Charging Up Your Portfolio: Top Stocks to Invest in for the Electric Car Revolution

Electric cars are changing the world as we know it. Not only are they environmentally friendly, they’re also proving to be financially beneficial for those invested in the right places. As the electric car industry continues to grow, so do the opportunities for investors.

But with so many options available, it can be hard to know where to put your money. That’s where data-driven analysis comes in. In this blog, we’ll delve into the stocks benefiting from electric cars and explore the data behind those choices.

So if you’re looking to invest in the future of transportation, keep reading to discover which stocks are worth your attention.

Overview

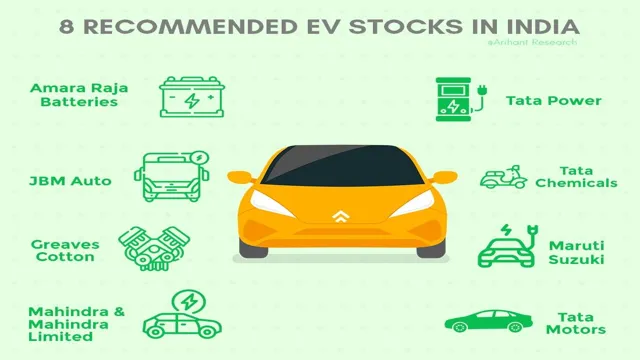

With the rising demand for electric cars comes a surge in the stocks of companies that are involved in the production of electric vehicles and their components. Companies like Tesla, Inc., NIO Inc.

, and General Motors Company are expected to see an increase in their stocks due to the growing interest in electric cars. In addition to these companies, those who manufacture batteries, charging stations, and electric motors, such as Panasonic Corporation, ChargePoint Holdings, Inc., and BorgWarner Inc.

, are also likely to see gains in their stocks. Even traditional car companies like Ford Motor Company and Volkswagen AG are investing heavily in electric cars, making their stocks worth considering for those looking to invest in the booming electric car market. As the demand for electric cars continues to grow, so too will the stocks of companies that are integral to their production and infrastructure.

The Rise of Electric Cars and the Stock Market

As the world shifts towards sustainable energy and reducing the carbon footprint, electric vehicles are becoming increasingly popular. The rise of electric cars is not only good for the environment, but it’s also creating new investment opportunities in the stock market. Companies like Tesla, Nio, and Lucid Motors are leading the way in the electric vehicle market and their stock prices are skyrocketing.

As more people invest in these companies, it creates a domino effect, causing their stock prices to rise even higher. However, investing in the stock market is always a risk, and it’s important to do thorough research before making any decisions. Nonetheless, with the increasing popularity of electric cars, it’s clear that investing in the stock market could bring some lucrative opportunities in the future.

Why Investing in Electric Cars is Smart

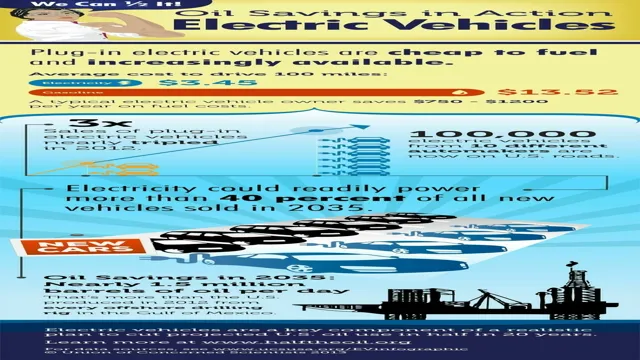

Electric Cars Overview: With rising concerns of climate change and the looming threat of fossil fuels running out, investing in electric cars is a smart choice. Electric cars use rechargeable batteries to power the motor, eliminating harmful emissions and reducing our carbon footprint. While electric cars may have a higher initial cost than traditional gas-fueled cars, they are cheaper to maintain and offer significant savings in the long run.

Not to mention, as technology improves, the range and efficiency of electric cars will continue to increase. Investing in an electric car not only benefits the environment but also proves to be a financially sound decision. So why not be a part of the green revolution and switch to an electric car today?

Top Stocks for Electric Car Investors

Investing in electric car stocks could prove to be incredibly profitable for investors in the coming years. As the world transitions away from fossil fuels, more and more people are turning to electric vehicles as a cleaner, more sustainable mode of transportation. Companies like Tesla, Nio, and Fisker are leading the charge when it comes to producing high-quality, efficient electric vehicles that are popular with consumers.

But it’s not just car manufacturers that stand to profit from this shift. Companies that produce batteries, like Panasonic and LG Chem, are also poised for success as electric cars become more commonplace. And let’s not forget charging infrastructure providers like ChargePoint and Blink, who will likely see a surge in demand as the number of electric cars on the road increases.

All of these companies offer great opportunities for investors looking to cash in on the electric car revolution.

Tesla (TSLA)

As the electric car industry continues to grow, more and more investors are taking an interest in which stocks to keep an eye on. One top stock in this industry is Tesla (TSLA). Not only is Tesla a pioneer in the electric car space, but they also have a dominant presence in the renewable energy market.

This makes them a popular choice for investors who want exposure to both industries. The company has also continued to innovate with features like autonomous driving and plans to expand its electric vehicle offerings. Tesla’s stock has experienced significant growth over the years, making it a desirable option for long-term investors.

However, it’s important to note that as with any investment, there is always a level of risk involved. It’s essential to do your research and make informed decisions before investing in any stock, including Tesla.

NIO (NIO)

If you’re an investor looking to hop on board the electric car train, NIO (NIO) is definitely a company worth watchng. This Chinese electric vehicle manufacturer has been making waves recently with its sleek designs, cutting-edge technology, and impressive battery range. Its flagship vehicle, the ES8, is already a hit in China, and the company has plans to expand to other international markets in the near future.

Plus, NIO has a strong backing from investors, including Chinese tech giant Tencent. This support, combined with NIO’s innovative approach to electric vehicle design, could make the company a major player in the industry. So, if you’re looking for a top stock in the electric car market, don’t sleep on NIO.

General Motors (GM)

If you’re interested in investing in the future of electric cars, General Motors (GM) might be a top choice for you. Over the past few years, GM has made significant investments in electric vehicles and plans to introduce at least 20 new electric models globally by 202 This means that there is ample opportunity for investors to get involved and take advantage of this shift towards a more sustainable future.

With GM’s focus on innovative technology and sustainable practices, it’s no surprise that the company has become a leader in the electric vehicle market. Whether you’re a seasoned investor or just starting out, GM’s commitment to electric cars makes it worth considering as a top stock for your portfolio. So why not join the ranks of investors who are embracing the future of electric cars and make GM a part of your investment strategy?

Plug Power (PLUG)

When it comes to investing in the electric vehicle industry, there are a variety of factors that can impact your potential returns. One top stock to consider is Plug Power (PLUG), a company that specializes in developing and manufacturing hydrogen fuel cell systems for use in a range of applications, including electric vehicles. With a focus on sustainable energy solutions, Plug Power has been making waves in the industry, and is poised for strong growth in the coming years.

In fact, the company has already experienced significant stock price increases in recent months, and many analysts believe that this trend will continue as the demand for electric vehicles continues to grow. Overall, if you’re an electric car investor looking for a strong stock with a lot of potential, Plug Power is definitely worth considering.

How to Evaluate Electric Car Stocks

If you’re considering investing in electric car stocks, there are a few things you should keep in mind. First and foremost, look at the automakers themselves. Companies like Tesla and General Motors are obvious choices, but keep in mind that traditional automakers like Ford and Volkswagen are also making significant investments in electric vehicles.

However, it’s also important to look beyond just the automakers themselves. Companies that produce batteries and charging infrastructure, like Panasonic and ChargePoint, could also benefit from the growing popularity of electric vehicles. And don’t forget about renewable energy companies that could see increased demand for their products as electric vehicles become more prevalent.

Overall, it’s important to evaluate not just the automakers but also the various companies in the electric car supply chain to determine which stocks will benefit the most from the shift towards electric vehicles.

Market Cap and P/E Ratio

If you’re considering investing in electric car stocks, you’ll need to do your due diligence to determine which companies are worth your time and money. One way to evaluate these stocks is to look at their market capitalization and P/E ratio. The market capitalization, or market cap, is the total value of all a company’s outstanding shares of stock.

This gives you an idea of how much investors believe the company is worth. The P/E ratio, or price-to-earnings ratio, is the current stock price divided by the company’s earnings per share. This gives you an idea of how much investors are willing to pay for each dollar of the company’s earnings.

A high P/E ratio can indicate that investors expect the company to continue to grow in the future. However, it’s important to consider other factors as well, such as the company’s financial health, competition in the industry, and any potential regulatory changes that could affect the electric car market. By taking all these factors into account, you can make an informed decision about which electric car stocks to invest in.

Sales and Revenue Growth

Investing in electric car stocks requires a careful evaluation of sales and revenue growth. One tool investors can use is to analyze the company’s financial statements, which should provide clear indications of growing revenues and increasing profitability. Additionally, investors should monitor market trends, including consumer preferences and government regulations, to gauge the potential for increased demand for electric vehicles.

Investors should also pay attention to the company’s research and development track record, as new innovations and technology can drive future growth. Another metric to consider is the company’s competitive advantage, which can be determined by analyzing the industry landscape and assessing the company’s market share. Overall, a thorough evaluation of a company’s financials, market trends, technological advancements, and competitive landscape are essential when considering investing in electric car stocks.

Conclusion: The Future of Electric Cars is Bright for Investors

As the electric car revolution charges ahead, savvy investors are seeking out which stocks will drive their portfolios forward. While there’s no sure bet when it comes to the stock market, one thing is clear: companies that specialize in battery technology, charging infrastructure, and renewable energy sources are poised for growth. But let’s not forget about the auto manufacturers too–those who are able to keep up with the pace of innovation in the electric car space are likely to see increased demand for their products, and thus, a boost to their bottom line.

So strap in and get ready–the ride may be electrifying, but the potential rewards are shockingly bright.”

FAQs

How will the rise of electric cars impact the stock market?

The rise of electric cars is expected to benefit stocks in the electric vehicle industry, such as Tesla, Nio, and BYD.

What are some stocks of companies that produce electric car batteries?

Some stocks of electric car battery producers include Tesla, Panasonic, Samsung SDI, LG Chem, and CATL.

Will traditional automakers that produce electric cars also benefit?

Yes, traditional automakers that produce electric cars, such as Ford, General Motors, and Volkswagen, are expected to benefit from the rise of electric cars.

Are there any stocks of charging station companies that may benefit from the rise of electric cars?

Yes, some stocks of companies that produce charging stations for electric cars include ChargePoint, Blink Charging, and EVBox.