Unlocking the Benefits of Electric Cars: A Guide to UK Benefit in Kind Policies

UK Benefit in Kind for Electric Cars Are you considering buying an electric car in the UK? If so, you’ll be pleased to know that the UK government offers a significant benefit in kind for electric cars. A benefit in kind (BIK) is a tax paid by employees who receive non-cash perks from their employers. This tax is based on the car’s value and the amount of private use, and it usually results in a hefty tax bill for employees who receive a company car as part of their employment package.

However, electric cars in the UK are exempt from many of these taxes, making them a much more cost-effective option for employees who want to drive a company car. The benefit in kind for electric cars in the UK is currently set at 0%, which means that employees who drive electric cars will not have to pay any additional taxes on their company car. This compares favourably to the benefit in kind for petrol and diesel cars, which can be up to 37%.

In addition to this benefit, electric car owners in the UK are also exempt from paying the congestion charge in London and receive free parking in many public car parks. If you’re considering buying an electric car in the UK, it’s important to weigh up the costs and benefits. Although electric cars tend to be more expensive to buy than petrol or diesel cars, the benefit in kind and other incentives can offset some of these costs over time.

Additionally, electric cars are generally cheaper to run and maintain than traditional cars, which can help to offset the higher purchase price. Overall, the UK benefit in kind for electric cars is a great incentive for employees who want to drive a company car and reduce their carbon footprint. With a range of electric cars now available on the market, there’s never been a better time to make the switch to an electric vehicle.

What is a Benefit in Kind?

If you’re considering an electric vehicle as a company car or for personal use, it’s important to understand what a Benefit in Kind (BIK) is. A BIK is essentially a perk or non-monetary benefit that an employee receives from their employer. In the UK, having an electric car as a company car is considered a BIK.

This is because electric vehicles have a lower carbon emissions rate than their petrol or diesel counterparts, which aligns with the UK’s efforts to reduce carbon emissions. However, owning an electric car also means paying a tax based on the car’s value, which is calculated as a percentage and added to an employee’s income. The percentage varies based on the car’s value and CO2 emissions level.

It’s important to note that there are exemptions and discounts available, which can save employees money in the long run. Overall, while owning an electric car does come with added financial responsibilities, the environmental and long-term cost-saving benefits make it a worthwhile investment in the end.

Explanation of Benefit in Kind for UK Employees

A Benefit in Kind (BIK) is any non-cash benefit that an employee receives from their employer in addition to their regular salary or wages. These benefits might include company cars, medical insurance, housing, gym memberships, or even food and drink allowances. Essentially, they are perks that an employer offers to their staff in order to improve job satisfaction and attract and retain talented workers.

However, the value of these benefits is usually added to the employee’s taxable income, meaning they must pay income tax and National Insurance on the value of the BIK. For example, if an employee receives a company car worth £10,000 per year, their taxable income would be £10,000 higher, and they would be required to pay tax on this amount. Overall, Benefit in Kind is an important concept to understand for both employers and employees in the UK, as it can have a significant impact on tax liabilities and financial planning.

Electric Cars as a Benefit in Kind

If you are an employee who receives their own car as a perk, it’s important to know that electric cars could be a better deal for you than traditional gas-powered vehicles. In the UK, benefit in kind tax rates for electric vehicles are significantly lower than for their petrol or diesel equivalents. This means that driving an electric car provided by your employer could potentially save you hundreds of pounds a year in taxes, and you’ll also benefit from lower running costs and reduced emissions.

As more and more businesses make the switch to electric vehicles, it’s worth considering whether this could be a viable option for you. With the government’s drive towards a greener economy, now might be the perfect time to make the switch and start reaping the rewards of electric driving.

Advantages of Electric Cars for Employers and Employees

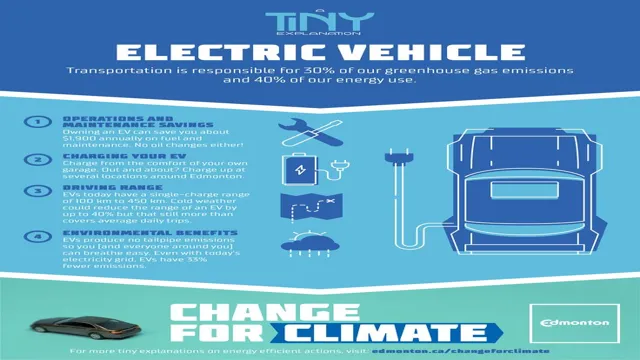

When it comes to electric cars, many people often think of the environment and cost savings. However, electric cars also have a significant impact on the workplace, particularly as a benefit in kind. For employers, offering electric cars as a benefit can attract and retain employees, increase corporate social responsibility and help meet sustainability goals.

Meanwhile, employees who receive electric cars as a benefit can save money on fuel and maintenance costs, help the environment, and enjoy a comfortable and quiet ride. Electric cars are also incredibly convenient for employees who live in urban areas and have limited parking or high gasoline costs. By offering electric cars as a benefit in kind, companies can show clients and competitors that they are prioritizing sustainability and invest in technology that can lead to a more sustainable future.

Overall, electric cars bring significant benefits to both employers and employees, making them an excellent investment for any workplace.

Example of Savings with Electric Cars as a Benefit in Kind

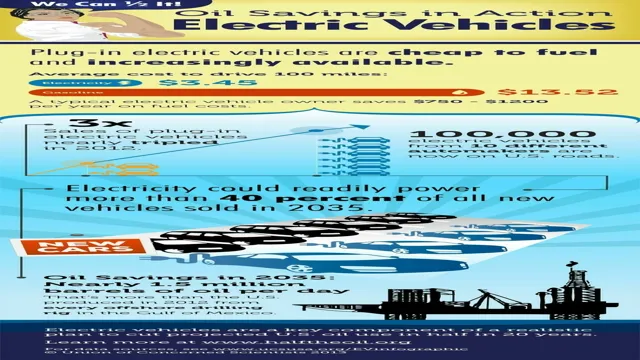

Electric Cars as a Benefit in Kind Electric cars are an increasingly popular way to reduce our carbon footprint, and they are becoming more affordable and accessible. One of the benefits of electric cars is that they can be a great way for employees to save money as a benefit in kind. For example, if an employee is provided with an electric company car, they will not have to pay any road tax or fuel costs.

This can lead to significant savings, especially if the car is used frequently. It is also worth noting that electric cars are eligible for a reduced rate of company car tax, making them an even more attractive option for businesses. In addition, electric cars have a low maintenance cost, thanks to their simple design and fewer moving parts, so companies can save money on repairs and servicing.

Overall, providing electric cars as a benefit in kind can be a win-win for employers and employees, as it provides savings and promotes sustainability at the same time.

How to Calculate Benefit in Kind for Electric Cars

If you’re considering an electric car as a company car, you may be wondering how to calculate the benefit in kind. In the UK, electric cars have a lower benefit in kind rate than petrol or diesel cars this year and next, making them an attractive option. To calculate the benefit in kind for an electric car, you first need to find the car’s list price, including any optional extras, and multiply it by the appropriate percentage rate based on the car’s CO2 emissions.

The benefit in kind rate for electric cars in the 2021-22 tax year is 1% and will increase to 2% in the 2022-23 tax year. However, if the electric car has a range of 130 miles or more on a single charge, the rate for the 2021-22 tax year drops to 0% and will increase to just 1% in the 2022-23 tax year. Keep in mind that the benefit in kind is added to your income and taxed accordingly, so choosing an electric car with a lower rate can save you money.

Formula and Parameters for Calculation

When it comes to calculating the Benefit in Kind (BIK) for electric cars, there are a few formulas and parameters that need to be considered. The BIK is essentially a tax that company car drivers pay on the personal use of their company vehicles. The BIK for electric cars is calculated based on the vehicle’s list price, its battery range, and the percentage of this list price that is taxable.

The battery range is a particularly important factor, as it determines the percentage of the list price that is taxed. For example, if the electric car has a range of 130 miles or more, the taxable percentage is 1% for the tax year 2021-202 However, if the range is less than 70 miles, the taxable percentage would be 4%.

It’s worth noting that these percentages can vary from year to year, so it’s important to stay up-to-date on the latest calculations. Overall, while the formula for calculating the BIK for electric cars may seem complex, understanding the parameters involved is key to ensuring that you’re paying the correct amount of tax on your company vehicle.

Example Calculation for Electric Cars as a Benefit in Kind

Electric Cars as a Benefit in Kind When it comes to calculating the Benefit in Kind (BIK) for electric cars, there are a few things to consider. Firstly, you need to determine the list price of the vehicle. This includes any optional extras and VAT.

Once you have this figure, you need to calculate the percentage of the list price that the employee will be liable for. For fully electric vehicles, this will be 0% for the tax year 2020/21 and 1% for the tax year 2021/2 You then need to multiply this percentage by the list price to determine the cash equivalent of the BIK.

This figure is then subject to income tax and National Insurance contributions. It’s worth noting that electric cars are not only environmentally friendly but also offer significant tax savings compared to their traditional petrol or diesel counterparts. So, if you’re thinking about offering an electric car as a benefit in kind, now could be the perfect time to do so!

Tax and National Insurance Contributions

If you’re an employee who is provided an electric car through your company, a “benefit in kind” tax liability may apply. The amount of tax you’ll have to pay will depend on the car’s value and CO2 emissions. However, the good news is that electric cars have significantly lower tax amounts than traditional combustion engine cars due to their emission-free nature.

Additionally, electric cars have lower running costs, so you’ll save on petrol expenses and other maintenance fees. National insurance contributions do not typically change based on the type of car you drive. So, consider an electric car as a possible option if you’re looking to reduce your carbon footprint and save on potential tax expenses.

Tax Implications for Employers and Employees

As an employer, you are required by law to deduct taxes and National Insurance contributions from your employees’ wages. These deductions are then paid to HM Revenue and Customs (HMRC) on behalf of your employees. The amount of tax and NI contributions that your employees pay depends on how much they earn.

The more they earn, the more they pay in tax and NI contributions. As an employer, it is your responsibility to ensure that you deduct the correct amount of tax and NI contributions from your employees’ wages each pay period. Failure to do so can result in fines and legal action.

As an employee, it is important to understand how tax and NI contributions impact your earnings. While it may seem frustrating to see a portion of your salary deducted each pay period, it is important to remember that these contributions go towards funding important public services such as schools, hospitals, and the police. Additionally, paying taxes and NI contributions also ensures that you are eligible for certain benefits, such as the state pension, sick pay, and maternity pay.

So while taxes and NI contributions may seem like a burden, they are an important part of supporting our society.

National Insurance Contributions for Employers and Employees

National Insurance Contributions Tax and National Insurance Contributions are essential components of payroll management for both employers and employees. National Insurance (NI) contributions help provide a range of state benefits, including the state pension, maternity and paternity leave, and unemployment benefits. These are paid by both employers and employees.

Employees’ National Insurance contributions are calculated on a percentage basis and are deducted directly from their salaries. Employers, on the other hand, are required to contribute an additional amount on top of each employee’s salary. The amount of employer’s National Insurance contributions is determined by the employee’s earnings and the current threshold set by the government.

Employers should be aware of their responsibilities to ensure that they maintain accurate payroll records and deduct the correct amounts of tax and National Insurance contributions for their employees. Failure to do so can result in hefty fines and penalties. It’s important that employers and employees understand the necessary payroll requirements to ensure that they remain compliant with all regulations and avoid problems in the long run.

Conclusion

In conclusion, switching to electric cars can not only save you money on fuel and maintenance but also offer a slew of benefits through the UK’s Benefit in Kind scheme. From tax exemptions to reduced carbon emissions, electric vehicles are paving the way towards a cleaner and greener future. So, why not make the switch today and reap the rewards? Trust us, your wallet and the environment will thank you.

“

FAQs

What are benefit in kind taxes for electric cars in the UK?

Benefit in kind taxes for electric cars in the UK are taxes that employees must pay on the value of the car they use for personal journeys, which is calculated based on CO2 emissions and list price.

Are electric cars exempt from UK benefit in kind taxes?

Electric cars are not completely exempt from benefit in kind taxes, but they have a much lower rate compared to petrol or diesel cars. In the tax year 2020/2021, the benefit in kind rate for electric cars is 0% for pure electric models.

How can I calculate my benefit in kind tax liability for my electric car in the UK?

To calculate your benefit in kind tax liability for your electric car in the UK, you can use the following formula: (list price of car x benefit in kind rate) x your income tax rate. For example, if the list price of your electric car is £30,000 and the benefit in kind rate is 0%, your annual tax liability would be £0.

Can I claim tax relief on the cost of installing a charging point for my electric car at home in the UK?

Yes, you can claim tax relief on the cost of installing a charging point for your electric car at home in the UK. The Electric Vehicle Homecharge Scheme provides up to 75% of the cost of installing a home charging point, up to a maximum of £350. This amount can be claimed as a tax deduction.