Unlocking Top Tax Benefits: Why Novated Leasing an Electric Car Could Be Your Smartest Decision Yet!

If you’re considering purchasing a car and want to save money on taxes, then an electric car novated lease could be a great option for you. Electric cars are becoming increasingly popular due to their cost-saving benefits, environmentally friendly nature, and government incentives. In this blog post, we’ll discuss the tax benefits of electric car novated leases and how they can save you money on tax payments.

We’ll also explore the process of getting a novated lease and how it works. So, buckle up and let’s hit the road to financial savings!

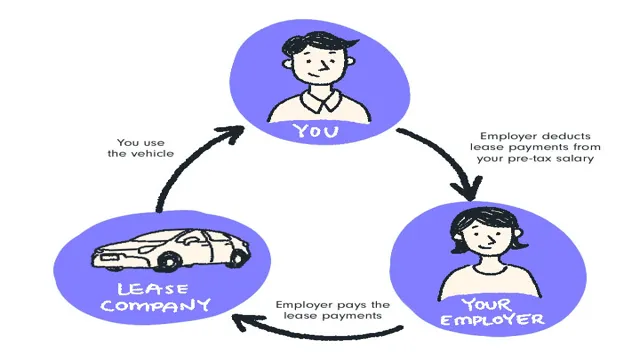

Lower Taxable Income

One of the biggest tax benefits of an electric car novated lease is the potential for lower taxable income. This is because the lease payments (including the cost of the car) are deducted from your pre-tax salary, which means less taxable income and lower tax bills. Additionally, some states and countries offer financial incentives and tax credits for purchasing electric vehicles, which could further reduce your tax liability.

With a novated lease, you can also benefit from reduced running costs, as electric cars tend to be more efficient and cheaper to maintain compared to their petrol or diesel counterparts. So not only can you save money on your taxes, but you can also save money on your everyday expenses. It’s a win-win situation that’s worth considering if you’re in the market for a new car.

Electric Cars have Deductible

Electric cars offer many benefits, including a lower taxable income. This is because investing in an electric car can provide you with a deductible for your taxes. The IRS offers a federal tax credit of up to $7,500 for those who purchase an electric car, which can significantly reduce the amount of taxable income you have to report.

This is a great incentive for those who want to reduce their carbon footprint while also saving money on their taxes. Additionally, some states offer additional tax incentives for those who purchase electric cars, so it is worth researching what incentives are available in your area. Overall, investing in an electric car can not only lower your carbon footprint but also offer financial benefits through tax deductions.

Deductable Driving Expenses

One way to lower your taxable income as a self-employed individual is to take deductions on your driving expenses. Deductible driving expenses can include gas, oil changes, insurance, repairs, and even parking fees. As long as these expenses are directly related to your business operation and not personal use, you can usually claim them on your taxes.

To maximize your deduction, keep track of your mileage throughout the year and use a mileage tracking app or logbook. This will not only help you accurately calculate your deduction but also serve as proof in case of an audit. By taking advantage of deductible driving expenses, you can save money on your taxes and ultimately lower your overall tax bill.

GST Benefits

One of the significant advantages of opting for an electric car novated lease is the tax benefits it offers. With the implementation of the Goods and Services Tax (GST), EVs are eligible for a lower tax rate, making them more affordable than their petrol or diesel counterparts. As per the new GST rates, EVs are taxed at 5%, while the tax on conventional vehicles is 28%.

Additionally, the GST paid on the lease payments for EVs can also be claimed as input tax credit, reducing the overall cost. Overall, choosing an electric car novated lease not only helps in reducing carbon emissions but also offers significant tax advantages that can help save on expenses.

GST is Claimable on Electric Car Purchases

If you are considering purchasing an electric car for your personal or business use in the near future, you may be happy to know that you can claim back the GST paid on its purchase. This is a great benefit for those who wish to invest in a cleaner, more sustainable mode of transport. Electric cars are becoming increasingly popular due to their lower environmental impact and decreased dependence on fossil fuels, so it makes sense that the government is incentivizing their use.

With this GST benefit, you can potentially save a significant amount of money on your electric car purchase and take a step toward a greener future. So, if you have been on the fence about purchasing an electric car, this added bonus may just be what you need to make the decision easier.

No Luxury Car Tax

With the implementation of the GST, there is a plethora of benefits that individuals can reap. One of the most significant advantages is the elimination of the luxury car tax. In the past, luxury car buyers had to pay an additional tax of 33% on vehicles priced above a certain threshold.

However, with the GST in place, this tax has been abolished. This means that individuals who are in the market for a luxury vehicle can now purchase one without worrying about the additional tax burden. Moreover, the GST has streamlined the taxation system, making it simpler and easier for businesses to comply with tax laws.

The elimination of the luxury car tax is a win-win situation for both buyers and sellers, as it has made luxury vehicles more affordable and accessible while also boosting sales in the luxury car industry. Overall, it is clear that the GST has brought about many benefits, including the removal of the luxury car tax.

No Fuel Tax Credits

When the Goods and Services Tax (GST) was implemented in India, it was hailed as a game-changer for the Indian economy. One of the biggest advantages of GST was the elimination of multiple taxes, which streamlined the taxation process and made it easier for businesses to operate. However, there are some downsides to the GST as well.

One of the biggest disadvantages is the lack of fuel tax credits. Under the previous tax system, businesses were able to claim credits for the excise duties paid on fuel. This meant that businesses could offset the cost of fuel against their tax liabilities.

However, under the GST system, businesses are no longer able to claim these credits. This has led to an increase in fuel prices, which has had a knock-on effect on the cost of goods and services. While there are other advantages to GST, the lack of fuel tax credits is certainly a major drawback.

It remains to be seen whether the government will address this issue in the future.

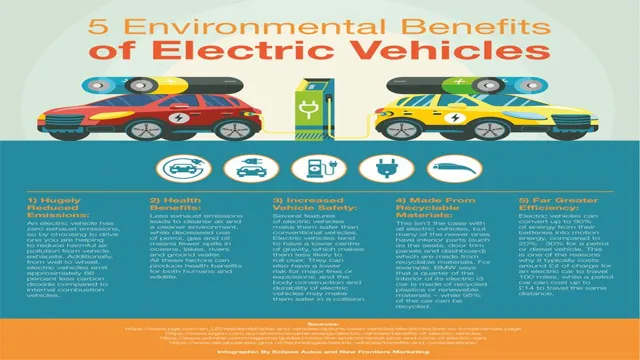

Environmental Savings

If you’re looking for a way to reduce your environmental footprint and save money on taxes, a novated lease for an electric car may be just the solution you need. With a novated lease, your employer will take on the responsibility of paying for the lease and car expenses, which can include maintenance, insurance, fuel, and registration. By choosing an electric car, you’ll not only reduce your carbon emissions, but you’ll also be eligible for tax benefits, such as the Federal Tax Credit and state incentives.

Depending on where you live, these incentives can range from several thousand dollars off the purchase price to a significant reduction in monthly payments. Additionally, because electric cars require less maintenance and fuel, you’ll save money on operating costs over the life of the car, making it a smart investment for both the environment and your wallet. So if you’re looking to make a positive impact and save money on taxes, a novated lease for an electric car may be the perfect choice for you.

Lower Emissions and Smaller Carbon Footprint

Lowering emissions and reducing our carbon footprint have become critical for safeguarding our environment. By opting for eco-friendly choices, businesses and individuals can significantly contribute towards achieving a sustainable future. One of the most significant benefits of reducing emissions is that it helps control air pollution, which poses a substantial threat to public health.

When we consume less energy, our reliance on fossil fuels decreases, meaning we need to burn less oil, coal, and gas. This not only mitigates the risk of air pollution but also reduces the amount of carbon dioxide released into the atmosphere. As a result, we can limit the greenhouse effect, thus slowing the pace of climate change.

It is essential to note that even small changes can have a big impact. For instance, using public transport or walking or cycling instead of driving, opting for energy-saving lights and appliances, and consuming products with eco-friendly packaging can go a long way in reducing our carbon footprint. Ultimately, saving the environment is a collective responsibility, and every positive action taken can help preserve our planet for future generations.

Green Vehicle Registration savings

Green vehicle registration savings are a great way to contribute to the environment while also saving money on your vehicle registration fees. By registering your green vehicle, you can receive a discount on your registration fees as an incentive for driving a low-emission vehicle. This is a win-win situation for both the environment and your wallet.

Not only are you reducing your carbon footprint by driving a more eco-friendly car, but you’re also able to save some cash on your vehicle’s operating costs. It’s important to remember that green vehicles have a lot of benefits beyond just registration savings. They emit less pollution, they save money on fuel costs, and they help to reduce our dependence on fossil fuels.

So, if you’re driving a green vehicle, be sure to take advantage of the registration savings and be proud of your contribution to a healthier planet.

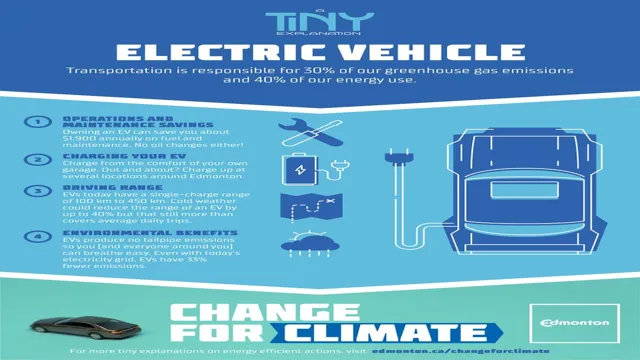

Savings in Maintenance and Fuel Costs

If you’re looking to save money on maintenance and fuel costs, then an electric car novated lease could be a great option for you. The tax benefits of an electric car novated lease are significant, and can make a big difference to your bottom line. Not only do electric cars cost less to maintain than traditional vehicles, but they also require less frequent maintenance thanks to their simpler mechanics.

And because they run on electricity rather than petrol or diesel, you’ll save a bundle on fuel costs too. Plus, with the added benefit of tax savings, an electric car novated lease can make owning a new car more affordable than ever. So why not consider making the switch to an electric car? You’ll save money, reduce your carbon footprint, and enjoy all the benefits of driving a new car.

Conclusion

So there you have it folks, the tax benefits of an electric car novated lease are truly electrifying! Not only do you get to save money on fuel and maintenance costs, but you also become a superhero for the environment. With electric cars becoming more common on our roads, it’s clear that the future is electric. So why not make the switch and take advantage of the tax benefits that come with a novated lease? In short, not only will you save money, but you’ll also be doing your part to reduce your carbon footprint and create a cleaner, greener world for generations to come.

It’s time to plug in, power up, and drive into a brighter future!”

FAQs

What are the tax benefits of having an electric car novated lease?

Electric cars are considered to be environmentally friendly and therefore qualify for certain tax benefits such as lower Fringe Benefit Tax (FBT) rates, reduced income tax liabilities, and potential Goods and Services Tax (GST) savings.

What are the requirements for getting an electric car novated lease?

To be eligible for an electric car novated lease, you must be an employee with a minimum income requirement and have an employer who is willing to enter into an agreement with you for the lease. You also need to ensure that the electric car you want to lease meets the eligible criteria for tax benefits.

Can you purchase the electric car at the end of the lease term?

Yes, you have the option to purchase the electric car at the end of the lease term. You can pay the residual value of the car, which is the agreed-upon market value of the vehicle at the end of the lease.

What happens if I leave my job during the lease term?

If you leave your job during the lease term, your employer will no longer be responsible for the payments on the car. You will have the option to either pay out the lease or transfer the lease to your new employer if they agree to take it on.