UK Electric Car Tax Benefits: Unlock Huge Savings Now!

Electric cars are becoming popular in the UK. Many people want to drive them. They are good for the environment. But did you know they also have tax benefits? In this article, we will explore the tax benefits of electric cars in the UK. Understanding these benefits can help you save money. Let’s dive in!

What is an Electric Car?

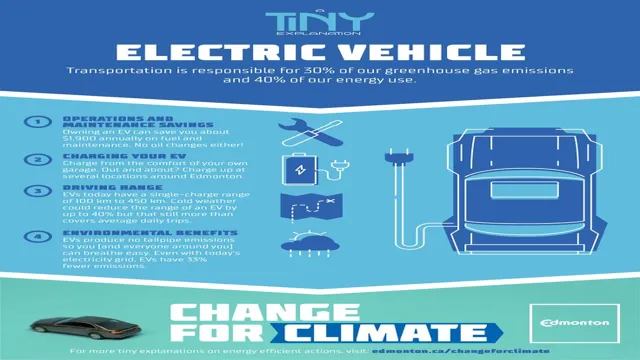

An electric car uses electricity to run. It has a battery instead of a petrol or diesel engine. Electric cars are quiet and produce no exhaust fumes. They are better for the planet. Many people choose electric cars for these reasons.

Why Choose an Electric Car?

- They help reduce air pollution.

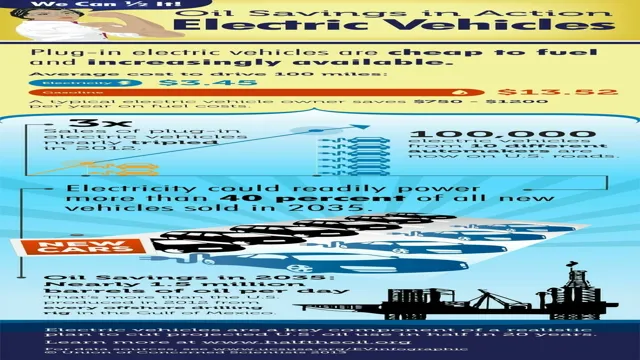

- They can save money on fuel costs.

- They often have lower maintenance costs.

- They are fun to drive.

Now, let’s look at tax benefits. These can make owning an electric car cheaper.

1. No Road Tax (Vehicle Excise Duty)

One big benefit is no road tax. Most electric cars do not pay Vehicle Excise Duty (VED). This tax is for cars that use petrol or diesel. It can be very expensive. Electric cars are exempt. This means you save money every year.

2. Reduced Company Car Tax

If you get a company car, you can save on taxes. The company car tax for electric cars is lower. For example, if you drive an electric car, you may pay only 2% in tax. This is much less than petrol or diesel cars. This can save you a lot of money if you use a company car.

3. Grants and Incentives

The UK government gives grants for electric cars. The Plug-in Car Grant helps people buy new electric cars. This grant can be up to £2,500. It makes buying an electric car cheaper. Many people take advantage of this grant.

4. Charging at Home

Another benefit is charging at home. The government helps with home charging points. You may get a grant to install a charging point. This means you can charge your car at home. It is convenient. You can also save money on electricity. Charging at night is often cheaper.

5. Low Emission Zones

Many cities have low emission zones. These zones have rules about car emissions. Electric cars can enter these areas without paying a fee. Petrol and diesel cars may have to pay. This makes driving an electric car easier in cities. It also helps reduce pollution.

6. Free Parking in Some Areas

Some cities offer free parking for electric cars. This can save you money. You can park without paying fees. This is a nice perk for electric car owners. Check local rules to see where you can park for free.

7. Access to Bus Lanes

In some places, electric cars can use bus lanes. This can help you avoid traffic. You can reach your destination faster. This benefit is great for people who drive a lot. It saves time on busy roads.

8. Environmental Benefits

Driving an electric car is good for the environment. It helps reduce greenhouse gases. Many people choose electric cars for this reason. The government supports this choice with tax benefits. They want more people to drive electric cars.

9. Future Benefits

The UK government aims for net-zero emissions by 2050. They want to encourage electric car use. More benefits may come in the future. This could mean more grants or lower taxes. Staying informed is important for electric car owners.

10. How to Get Started

Thinking about buying an electric car? Here are some steps:

- Research different electric car models.

- Check the Plug-in Car Grant eligibility.

- Look for local charging points.

- Calculate potential savings on taxes.

- Visit a dealership for a test drive.

Frequently Asked Questions

What Are The Tax Benefits For Electric Cars In The Uk?

The UK offers several tax benefits for electric cars, including no road tax and lower company car tax rates.

How Much Can I Save On Road Tax?

Electric vehicles typically pay zero road tax, saving you up to £165 annually.

Is There A Discount For Electric Car Charging?

Yes, electric car charging at home can qualify for tax relief under the Electric Vehicle Homecharge Scheme.

Are There Benefits For Electric Vans?

Electric vans also enjoy tax benefits, including reduced road tax and incentives for businesses.

Conclusion

Electric cars offer many tax benefits in the UK. From no road tax to grants, the savings can add up. Many people enjoy these benefits. They help save money and protect the environment. If you are considering an electric car, explore these tax benefits. They make driving electric cars more affordable. Choosing an electric car is a smart choice for many reasons.

FAQs

1. Are Electric Cars More Expensive To Buy?

Electric cars can cost more upfront. However, tax benefits and grants help lower the price.

2. How Do I Charge My Electric Car?

You can charge your car at home or at public charging stations.

3. Can I Drive An Electric Car In The City?

Yes, electric cars can drive in low emission zones without fees.

4. What Happens If I Need To Travel Far?

Many charging stations are available on major roads. You can plan your trip to include charging stops.

5. How Do I Find Charging Points?

There are apps and websites that show charging point locations.

In summary, the UK electric car tax benefits make owning an electric car a great choice. Not only do you save money, but you also help the planet. Explore your options and consider making the switch today.