

Businesses can start by researching electric cars. There are many options available. It is important to choose the right car. The car should fit the business needs. Consider the following steps:

- Research electric car options.

- Check local tax credits and incentives.

- Calculate potential savings.

- Consider charging options for the business.

Important Considerations

While electric cars have many benefits, there are some things to think about. The initial cost of electric cars can be high. But the long-term savings can be worth it. Here are some considerations:

- Charging infrastructure: Is there a place to charge the car?

- Range: How far can the car go on a charge?

- Maintenance: Electric cars need less maintenance, but it is still important.

Frequently Asked Questions

What Are Tax Deductions For Electric Cars In Business?

Tax deductions for electric cars can lower your taxable income. Businesses can deduct expenses related to the purchase, maintenance, and operation of electric vehicles.

How Much Can I Save On Taxes With An Electric Vehicle?

Savings depend on the vehicle’s cost and local tax laws. Some businesses save thousands through federal and state incentives.

Do Electric Cars Qualify For Any Federal Tax Credits?

Yes, electric cars may qualify for federal tax credits. The amount varies by vehicle type and battery capacity.

Are There State Tax Benefits For Electric Vehicles?

Many states offer tax benefits for electric vehicles. These can include additional credits, rebates, or reduced registration fees.

Conclusion

Electric cars offer many tax benefits for businesses. They can save money and help the environment. Businesses should consider these benefits when making decisions. The investment in electric cars can pay off in the long run.

In summary, electric cars provide:

- Tax credits for purchases

- Deductions for expenses

- Lower registration fees

- Incentives for charging stations

By understanding the tax benefits, businesses can make smart choices. Electric cars can be a good investment for many businesses. They can help save money while helping the planet.

Frequently Asked Questions (FAQs)

1. What Is A Tax Credit?

A tax credit reduces the amount of tax you owe. It can save you money.

2. How Can I Find Out About Local Incentives?

You can check government websites. They often list available incentives.

3. Are Electric Cars More Expensive Than Gas Cars?

Yes, but they can save money over time. They have lower fuel and maintenance costs.

4. Can I Charge An Electric Car At Home?

Yes, many people charge their electric cars at home. You may need a special charger.

5. What If My Business Does Not Have A Charging Station?

You can consider installing one. Or, you can use public charging stations.

6. Are There Any Federal Tax Credits Available?

Yes, many countries offer federal tax credits for electric car purchases.

7. How Do I Calculate The Savings From Electric Cars?

Consider fuel savings, maintenance costs, and tax benefits. This can show the overall savings.

Final Thoughts

Electric cars are a smart choice for businesses. They offer many tax benefits that can help save money. The environment also benefits from electric cars. Businesses should explore these options carefully. Investing in electric cars can be a good decision for the future.