Uncovering the Hidden Savings: The Tax Benefits of Owning an Electric Car

Do you want to save money on your taxes while also doing your part to help the environment? Look no further than purchasing an electric car. Not only will you benefit from lower fuel costs and reduced emissions, but you may also qualify for substantial tax credits and incentives. In this blog, we’ll explore the tax benefits of buying an electric car, including federal and state tax credits, rebates, and exemptions.

Plus, we’ll delve into the eligibility requirements and limitations for each program, so you can determine if purchasing an electric car is the right choice for you. So buckle up and get ready to learn how you can save some green while going green.

Overall Tax Credits

If you’re considering purchasing an electric vehicle, you may be wondering what the tax benefit is. The tax credit for electric cars comes in two forms: a federal tax credit and a state-level tax credit. The federal tax credit ranges from $2,500 to $7,500, depending on the size of the vehicle’s battery.

Additionally, some states offer their own tax credits and rebates, which vary depending on where you live. For example, in California, the state offers a rebate of up to $2,500 for the purchase or lease of a new electric car. The tax credit and rebate amounts can add up quickly, making an electric car a more affordable option than you may have originally thought.

So, not only will you be doing your part to help the environment by driving an electric car, but you’ll also be getting a great tax incentive.

Federal Tax Credit

When it comes to filing your taxes, a federal tax credit can be a significant advantage. Tax credits are a way for the government to incentivize certain behaviors or activities by allowing you to deduct a portion of your taxes owed. One popular federal tax credit is the Earned Income Tax Credit (EITC), which is designed to help low and moderate-income workers.

This credit can be worth up to several thousand dollars, depending on your income, family size, and filing status. Another popular tax credit is the Child Tax Credit, which allows you to deduct up to $2,000 per child under the age of 1 Other federal tax credits include the American Opportunity Tax Credit, which helps offset the costs of higher education, and the Premium Tax Credit, which helps low and moderate-income families pay for health insurance under the Affordable Care Act.

Overall, taking advantage of federal tax credits can help reduce your tax liability and increase your refund, so it’s worth exploring which credits may apply to your situation.

State Tax Credits

State tax credits are a fantastic opportunity for taxpayers to reduce their overall tax liability. These credits are tax incentives offered by individual state governments to encourage certain behaviors or investments in their state. Different states offer different kinds of tax credits, but some common ones include credits for investing in renewable energy or historic property renovations.

By taking advantage of these credits, taxpayers can significantly decrease the amount they owe in state taxes. It’s important to note that certain restrictions and qualifications may apply, and some credits may be more beneficial than others depending on individual circumstances. However, with the right research and planning, state tax credits can be a valuable tool for reducing tax burdens and increasing financial benefits.

Additional Tax Savings

In addition to the environmental benefits, buying an electric car can also provide significant tax savings. The biggest tax benefit of buying an electric car is the federal tax credit, which can provide up to $7,500 in tax credits for qualifying vehicles. However, it’s important to note that the amount of this credit varies depending on factors such as the battery size of the vehicle and the manufacturer.

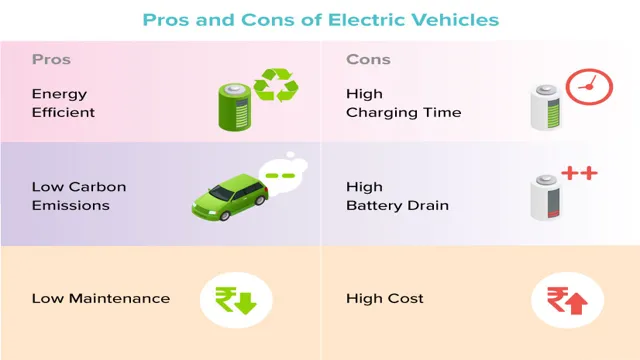

State and local governments may also offer additional tax incentives, such as exemption from sales tax, lower registration fees, or special tax credits. Additionally, electric cars can lead to lower overall operating costs, including fuel and maintenance savings. So not only can buying an electric car benefit the environment, it can also benefit your wallet.

Lower Fuel Costs

Lower Fuel Costs Lower fuel costs not only reduce your expenses but can also result in additional tax savings for your business. By utilizing more fuel-efficient vehicles or implementing eco-driving strategies, you can not only save money on fuel costs but also potentially qualify for tax incentives. For example, the IRS offers a tax credit for hybrid and electric vehicles, which can help offset the higher upfront costs of these vehicles.

Additionally, if your business uses alternative fuel vehicles or implements sustainable transportation practices, you may qualify for tax deductions or credits. Not only is it financially beneficial, but reducing your fuel consumption can also have a positive impact on the environment. By implementing fuel-efficient practices, your business can save money while also contributing to a more sustainable future.

Lower Maintenance Costs

Lower maintenance costs can be a significant advantage of owning a commercial property. Not only can it result in significant financial savings, but it can also help to improve the overall value of your property. One way to reduce maintenance expenses is through additional tax savings.

By taking advantage of tax deductions and credits, you can save money on a wide range of expenses, from repairs and maintenance to energy-efficient upgrades. These tax savings can help offset the costs of owning and maintaining a commercial property, making it more affordable and profitable in the long run. So, if you’re looking to lower your maintenance costs and boost your property’s value, be sure to explore the many tax benefits available to commercial property owners.

State and Local Incentives

State and Local Incentives can provide an additional tax savings for individuals and businesses. These incentives can vary by state and can include tax credits, exemptions, and deductions. Some states even offer programs specifically designed to attract new businesses, such as tax breaks for job creation or investment in certain industries.

One example of a state incentive program is the California Competes Tax Credit, which provides businesses with a credit based on the number of jobs created and the wages paid to employees. Additionally, many local governments offer property tax abatements or reductions for new construction or investment in certain areas. It’s important to research state and local incentives as they can provide significant savings and help make a decision about where to start or expand a business.

By taking advantage of these incentives, businesses can save money and contribute to the growth of the local economy.

Calculating Tax Savings

If you’re considering purchasing an electric car, you may be wondering what the tax benefit is. The good news is that electric car owners can qualify for tax savings. The federal government offers a tax credit of up to $7,500 for electric car purchases.

Additionally, some states offer additional tax incentives for electric vehicle purchases. These tax savings can make the initial cost of an electric car more affordable and can save you money in the long run. In addition to tax savings, electric cars can also save you money on gas and maintenance costs.

Overall, the tax benefit of buying an electric car can make it a smart financial decision.

Example Calculation

Calculating tax savings can seem like a daunting task, but it is well worth the effort. Let’s say you are in the 22% tax bracket and you have made a $10,000 contribution to your traditional IRA. This means that you can reduce your taxable income by $10,000, and you will owe $2,200 less in taxes.

But that’s not all! Your $10,000 will also grow tax-free until you withdraw it in retirement. Assuming an average rate of return of 7%, this will result in a total of $19,671 after 20 years. That’s almost double your initial investment! By taking advantage of tax-saving opportunities like this, you can make your money work for you and secure a comfortable retirement.

So why not start today and see how much you can save?

Considerations Before Buying

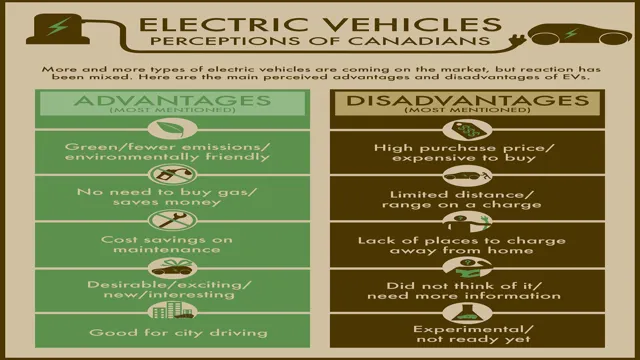

If you’re considering buying an electric car, one of the most compelling reasons to do so is the potential tax benefits. There are a number of federal and state tax credits and incentives available for electric car buyers that can help reduce the cost of ownership. For example, in the US, you may qualify for a federal tax credit of up to $7,500 for the purchase of a new electric car.

Additionally, many states offer their own incentives, such as rebates or tax breaks. However, it’s important to note that these incentives vary by location and are subject to change, so it’s important to do your research and make sure you understand the tax implications before making a purchase. It’s also worth considering the long-term cost savings of owning an electric car, such as lower fuel and maintenance costs, which can make a big difference over time.

All of these factors should be taken into account when deciding whether an electric car is the right choice for you.

Upfront Cost vs Long-Term Savings

When it comes to making a big purchase like a new appliance or home improvement project, it’s important to weigh the upfront cost versus the long-term savings. While it might be tempting to go for the cheaper option at first, it could end up costing you more money in the long run if it breaks down easily or needs frequent repairs. On the other hand, investing in a higher quality and more energy-efficient option could end up saving you money in utility bills and maintenance costs over time.

Additionally, it’s important to consider how long you plan on owning the item or living in the home. If it’s a short-term investment, it may not be worth the extra money for long-term savings. However, if it’s something you plan on using for years to come, it may be worth the initial investment for the long-term benefits.

When making any big purchase, it’s important to carefully consider all the factors and do your research to make the best decision for your individual needs.

Conclusion

In conclusion, the tax benefits of buying an electric car are shockingly good – they make it easier for eco-conscious drivers to zap away their carbon footprint while saving on their taxes. Not only do electric cars emit fewer pollutants, but they also generate tax credits that could give your bank account a jolt. So, go electrify your ride and electrify your wallet as well!”

FAQs

What are the tax incentives for buying an electric car?

The tax incentives for buying an electric car include a federal tax credit of up to $7,500 and potential state and local incentives such as rebates, credits, and exemptions from certain taxes.

Are there any restrictions on the tax benefits for electric car purchases?

Yes, there are restrictions on the tax benefits for electric car purchases. The federal tax credit begins to phase out after an automaker sells 200,000 qualifying vehicles, and some state and local incentives have eligibility requirements and expiration dates.

What types of electric vehicles are eligible for tax benefits?

Generally, all-electric vehicles and plug-in hybrid electric vehicles (PHEVs) with a battery capacity of at least 4 kWh are eligible for tax benefits. However, it is important to check the specific requirements for each incentive program.

How can I claim the tax benefits for buying an electric car?

To claim the federal tax credit, you need to file IRS Form 8936 with your tax return. For state and local incentives, you may need to apply directly with the relevant agency or provide proof of purchase to your tax preparer. It is important to keep all documentation related to the purchase of the electric car.