Electric Cars and Tax Savings: Unlocking the Financial Benefits of Eco-Friendly Driving

Are you considering buying an electric car, but not sure if the expense is worth it? There are several tax benefits of owning an electric car that can help offset the initial cost and continue to save you money in the long run. Not only will you be reducing your carbon footprint, but you could also be saving hundreds or even thousands of dollars each year on taxes. In this blog, we’ll explore the various tax benefits of owning an electric car, including federal tax credits, state incentives, and more.

So, buckle up and let’s dive in!

Overview

When it comes to environmental responsibility, electric cars are an excellent investment for those looking to lower their carbon footprint. But what many people don’t know is that electric cars also come with a significant tax benefit. The US government provides a federal tax credit of up to $7,500 for the purchase of a new electric car.

That means if your new electric car costs $30,000, you would only have to pay $22,500 after the tax credit is applied. Additionally, some states also offer tax incentives for electric cars, which can vary from a few hundred dollars to several thousand dollars. This can make a big difference in the overall cost of the vehicle and make it much more accessible for those who may not have been able to afford it otherwise.

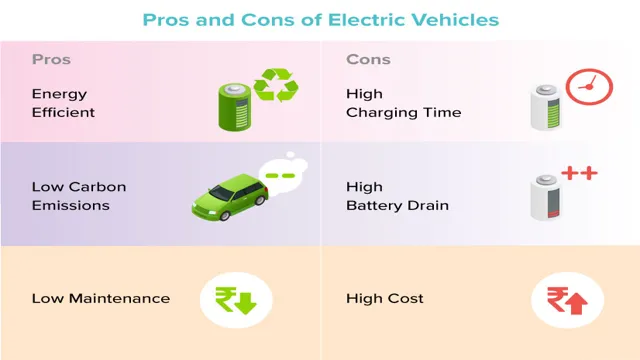

Not to mention that you’ll also save money on gas and maintenance, making electric cars a smart financial choice in the long run. So not only are electric cars good for the environment, but they’re good for your wallet too!

Reduced federal tax credit

Starting with the year 2020, the federal government has reduced the tax credit available for electric vehicles. Until then, an individual purchasing a fully electric vehicle could apply for a tax credit of up to $7,500, while those who own a plug-in hybrid vehicle could get up to $4,500. The new federal tax credit rules have phased out the credit for some manufacturers, while others have seen their tax credits reduced.

At present, only Tesla and General Motors have reached the cap on the number of eligible vehicles, meaning buyers of their electric vehicles will not able to enjoy the tax credit. For all other manufacturers, the tax credit available in the initial purchase price phases out over time. Anyone in the market to buy an electric car should consider the tax credit, as it can decrease the cost of purchasing an electric vehicle significantly.

State incentives and exemptions

State incentives and exemptions are tools that states use to attract businesses and individuals to their area while also promoting economic growth and development. These incentives can vary depending on the state and can range from tax breaks to grants and other financial incentives. For example, a state may offer tax credits for companies that invest in renewable energy or a specific industry.

Some states even offer no-sales-tax holidays or property tax exemptions for certain types of businesses. However, these incentives often come with specific requirements or eligibility criteria that must be met. It is important to carefully review the incentives and exemptions offered by each state to determine if they align with your business or personal goals.

By taking advantage of these state incentives and exemptions, individuals and businesses can save money and be more competitive in their respective markets.

Depreciation Deductions

Electric cars come with several tax benefits, one of which is the depreciation deduction. Federal tax code section 179 allows businesses to write off the full cost of any qualifying electric vehicle that was purchased for business use. In addition, businesses can claim a bonus depreciation for the electric vehicle that is 100% of the vehicle’s cost.

This amounts to a massive tax deduction that can significantly reduce the cost of purchasing an electric vehicle for business purposes. Furthermore, for individual drivers who use their electric cars solely for personal use, they may also be eligible for a standard depreciation deduction if they choose to itemize their tax deductions. All in all, the depreciation deduction makes owning an electric car more affordable and accessible for both businesses and individuals.

Section 179 deduction

The Section 179 deduction is a tax incentive that allows businesses to deduct the full purchase price of qualifying equipment and software within a given tax year. This means that instead of depreciating the equipment over several years, businesses can write off the entire cost in the year of purchase. This deduction is especially helpful for small businesses that may not have the cash flow to purchase expensive equipment outright.

It can also be used on both new and used equipment, making it a versatile deduction for businesses looking to upgrade or expand their operations. However, it’s important to note that there are limits to the amount that can be deducted each year, as well as specific rules and qualifications that must be met in order to take advantage of this deduction.

Bonus depreciation

Bonus depreciation is a tax break that provides businesses with the opportunity to write off more of the cost of their assets in the year they are acquired. This means that businesses can deduct a larger percentage of the full cost of their qualifying assets in the first year of ownership, rather than having to spread the deduction out over the life of the assets. The bonus depreciation deduction is intended to encourage businesses to invest in capital assets, such as equipment and property, by making it more affordable to do so.

The value of the bonus depreciation deduction varies, but it can be as high as 100% of the cost of the asset in the year it is acquired. In short, bonus depreciation is a valuable tax-saving tool that businesses should consider when making investment decisions.

Fuel Savings

If you’re considering switching to an electric car, there are a few tax incentives that might make it an even more appealing choice. In the US, for example, certain states offer tax credits for electric vehicle purchases, which can offset some of the initial costs. Additionally, electric cars can qualify for federal tax credits of up to $7,500, depending on the make and model you choose.

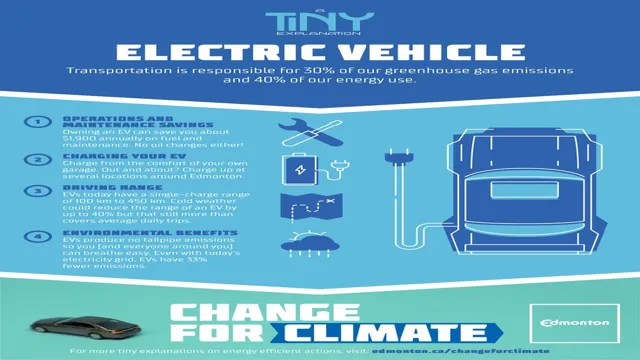

Not only that, but electric cars are also eligible for certain state and local tax incentives, like exemptions from sales or use taxes, which can save you even more money. When you factor in the long-term fuel savings and other benefits of going electric, like lower maintenance costs and reduced emissions, it’s clear that electric cars are a smart choice for both your wallet and the environment. So, whether you’re looking to save money on taxes or just do your part to reduce your carbon footprint, an electric car might be the perfect option for you.

Lower tax on electricity usage

If you’re looking for a way to save money on your electricity bills, you might be pleased to know that lower taxes on electricity usage could be the answer. By reducing the taxes on energy consumption, governments can help alleviate the burden on consumers and make it easier for people to afford their power bills. The savings on electricity usage could add up quickly, and you could use those extra funds to invest in other areas of your life.

It’s like getting a bonus paycheck from the government every month! Plus, it’s not just individual consumers who would benefit from lower electricity taxes. Businesses and industries could also reap significant savings by having to pay less for their energy consumption. So, if you’re looking to save money on energy costs, be sure to keep an eye on tax policies affecting electricity usage – they could make a big difference in your monthly budget.

Exemption from gas taxes

If you’re looking for a way to save money on gas, look no further than fuel tax exemptions. Many states offer exemptions from the gas tax to specific groups of people, such as farmers, ranchers, or commercial truck drivers. By taking advantage of these exemptions, you can save a significant amount of money on fuel costs.

For example, let’s say you’re a farmer who frequently has to travel long distances to transport your crops. By using a vehicle that’s registered as a farm vehicle, you may be eligible for a fuel tax exemption. This could save you anywhere from a few cents to several dollars per gallon of gas, depending on your state’s tax rate.

It’s important to note that not everyone is eligible for fuel tax exemptions, and the rules vary by state. Additionally, you’ll need to keep detailed records to prove that you qualify for the exemption, which can require some extra effort. However, for those who are eligible, the savings can be well worth the effort.

In conclusion, if you’re looking for a way to save money on gas, consider looking into fuel tax exemptions. While they may not be available to everyone, they can provide significant savings for those who are eligible. So, if you’re a farmer, rancher, or commercial truck driver, it’s definitely worth exploring whether you can take advantage of these exemptions and keep more money in your wallet.

Conclusion

In conclusion, the tax benefits of electric cars are like a breath of fresh air for both the environment and your wallet. With savings on tax deductions and credits, this eco-friendly mode of transportation is not only reducing harmful emissions but also saving you money. So why not hop on the electric bandwagon and give planet Earth a smoother ride towards a sustainable and prosperous future!”

FAQs

What tax incentives are available for electric car buyers?

Electric car buyers may be eligible for federal tax credits ranging from $2,500 to $7,500, depending on the car’s battery capacity. They may also be eligible for state and local incentives, such as rebates or exemptions from sales tax.

How long do the federal tax incentives for electric cars last?

The federal tax credit starts to phase out for each car manufacturer once they have sold 200,000 qualifying electric vehicles. However, the credit is still available for Tesla and General Motors vehicles, but at a reduced amount.

Are there any additional benefits to owning an electric car besides tax incentives?

Yes, electric car owners typically save money on fuel and maintenance costs. They also produce zero emissions, which is good for the environment.

Are there any restrictions on which electric vehicles qualify for tax incentives?

To qualify for federal tax credits, electric cars must have a battery capacity greater than 4 kilowatt-hours and be propelled by an electric motor drawing power from a battery pack. Some state and local incentives may have additional requirements or limitations.