Maximize your Savings with US Tax Benefits for Purchasing a New Tesla Electric Car

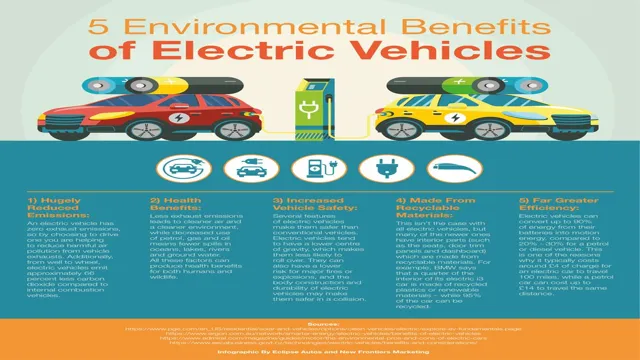

If you’re in the market for a new car and considering an electric vehicle, you might want to take a closer look at Tesla. Not only will you be emitting fewer pollutants and reducing your carbon footprint, but owning a Tesla can also provide you with some significant tax benefits. With the rising demand for greener transportation options, the United States government has introduced multiple incentives to support EV owners, and Tesla owners are no exception.

In this blog post, we’ll take a look at the US tax benefits for owning a new Tesla electric car, and how it can help save you money while benefiting the environment.

Overview of Tax Credits and Deductions

Electric cars are becoming increasingly popular in the US due to their environmental benefits and cost-saving advantages. One of the significant incentives provided by the government is tax benefits for electric car buyers. Tesla, the world-renowned electric car manufacturer, is no exception.

Those who purchase a new Tesla get to enjoy a federal tax credit of up to $7,500. However, note that this credit is gradually phased out once specific sales targets are met. Additionally, some states offer additional incentives such as rebates and tax credits.

Before making a purchase, it is essential to research the tax benefits provided by your state to take full advantage of the savings. Moving forward, the government’s commitment to promoting the use of electric cars is becoming more evident, which means that tax incentives will continue to be available for eligible vehicles.

Federal Tax Credit for Electric Cars

If you’re thinking about purchasing an electric car, you might be eligible for a federal tax credit or deduction. The federal government offers various incentives to encourage the adoption of electric cars, and tax credits and deductions are among them. Tax credits are typically more generous because they directly reduce the amount of tax you owe, while deductions reduce your taxable income.

The federal tax credit for electric cars ranges from $2,500 to $7,500, depending on the battery size and capacity. However, the credit is subject to certain limitations, such as a cap on the number of eligible cars and phased-out eligibility based on the manufacturer’s sales volume. To claim the tax credit, you need to file Form 8936 with your tax return and meet other requirements, such as owning the car for personal use and not leasing it.

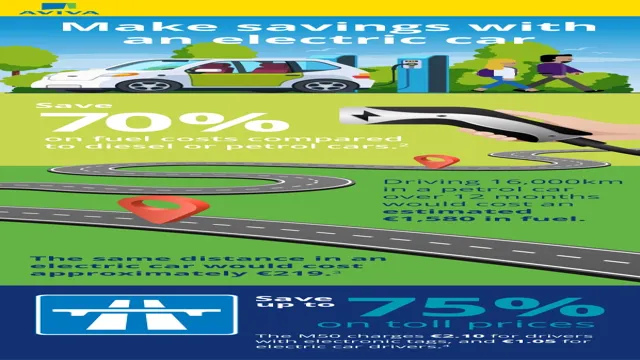

The tax credit is designed to incentivize more people to switch to electric cars, which are better for the environment and can save you money on fuel and maintenance costs in the long run.

State and Local Tax Credits and Incentives

State and local tax credits and incentives are a way for businesses and individuals to reduce their tax burdens through deductions and credits. These programs vary widely depending on where you live and what you qualify for, but they share the common goal of encouraging economic growth and development in a given area. Some tax credits are available to businesses that invest in certain industries or create jobs in particular regions, while others target individuals who purchase or install renewable energy systems or energy-efficient appliances.

Deductions, on the other hand, are subtracted from your taxable income, allowing you to pay less in taxes overall. It’s important to understand how these programs work and how they can benefit you, whether you’re a small business owner, a homeowner, or someone who simply wants to reduce their tax bill. By taking advantage of the tax credits and deductions available to you, you can save money while supporting local economies and promoting sustainability initiatives.

Requirements to Qualify for Tax Benefits

If you’re considering purchasing a new electric car, such as a Tesla, you may be eligible for US tax benefits. However, there are some requirements you must meet to qualify. First, the vehicle must be brand new (not previously leased or used) and you must be the original owner.

Secondly, the vehicle must be primarily used for personal, rather than business, purposes. Lastly, the vehicle must meet certain requirements for battery capacity and efficiency. For example, a Tesla Model S must have a battery capacity of at least 60 kilowatt hours to qualify for the full tax credit.

It’s important to note that the tax benefit is a credit, not a deduction, which means it directly reduces the amount of taxes owed. So if you’re in the market for a new electric car, be sure to look into the tax benefits available to you!

Tesla Models Eligible for Tax Benefits

If you are considering purchasing a Tesla, you may be eligible for tax benefits. But what are the requirements to qualify for these benefits? First and foremost, the car must be new and bought for personal use. The tax credit is not available if the car is leased or bought for business purposes.

Another requirement is that the vehicle must be fully electric or run on hydrogen fuel cells. Additionally, the tax benefits are only available for a limited time. The federal tax credit for a new Tesla vehicle is currently $7,500, but this amount decreases once the manufacturer reaches a certain amount of sales.

State and local tax credits may also be available, depending on where you live. Make sure to research and understand all the requirements and limitations before making your purchase to ensure eligibility for these tax benefits.

Income Limits and Other Criteria

When it comes to accessing tax benefits, there are certain requirements that must be met. One of the most important factors to consider is your income. Income limits vary depending on the specific benefit you are trying to access, with some programs offering benefits to individuals with lower incomes.

Other criteria may also come into play, such as age, disability status, or marital status. It’s important to carefully review the eligibility requirements of the specific tax benefit you are seeking to access. If you don’t meet the requirements, you won’t be able to access the benefit – so it’s important to make sure you’re fully informed before applying.

Overall, understanding the requirements for accessing tax benefits can help you make the most of your tax profile and ensure you receive any benefits you’re entitled to.

Documentation Required for Tax Filing

Qualifying for tax benefits requires specific documentation to be submitted with your tax return. The most important documentation includes proof of income, such as Form W-2 or 1099, and receipts for deductible expenses, such as medical expenses or charitable contributions. It’s also important to have documentation for any credits or exemptions you plan to claim, such as education credits or dependent care expenses.

To claim some tax benefits, you may need to provide additional information, such as proof of residency or proof of adoption or foster care. If you’re unsure of what documentation is needed for a particular tax benefit, it’s always best to seek the advice of a tax professional or consult the IRS website. By ensuring you have all the necessary documentation, you can maximize your tax benefits and save money come tax time.

Maximizing Your Tax Benefits

If you are considering purchasing a new electric car, especially a Tesla, you may be eligible for significant tax benefits that can help reduce your overall tax burden. These benefits are typically offered in the form of federal tax credits that can be applied to your tax liability. For example, if you purchase a new Tesla Model 3, you may be eligible for a tax credit of up to $7,500.

However, it’s important to note that these tax benefits do have specific criteria that must be met in order to qualify. It’s recommended that you work with a tax professional to ensure that you are eligible and that you are able to take full advantage of these tax benefits. By doing so, you can maximize your tax savings and enjoy the many benefits that come with driving an electric car, including lower fuel costs and reduced emissions.

So, if you’re in the market for a new car and want to make the most of your tax benefits, consider purchasing a new electric car today!

Timing Your Purchase to Maximize Credits and Deductions

Timing Your Purchase to Maximize Credits and Deductions can be a smart move for anyone looking to reduce their tax burden. Whether you are purchasing a new car or making home renovations, timing your purchase to coincide with tax credit or deduction opportunities can result in substantial savings on your tax bill. For instance, if you need to purchase a new car for business use, it may be beneficial to take advantage of the Section 179 tax deduction, which allows you to write off the entire purchase price of a new vehicle as a business expense.

Similarly, if you’re thinking about making energy-efficient home improvements such as installing solar panels or upgrading your HVAC system, doing so before the end of the year will let you take advantage of the federal energy tax credit. By timing your purchases strategically, you can make the most of the tax breaks available to you and reduce your overall tax liability.

Keeping Accurate Records and Properly Filing Your Taxes

When it comes to managing your finances, keeping accurate records and properly filing your taxes can have a significant impact on your bottom line. It’s important to understand the tax benefits that are available to you and take advantage of them to the fullest extent possible. This means keeping detailed records of all your income and expenses throughout the year, including receipts and invoices, and organizing them in a systematic manner.

By doing so, you can ensure that you’re not missing out on any potential deductions or credits come tax time. Additionally, it’s a good idea to work with a qualified accountant or tax professional to help you navigate the complex world of taxes and ensure that you’re maximizing your benefits. With the right approach, you can keep more money in your pocket and reduce the stress and anxiety that often comes with tax season.

So, take the time to get your financial house in order, and reap the rewards of proper tax planning.

Conclusion and Next Steps

In conclusion, investing in a new electric car from Tesla not only shows a commitment to sustainability and reducing carbon emissions but also provides significant tax benefits for US taxpayers. It’s a win-win situation for both the environment and your wallet. So why not make the leap towards a more sustainable future and join Tesla’s electric revolution?”

FAQs

What is the US tax benefit for purchasing a new electric car?

The US government offers a tax credit of up to $7,500 for the purchase of a new electric car.

Can the US tax benefit for purchasing a new electric car be applied to any brand, such as Tesla?

Yes, the tax credit applies to any brand of electric car, including Tesla.

Is there a limit to how many times the US tax benefit for purchasing a new electric car can be claimed?

No, there is no limit to how many times the tax credit can be claimed as long as the car purchased is eligible.

How does one claim the US tax benefit for purchasing a new electric car?

The tax credit is claimed through filing Form 8936 with your tax return. Make sure to keep all documentation related to the purchase of the electric car.