Are There Tax Benefits to Buying an Hybrid Electric Car? Unveiled!

Buying a hybrid electric car is popular today. Many people want to save money and help the environment. But, are there tax benefits when you buy one? This article will explain the tax benefits of hybrid electric cars. We will make it easy to understand.

What is a Hybrid Electric Car?

First, let’s know what a hybrid electric car is. A hybrid electric car uses two types of power. It has a gasoline engine and an electric motor. This helps the car use less fuel. It also produces fewer harmful gases. Many people choose hybrid cars for these reasons.

Tax Benefits Explained

Now, let’s talk about tax benefits. Tax benefits are ways to save money on taxes. When you buy a hybrid electric car, you might save money on your taxes. Let’s look at some of these benefits.

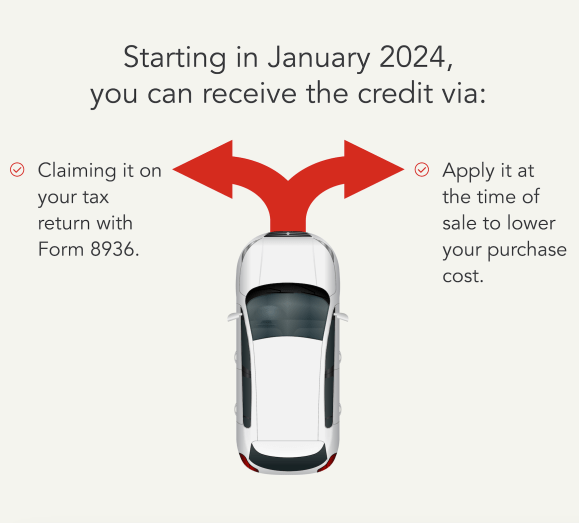

1. Federal Tax Credit

One of the biggest tax benefits is the federal tax credit. This credit helps you pay less tax. The amount of the credit can be up to $7,500. But, not all hybrid cars qualify for this credit. You need to check if the car you want qualifies.

- The car must be new.

- The car must have a battery with a certain size.

- The car must be from a manufacturer that has not sold too many electric cars.

2. State Tax Credits

Some states offer their own tax credits. These credits are on top of the federal credit. Each state has different rules. Some states may give $1,000 or more. Check your state’s tax office for details.

3. Sales Tax Exemptions

Some states do not charge sales tax on hybrid cars. This means you pay less when you buy the car. This saves you money. You can check with your local tax office to see if your state has this benefit.

4. Reduced Registration Fees

In some places, hybrid car owners pay lower registration fees. This means you pay less money to keep your car registered each year. Again, this benefit depends on where you live.

5. Carpool Lane Access

In many states, hybrid car owners can use carpool lanes. This is great if you are driving alone. It can help you get to work faster. Check local laws for specific rules in your area.

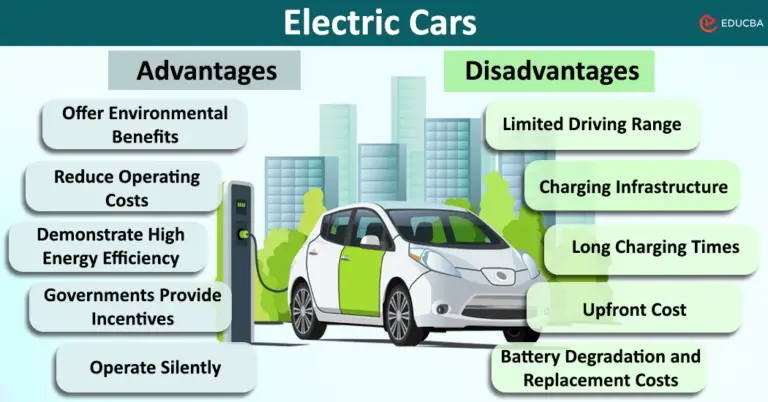

Other Benefits of Buying a Hybrid Electric Car

Besides tax benefits, hybrid cars have other advantages. Here are some of them:

- They save money on gas.

- They help reduce air pollution.

- They can have lower maintenance costs.

- They often have a high resale value.

How to Find Tax Benefits

Finding tax benefits can be simple. Here are some steps to help you:

- Research hybrid electric cars. Make a list of the ones you like.

- Check if these cars qualify for the federal tax credit.

- Look at state tax credits in your area.

- Contact your local tax office for more information.

- Keep all receipts and documents when you buy the car.

Things to Consider

While there are many benefits, there are also some things to think about:

- Hybrid cars can be more expensive than regular cars.

- Some models may not qualify for tax credits.

- Fuel efficiency varies by model.

Frequently Asked Questions

What Tax Credits Exist For Hybrid Electric Cars?

Many countries offer tax credits for buying hybrid electric cars. These credits help reduce your tax bill.

How Much Can I Save On Taxes With A Hybrid Car?

Tax savings vary by location and vehicle type. Savings can range from a few hundred to several thousand dollars.

Do All Hybrid Cars Qualify For Tax Benefits?

Not all hybrid cars qualify. Check local regulations and vehicle specifications for eligibility.

Are Tax Benefits Available For Used Hybrid Cars?

Some areas offer tax credits for used hybrid cars. It depends on local laws and the car’s age.

Conclusion

In summary, buying a hybrid electric car can have tax benefits. These benefits can save you money on your taxes. Federal and state credits, sales tax exemptions, and lower fees can help. Always research the specific rules in your area. A hybrid car can be a smart choice for your wallet and the planet. Make sure to consider all factors before you buy.

If you are thinking about buying a hybrid electric car, take your time. Look at your options. Ask questions. You want to make the best choice for you and your family.

Remember, saving money and helping the environment is important. A hybrid electric car can be part of that effort.