Toyota Electric Car Credit Guide Maximize Your Savings Now

Featured image for toyota electric car credit

Image source: cdn.osvehicle.com

Unlock significant savings with the Toyota Electric Car Credit, offering up to $7,500 in federal tax incentives for eligible buyers. This guide reveals how to qualify, which models apply, and smart strategies to maximize your credit—from combining state rebates to timing your purchase for optimal benefits. Don’t miss out on slashing the cost of your eco-friendly Toyota EV.

Key Takeaways

- Check eligibility early: Confirm your qualification for federal and state EV tax credits before purchasing.

- Combine incentives wisely: Stack federal, state, and local rebates to maximize total savings.

- Act before credits expire: Some Toyota EV credits are time-limited—apply while available.

- Use the $7,500 federal credit: New Toyota EVs may qualify for the full federal tax incentive.

- Consider lease options: Lessees can often pass tax credits directly to you as lower payments.

- Verify battery requirements: Ensure the model meets sourcing rules to qualify for full credits.

📑 Table of Contents

- The Future Is Electric: Why Toyota’s Incentives Matter

- Understanding the Federal EV Tax Credit (And How Toyota Fits In)

- State and Local Incentives: Your Hidden Savings

- Toyota’s Own Incentives: Beyond the Basics

- How to Stack Incentives (And Avoid Common Pitfalls)

- Future-Proofing Your Purchase: What’s Coming in 2024 and Beyond

- Data Table: Toyota bZ4X Incentive Comparison (2024)

- Your Next Steps: Start Saving Today

The Future Is Electric: Why Toyota’s Incentives Matter

Imagine pulling up to your favorite coffee shop, plugging in your Toyota bZ4X, and knowing that every mile driven is not just eco-friendly—but also cheaper thanks to government incentives and Toyota’s own electric car credit programs. That’s not a futuristic dream. It’s happening right now.

If you’re considering switching to an electric vehicle (EV), you’re not alone. More people than ever are asking, “How can I save on an EV?” The answer? A mix of federal, state, and manufacturer-backed incentives—especially the Toyota electric car credit options available today. But here’s the thing: these credits aren’t automatic. You have to know where to look, how to qualify, and when to act.

As someone who recently helped my sister navigate the EV incentive maze (and saved her over $12,000!), I’ve learned that the process isn’t always straightforward. Toyota, long known for its hybrid success, is now stepping into the full-electric game with the bZ4X and more models on the way. And with them come a host of financial perks designed to make going electric not just smart—but affordable.

In this guide, I’ll walk you through everything you need to know about the Toyota electric car credit landscape. From federal tax credits to state rebates, lease deals, and Toyota’s own incentives, we’ll cover it all—with real-world tips, examples, and even a handy data table to help you compare options. Whether you’re buying, leasing, or just exploring, this is your roadmap to maximizing savings.

Understanding the Federal EV Tax Credit (And How Toyota Fits In)

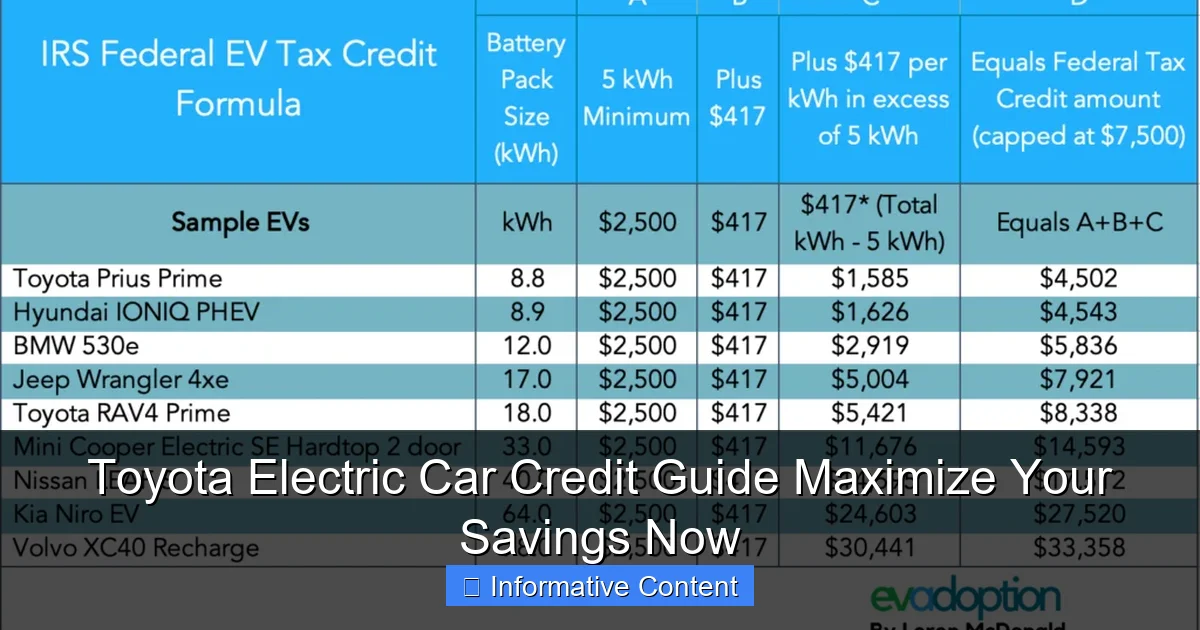

What Is the Federal EV Tax Credit?

The federal electric vehicle tax credit, officially called the Clean Vehicle Credit, is a non-refundable tax credit of up to $7,500 for new EV purchases. It’s designed to make EVs more accessible by reducing your federal tax liability. But—and this is a big but—not all EVs qualify, and not all buyers get the full amount.

Visual guide about toyota electric car credit

Image source: i.ytimg.com

For example, the credit is only available if you buy (not lease) the vehicle and if your income falls under certain limits. As of 2024, single filers must earn under $150,000, joint filers under $300,000, and heads of household under $225,000. If you earn more, you’re out of luck.

Does the Toyota bZ4X Qualify?

Good news: the Toyota bZ4X does qualify for the full $7,500 federal tax credit—but only if you buy it. As of early 2024, the bZ4X meets the critical battery component and final assembly requirements under the Inflation Reduction Act (IRA). That means it’s built in North America with a battery made using materials sourced from the U.S. or free-trade partners.

However, there’s a catch: the credit is phased in. Some 2023 models may not qualify, depending on when they were assembled. Always check the fueleconomy.gov database using your VIN to confirm eligibility.

How to Claim the Credit

You don’t get the $7,500 at the dealership. Instead, you claim it when you file your federal tax return using IRS Form 8936. The credit reduces your tax bill dollar-for-dollar. If your tax liability is less than $7,500, you can only claim up to that amount—so if you owe $5,000 in taxes, you’ll get $5,000, not $7,500.

Pro Tip: If you’re close to the income limit, consider making a traditional IRA contribution before year-end to lower your taxable income and stay eligible.

Also, starting in 2024, you can transfer the credit to the dealership at the time of purchase. This means you can get the $7,500 discount upfront instead of waiting for tax season. Ask your dealer about this option—it’s a game-changer!

Real-Life Example

Meet Mark from Colorado. He bought a 2024 Toyota bZ4X for $44,000. He qualified for the full $7,500 federal credit and transferred it to the dealer at purchase. He also got a $2,000 state rebate. His final out-of-pocket cost? Just $34,500—over 20% off the sticker price!

State and Local Incentives: Your Hidden Savings

Why State Incentives Matter

While the federal credit is great, it’s only one piece of the puzzle. Many states offer additional rebates, tax credits, or exemptions that can add thousands more in savings. These programs are often overlooked, but they’re crucial—especially if your federal tax liability is low.

For example, California’s Clean Vehicle Rebate Project (CVRP) offers up to $7,500 for low- and moderate-income buyers of new EVs. Colorado provides a $5,000 state tax credit (on top of the federal one). Even states with smaller programs, like Texas ($2,500 rebate) or New York ($2,000), can make a big difference.

How to Find Your State’s Incentives

Start with the Alternative Fuels Data Center (AFDC) website. It has a searchable database of all state, local, and utility incentives. Just enter your ZIP code and select “Electric Vehicles.”

Here’s what to look for:

- Rebates: Cash back after purchase (e.g., $2,000 from Massachusetts).

- Tax Credits: Reduce your state tax bill (e.g., $4,000 in Illinois).

- Sales Tax Exemptions: No sales tax on the EV (e.g., Oregon, New Jersey).

- HOV Lane Access: Drive in carpool lanes solo (California, Virginia).

- Home Charger Rebates: Up to $500 off Level 2 charger installation (many states).

Toyota bZ4X: A Case Study in State Savings

Let’s say you’re in California and buy a $44,000 Toyota bZ4X. Here’s what you could save:

- Federal tax credit: $7,500 (transferred at purchase)

- State CVRP rebate: $7,500 (income-qualified)

- Home charger rebate: $500 (from local utility)

- Total savings: $15,500 — that’s over 35% off!

But here’s the catch: CVRP has income limits ($135,000 single, $270,000 joint) and a waiting list. Apply early. Some counties even offer extra local incentives—check your city’s sustainability office website.

Utility Company Perks

Don’t forget your electric provider! Many utilities offer:

- Time-of-use (TOU) rates: Cheaper charging at night

- Free or discounted Level 2 chargers

- Rebates for installing smart chargers

For example, Pacific Gas & Electric (PG&E) in California gives up to $1,000 for a home charger. Duke Energy in North Carolina offers a $1,000 rebate for EV owners. These are often stackable with state and federal credits.

Toyota’s Own Incentives: Beyond the Basics

Lease Deals and Cash Rebates

While the federal credit doesn’t apply to leased EVs (the manufacturer claims it), Toyota offers its own lease incentives that can be just as valuable. In early 2024, Toyota was running a $7,500 lease cash bonus on the bZ4X—effectively giving you the federal credit’s value at signing.

Here’s how it works: You lease the bZ4X for 36 months at $499/month. Toyota applies a $7,500 “lease cash” discount, lowering your monthly payment to $299/month (before taxes/fees). That’s a $200/month saving—over $7,200 in total.

Plus, many Toyota dealers offer additional dealer discounts, especially on demo models or last year’s inventory. Always ask: “What’s your best lease or finance deal today?”

Military and First Responder Discounts

Toyota offers a $500 bonus for active-duty military, veterans, and first responders (firefighters, police, EMTs). This can be stacked with other incentives. Just bring your ID or proof of service.

College Graduate Program

If you’ve graduated in the past two years, Toyota’s College Graduate Program gives you a $500 bonus on top of other incentives. You’ll need proof of graduation (diploma, transcript) and a job offer or current employment.

Financing Offers

As of 2024, Toyota Financial Services offers 0.9% APR for 60 months on the bZ4X. That’s incredibly low—especially compared to average auto loan rates of 6-8%. Even better, this rate can be combined with cash rebates in many states.

Example: You buy a $44,000 bZ4X with $0 down, 0.9% APR, and a $7,500 dealer cash discount. Your loan amount is $36,500. Over 60 months, your payment is just $650/month—and you’ll pay less than $900 in total interest.

Trade-In Bonuses

Some Toyota dealers offer extra trade-in value for gas-powered cars. While not a nationwide program, it’s worth asking: “Do you have any EV trade-in bonuses?” I’ve seen dealers add $1,000–$2,000 to your trade-in value to encourage EV adoption.

How to Stack Incentives (And Avoid Common Pitfalls)

The Art of Stacking

“Stacking” means combining multiple incentives to maximize savings. But there are rules. For example:

- You can combine federal tax credit + state rebate + dealer cash.

- You cannot combine federal credit with a lease (but Toyota’s lease cash mimics it).

- Some state rebates require you to forgo the federal credit—always check.

Smart Strategy: Buy the car, claim the federal credit, and apply for state rebates. Then, use Toyota’s financing and bonus programs to lower your monthly cost.

Common Pitfalls to Avoid

- Assuming all EVs qualify: Check fueleconomy.gov with your VIN. Some 2023 bZ4X models don’t qualify for the full credit.

- Missing deadlines: State rebates often have limited funds. Apply as soon as you buy.

- Ignoring utility programs: Your electric bill might offer free charging or rebates.

- Not negotiating the price: Incentives reduce your tax liability, not the car’s price. Always negotiate the sticker price first.

- Forgetting about home charging: A Level 2 charger ($500–$1,000) is a must. Many states rebate 50–100% of the cost.

Step-by-Step Action Plan

Follow these steps to maximize your savings:

- Check eligibility: Use fueleconomy.gov to confirm your bZ4X qualifies for the federal credit.

- Research state incentives: Visit AFDC and your state’s energy office website.

- Talk to your utility: Ask about charger rebates and TOU rates.

- Get pre-approved: Secure financing from Toyota or a credit union.

- Visit multiple dealers: Ask for “all available incentives” in writing.

- Negotiate the price: Aim for $2,000–$4,000 below MSRP.

- Apply for rebates: Submit forms within 30 days of purchase.

- File your taxes: Claim the federal credit with Form 8936.

Future-Proofing Your Purchase: What’s Coming in 2024 and Beyond

More Toyota EVs on the Way

The bZ4X is just the start. Toyota plans to launch 10+ new EVs by 2026, including a three-row SUV, a pickup truck, and compact city cars. These models will likely qualify for the same incentives as the bZ4X—and possibly more, as battery sourcing improves.

Changes to the Federal Credit

The Inflation Reduction Act is phasing in stricter battery and mineral requirements. By 2025, EVs must use 80% U.S.-sourced minerals and 100% U.S.-made battery components to qualify. Toyota is investing $13.6 billion in U.S. battery plants, so future models should stay eligible.

State Incentive Trends

Many states are expanding EV programs. California plans to ban new gas car sales by 2035. New York, Washington, and others are following suit. Expect more rebates, tax credits, and charging infrastructure support in the coming years.

Used EV Credits (Yes, Really!)

Starting in 2023, the federal government offers a $4,000 tax credit for used EVs (priced under $25,000) and plug-in hybrids. If you buy a used bZ4X in 2025, you could save thousands—and help reduce emissions without buying new.

Smart Charging and V2G

Vehicle-to-grid (V2G) technology lets your EV feed power back into the grid during peak demand. Toyota is testing this with the bZ4X. Future incentives may pay you to participate—turning your car into a mobile battery!

Data Table: Toyota bZ4X Incentive Comparison (2024)

| Incentive Type | Amount | Eligibility | Notes |

|---|---|---|---|

| Federal Tax Credit | $7,500 | Income limits; purchase only | Transferable to dealer at purchase (2024) |

| California CVRP | $7,500 | Income limits; new EVs only | Waiting list; apply early |

| Colorado State Credit | $5,000 | No income limits | Claim on state tax return |

| Massachusetts MOR-EV | $2,500 | $125k single / $250k joint income | Rebate check after purchase |

| Toyota Lease Cash | $7,500 | Lease only | Applies at signing; lowers monthly payment |

| Military/First Responder | $500 | Proof of service | Stackable with other incentives |

| Home Charger Rebate | Up to $1,000 | Utility-specific | Check with local provider |

Your Next Steps: Start Saving Today

Switching to an electric car isn’t just about going green—it’s about going smart. With the Toyota electric car credit ecosystem, you can save thousands, reduce your carbon footprint, and enjoy a quieter, smoother ride.

But here’s the truth: these incentives won’t last forever. Federal credits could be reduced or eliminated. State programs may run out of funds. And as EVs become mainstream, the perks might shrink.

So what should you do? Act now. Research your state’s incentives. Talk to Toyota dealers about current lease and finance deals. And don’t forget the small stuff—like utility rebates for home chargers. Every dollar saved adds up.

I’ll leave you with this: my sister drove her bZ4X for six months and hasn’t paid a dime for gas. She saved $12,300 in total incentives. And best of all? She says it’s the most fun she’s ever had behind the wheel.

The road to savings starts with a single step. Take it today—and let Toyota’s electric future work for you.

Frequently Asked Questions

What is the Toyota Electric Car Credit?

The Toyota Electric Car Credit is a federal tax incentive available to buyers of eligible Toyota electric or plug-in hybrid vehicles. It can reduce your tax liability by up to $7,500, depending on the model and battery specifications.

Which Toyota models qualify for the electric car credit?

Currently, the Toyota bZ4X and select plug-in hybrid models like the RAV4 Prime may qualify for the toyota electric car credit. Check the IRS or Toyota’s official site for the latest eligibility list.

How do I claim the Toyota Electric Car Credit?

You claim the credit when filing your annual federal tax return using IRS Form 8936. Keep your purchase documents and the manufacturer’s certification statement to verify eligibility.

Can I combine the Toyota Electric Car Credit with state incentives?

Yes, in most cases, you can stack the federal toyota electric car credit with state or local rebates and incentives. States like California and New York offer additional savings for EV buyers.

Is the credit a refund or a deduction?

The Toyota Electric Car Credit is a non-refundable tax credit, meaning it reduces your tax bill dollar-for-dollar but won’t result in a refund if it exceeds your tax liability.

Do leased Toyota electric cars qualify for the credit?

No, when you lease a Toyota EV, the leasing company (not you) claims the credit. However, the savings may be passed on through lower lease payments—ask your dealer for details.