Tax Benefits of Owning an Electric Car: Maximize Savings!

Electric cars are becoming popular. Many people want to help the environment. They also want to save money. One way to save money is through tax benefits. This article will explain the tax benefits of owning an electric car. Let’s explore these benefits together.

What is an Electric Car?

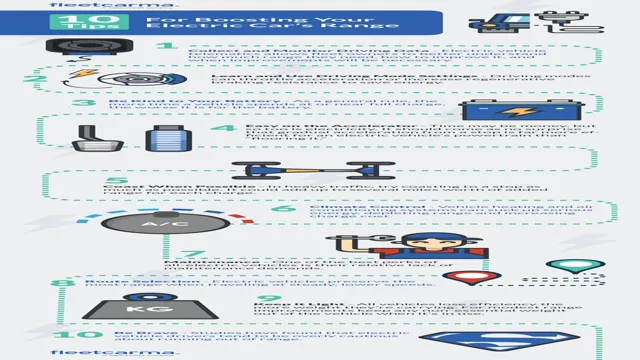

An electric car is a vehicle that runs on electricity. It does not use gasoline or diesel. Instead, it has a large battery. This battery powers an electric motor. Electric cars are quiet and clean. They produce no tailpipe emissions. This means they do not pollute the air. Many people choose electric cars for their environmental benefits.

Why Buy an Electric Car?

People buy electric cars for many reasons:

- They are good for the environment.

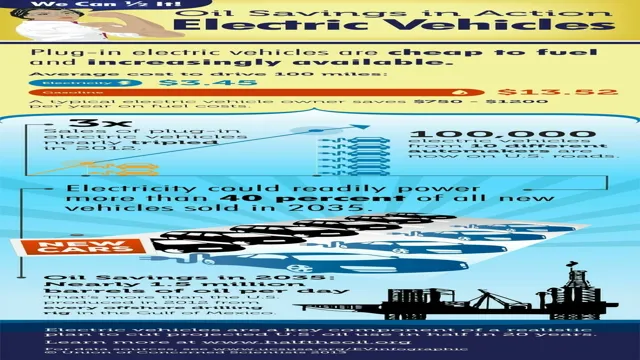

- They save money on gas.

- They often have lower maintenance costs.

- They can be fun to drive.

Understanding Tax Benefits

Now, let’s talk about tax benefits. A tax benefit helps you pay less money in taxes. There are different ways to get tax benefits. They can come as credits or deductions. A credit reduces your tax bill directly. A deduction lowers the amount of money you pay taxes on.

Federal Tax Credit for Electric Cars

In the United States, there is a federal tax credit. This credit is for people who buy electric cars. It can be worth up to $7,500. The exact amount depends on the car’s battery size. Bigger batteries usually mean a bigger credit.

However, this credit has limits. Not all electric cars qualify. Each car company can only get credits for 200,000 cars. After that, the credit starts to decrease. It is important to check if your car qualifies before buying.

State Tax Benefits

Many states offer additional tax benefits. These benefits can be credits or deductions. Each state has its own rules. Some states offer credits similar to the federal tax credit. Other states may offer lower registration fees or tax exemptions.

For example:

- California gives a rebate for electric car buyers.

- New York offers a tax credit for certain electric cars.

- Texas has no state sales tax on electric vehicles.

Local Incentives

Some cities and counties provide incentives too. They may offer discounts on parking or charging stations. Some areas have special carpool lanes for electric cars. These incentives make owning an electric car even better.

Charging Station Tax Benefits

If you install a charging station at home, you may get benefits. You can often claim a tax credit. This credit is for the cost of the charging station. It can be up to 30% of the total cost. This helps lower the overall price of going electric.

Tax Deductions for Business Owners

If you own a business, you can get more benefits. You may be able to deduct the cost of the electric car. This is true if you use the car for business. You can also deduct expenses related to charging. This can save you a lot of money on taxes.

State and Local Tax Deductions

Some states allow you to deduct sales tax. This is for the purchase of electric vehicles. This can lead to significant savings. Always check your state’s rules to see what you qualify for.

Environmental Tax Benefits

Owning an electric car helps the environment. Some states reward this with tax benefits. They want to encourage people to drive electric cars. This can also include rebates for solar panels. If you have solar panels, you can charge your electric car for free.

How to Claim Tax Benefits

Claiming your tax benefits is not hard. Here are steps to follow:

- Keep all receipts for your electric car purchase.

- Save receipts for charging station costs.

- Check if your car qualifies for federal and state credits.

- Fill out the right tax forms when you file.

- Consult a tax professional if you have questions.

Important Points to Remember

Here are some important points about tax benefits:

- Not all electric cars qualify for the federal tax credit.

- State benefits vary widely. Check local laws.

- Keep records of your purchases and expenses.

- Consult a tax expert if unsure about anything.

Frequently Asked Questions

What Are The Tax Credits For Electric Cars?

Tax credits vary by state and federal laws. They can reduce your tax bill significantly, often up to $7,500.

How Do Electric Car Tax Deductions Work?

Deductions lower your taxable income. They help reduce the amount of tax you owe.

Can I Claim Tax Benefits For Used Electric Cars?

Yes, some states offer tax benefits for used electric cars. Check your local regulations.

Do Electric Cars Qualify For State Tax Incentives?

Many states provide tax incentives for electric car owners. These can include rebates and credits.

Conclusion

Owning an electric car has many benefits. The tax benefits can help you save money. From federal credits to state incentives, there are many ways to save. Remember to keep good records. Make sure to check if your car qualifies for these benefits. If you do this, you will enjoy owning an electric car even more.

As electric cars become more popular, tax benefits may change. Stay informed about the latest news. This will help you maximize your savings. Owning an electric car is not only good for you. It is also good for the planet.